The BofA View: Why Current Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Rationale: Earnings Growth Outpaces Valuation Concerns

BofA's bullish stance on the market rests on the expectation that robust corporate earnings growth will outstrip current valuation concerns. This positive outlook isn't based on blind optimism but on a detailed analysis of various economic indicators and corporate performance projections.

Strong Corporate Earnings Projections

BofA predicts continued strong corporate earnings growth in the coming quarters and years. Their projections are supported by several key factors:

- Technology Sector Boom: BofA anticipates continued growth in the technology sector, driven by advancements in artificial intelligence and cloud computing. Projected EPS growth for this sector is estimated at [insert data from BofA report, e.g., 15-20%] for the next fiscal year.

- Resilience in Healthcare: The healthcare sector is expected to maintain strong performance due to an aging population and continued investment in pharmaceutical research and development. BofA projects EPS growth of [insert data from BofA report, e.g., 10-15%].

- Consumer Staples' Steady Performance: Despite economic uncertainties, consumer staples companies are expected to continue delivering stable earnings due to their consistent demand. BofA forecasts a conservative but steady EPS growth of [insert data from BofA report, e.g., 5-10%].

These strong earnings projections, across various sectors, significantly mitigate concerns about high valuations. The anticipated growth suggests that current price levels are justifiable and potentially undervalued relative to future earnings potential.

Resilient Consumer Spending and Economic Growth

BofA's positive outlook is further underpinned by their analysis of consumer spending and broader economic indicators. Their projections suggest a healthy and sustained economic environment supporting continued corporate profitability.

- GDP Growth: BofA projects a [insert data from BofA report, e.g., 2-3%] GDP growth rate for the next year, indicating continued economic expansion.

- Low Unemployment: The low unemployment rate [insert data from BofA report, e.g., 3.5%] indicates a strong labor market, supporting consumer confidence and spending.

- Positive Consumer Confidence Index: Consumer confidence remains relatively high [insert data from BofA report, e.g., above 100], pointing to continued consumer spending and fueling economic growth.

These strong economic fundamentals directly translate into sustained corporate profitability, justifying the current, seemingly high, stock market valuations. A healthy economy supports higher earnings, making current prices more reasonable in the context of future growth.

Interest Rate Environment: A Balanced Perspective

The impact of rising interest rates on stock valuations is a key concern for many investors. However, BofA offers a more nuanced perspective.

Interest Rate Hikes and Their Impact

BofA acknowledges the impact of rising interest rates on stock valuations. Higher interest rates generally increase the discount rate used in valuation models, potentially reducing the present value of future earnings. However, their projections suggest:

- Gradual Rate Hikes: BofA anticipates gradual, rather than drastic, interest rate increases [insert data from BofA report, e.g., 0.25% increments]. This measured approach minimizes the shock to the market.

- Controlled Inflation: BofA's analysis suggests that inflation is likely to remain under control [cite BofA's inflation projections], limiting the need for aggressive interest rate hikes.

Therefore, BofA believes the current interest rate environment is not overly detrimental to stock market performance. The gradual increases are priced into the market, and the projections for controlled inflation suggest that the negative impact on valuations will be limited.

Long-Term Interest Rate Outlook

BofA's long-term perspective on interest rates further supports their positive market outlook. They anticipate:

- Rate Stabilization: BofA expects interest rates to eventually stabilize at a level that supports sustainable economic growth [explain BofA's reasoning].

- Potential for Rate Decreases: Depending on economic conditions, BofA does not rule out potential interest rate decreases in the future, which would be positive for stock valuations.

This long-term perspective counters short-term concerns about high valuations. The anticipated stabilization or even decline in interest rates suggests that the current environment is not a long-term threat to the market’s performance.

Valuation Metrics: A Deeper Dive

BofA employs a sophisticated approach to valuation, moving beyond simple P/E ratios to gain a more comprehensive perspective.

Beyond P/E Ratios: A Multi-Factor Approach

BofA uses a range of valuation metrics to arrive at its conclusions. Focusing solely on the Price-to-Earnings ratio can be misleading. Their analysis incorporates:

- Price-to-Sales Ratio: This metric provides insights into the valuation relative to revenue generation, which is less sensitive to accounting variations than earnings.

- Price-to-Book Ratio: This ratio compares the market value to the net asset value of the company, offering a different perspective on valuation.

- Dividend Yield: This metric considers the dividend payout relative to the stock price, providing an indication of income potential.

These multiple metrics offer a more nuanced and comprehensive picture of market valuations than relying solely on P/E ratios, supporting their assessment that valuations aren't excessively high across the board.

Sector-Specific Valuations

BofA recognizes that valuations vary significantly across different sectors and industries. Their analysis considers this sector-specific variation:

- Technology: Fairly Valued to Slightly Overvalued: While the technology sector shows strong growth prospects, some segments might be slightly overvalued based on their specific metrics.

- Financials: Undervalued in Specific Niches: Certain segments within the financial sector, showing strong earnings and robust balance sheets, could be considered undervalued.

- Energy: Moderately Valued: The energy sector’s valuation reflects current market conditions and future energy demands.

Considering sector-specific valuations leads to a more balanced view of the overall market. Focusing only on broad market indices can obscure the opportunities presented by specific sectors.

Conclusion

BofA's analysis suggests that current stock market valuations are not a significant threat to long-term investors. Their perspective rests on the pillars of strong earnings growth projections, a manageable interest rate environment, and a multi-faceted approach to valuation metrics. While some sectors may be slightly overvalued, others offer attractive opportunities. Potential counterarguments, such as unexpected economic downturns or a more aggressive interest rate hike cycle, are certainly possible. However, BofA's analysis suggests that these risks are already largely factored into current market prices.

Don't let anxieties over current stock market valuations deter you from a well-researched investment strategy. Consider BofA's comprehensive view and explore opportunities within the current market. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions. [Link to relevant BofA research reports, if available].

Featured Posts

-

April 16 2025 Lotto Results Winning Numbers

May 02, 2025

April 16 2025 Lotto Results Winning Numbers

May 02, 2025 -

Daily Lotto Winning Numbers For Tuesday April 15th 2025

May 02, 2025

Daily Lotto Winning Numbers For Tuesday April 15th 2025

May 02, 2025 -

The Pros And Cons Of Using Smart Rings To Combat Infidelity

May 02, 2025

The Pros And Cons Of Using Smart Rings To Combat Infidelity

May 02, 2025 -

Zdravkove Prve Ljubavi Zasto Se Udala Kad Se On Vratio

May 02, 2025

Zdravkove Prve Ljubavi Zasto Se Udala Kad Se On Vratio

May 02, 2025 -

Ripple Sec Lawsuit Will Victory Mean A Us Xrp Etf Todays Xrp News

May 02, 2025

Ripple Sec Lawsuit Will Victory Mean A Us Xrp Etf Todays Xrp News

May 02, 2025

Latest Posts

-

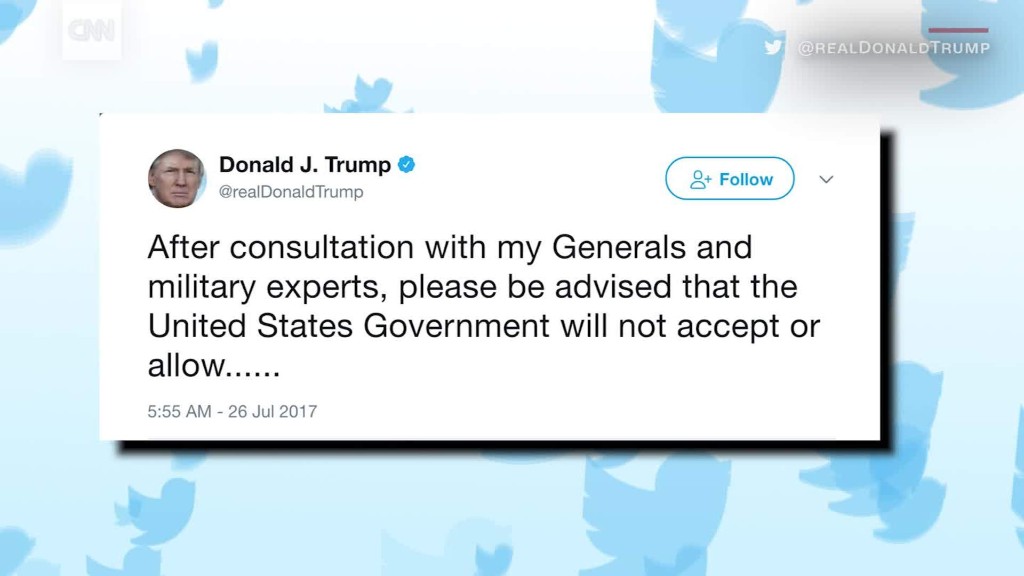

Analyzing Trumps Stance On Transgender Service In The Military

May 10, 2025

Analyzing Trumps Stance On Transgender Service In The Military

May 10, 2025 -

Understanding Trumps Transgender Military Ban Separating Fact From Fiction

May 10, 2025

Understanding Trumps Transgender Military Ban Separating Fact From Fiction

May 10, 2025 -

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025 -

Transgender Girls Banned From Ihsaa Sports Following Trump Order

May 10, 2025

Transgender Girls Banned From Ihsaa Sports Following Trump Order

May 10, 2025 -

Analyzing Brobbeys Strength A Decisive Factor In The Europa League

May 10, 2025

Analyzing Brobbeys Strength A Decisive Factor In The Europa League

May 10, 2025