The Financial Aspects Of Your Escape To The Country

Table of Contents

Property Purchase and Related Costs

Buying rural property is a significant investment, and understanding the associated costs is paramount. Rural property prices vary dramatically depending on location, size, and condition. While you might find charming cottages at a lower price than comparable urban properties, it's crucial to account for several hidden costs that can quickly inflate your budget.

-

Average Property Prices: Researching average rural property prices in your desired area is crucial. Websites dedicated to property listings can provide this information, and it's wise to look at trends over several months to get a realistic picture. Remember to factor in the potential for higher prices in popular, picturesque locations.

-

Hidden Costs: Beyond the purchase price, expect additional expenses, including:

- Stamp Duty: This government tax on property purchases varies depending on the property value and your location.

- Conveyancing Fees: Legal fees for solicitors to handle the property transaction can be substantial.

- Property Surveys: A thorough survey is crucial to identify potential problems and avoid costly surprises after purchase.

- Renovation Expenses: Older rural properties often require significant renovations, adding considerably to the overall cost. Factor in potential structural repairs, updating plumbing and electrics, and cosmetic improvements.

-

Securing a Mortgage: Securing a mortgage for rural properties can sometimes be more challenging than for urban properties. Some lenders specialize in rural mortgages and may offer more competitive rates. It’s wise to explore your options with multiple lenders.

-

Typical Property Purchase Cost Breakdown (Example):

- Purchase Price: £300,000

- Stamp Duty: £10,000

- Conveyancing Fees: £2,000

- Survey: £1,000

- Renovation Budget: £20,000

- Total Estimated Cost: £333,000

Ongoing Living Expenses in the Country

While the initial property purchase is substantial, the ongoing costs of country living can be surprisingly high. These often-overlooked expenses can significantly impact your budget.

-

Higher Utility Bills: Larger properties typically mean higher heating, water, and electricity bills. Rural properties might rely on oil or LPG for heating, making costs significantly higher than gas or electric central heating.

-

Increased Transportation Costs: Longer commutes, reliance on cars, and the often limited public transport options in rural areas contribute to increased fuel and vehicle maintenance expenses.

-

Rural Broadband Costs: Access to reliable, high-speed broadband can be a challenge in rural areas, with slower speeds and potentially higher costs. Investigate available options and factor this expense into your budget.

-

Grocery Shopping: Grocery shopping often involves traveling further to larger supermarkets, increasing fuel costs and potentially affecting the overall cost of groceries.

-

Increased Living Expenses Summary (Example):

- Utilities: £300/month (vs £150/month in urban area)

- Transportation: £200/month (vs £50/month in urban area)

- Broadband: £50/month (vs £30/month in urban area)

- Groceries: £100/month (potentially higher due to travel)

Hidden Costs and Unexpected Expenses

Beyond the predictable costs, several hidden expenses can significantly impact your budget. Being prepared for these contingencies is crucial.

-

Property Maintenance and Repairs: Older rural properties often require more extensive maintenance and repairs. Factor in regular upkeep costs, such as roof repairs, plumbing issues, and general wear and tear.

-

Higher Insurance Premiums: Insurance premiums for rural properties can be higher due to factors like location, increased risk of flooding or fire, and potential difficulties accessing emergency services.

-

Gardening and Landscaping: Maintaining larger gardens can be time-consuming and expensive. Factor in the costs of gardening equipment, supplies, and potential landscaping services.

-

Pest Control: Rural areas can present unique pest control challenges, adding unexpected costs to your budget.

-

Unexpected Repairs or Emergencies: Boiler breakdowns, plumbing emergencies, and other unforeseen issues can quickly drain your savings. Having a contingency fund is essential.

Financial Planning for Your Country Escape

Moving to the country requires careful financial planning. Don't let the dream overshadow the need for a realistic assessment and a well-defined plan.

-

Create a Realistic Budget: Compile a comprehensive budget that incorporates all anticipated costs, including property purchase, ongoing living expenses, and potential hidden expenses. Be conservative in your estimations.

-

Explore Financing Options: Explore different financing options, such as mortgages, savings, investments, or a combination of these. Seek professional advice on the most suitable approach.

-

Seek Professional Financial Advice: Consulting with a financial advisor specializing in rural property purchases is highly recommended. They can provide tailored guidance on budgeting, financing, and long-term financial planning.

-

Saving and Investing Strategies: Develop a solid savings and investment plan to ensure you have sufficient funds for the purchase and the ongoing costs of country living.

Conclusion:

Escaping to the country is a significant life change, and thorough financial planning is crucial for a smooth transition. The costs associated with rural living extend far beyond the initial property purchase. Higher utility bills, increased transportation costs, and unexpected maintenance expenses are just some of the factors to consider. By creating a detailed budget, researching property prices and living expenses in your desired area, and seeking professional financial advice, you can make your dream of country living a financially sound reality! Start planning your escape to the country today by using a [link to mortgage calculator/financial advisor directory]. Make your dream of country living a financially sound reality!

Featured Posts

-

Dax Under 24 000 A Report On Frankfurt Market Losses

May 25, 2025

Dax Under 24 000 A Report On Frankfurt Market Losses

May 25, 2025 -

Markt Draai Europese Aandelen Presteren Beter Dan Wall Street Toekomstige Trend

May 25, 2025

Markt Draai Europese Aandelen Presteren Beter Dan Wall Street Toekomstige Trend

May 25, 2025 -

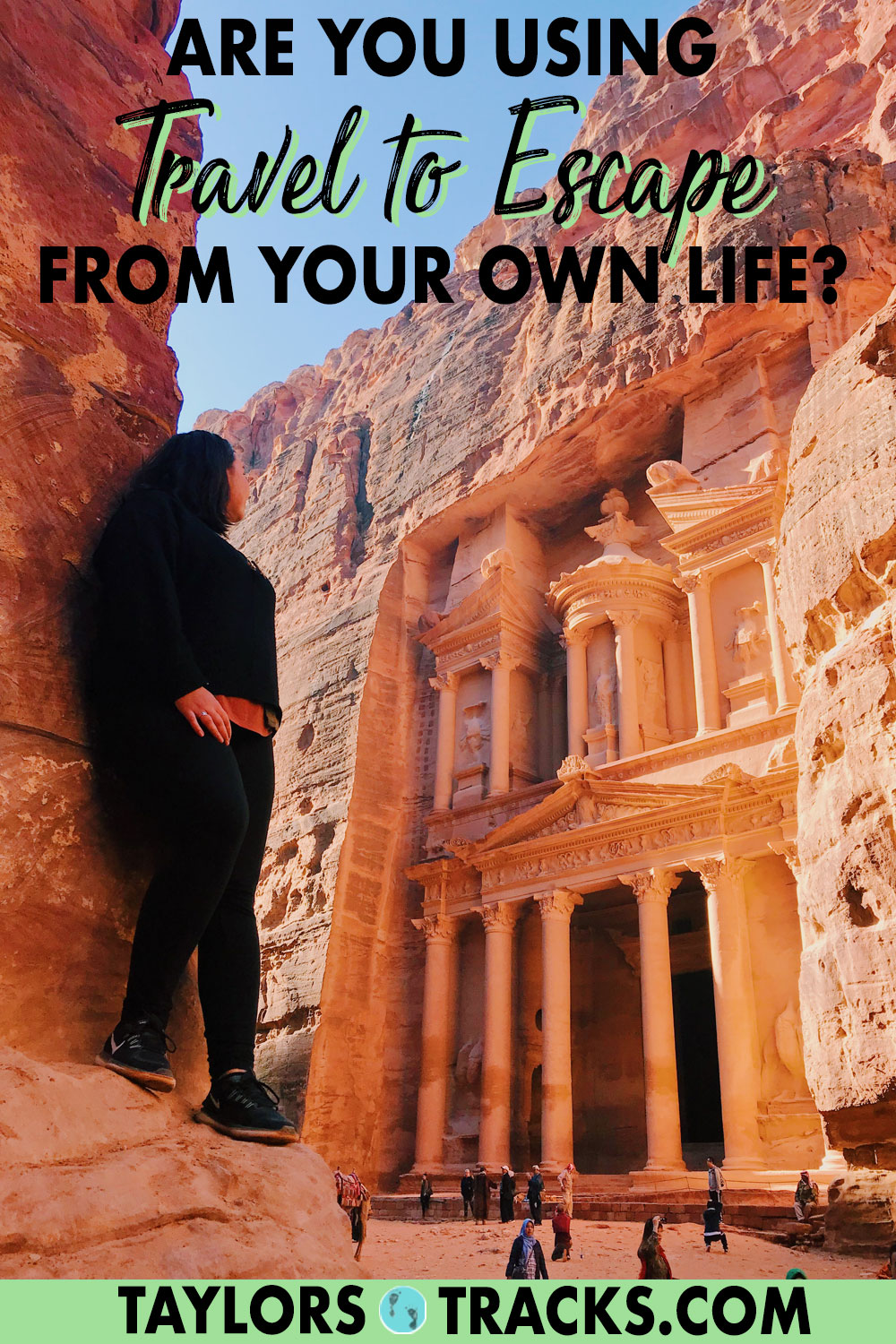

2 Lvmh Share Drop After Disappointing Q1 Sales Figures

May 25, 2025

2 Lvmh Share Drop After Disappointing Q1 Sales Figures

May 25, 2025 -

Emmy Winners Daughter Poses With Gerard Butler A Nepo Baby Moment

May 25, 2025

Emmy Winners Daughter Poses With Gerard Butler A Nepo Baby Moment

May 25, 2025 -

Alex Eala Targets Strong French Open Debut

May 25, 2025

Alex Eala Targets Strong French Open Debut

May 25, 2025