The Ripple (XRP) Phenomenon: Fourth Largest Crypto & Wealth Creation

Table of Contents

Understanding Ripple (XRP) and its Functionality

XRP, the native cryptocurrency of the Ripple network, operates on the XRP Ledger (XRPL), a decentralized, public blockchain distinct from Bitcoin or Ethereum. Understanding the XRPL is key to understanding XRP's value proposition.

-

The XRP Ledger (XRPL): Unlike other blockchains, the XRPL is designed for speed and efficiency. Its consensus mechanism allows for rapid transaction processing, significantly faster than many competitors. This is crucial for its intended use in facilitating near-instantaneous global payments.

-

Speed and Low Cost of Transactions: XRP transactions boast incredibly low fees and processing times measured in seconds, a stark contrast to the higher costs and slower speeds associated with some other cryptocurrencies. This low cost and speed are crucial for mass adoption.

-

Scalability and High Transaction Volume: The XRPL is designed to handle a very large volume of transactions concurrently, making it suitable for the high-throughput demands of global financial transactions. This scalability is a key advantage over some blockchain networks that struggle with congestion.

-

Cross-Border Payments via RippleNet: RippleNet is a global network of financial institutions using XRP to facilitate fast and inexpensive cross-border payments. This is perhaps XRP's most significant application, addressing a major pain point in the current financial system.

-

Use Cases Beyond Payments: While primarily known for payments, XRP also finds applications in decentralized exchanges (DEXs) and other financial technologies, expanding its potential use cases beyond traditional payment rails.

RippleNet: Revolutionizing Global Payments

RippleNet is the engine driving XRP's adoption and its potential for wealth creation. It's a real-world application transforming the way financial institutions conduct business.

-

Connecting Financial Institutions Globally: RippleNet connects banks, payment providers, and other financial institutions worldwide, enabling seamless cross-border transactions. This network effect is a significant contributor to XRP's value.

-

On-Demand Liquidity (ODL): ODL is a groundbreaking solution using XRP to reduce the need for pre-funded nostro accounts, dramatically improving efficiency and reducing costs for cross-border payments. This technology is a game-changer for international finance.

-

Benefits for Financial Institutions: RippleNet offers banks and other financial institutions reduced costs, faster settlement times, increased transparency, and improved liquidity management—all highly desirable in international finance.

-

Real-World Examples: Several major banks and financial institutions worldwide are already utilizing RippleNet, demonstrating its real-world adoption and validating its potential. The growing adoption signifies the increasing relevance of RippleNet in the global financial infrastructure.

-

Impact on Transaction Speed and Cost Reduction: The use of RippleNet and XRP results in significantly faster transaction speeds, often within seconds, compared to traditional methods which can take days or even weeks. Transaction costs are also drastically reduced.

XRP's Market Position and Price Volatility

XRP's position in the cryptocurrency market and its price volatility are key aspects to consider.

-

Market Capitalization and Ranking: XRP consistently ranks among the top cryptocurrencies by market capitalization, reflecting its established position in the market. This ranking, however, can fluctuate based on market conditions.

-

Historical Price Volatility: Like most cryptocurrencies, XRP experiences price volatility. Understanding historical price trends and the factors influencing them is crucial for investors.

-

Factors Influencing XRP's Price: Factors like regulatory announcements, market sentiment, adoption rates by financial institutions, and overall market trends in the cryptocurrency space all significantly influence XRP's price.

-

Investment Risks: Investing in XRP, like any cryptocurrency, involves significant risk. Price volatility, regulatory uncertainty, and technological risks all need careful consideration.

-

Potential Future Price Movements: While predicting the future price of XRP is impossible, analyzing the influencing factors mentioned above can offer some insight into potential price movements. However, investors should always conduct thorough research and understand the inherent risks.

Analyzing XRP's Investment Potential

Investing in XRP requires careful consideration of your risk tolerance and investment strategy.

-

Long-Term Investment Potential: Some investors view XRP as a long-term investment, believing in its potential for growth as RippleNet gains wider adoption and the cryptocurrency market matures.

-

Short-Term Trading Risks: Short-term trading in XRP carries higher risks due to its price volatility. Profit potential is higher, but so are the chances of losses.

-

Risk Tolerance and Diversification: Diversifying your investment portfolio is crucial, especially when investing in volatile assets like XRP. Your investment decisions should align with your risk tolerance.

-

Fundamental and Technical Analysis: Both fundamental analysis (examining the underlying technology and adoption) and technical analysis (studying price charts and trading patterns) can inform investment decisions, but neither guarantees success.

The Future of Ripple (XRP) and its Impact

The future of Ripple (XRP) hinges on several key factors.

-

Future Adoption Rate: The wider adoption of RippleNet by financial institutions will be a major driver of XRP's future growth. Increased adoption translates to increased demand and potentially higher value.

-

Regulatory Landscape: Regulatory clarity and acceptance of cryptocurrencies are crucial for the long-term success of XRP. Favorable regulations can drive adoption, while unfavorable ones can hinder growth.

-

Technological Advancements: Continued innovation in blockchain technology and RippleNet's functionality will be essential for XRP to maintain its competitive edge.

-

Potential Disruptive Impact: XRP and RippleNet have the potential to disrupt the traditional global payment system, offering a faster, cheaper, and more efficient alternative.

Conclusion

This article explored the Ripple (XRP) phenomenon, examining its functionality, market position, and potential for wealth creation. We discussed RippleNet's impact on global payments and analyzed the associated investment risks and opportunities. The future of XRP is intricately linked to the adoption of RippleNet, regulatory developments, and technological advancements within the broader cryptocurrency space.

Call to Action: Understanding the nuances of Ripple (XRP) is crucial for navigating the dynamic world of cryptocurrency. Further research and careful consideration of your risk tolerance are essential before making any investment decisions related to XRP or other digital assets. Continue learning about the potential of Ripple (XRP) and the evolving cryptocurrency landscape. Remember to conduct thorough due diligence and consult with a financial advisor before investing in any cryptocurrency, including XRP.

Featured Posts

-

Npps 2024 Election Loss Abu Jinapors Perspective And The Partys Future

May 02, 2025

Npps 2024 Election Loss Abu Jinapors Perspective And The Partys Future

May 02, 2025 -

Lottozahlen 6aus49 Ziehung Vom 19 April 2025

May 02, 2025

Lottozahlen 6aus49 Ziehung Vom 19 April 2025

May 02, 2025 -

Fixing Fortnite Matchmaking Error 1 A Comprehensive Guide

May 02, 2025

Fixing Fortnite Matchmaking Error 1 A Comprehensive Guide

May 02, 2025 -

Levenslang Voor Fouad L Waarom Geen Tbs Maatregel

May 02, 2025

Levenslang Voor Fouad L Waarom Geen Tbs Maatregel

May 02, 2025 -

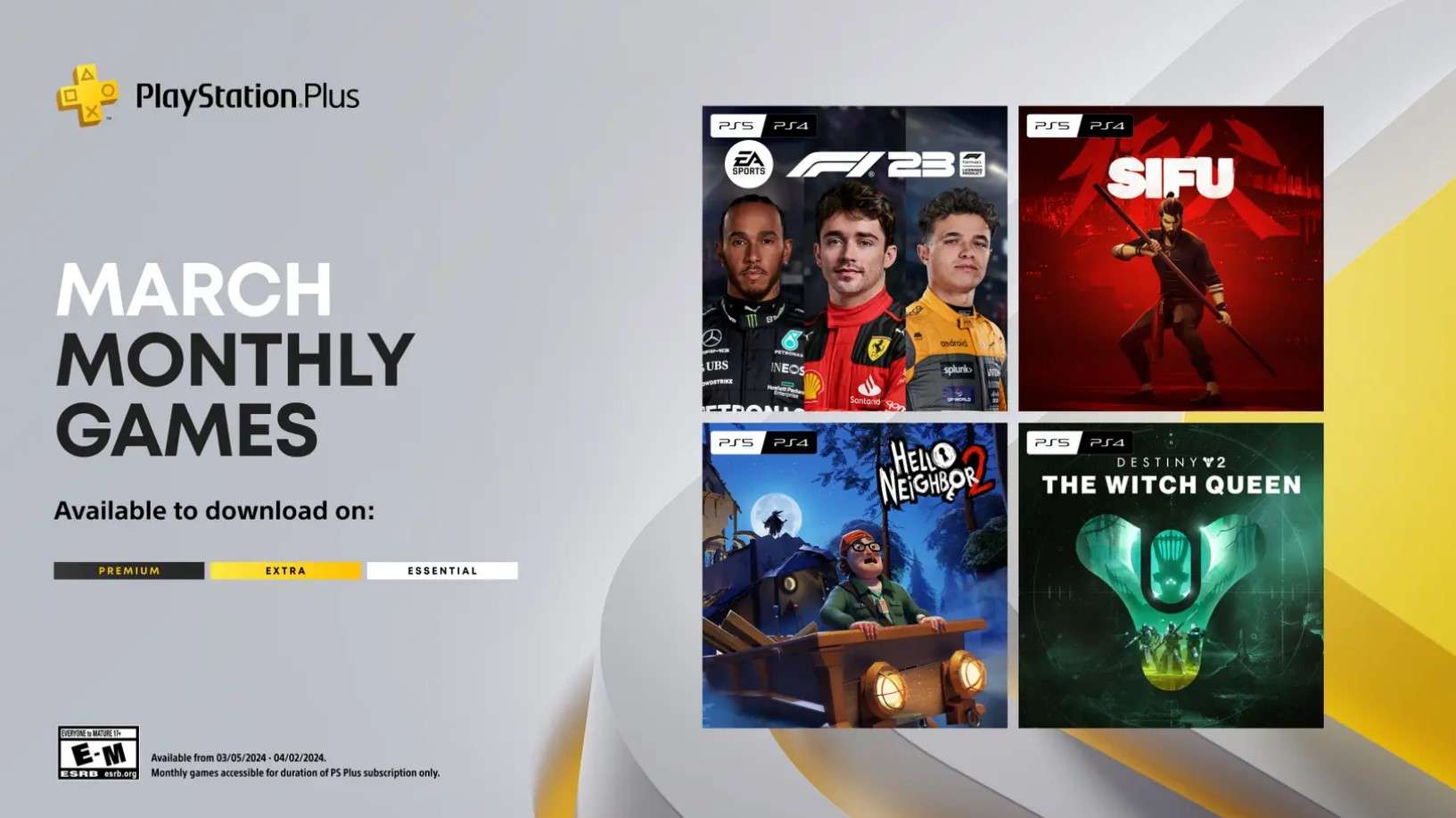

This Months Ps Plus An Underrated 2024 Game You Shouldnt Miss

May 02, 2025

This Months Ps Plus An Underrated 2024 Game You Shouldnt Miss

May 02, 2025

Latest Posts

-

The Harry Styles Influence On Benson Boone Fact Or Fiction

May 10, 2025

The Harry Styles Influence On Benson Boone Fact Or Fiction

May 10, 2025 -

Benson Boone Vs Harry Styles A Look At The Sound Alike Claims

May 10, 2025

Benson Boone Vs Harry Styles A Look At The Sound Alike Claims

May 10, 2025 -

Snls Bad Harry Styles Impression How He Really Felt

May 10, 2025

Snls Bad Harry Styles Impression How He Really Felt

May 10, 2025 -

Addressing The Controversy Benson Boone And The Harry Styles Comparisons

May 10, 2025

Addressing The Controversy Benson Boone And The Harry Styles Comparisons

May 10, 2025 -

Is Benson Boone Copying Harry Styles The Singers Response

May 10, 2025

Is Benson Boone Copying Harry Styles The Singers Response

May 10, 2025