The Trump Presidency And Cheap Oil: Impacts On The US Energy Sector

Table of Contents

The Trump Administration's Energy Policies and Their Impact on Oil Prices

The Trump administration's energy policies significantly influenced oil prices, primarily through deregulation and shifts in international relations.

Deregulation and Increased Domestic Production

A key aspect of the Trump administration's approach was deregulation, aiming to boost domestic oil and gas production. This involved:

- Increased drilling on federal lands: The administration eased restrictions on drilling on public lands and offshore areas, leading to a surge in activity.

- Streamlining permitting processes: Regulations surrounding the permitting process for new oil and gas projects were significantly streamlined, reducing delays and accelerating production.

- Rollback of the Clean Power Plan: The repeal of the Clean Power Plan, aimed at reducing carbon emissions from power plants, indirectly benefited the fossil fuel industry.

These actions resulted in a substantial increase in US oil supply. The Energy Information Administration (EIA) reported a significant rise in domestic crude oil production during this period. This increased supply contributed to lower global oil prices, impacting both domestic and international markets.

International Relations and OPEC Influence

The Trump administration's foreign policy also played a role in shaping global oil markets. Key aspects include:

- Relationship with OPEC nations: The administration engaged in direct negotiations with OPEC (Organization of the Petroleum Exporting Countries) members, attempting to influence their production decisions.

- Sanctions on Iran and Venezuela: Sanctions imposed on Iran and Venezuela, major oil producers, temporarily disrupted global supply, leading to price increases. However, these increases were often short-lived.

- Withdrawal from the Paris Agreement: The decision to withdraw from the Paris Agreement on climate change signaled a shift away from global cooperation on climate mitigation, potentially affecting long-term energy investments and indirectly influencing oil demand.

The impact of these actions on global oil prices was complex and often debated. While sanctions initially caused price spikes, the overall effect of the administration's foreign policy on long-term oil prices is a subject of ongoing discussion amongst economists and energy analysts. Some argue that the increased US production offset the impact of sanctions.

Impact on Different Sectors of the US Energy Industry

The fluctuating oil prices during the Trump presidency had varying impacts on different segments of the US energy industry.

Oil and Gas Exploration and Production

Cheap oil presented challenges to the oil and gas exploration and production sector:

- Impact on shale oil production: While production increased initially, low oil prices squeezed profit margins for shale oil producers, leading to bankruptcies and mergers.

- Bankruptcies and mergers in the industry: Numerous smaller oil and gas companies struggled to survive the low price environment, resulting in a wave of bankruptcies and industry consolidation.

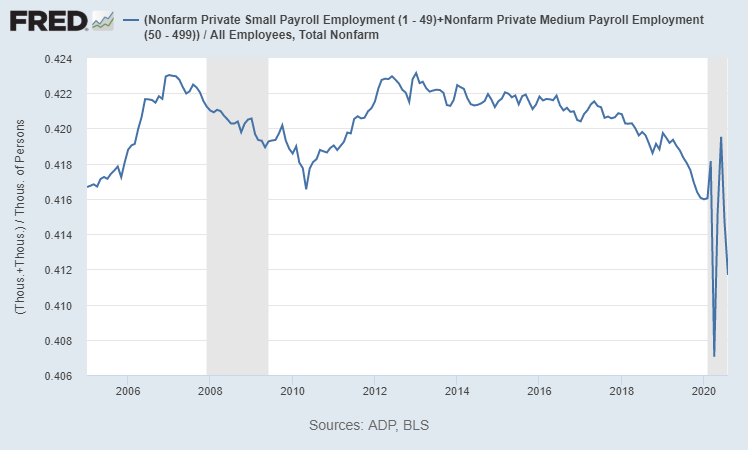

- Job growth/loss statistics: While initial deregulation led to job growth, sustained low prices eventually caused job losses in certain sectors.

Larger, integrated oil companies generally fared better than smaller, independent producers due to their greater financial resources and diversification.

Renewable Energy Sector

Fluctuating oil prices impacted the renewable energy sector:

- Government subsidies for renewables: Government support for renewables remained relatively stable, even with low oil prices.

- Comparative cost analysis between fossil fuels and renewables: Low oil prices made fossil fuels more competitive compared to renewables, potentially slowing the growth of some renewable energy projects.

- Effects on investment in renewable energy infrastructure: Despite the competition, investment in renewable energy infrastructure continued, albeit at a possibly slower pace than if oil prices were higher.

However, the long-term trend of declining renewable energy costs continued, maintaining its competitiveness against fossil fuels.

Refining and Petrochemicals

The refining and petrochemical industries were also affected by cheap oil:

- Changes in refining margins: Refining margins, the difference between the cost of crude oil and the price of refined products, narrowed during periods of low oil prices.

- Investment in new petrochemical plants: Low oil prices stimulated investment in some petrochemical plants, as the feedstock was cheaper.

- Impact on consumer prices: Consumers generally benefited from lower gasoline prices, a direct consequence of cheaper crude oil.

The relationship between crude oil prices and downstream industry profitability is complex, depending on factors such as demand, refining capacity, and global market conditions.

Long-Term Consequences and Future Outlook

The Trump administration's energy policies had significant long-term consequences.

Energy Security and Independence

The policies aimed to enhance US energy security and independence through increased domestic production. However:

- Increased domestic production: The policies did lead to a considerable increase in domestic oil and gas production.

- Reliance on international markets: The US still relies on international markets for certain types of oil and gas.

- Geopolitical vulnerabilities: Dependence on stable international relations to secure reliable access to energy resources continues.

The long-term impact on energy security remains a complex issue with both advantages and disadvantages.

Environmental Impact

Increased oil and gas production raised environmental concerns:

- Greenhouse gas emissions: Higher production led to increased greenhouse gas emissions, exacerbating climate change concerns.

- Water pollution: Oil and gas extraction can cause water pollution, harming ecosystems.

- Habitat destruction: Development of oil and gas infrastructure often involves habitat destruction.

The environmental consequences of the Trump administration's energy policies require ongoing monitoring and mitigation efforts.

Conclusion

The Trump presidency's impact on the US energy sector, in conjunction with fluctuating oil prices, was multifaceted and far-reaching. Deregulation spurred domestic production, while foreign policy decisions influenced global supply and demand. This led to varying impacts across different energy sectors, with the oil and gas industry facing both opportunities and challenges, and the renewable energy sector navigating a competitive landscape. The long-term consequences involved enhanced energy independence but also raised environmental concerns. Understanding the complex interplay between the "Trump Presidency and Cheap Oil" is essential for analyzing the present and future of the US energy landscape. We encourage further research into the continuing legacy of these policies and their impact on the US energy sector. Share your thoughts and insights on this crucial topic!

Featured Posts

-

Trumps Tariffs A Small Business Crisis Ignored By Washington

May 12, 2025

Trumps Tariffs A Small Business Crisis Ignored By Washington

May 12, 2025 -

Upcoming Mntn Ipo What To Expect From Ryan Reynolds Company

May 12, 2025

Upcoming Mntn Ipo What To Expect From Ryan Reynolds Company

May 12, 2025 -

Sydney Mc Laughlin Levrones World Leading 400m Hurdle Run In Miami

May 12, 2025

Sydney Mc Laughlin Levrones World Leading 400m Hurdle Run In Miami

May 12, 2025 -

Ranking The Top 10 John Wick Copycat Movies

May 12, 2025

Ranking The Top 10 John Wick Copycat Movies

May 12, 2025 -

Find The Doom Dark Ages Limited Edition Xbox Controller On Sale At Amazon

May 12, 2025

Find The Doom Dark Ages Limited Edition Xbox Controller On Sale At Amazon

May 12, 2025

Latest Posts

-

Aktualizacia Atlasu Romskych Komunit Zber Dat V Aprili

May 13, 2025

Aktualizacia Atlasu Romskych Komunit Zber Dat V Aprili

May 13, 2025 -

Climate Change Fuels Wildfires Threatening Uks Endangered Species

May 13, 2025

Climate Change Fuels Wildfires Threatening Uks Endangered Species

May 13, 2025 -

Zber Dat Pre Aktualizaciu Atlasu Romskych Komunit Sa Zacina V Aprili

May 13, 2025

Zber Dat Pre Aktualizaciu Atlasu Romskych Komunit Sa Zacina V Aprili

May 13, 2025 -

Dukungan Masyarakat Papua Untuk Persipura Ajakan Kakanwil Anthonius Ayorbaba

May 13, 2025

Dukungan Masyarakat Papua Untuk Persipura Ajakan Kakanwil Anthonius Ayorbaba

May 13, 2025 -

Rampant Wildfires Pushing Uks Rarest Wildlife To Extinction

May 13, 2025

Rampant Wildfires Pushing Uks Rarest Wildlife To Extinction

May 13, 2025