The Trump Tax Bill: A Breakdown Of The House-Passed Version

Table of Contents

Individual Income Tax Changes

The Trump Tax Bill brought about substantial changes to individual income taxes, affecting taxpayers across various income brackets. These changes aimed to simplify the tax system while offering tax relief to certain groups.

Standard Deduction Increase

One of the most significant changes was the substantial increase in the standard deduction. This move potentially benefited many taxpayers by reducing their taxable income.

- Increased amounts: The standard deduction was significantly raised for single filers, married couples filing jointly, and heads of households. Specific amounts varied depending on filing status.

- Reduced itemizers: The increase led to a reduction in the number of taxpayers who itemized deductions, as the standard deduction became more advantageous for many.

- Tax savings: This change resulted in considerable tax savings for numerous low-to-middle-income taxpayers, simplifying their tax preparation.

Child Tax Credit Expansion

The Child Tax Credit (CTC) received a substantial boost under the Trump Tax Bill, providing greater financial relief to families.

- Higher Credit Amount: The maximum CTC amount was increased, providing a larger tax break for each qualifying child.

- Refundable Portion: A larger portion of the CTC became refundable, meaning that even low-income families who owed little or no tax could receive a portion of the credit as a refund.

- Multiple Children: Families with multiple children benefited greatly from this expansion, significantly reducing their tax burden.

- Low-Income Impact: The refundable portion of the credit was particularly impactful for low-income families, offering crucial financial assistance.

Changes to Itemized Deductions

The Trump Tax Bill also modified several itemized deductions, impacting taxpayers' ability to reduce their taxable income.

- SALT Deduction Limitation: The state and local tax (SALT) deduction, previously unlimited, faced significant limitations, potentially increasing taxes for high-income taxpayers in high-tax states.

- Medical Expense Deduction: Changes were made to the medical expense deduction, affecting the threshold for deductibility.

- High-Income Taxpayers: High-income taxpayers were particularly affected by the changes to itemized deductions, often experiencing a net tax increase.

- Tax Increases: For some taxpayers, the modifications to itemized deductions resulted in higher tax liabilities.

Corporate Tax Rate Reduction

A cornerstone of the Trump Tax Bill was the dramatic reduction in the corporate tax rate. This change aimed to boost economic growth and enhance corporate competitiveness.

Lower Corporate Tax Rate

The corporate tax rate was slashed from 35% to 21%, a substantial reduction.

- Increased Profitability: This lower rate directly increased corporate profitability, providing businesses with more capital for investment and expansion.

- Investment and Job Creation: Proponents argued the lower rate would stimulate investment and lead to job creation.

- Tax Avoidance Concerns: Critics raised concerns about the potential for increased tax avoidance by multinational corporations.

- National Deficit: The significant revenue loss from the corporate tax cut raised concerns about its impact on the national deficit.

Pass-Through Business Tax Changes

The Trump Tax Bill also introduced significant changes for pass-through businesses, impacting small business owners and entrepreneurs.

Deduction for Qualified Business Income (QBI)

A new deduction for Qualified Business Income (QBI) was created, benefiting owners of pass-through entities such as partnerships and S corporations.

- QBI Deduction Calculation: The calculation of the QBI deduction involved several complexities, requiring careful consideration of business income and limitations.

- Deduction Limitations: The deduction was subject to limitations based on taxable income, preventing excessive tax benefits for high-income earners.

- Small Business Impact: This deduction provided substantial tax relief to many small business owners, potentially boosting investment and growth.

- Comparison with Previous Laws: The QBI deduction represented a significant departure from previous tax laws, offering a more favorable treatment for pass-through businesses.

Other Notable Changes

Beyond the key provisions, the Trump Tax Bill included several other notable changes:

- Individual Tax Brackets: The number of individual tax brackets was reduced, simplifying the tax system for some.

- Estate and Gift Taxes: Changes were made to estate and gift taxes, potentially affecting high-net-worth individuals and families.

- Income Level Impact: The bill's impact varied significantly across different income levels, with some benefiting more than others.

Conclusion

The House-passed Trump Tax Bill implemented sweeping changes to the US tax system. Understanding the key provisions, including the increased standard deduction, expanded Child Tax Credit, lower corporate tax rate, and the QBI deduction, is vital for effective financial planning. While the bill aimed to simplify the tax code and spur economic growth, its long-term consequences remain a subject of ongoing debate. For in-depth analysis and personalized advice on how the Trump Tax Bill impacts your financial situation, consult a qualified tax advisor. A thorough understanding of the Trump Tax Bill and its implications is essential for making sound financial decisions.

Featured Posts

-

Ralph Macchio Offers Hints On Potential My Cousin Vinny Reboot With Joe Pesci

May 23, 2025

Ralph Macchio Offers Hints On Potential My Cousin Vinny Reboot With Joe Pesci

May 23, 2025 -

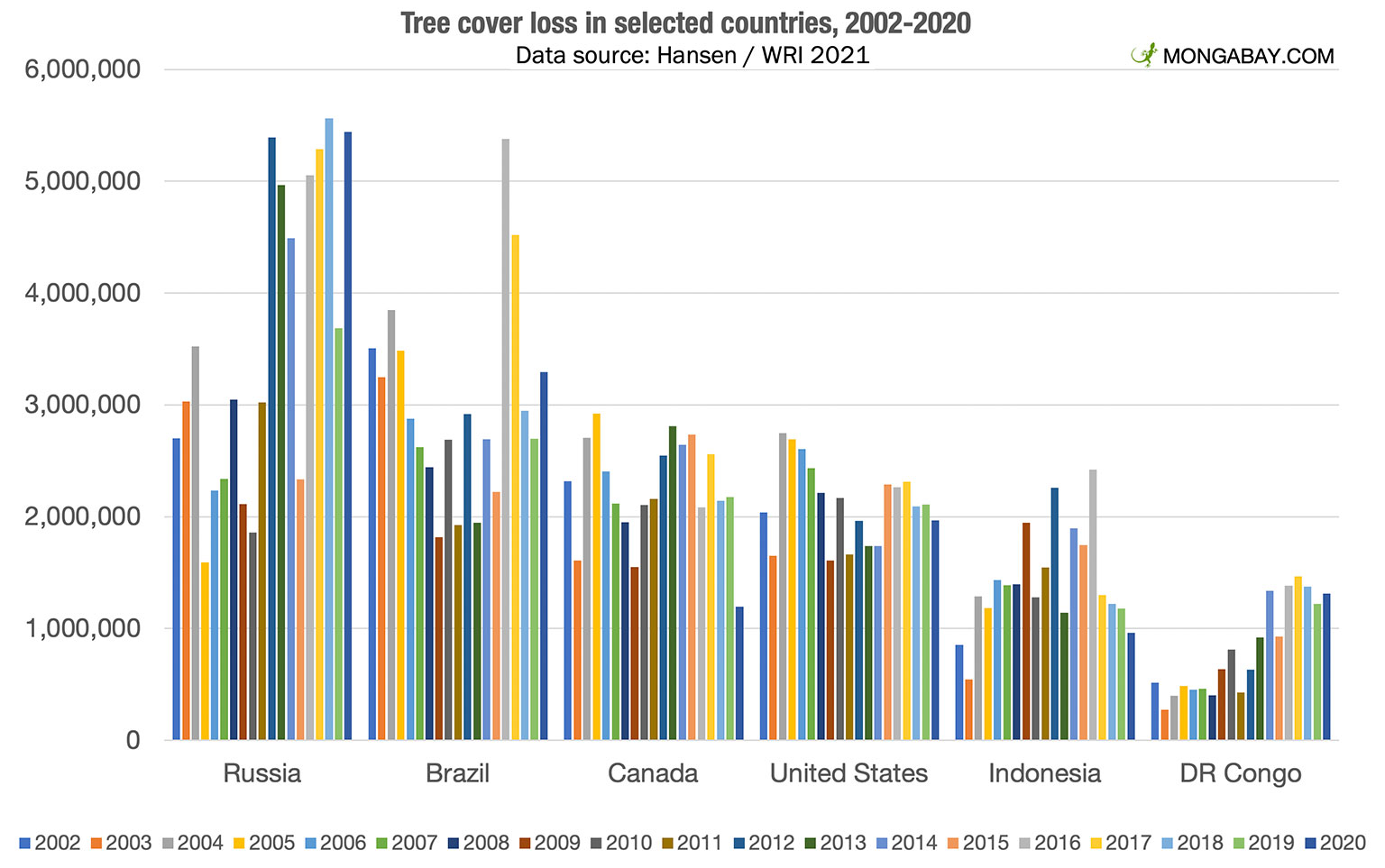

The Rising Threat Of Wildfires Driving Record Levels Of Global Forest Loss

May 23, 2025

The Rising Threat Of Wildfires Driving Record Levels Of Global Forest Loss

May 23, 2025 -

Dc Legends Of Tomorrow Mastering The Gameplay

May 23, 2025

Dc Legends Of Tomorrow Mastering The Gameplay

May 23, 2025 -

Responding To A Best And Final Job Offer A Negotiation Guide

May 23, 2025

Responding To A Best And Final Job Offer A Negotiation Guide

May 23, 2025 -

Emergency Evacuation Swiss Alpine Village Livestock Moved Due To Landslide Risk

May 23, 2025

Emergency Evacuation Swiss Alpine Village Livestock Moved Due To Landslide Risk

May 23, 2025

Latest Posts

-

Jonathan Groffs Potential Tony Award History With Just In Time

May 23, 2025

Jonathan Groffs Potential Tony Award History With Just In Time

May 23, 2025 -

Jonathan Groff Just In Time And The Race For A Tony Award

May 23, 2025

Jonathan Groff Just In Time And The Race For A Tony Award

May 23, 2025 -

Could Jonathan Groff Win A Tony For Just In Time A Broadway Prediction

May 23, 2025

Could Jonathan Groff Win A Tony For Just In Time A Broadway Prediction

May 23, 2025 -

Jonathan Groff And The Tony Awards Could Just In Time Make History

May 23, 2025

Jonathan Groff And The Tony Awards Could Just In Time Make History

May 23, 2025 -

Jonathan Groffs Potential Tony Award History A Look At Just In Time

May 23, 2025

Jonathan Groffs Potential Tony Award History A Look At Just In Time

May 23, 2025