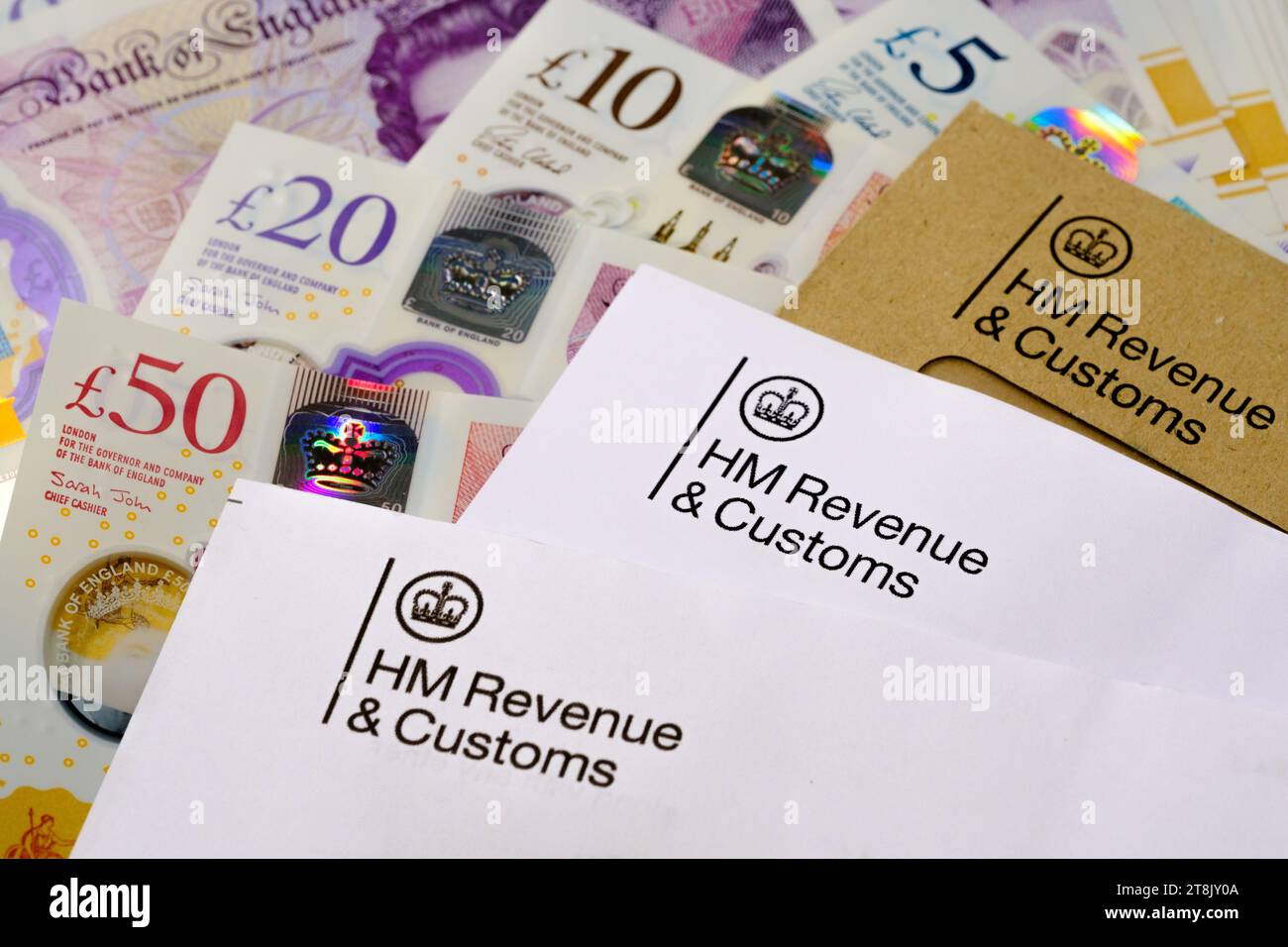

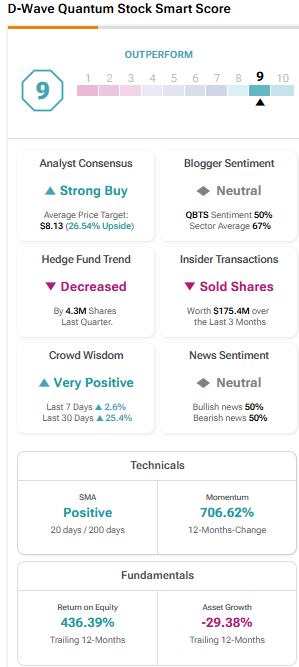

Thousands Of UK Households Receiving HMRC Letters: Income Tax Checks

Table of Contents

Why is HMRC Sending Out These Letters? (HMRC Tax Letters)

HMRC's increased scrutiny of income tax returns stems from several key factors. The aim is to ensure fair tax collection and address issues such as tax avoidance and evasion. This proactive approach has led to a significant rise in the number of income tax checks being undertaken.

Here are some of the primary reasons behind the surge in HMRC tax letters:

- Combating Tax Avoidance and Evasion: HMRC is actively working to identify and address instances of individuals and businesses under-reporting income or using illegal methods to reduce their tax liability.

- Improving Tax Assessment Accuracy: Regular checks help ensure the accuracy of tax assessments and identify any discrepancies between reported income and the information HMRC holds.

- Addressing Changes in Employment Patterns: The rise of the gig economy and other non-traditional employment arrangements has led to complexities in tax reporting, necessitating more frequent checks to ensure accurate tax collection.

- Addressing Discrepancies in Self-Assessment Returns: Inconsistencies between self-assessment returns and other information available to HMRC often trigger further investigation.

Several common scenarios might lead to an HMRC letter:

- Under-reporting income: Failing to declare all sources of income, including self-employment, rental income, or investment income.

- Missing deadlines for self-assessment: Submitting your self-assessment tax return late can trigger an HMRC review.

- Inconsistent information across different tax returns: Discrepancies between your self-assessment and information provided to your employer or other sources can raise red flags.

- Changes in circumstances not reported: Significant life changes, such as starting a new job, becoming self-employed, or moving house, must be reported to HMRC to update your tax code and ensure accurate tax calculations.

What Should You Do if You Receive an HMRC Letter? (HMRC Letter Response, Tax Enquiry)

Receiving an HMRC letter about an income tax check can be stressful, but the most important thing is not to ignore it. Prompt action is vital. Failure to respond can lead to penalties and further complications.

Here's a step-by-step guide to responding to an HMRC letter:

- Read the letter carefully: Understand exactly what HMRC is requesting and the deadline for your response.

- Gather all relevant documentation: This includes P60s, payslips, bank statements, invoices, and any other documents related to your income and expenses. Thorough preparation is key.

- Respond within the timeframe specified: Adhering to the deadlines set by HMRC is crucial to avoiding penalties.

- Contact HMRC directly if you have questions or need clarification: Don't hesitate to call HMRC if you have any questions or require further guidance on responding to the letter.

- Consider seeking professional advice from an accountant: If the matter is complex or you feel overwhelmed, seeking help from a qualified accountant is a wise decision. They can assist with navigating the process and ensuring compliance.

Addressing common anxieties: Many people fear HMRC tax investigations. Remember, a routine HMRC income tax check isn't necessarily an accusation of wrongdoing. It's often a standard procedure to verify the accuracy of tax returns. However, prompt and accurate responses are still crucial.

Understanding the HMRC Income Tax Check Process (HMRC Tax Investigation, Income Tax Check Process)

The HMRC income tax check process can vary in complexity. It may range from a simple request for clarification to a more extensive investigation.

General steps involved may include:

- Initial contact: You receive a letter requesting further information or clarification.

- Information gathering: HMRC may request additional documentation to verify your income and expenses.

- Review and assessment: HMRC will review the information provided and assess your tax liability.

- Outcome: The outcome can range from no further action required, to a request for additional tax payment, or even penalties for non-compliance.

Potential outcomes of an HMRC income tax check:

- No further action needed: This is the ideal outcome, indicating your tax return was accurate.

- Request for further information: HMRC may require additional documentation to clarify certain aspects of your return.

- Additional tax payable: If HMRC identifies under-reporting of income, you may be liable for additional tax.

- Penalties for late payment or non-compliance: Failure to comply with HMRC's requests or pay outstanding tax on time will result in penalties.

It is important to distinguish between routine checks and full-scale investigations. Routine checks are common and generally involve a simple review of your tax return. Full-scale investigations are more in-depth and usually involve a more thorough examination of your financial affairs.

Avoiding HMRC Income Tax Checks in the Future (Prevent HMRC Tax Investigation)

Proactive tax management is the best way to minimize the risk of future HMRC reviews.

Here are some practical steps you can take:

- Keep accurate and detailed records of income and expenses: Maintain meticulous records of all your financial transactions. Digital record-keeping is often more efficient and secure.

- File tax returns on time: Submitting your tax return promptly avoids late filing penalties and reduces the likelihood of an HMRC review.

- Understand your tax obligations: Stay informed about your tax responsibilities and ensure you are complying with all relevant legislation.

- Use tax software or seek professional help with your self-assessment: Tax software can help you accurately complete your tax return, while professional advice from an accountant can provide peace of mind.

- Report any changes in your circumstances promptly to HMRC: Notify HMRC immediately of any changes that may affect your tax liability, such as a change of job, address, or marital status.

By following these guidelines, you can significantly reduce your risk of encountering future HMRC income tax checks.

Conclusion

Receiving an HMRC letter about an income tax check can be unsettling, but understanding the process and responding promptly is key to resolving the issue efficiently. By following the steps outlined above and maintaining accurate and up-to-date financial records, you can significantly minimize the risk of future HMRC income tax checks and ensure compliance with your tax obligations. Remember, proactive tax management and seeking professional advice when needed are crucial for avoiding problems with HMRC income tax checks. Don't hesitate to seek professional help if you have any uncertainties about your tax affairs. Proactive tax management is the best defence against HMRC income tax checks.

Featured Posts

-

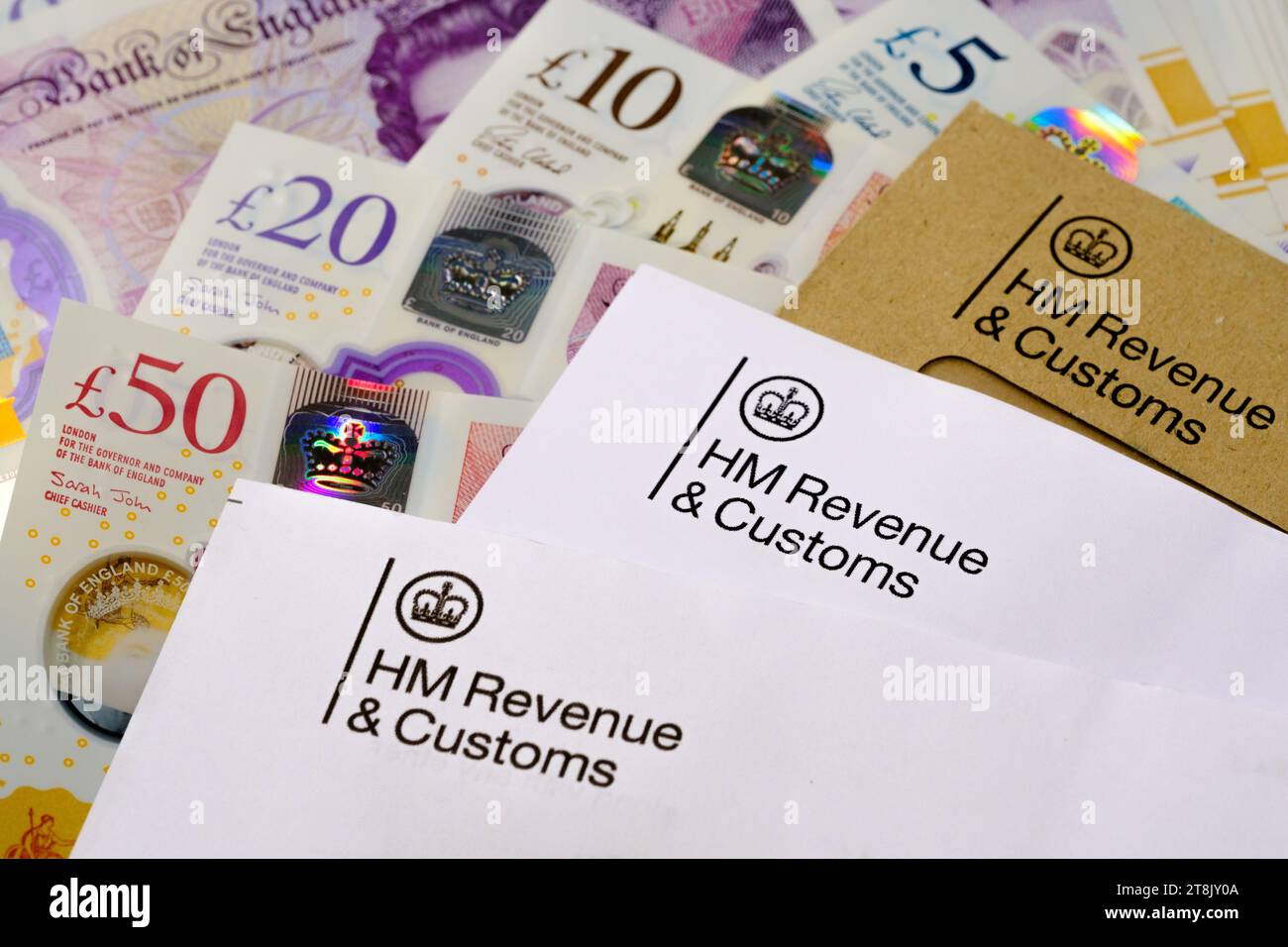

D Wave Quantum Qbts Stock Crash Causes And Analysis

May 20, 2025

D Wave Quantum Qbts Stock Crash Causes And Analysis

May 20, 2025 -

Bbai Stock Analyst Downgrade Reflects Growth Challenges

May 20, 2025

Bbai Stock Analyst Downgrade Reflects Growth Challenges

May 20, 2025 -

Snls 50th Season Finale Record Breaking Ratings And Highlights

May 20, 2025

Snls 50th Season Finale Record Breaking Ratings And Highlights

May 20, 2025 -

Space Supercomputer Chinas Ambitious Project Takes Shape

May 20, 2025

Space Supercomputer Chinas Ambitious Project Takes Shape

May 20, 2025 -

Efimeries Iatron Patras Savvatokyriako Pliris Lista

May 20, 2025

Efimeries Iatron Patras Savvatokyriako Pliris Lista

May 20, 2025