Thursday's CoreWeave (CRWV) Stock Decline: A Detailed Explanation

Table of Contents

Thursday witnessed a significant decline in CoreWeave (CRWV) stock price, leaving investors scrambling to understand the reasons behind this sudden plunge. This article delves into the key factors contributing to this downturn, analyzing market conditions, company-specific challenges, investor sentiment, and technical indicators to provide a comprehensive understanding of the situation and its potential implications.

Market-Wide Volatility and Sectoral Downturn

Thursday's broader market conditions played a significant role in CoreWeave's stock price drop. The tech sector, already facing increased scrutiny due to rising interest rates and concerns about future economic growth, experienced a general downturn. This wider market volatility negatively impacted investor confidence across the board, affecting even strong performers like CoreWeave.

- Major Economic News: Negative economic indicators released on Thursday, such as unexpectedly high inflation figures or disappointing employment data, could have fueled a sell-off across the tech sector, impacting investor sentiment. The overall market uncertainty contributed to a risk-off sentiment, leading investors to liquidate holdings in growth stocks like CRWV.

- Cloud Computing and AI Sector Impacts: The cloud computing and AI infrastructure sectors, while experiencing long-term growth, are not immune to market fluctuations. Any negative news regarding government regulations, increased competition, or slowing adoption rates within these specific sectors could have triggered widespread selling pressure.

- Correlation with Other Tech Stocks: A strong negative correlation was observed between CRWV and other major tech stocks on Thursday. This suggests that the decline wasn't solely CoreWeave-specific but rather a reflection of broader market concerns affecting the entire technology sector. The movement of similar cloud computing stocks like those of major cloud providers should be analyzed for correlations.

CoreWeave's Specific Challenges

While broader market forces contributed significantly, it's crucial to analyze any company-specific factors that might have exacerbated CoreWeave's stock price decline.

- Earnings Reports and Guidance: The absence of any recent negative earnings reports or significantly revised guidance from CoreWeave suggests that the stock drop is primarily market-driven, rather than stemming from internal company issues. However, a closer examination of future guidance and potential upcoming earnings reports would be beneficial to understand the impact of the recent drop on future company performance.

- Analyst Ratings and Concerns: Any downgrades from prominent analysts or concerns raised by rating agencies regarding CoreWeave's future prospects could have added to the selling pressure. Monitoring analyst reports and ratings is crucial to gain a comprehensive understanding of the market sentiment around CRWV.

- Competitive Landscape: Increased competition within the cloud computing and AI infrastructure space is a constant factor. A significant announcement from a competitor, introducing a disruptive technology or securing a major partnership, might have indirectly influenced investor perception of CoreWeave's market share and competitive advantage.

Investor Sentiment and Trading Activity

Understanding investor sentiment and trading activity on Thursday is critical to fully grasp the CRWV stock price decline.

- High Trading Volume: Unusually high trading volume on Thursday indicates significant activity, suggesting a large number of investors were actively selling their CRWV shares. This high volume further amplifies the impact of negative sentiment.

- Sell-offs and Short Selling: A surge in sell-offs and potentially increased short-selling activity would have contributed to the downward price pressure on CRWV. This signifies a bearish market sentiment with investors expecting further price declines.

- Social Media Sentiment and News Coverage: Negative social media sentiment or unfavorable news coverage surrounding CoreWeave could have influenced investor behavior, leading to increased selling pressure. Monitoring social media trends and news coverage regarding CRWV is crucial to understanding the narrative impacting the stock price.

Technical Analysis of CRWV Stock Chart

A technical analysis of the CRWV stock chart on Thursday could reveal important insights. For example, a break below a key support level or a negative crossover of significant moving averages might have triggered stop-loss orders, contributing to the sharp decline. Analyzing chart patterns, such as head and shoulders formations or bearish flags, can provide additional context to the price movement. (Note: Inclusion of a relevant, appropriately licensed chart would enhance this section significantly).

Long-Term Implications and Future Outlook

While Thursday's decline is concerning, it's important to analyze the long-term implications for CoreWeave.

- Recovery Strategies: CoreWeave's management will likely focus on reinforcing its core strengths, highlighting its long-term growth potential, and perhaps implementing specific initiatives to regain investor confidence. This could include strategic partnerships, product enhancements, or refined marketing strategies.

- Growth Prospects: The long-term prospects for CoreWeave in the rapidly growing cloud computing and AI markets remain positive. The company's innovative technology and strategic positioning within the industry should contribute to continued growth over the long term, despite short-term market fluctuations.

- Upcoming Catalysts: Any upcoming product launches, partnerships, or earnings reports could significantly impact CoreWeave's stock price. Keeping an eye on these future catalysts will be crucial for assessing the company's trajectory.

Conclusion

Thursday's decline in CoreWeave (CRWV) stock price resulted from a confluence of factors, including broader market volatility, sector-specific concerns, and shifts in investor sentiment. While the short-term outlook might appear uncertain, a thorough analysis reveals that the long-term prospects for CoreWeave remain largely dependent on its ability to navigate these challenges and capitalize on the growing demand for AI infrastructure. The impact of Thursday's CoreWeave (CRWV) stock decline is a complex interplay of market forces and company-specific factors, demanding careful observation.

Call to Action: Stay informed about the ongoing developments surrounding CoreWeave (CRWV) stock. Continue to monitor market news, analyst reports, and company announcements to make informed investment decisions related to CoreWeave and other similar cloud computing stocks. Understanding the complexities of the CoreWeave (CRWV) stock decline is crucial for navigating the ever-evolving landscape of the AI and cloud computing markets. Investors should carefully consider the interplay between market conditions and CoreWeave's specific performance before making any investment decisions regarding CRWV stock.

Featured Posts

-

A Geographic Overview Of The Countrys Most Promising Business Locations

May 22, 2025

A Geographic Overview Of The Countrys Most Promising Business Locations

May 22, 2025 -

Les Grands Fusains De Boulemane Debat Anime Au Book Club Le Matin

May 22, 2025

Les Grands Fusains De Boulemane Debat Anime Au Book Club Le Matin

May 22, 2025 -

The Selena Gomez Taylor Swift Rift Blake Lively At The Center Of The Storm

May 22, 2025

The Selena Gomez Taylor Swift Rift Blake Lively At The Center Of The Storm

May 22, 2025 -

Boe Rate Cut Probabilities Reduced Pound Gains After Uk Inflation Figures

May 22, 2025

Boe Rate Cut Probabilities Reduced Pound Gains After Uk Inflation Figures

May 22, 2025 -

The Kartels Grip On Guyanas Rum Industry Stabroek News Analysis

May 22, 2025

The Kartels Grip On Guyanas Rum Industry Stabroek News Analysis

May 22, 2025

Latest Posts

-

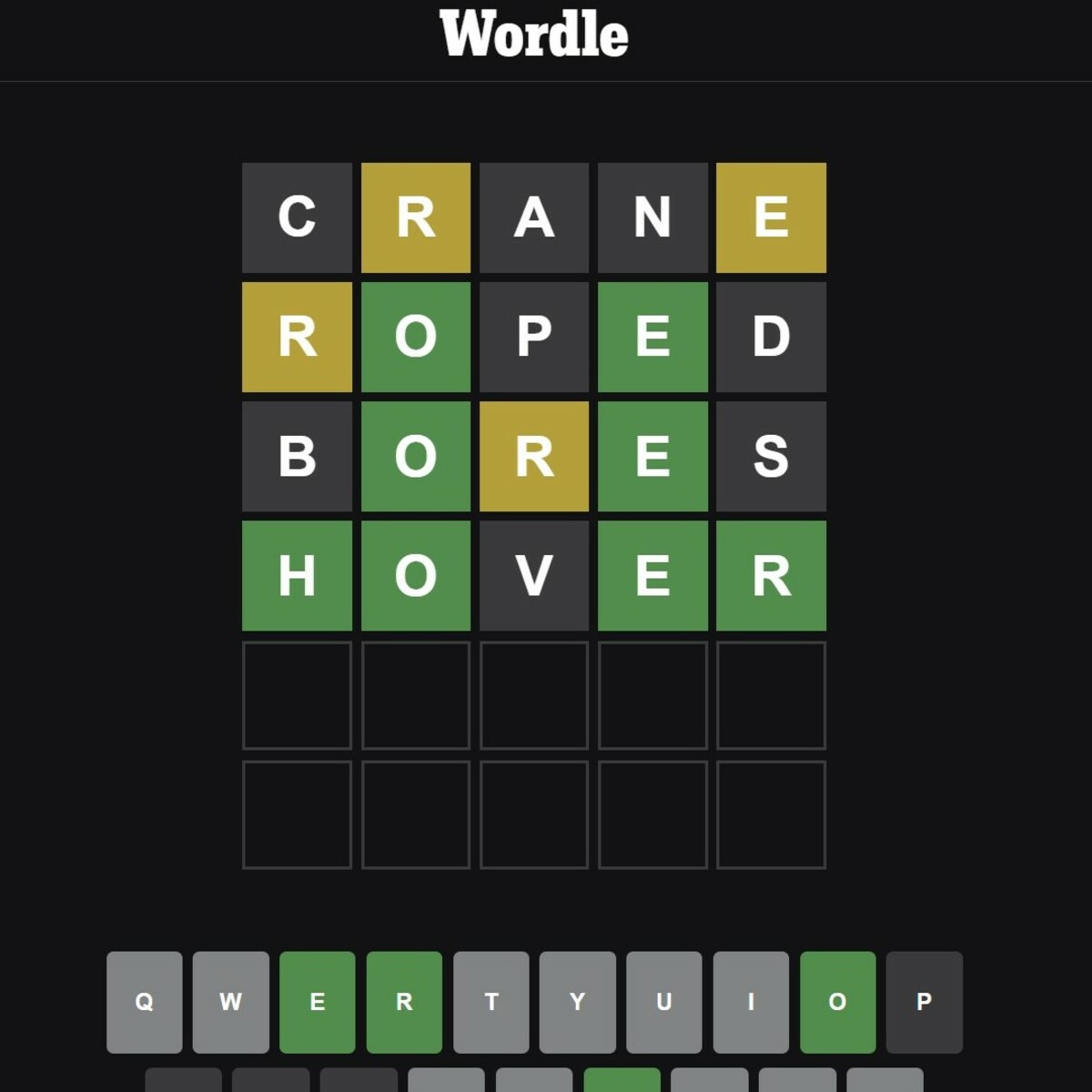

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025 -

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025 -

Nyt Wordle Answer March 26 Difficulty And Solution

May 22, 2025

Nyt Wordle Answer March 26 Difficulty And Solution

May 22, 2025