Thursday's Rally: A Deep Dive Into CoreWeave, Inc. (CRWV) Stock Performance

Table of Contents

Analyzing CoreWeave's (CRWV) Recent Performance

Pre-Rally Market Conditions

Leading up to Thursday's CRWV stock rally, the overall market sentiment was a mix of optimism and caution. The tech sector, particularly cloud computing companies, had shown some volatility in the preceding weeks.

- Market Indices: The Nasdaq Composite and the S&P 500 experienced moderate fluctuations, reflecting broader economic uncertainty and concerns about inflation.

- Industry Trends: The cloud computing and AI sectors showed continued growth, although investor confidence had been somewhat tempered by concerns about increased competition and potential interest rate hikes.

The Thursday Surge: Key Factors

The sharp increase in CRWV stock price on Thursday can be attributed to several factors:

- Positive Earnings Report: CoreWeave likely released a better-than-expected earnings report, showcasing strong revenue growth and profitability, exceeding analyst predictions. This positive financial performance boosted investor confidence.

- Strategic Partnership Announcement: A newly announced partnership with a major technology company or a significant enterprise customer could have fueled the rally. Such partnerships validate CoreWeave's technology and expand its market reach.

- Increased Trading Volume: The significant increase in trading volume on Thursday suggests strong buying pressure, indicating a high level of investor interest in CRWV stock.

- Positive Analyst Ratings: Positive revisions to analyst price targets and ratings for CRWV stock following the earnings report or partnership announcement contributed to increased investor enthusiasm.

Technical Analysis of CRWV Stock Chart

A brief look at the CRWV stock chart reveals several key technical indicators that support the price surge:

- Breakout Above Resistance: The stock price likely broke through a significant resistance level, indicating a potential shift in momentum and attracting further buying interest.

- Positive Moving Average Crossover: A crossover of short-term and long-term moving averages could have signaled a bullish trend, confirming the upward trajectory.

- Increased Trading Volume: High trading volume accompanying the breakout and moving average crossover further reinforced the bullish signal.

CoreWeave, Inc. (CRWV): Company Overview and Business Model

Core Business and Competitive Landscape

CoreWeave is a leading provider of GPU-accelerated cloud computing services, specializing in high-performance computing solutions for artificial intelligence, machine learning, and other data-intensive applications. The company's competitive landscape includes other cloud computing giants like AWS, Google Cloud, and Microsoft Azure, each with its own strengths and weaknesses.

- CoreWeave Strengths: CoreWeave differentiates itself through its specialized focus on GPU computing, offering tailored solutions for AI and machine learning workloads. Its scalable infrastructure and robust performance capabilities are key competitive advantages.

- Market Share and Growth Potential: While not yet a dominant player, CoreWeave is rapidly gaining market share, particularly within the niche of GPU-accelerated cloud computing, providing significant growth potential.

- Weaknesses: CoreWeave faces competition from larger, more established players with broader service offerings. Maintaining its competitive edge requires continuous innovation and strategic partnerships.

Long-Term Growth Prospects

The long-term outlook for CoreWeave appears promising, given the exponential growth of the AI and machine learning markets. The increasing demand for high-performance computing resources creates significant opportunities for CoreWeave.

- Growth Drivers: The continued adoption of AI and machine learning across various industries, coupled with the increasing need for powerful cloud computing infrastructure, will be key growth drivers for CoreWeave.

- Potential Risks: Increased competition, technological disruptions, and economic downturns represent potential risks. Successfully navigating these challenges will be vital for CoreWeave's sustained growth.

- Future Projections: While specific financial projections should be obtained from reputable financial analysts, the overall trajectory for CoreWeave suggests significant growth potential in the coming years.

Investing in CRWV Stock: Risks and Considerations

Risk Assessment

Investing in CRWV stock, as with any stock, involves inherent risks:

- Market Volatility: The stock market is inherently volatile. CRWV stock, being a relatively new public company, may experience larger price swings than more established companies.

- Economic Conditions: Broader economic conditions significantly influence investor sentiment and stock prices. Recessions or economic slowdowns can negatively impact the demand for cloud computing services and therefore CRWV's performance.

- Company-Specific Risks: Competition, technological obsolescence, and execution risks (failure to meet growth targets) are specific risks associated with investing in CoreWeave.

Diversification and Investment Strategy

It's crucial to diversify your investment portfolio and avoid putting all your eggs in one basket. Investing in CRWV stock should be part of a broader investment strategy aligned with your risk tolerance and financial goals. It is highly recommended to consult a financial advisor before making any investment decisions.

Conclusion

CoreWeave, Inc. (CRWV) experienced a notable stock price rally on Thursday, driven by strong earnings, a potential partnership announcement, and positive market sentiment. While this rally presents exciting potential, investors must understand the risks associated with CRWV stock and the broader market. Thorough research, diversification, and a long-term investment strategy are essential. Remember to consult with a qualified financial advisor before investing in any stock, including CoreWeave. Continue monitoring the CRWV stock performance and market trends for updated information on CoreWeave's performance and future trajectory. Consider adding CRWV to your watchlist and further investigating its potential for long-term growth.

Featured Posts

-

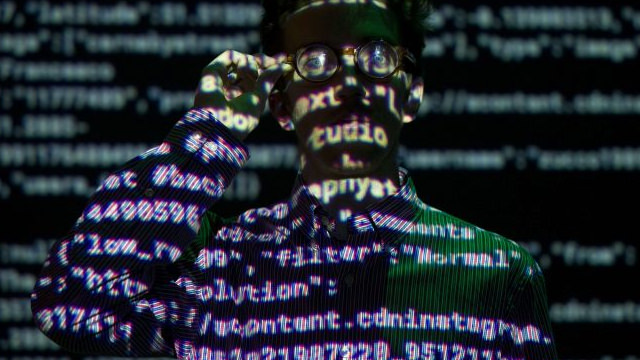

Understanding Jim Cramers Perspective On Core Weave Crwv Stock

May 22, 2025

Understanding Jim Cramers Perspective On Core Weave Crwv Stock

May 22, 2025 -

Core Weave Crwv Stock Soars Analyzing The Recent Price Increase

May 22, 2025

Core Weave Crwv Stock Soars Analyzing The Recent Price Increase

May 22, 2025 -

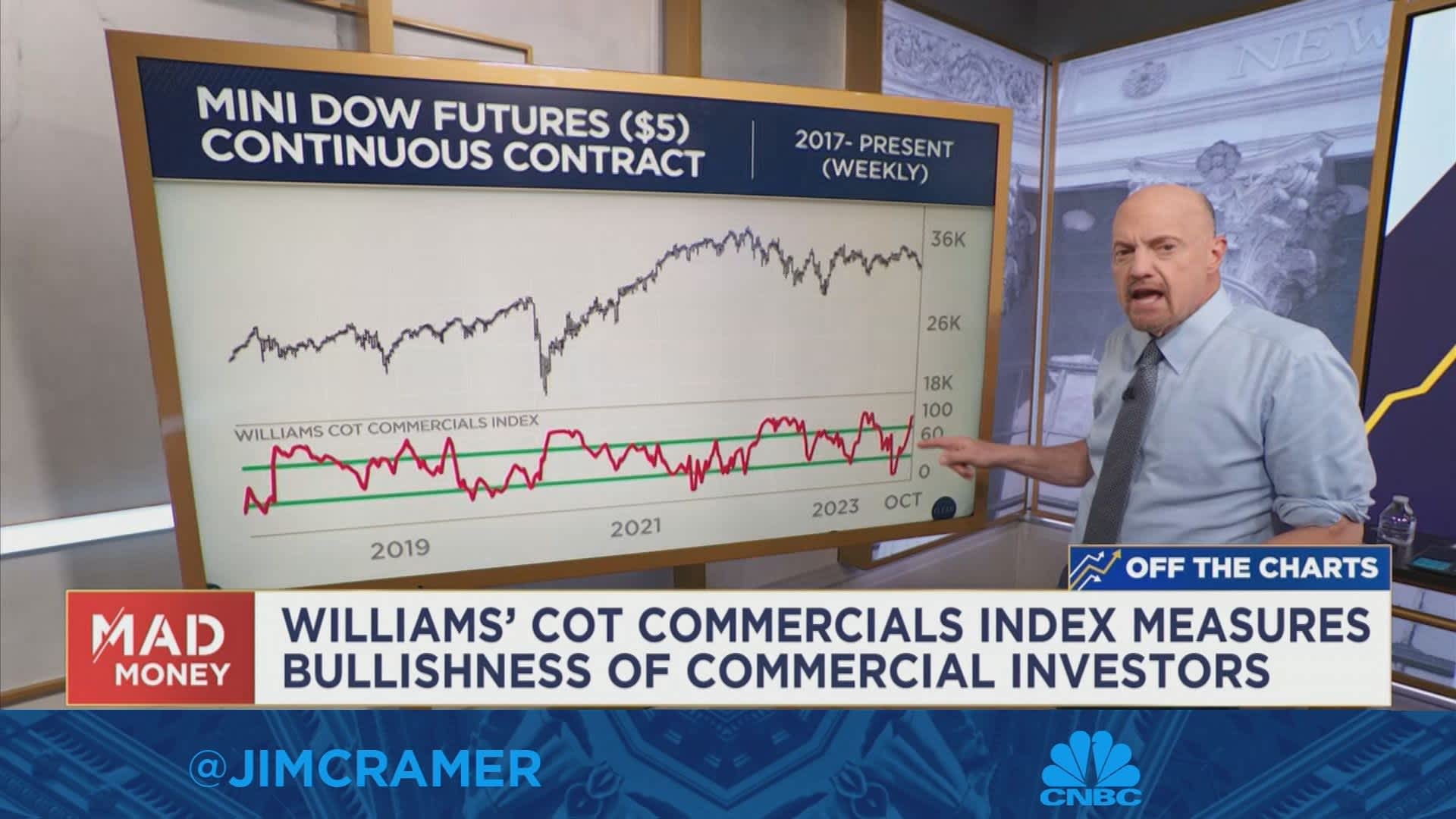

Risicos Van Goedkope Arbeidsmigratie In De Voedingssector Analyse Abn Amro

May 22, 2025

Risicos Van Goedkope Arbeidsmigratie In De Voedingssector Analyse Abn Amro

May 22, 2025 -

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Blake Lively Alleged Controversies And Recent News

May 22, 2025 -

Le Port De La Croix Catholique Au College De Clisson Un Sujet Sensible

May 22, 2025

Le Port De La Croix Catholique Au College De Clisson Un Sujet Sensible

May 22, 2025

Latest Posts

-

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025 -

Nyt Wordle Answer March 26 Difficulty And Solution

May 22, 2025

Nyt Wordle Answer March 26 Difficulty And Solution

May 22, 2025 -

Solve Todays Nyt Wordle March 26 The Answer Explained

May 22, 2025

Solve Todays Nyt Wordle March 26 The Answer Explained

May 22, 2025 -

Solve Wordle 367 Hints Clues And Solution For Monday March 17

May 22, 2025

Solve Wordle 367 Hints Clues And Solution For Monday March 17

May 22, 2025