Top Business News: Monday's Headlines At 1 AM ET

Table of Contents

Global Market Overview

The global markets experienced a mixed performance overnight, influenced by a confluence of factors. Analyzing these International Business trends is vital for understanding the broader Market Trends. Let's break down the key indices:

- Dow Jones: The Dow Jones Industrial Average saw a slight dip of 0.2% overnight, attributed largely to concerns about rising interest rates. This follows a week of volatile trading, reflecting the ongoing uncertainty in the Stock Market.

- NASDAQ: The NASDAQ Composite, heavily weighted towards the technology sector, performed slightly better, closing with a marginal increase of 0.1%. This suggests relative resilience in the tech sector despite broader market anxieties.

- FTSE 100: European markets also saw a mixed performance, with the FTSE 100 in London ending the session flat. Asian markets mirrored this trend, with the Nikkei in Tokyo showing minor losses.

- Currency Fluctuations: The US dollar strengthened slightly against the Euro and Yen overnight, a trend to monitor for its impact on international trade and Global Markets. These Market Trends underscore the interconnectedness of global finance.

Key Economic Indicators

Several key Economic News releases overnight will likely influence market sentiment throughout the day. Understanding these Economic Data points is crucial for investors and businesses alike.

- US Inflation Report: The latest US inflation figures showed a slight deceleration in the rate of price increases, dropping to 3.2% year-on-year. While still above the Federal Reserve's target, this data could temper expectations of further aggressive interest rate hikes.

- Eurozone GDP Figures: Preliminary estimates for Eurozone GDP growth in Q2 2024 showed a modest expansion, indicating continued, albeit slower, economic growth in the region. This positive Economic Data could provide some support to European markets.

- Potential Future Policy Changes: The relatively positive economic indicators, while not entirely reassuring, may lead central banks to adopt a more cautious approach to monetary policy. This means there's less immediate pressure for drastic interest rate increases, a factor that will shape investment strategies in the coming weeks. Monitoring Interest Rates will be crucial in this regard.

Specific Company News

Several companies made headlines overnight, with significant implications for their stock prices and broader market sentiment.

- TechGiant Corp Earnings Report: TechGiant Corp announced better-than-expected second-quarter earnings, sending its stock price soaring by 5% in after-hours trading. This positive Company News is a boost for investor confidence in the tech sector.

- MegaCorp Acquisition: MegaCorp, a major player in the energy sector, announced its acquisition of a smaller competitor, strengthening its market position and creating significant synergies. The impact on Stock Prices is expected to be positive in the long term, despite short-term market volatility. This demonstrates the importance of keeping track of major Mergers and Acquisitions.

Other Important Headlines

Beyond the major market movements and economic releases, several other noteworthy news stories emerged overnight:

- Regulatory Changes in the Fintech Sector: New regulations impacting the Fintech industry were announced in several key markets, potentially altering the competitive landscape for digital financial services.

- Global Supply Chain Disruptions: Continued disruptions in global supply chains due to geopolitical factors are creating uncertainty for businesses reliant on international trade.

Both of these items illustrate the importance of staying abreast of the ever-evolving Business News landscape. We encourage you to follow the links to original sources for in-depth analysis.

Conclusion

Today's Business News Summary reveals a complex picture of global markets, influenced by a mix of positive and negative economic indicators, along with significant corporate announcements. The relatively positive inflation data and company earnings reports offer some counterbalance to ongoing geopolitical uncertainties and supply chain disruptions. To stay ahead of the curve, remember to check back regularly for the latest Top Business News. Subscribe to our daily updates or follow us on social media for breaking Monday Headlines and other crucial Financial News alerts. Staying informed about daily Market Updates is crucial to making well-informed decisions.

Featured Posts

-

Maya Jama Opens Up About Past Relationship Breakups

May 14, 2025

Maya Jama Opens Up About Past Relationship Breakups

May 14, 2025 -

Oqtf Et Fraude Sncf Un Ivoirien Exhibe Son Sexe A Une Controleuse En Region Nord

May 14, 2025

Oqtf Et Fraude Sncf Un Ivoirien Exhibe Son Sexe A Une Controleuse En Region Nord

May 14, 2025 -

E Toros 500 Million Ipo Push A Closer Look

May 14, 2025

E Toros 500 Million Ipo Push A Closer Look

May 14, 2025 -

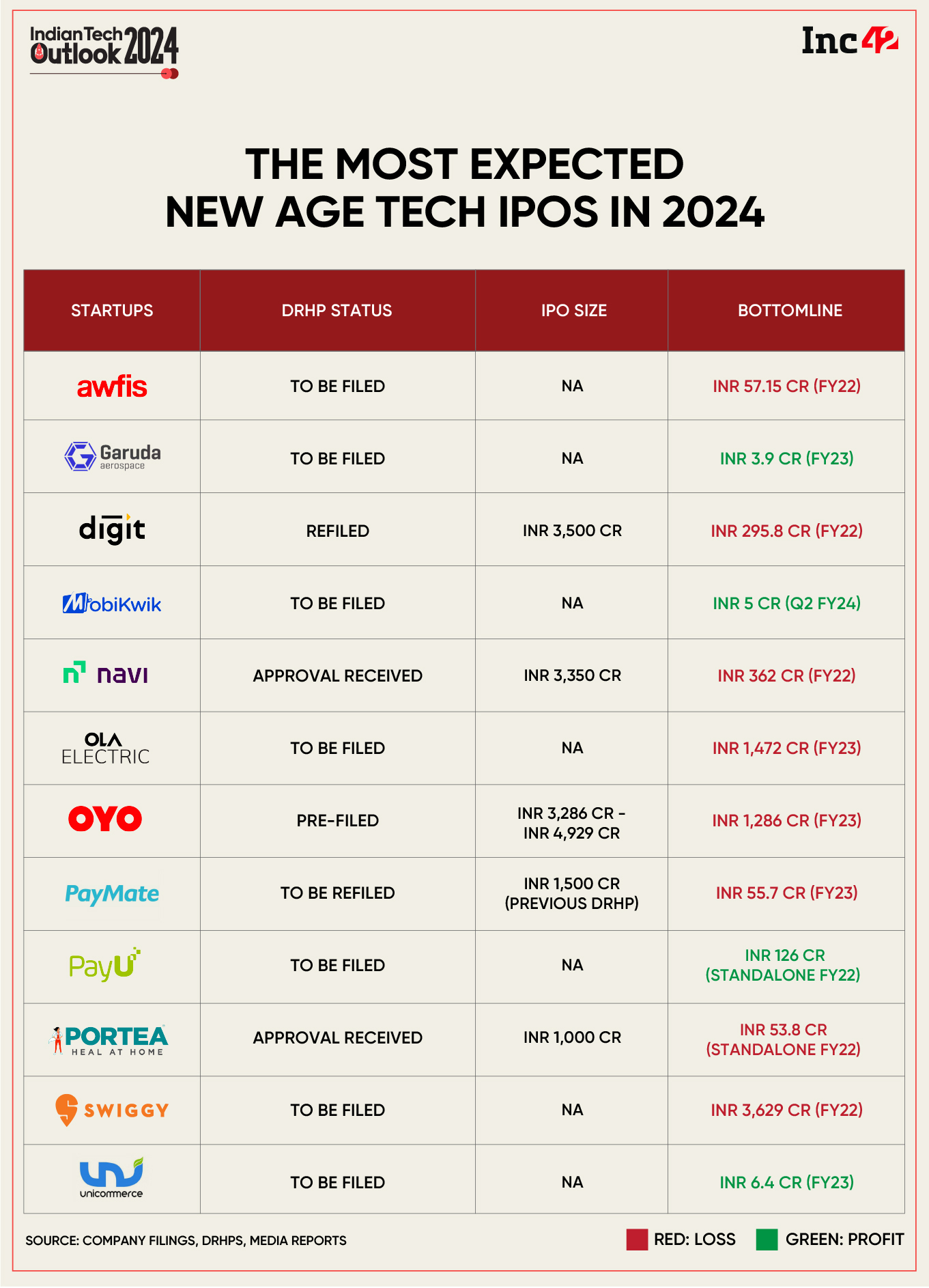

Tariff Uncertainty How Its Impacting Tech Ipos In 2024

May 14, 2025

Tariff Uncertainty How Its Impacting Tech Ipos In 2024

May 14, 2025 -

Eurovizija Bazelyje Issami Muzikos Protestu Ir Saunu Savaites Apzvalga

May 14, 2025

Eurovizija Bazelyje Issami Muzikos Protestu Ir Saunu Savaites Apzvalga

May 14, 2025