Tracking The Losses: $194 Billion+ And Counting For Tech Billionaires

Table of Contents

The Tech Market Downturn: A Perfect Storm?

The current crisis facing tech billionaires isn't a single event but rather a confluence of factors contributing to a significant tech stock decline.

Rising Interest Rates and Inflation

Increased interest rates and persistent inflation have created a challenging environment for tech companies.

- Investor Sentiment: Higher interest rates make bonds more attractive, diverting investment away from riskier tech stocks. This decreased investor confidence fuels a downward spiral in valuations.

- Venture Capital Crunch: The cost of borrowing has increased dramatically, making it harder for startups and established tech companies to secure funding. This limits growth and innovation, impacting profitability and consequently stock prices.

- Increased Borrowing Costs: Tech companies often rely on debt financing for expansion. Higher interest rates significantly increase these borrowing costs, impacting profitability and potentially leading to financial distress.

These factors have drastically impacted the valuation of numerous tech companies, contributing significantly to tech billionaires' losses and the overall "inflation's impact on tech." The impact of interest rate hikes on the sector cannot be understated.

The Crypto Crash

The cryptocurrency market crash played a significant role in wiping billions off the net worth of tech billionaires heavily invested in digital assets.

- Bitcoin's Effect on Billionaire Wealth: Many tech billionaires held significant portions of their wealth in Bitcoin and other cryptocurrencies. The "crypto market crash" saw a dramatic devaluation of these assets, leading to substantial personal losses.

- Examples of Impact: Several high-profile tech figures who championed cryptocurrency investments experienced massive losses as the market plummeted. The subsequent "digital asset losses" reverberated throughout the industry, emphasizing the inherent risk in this volatile asset class.

The correlation between the crypto market downturn and the overall decline in tech billionaires' net worth is undeniable.

Overvaluation and Correction

The tech sector experienced a period of significant overvaluation in recent years, fueled by easy monetary policies and investor exuberance. This created a "tech stock correction" that is now impacting billionaire net worth.

- Market Overvaluation: Many tech companies' valuations far exceeded their underlying fundamentals, leading to an unsustainable bubble.

- Bubble Burst: The current market correction is essentially a return to more realistic valuations, resulting in significant stock price drops for numerous tech giants. This "bubble burst" has directly translated into substantial losses for those who held significant shares.

Examples include several prominent companies that experienced steep stock price declines, directly impacting the net worth of their founders and major shareholders. This "market overvaluation" was a significant contributor to the current situation.

Specific Examples of Tech Billionaires' Losses

The impact of the tech market downturn is acutely felt by individual tech billionaires.

Case Study 1: Elon Musk

Elon Musk, CEO of Tesla and SpaceX, has seen his net worth significantly decrease due to a combination of factors.

- Tesla Stock Price Plummet: A drop in Tesla's stock price has been a major contributor to Musk's "net worth decline." This is partly attributed to concerns about Tesla's future performance and market competition.

- Twitter Acquisition: The controversial acquisition of Twitter has also impacted his personal finances, adding another layer to his overall "stock price plummet."

The combination of these factors has resulted in a substantial decrease in Musk's overall wealth.

Case Study 2: Mark Zuckerberg

Mark Zuckerberg, founder of Meta (formerly Facebook), has also experienced a significant reduction in his net worth.

- Facebook Stock Performance: Meta's stock price has plummeted due to decreased advertising revenue and increased competition. This "Facebook stock performance" has significantly impacted Zuckerberg's wealth.

- Metaverse Investments: Heavy investment in the Metaverse, while potentially long-term lucrative, has yet to yield substantial returns, adding to the pressure on Meta's stock price and impacting Zuckerberg's "wealth loss."

Zuckerberg's experience illustrates the challenges faced by tech leaders in navigating a rapidly evolving and competitive market.

The Broader Impact

The losses experienced by tech billionaires have broader implications for the tech industry and the global economy. Reduced investment in innovation and a potential slowdown in technological advancement are key concerns.

Looking Ahead: Future Prospects for Tech Billionaires

While the current situation is challenging, the future isn't entirely bleak.

Potential Recovery Scenarios

Several factors could contribute to a tech market recovery and the restoration of some lost wealth.

- Technological Innovation: Breakthroughs in areas like artificial intelligence and renewable energy could reignite investor interest and drive up valuations.

- Changing Investor Sentiment: A shift in investor sentiment, spurred by economic recovery or positive industry developments, could lead to a market rebound. This "tech market recovery" would directly benefit tech billionaires.

The "future of tech billionaires" will depend heavily on these and other key factors.

Lessons Learned and Adaptations

This downturn offers valuable lessons for tech billionaires and the industry as a whole. More conservative investment strategies, diversification, and a focus on sustainable growth are likely to be key adaptations. This will influence the future direction of investment and business strategies within the tech sector.

Conclusion

The collective loss of $194 billion+ for prominent tech billionaires represents a significant turning point in the tech industry. This downturn is the result of a "perfect storm" of factors including rising interest rates, inflation, the crypto crash, and a market correction addressing previous overvaluation. Examining specific cases like Elon Musk and Mark Zuckerberg reveals the varied factors impacting individual fortunes. Keep tracking tech billionaires' losses to understand the evolving dynamics of the tech landscape and its implications for the global economy. Stay updated on the latest developments in the tech sector affecting billionaire wealth; continue monitoring the impact of the market downturn on tech billionaires' net worth.

Featured Posts

-

Metas Legal Battle Over Whats App Spyware The 168 Million Verdict And Its Significance

May 09, 2025

Metas Legal Battle Over Whats App Spyware The 168 Million Verdict And Its Significance

May 09, 2025 -

Operation Sindoors Impact Kse 100 Halted After Sharp 6 Decline

May 09, 2025

Operation Sindoors Impact Kse 100 Halted After Sharp 6 Decline

May 09, 2025 -

Assessing The Lasting Impact Of High Potential An 11 Year Retrospective

May 09, 2025

Assessing The Lasting Impact Of High Potential An 11 Year Retrospective

May 09, 2025 -

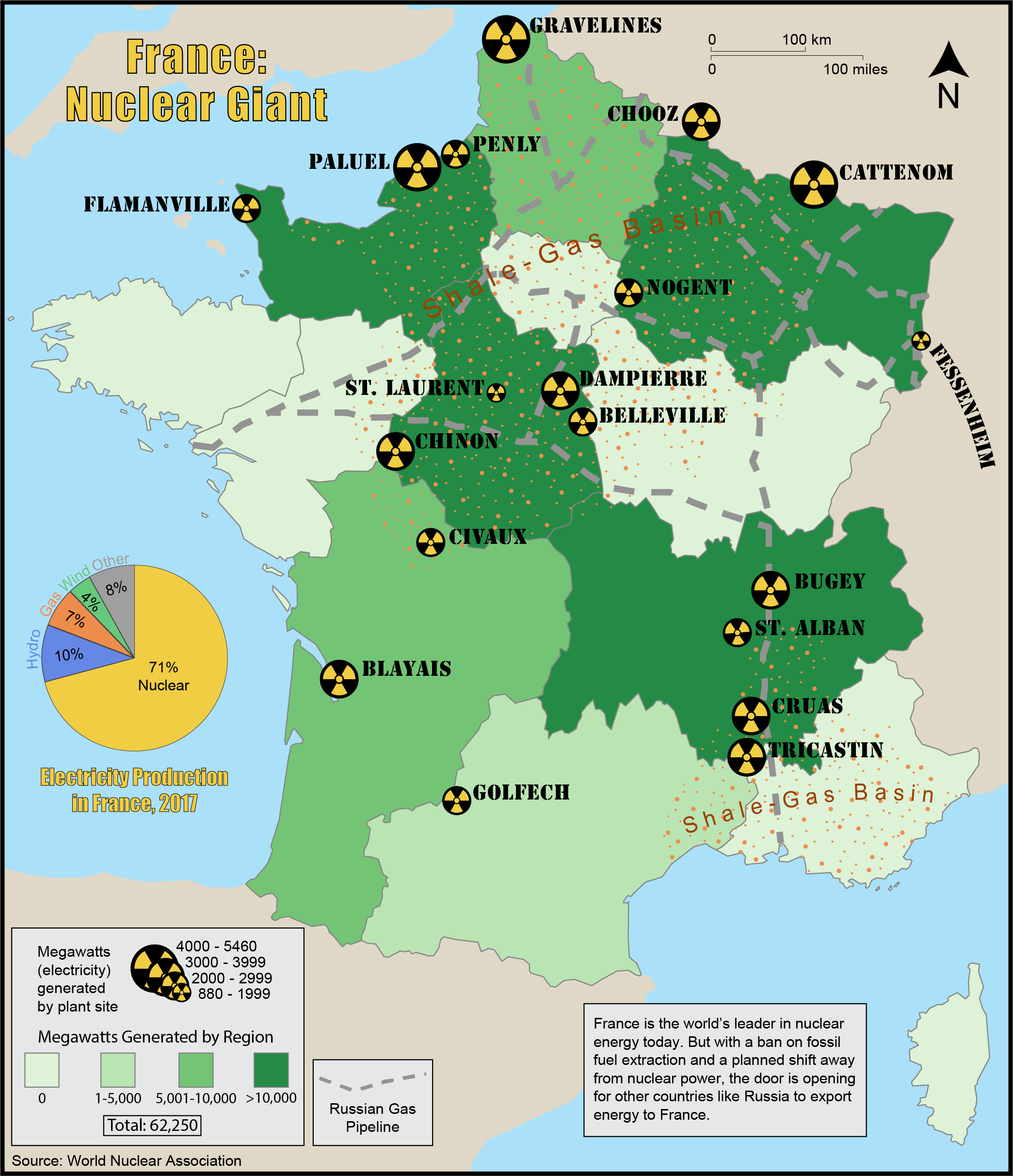

Shared Nuclear Power Frances European Initiative

May 09, 2025

Shared Nuclear Power Frances European Initiative

May 09, 2025 -

Nl Federal Election Getting To Know Your Candidates

May 09, 2025

Nl Federal Election Getting To Know Your Candidates

May 09, 2025

Latest Posts

-

Us Surgeon General Nomination White Houses Last Minute Pivot To Maha Influencer

May 10, 2025

Us Surgeon General Nomination White Houses Last Minute Pivot To Maha Influencer

May 10, 2025 -

Planning Your Summer Trip Navigating Real Id Requirements

May 10, 2025

Planning Your Summer Trip Navigating Real Id Requirements

May 10, 2025 -

White House Withdraws Key Nomination Opting For Maha Influencer For Surgeon General Role

May 10, 2025

White House Withdraws Key Nomination Opting For Maha Influencer For Surgeon General Role

May 10, 2025 -

Kilmar Abrego Garcia From Gang Violence In El Salvador To Us Political Flashpoint

May 10, 2025

Kilmar Abrego Garcia From Gang Violence In El Salvador To Us Political Flashpoint

May 10, 2025 -

Bodycam Captures Police Saving Toddler Choking On Tomato

May 10, 2025

Bodycam Captures Police Saving Toddler Choking On Tomato

May 10, 2025