Tracking The Net Asset Value (NAV) Of Amundi MSCI World Ex-United States UCITS ETF Acc

Table of Contents

What is Net Asset Value (NAV) and Why is it Important for ETFs?

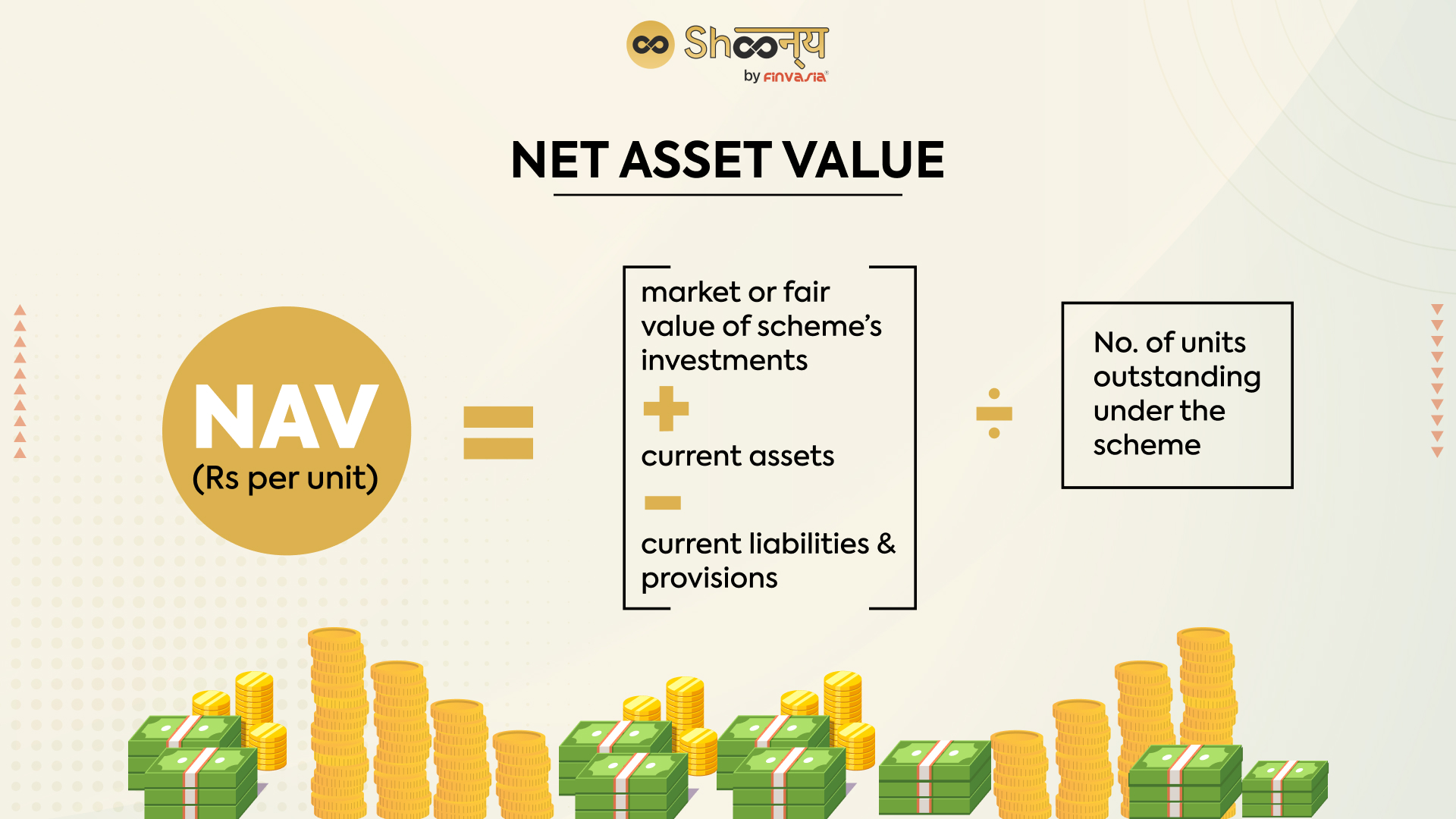

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. Simply put, it reflects the intrinsic worth of a single ETF share. For ETFs, the NAV is calculated daily by taking the market value of all the securities held in the ETF's portfolio and subtracting any expenses or liabilities.

Understanding the NAV is crucial for several reasons:

- NAV reflects the underlying asset value of the ETF. It provides a true picture of the ETF's holdings' value, irrespective of market trading price fluctuations.

- Daily NAV fluctuations show ETF price movements. Tracking daily changes in NAV helps investors assess the ETF's performance over time.

- NAV helps compare ETF performance against benchmarks. By comparing the NAV against the benchmark index (in this case, the MSCI World ex-United States Index), investors can gauge the ETF's effectiveness in tracking its target.

- NAV is crucial for buy/sell decisions. Investors often use NAV as a benchmark for making informed buy and sell decisions, aiming to purchase at a discount to NAV or sell at a premium.

How to Track the Amundi MSCI World ex-United States UCITS ETF Acc NAV

Tracking the Amundi MSCI World ex-United States UCITS ETF Acc NAV is straightforward using several reliable methods:

- Brokerage platforms: Most brokerage accounts provide real-time or delayed NAV data for the ETFs held within your portfolio. Check your account's specific features for details.

- ETF provider's website: Amundi's official website is the definitive source for accurate and up-to-date NAV information on the Amundi MSCI World ex-United States UCITS ETF Acc.

- Financial news websites: Reputable financial news websites like Yahoo Finance, Google Finance, and Bloomberg often display ETF data, including NAVs.

- Dedicated financial data providers: For professional investors, dedicated financial data providers like Bloomberg Terminal or Refinitiv Eikon offer comprehensive ETF data, including detailed NAV histories.

Key Considerations:

- The Amundi MSCI World ex-United States UCITS ETF Acc NAV is typically updated daily, at the close of market hours.

- Always rely on reputable sources to avoid inaccurate or misleading information.

- Minor discrepancies might exist between the NAV and the ETF's market price, due to trading volume and market dynamics.

Factors Affecting the Amundi MSCI World ex-United States UCITS ETF Acc NAV

Several factors influence the Amundi MSCI World ex-United States UCITS ETF Acc NAV:

- Underlying asset performance: The performance of the companies included in the MSCI World ex-United States Index directly impacts the ETF's NAV. Positive performance from these underlying assets will increase the NAV, and vice versa.

- Currency fluctuations: Since the ETF invests globally, fluctuations in exchange rates between the currencies of the underlying assets and the ETF's base currency can affect the NAV.

- Dividend distributions: When companies within the ETF's portfolio pay dividends, the NAV will adjust accordingly. The dividend payments are typically reinvested, boosting the NAV.

- Expense ratio: The ETF's expense ratio, representing its annual management fees, slightly reduces the NAV over time.

Key Influences:

- The MSCI World ex-United States Index is the benchmark, so its movements are crucial in determining the NAV's direction.

- Major global events, such as economic recessions, geopolitical instability, or significant industry disruptions, can significantly impact the NAV. For example, a global pandemic could negatively impact numerous underlying assets, causing a drop in the NAV.

Interpreting NAV Changes in the Context of Market Trends

Interpreting NAV changes requires considering broader market trends. A decrease in the Amundi MSCI World ex-United States UCITS ETF Acc NAV might be due to a general market downturn, while an increase could reflect positive market sentiment or strong performance of the underlying assets within the ETF. Remember to always consider the ETF's investment strategy and risk profile when analyzing NAV fluctuations. A more volatile index will naturally lead to greater fluctuations in its NAV.

Conclusion: Mastering Amundi MSCI World ex-United States UCITS ETF Acc NAV Tracking

Regularly tracking the Amundi MSCI World ex-United States UCITS ETF Acc NAV is essential for informed investment decisions. By utilizing the methods outlined above – checking brokerage platforms, the Amundi website, or reputable financial news sources – you can gain a clear understanding of this ETF's performance and value. Remember to consider the various factors influencing the NAV and interpret changes within the context of broader market trends. Active monitoring of the Amundi MSCI World ex-United States UCITS ETF Acc NAV, combined with thorough research and, if necessary, consultation with a financial advisor, empowers you to make sound investment choices.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025 -

Indonesia Classic Art Week 2025 Menampilkan Kemewahan Porsche

May 24, 2025

Indonesia Classic Art Week 2025 Menampilkan Kemewahan Porsche

May 24, 2025 -

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025 Avrupa Piyasa Raporu

May 24, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025 Avrupa Piyasa Raporu

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025 -

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025

Latest Posts

-

Pochti 40 Par Pozhenilis Na Kharkovschine Svadebniy Bum V Data Foto

May 24, 2025

Pochti 40 Par Pozhenilis Na Kharkovschine Svadebniy Bum V Data Foto

May 24, 2025 -

Kerings Financial Report Sales Down Demnas Gucci Designs To Launch September

May 24, 2025

Kerings Financial Report Sales Down Demnas Gucci Designs To Launch September

May 24, 2025 -

Krasivye Daty Svadeb Kharkovschina Ustanovila Rekord 89 Brakov

May 24, 2025

Krasivye Daty Svadeb Kharkovschina Ustanovila Rekord 89 Brakov

May 24, 2025 -

Forbes 2025 La Nuova Classifica Degli Uomini Piu Ricchi Del Mondo

May 24, 2025

Forbes 2025 La Nuova Classifica Degli Uomini Piu Ricchi Del Mondo

May 24, 2025 -

Guccis New Era Kering Reports Sales Drop Demnas First Collection Coming Soon

May 24, 2025

Guccis New Era Kering Reports Sales Drop Demnas First Collection Coming Soon

May 24, 2025