Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Sources for Finding the Daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Knowing where to find the daily NAV is the first step. Several reliable sources provide this crucial data:

Official ETF Provider Website: Amundi

The most authoritative source is the official website of the ETF provider, Amundi. Here's how to typically find the information:

- Steps: Navigate to the ETF product page for the Amundi Dow Jones Industrial Average UCITS ETF. Look for sections labeled "Pricing," "Fund Facts," or "Key Figures." The NAV is usually displayed prominently, often alongside the market price. (Note: Screenshots would ideally be included here in a published article.)

- Frequency: The NAV is typically updated daily, reflecting the closing prices of the underlying assets.

- Reliability: This is the most reliable source, offering the most accurate and up-to-date NAV.

Financial News Websites and Data Providers

Reputable financial news websites and data providers also offer ETF NAV data.

- Examples: Bloomberg, Yahoo Finance, Google Finance, and dedicated financial data platforms often include ETF NAV information.

- Variations in Reporting: Note that reporting times might slightly vary across different sources due to data lags and time zone differences.

- Advantages and Disadvantages: While convenient, these sources may not always be as timely or accurate as the official provider's website. Always double-check against Amundi's data.

Brokerage Platforms

If you hold the Amundi Dow Jones Industrial Average UCITS ETF within your brokerage account, the NAV is often readily available.

- Examples: Interactive Brokers, Fidelity, Schwab, and other major brokerage platforms usually display the NAV alongside other ETF details.

- Data Display: The format and ease of access can vary depending on the brokerage platform.

- Convenience: This offers a convenient method for investors who already use the brokerage for trading.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors directly impact the Amundi Dow Jones Industrial Average UCITS ETF NAV:

Performance of Underlying Assets

The ETF's NAV is directly linked to the performance of the 30 companies that make up the Dow Jones Industrial Average (DJIA).

- Market Movements: A rising DJIA generally leads to a higher ETF NAV, while a falling DJIA results in a lower NAV. The correlation is usually very strong.

- Individual Stock Performance: The performance of individual stocks within the DJIA also influences the overall ETF NAV. Strong performance by one or more large-cap companies can positively impact the NAV, and vice-versa.

Currency Fluctuations

For investors outside the base currency of the ETF, currency fluctuations play a role.

- Exchange Rate Impact: If the ETF is denominated in US dollars (USD) and you are investing in Euros (EUR), changes in the EUR/USD exchange rate will affect your NAV in EUR.

- International Investors: This is particularly critical for international investors who need to consider the currency conversion when assessing their returns. A strengthening USD against your local currency will reduce your NAV in local currency terms, even if the underlying assets have performed well.

Expense Ratio

The ETF's expense ratio gradually impacts the NAV over time.

- Definition: The expense ratio is the annual fee charged by the ETF provider for managing the fund.

- Long-Term Impact: While seemingly small, the expense ratio gradually erodes the NAV over the long term. This is why comparing expense ratios between similar ETFs is important.

- Comparison: A lower expense ratio generally translates to higher NAV growth over time, all else being equal.

Interpreting and Utilizing Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Understanding the NAV is only half the battle; knowing how to use it is just as crucial.

Tracking NAV Changes Over Time

Monitoring NAV trends is vital for performance analysis and strategy adjustment.

- Tracking Methods: Use charts, spreadsheets, or dedicated investment tracking software to visually monitor NAV changes over time.

- Short-Term vs. Long-Term: Pay attention to both short-term fluctuations and long-term trends. Short-term volatility is normal, but consistent downward trends might warrant review of your investment strategy.

Comparing NAV to the ETF's Market Price

The NAV and the market price of an ETF are not always identical.

- Bid-Ask Spread: The difference between the bid and ask price creates a spread.

- Premium/Discount to NAV: The market price may trade at a premium or discount to the NAV. Various market factors can influence this.

- Reasons for Discrepancies: Supply and demand dynamics, trading volume, and market sentiment all contribute to potential discrepancies between NAV and market price.

Using NAV for Buy/Sell Decisions

While NAV is a key indicator, it shouldn't be the sole factor in buy/sell decisions.

- Beyond NAV: Consider your risk tolerance, investment goals, overall market outlook, and diversification strategy.

- Informed Decisions: Use NAV data in conjunction with other analyses to make informed investment choices.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Tracking

Effectively tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV involves utilizing multiple reliable sources, understanding influencing factors, and interpreting the data in context with your broader investment strategy. Remember that while the NAV is a vital metric, it’s not the only factor. Consider other market indicators and your own financial goals to make informed investment decisions. Actively tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV, coupled with a thorough understanding of market dynamics, will empower you to navigate the world of ETF investing with confidence. For further learning on ETF investing strategies, explore reputable financial education resources and consult with a qualified financial advisor.

Featured Posts

-

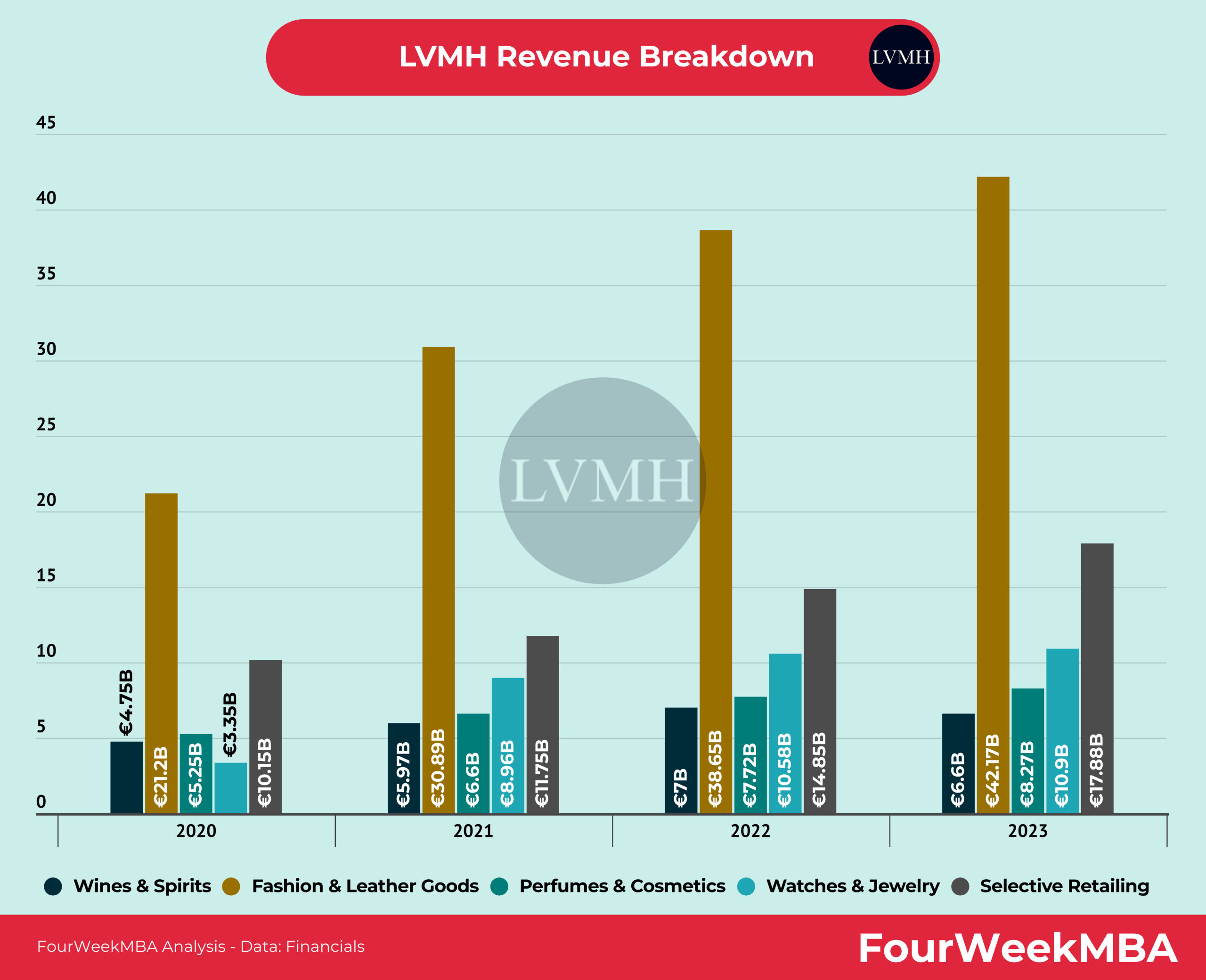

Lvmh Stock Falls 8 2 After Q1 Revenue Disappoints

May 24, 2025

Lvmh Stock Falls 8 2 After Q1 Revenue Disappoints

May 24, 2025 -

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025 -

Pochti 40 Par Pozhenilis Na Kharkovschine Svadebniy Bum V Data Foto

May 24, 2025

Pochti 40 Par Pozhenilis Na Kharkovschine Svadebniy Bum V Data Foto

May 24, 2025 -

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025 -

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Latest Posts

-

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025 -

Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 24, 2025

Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025 -

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025