Trade War Intensifies: Amsterdam Stock Market Opens Down 7%

Table of Contents

Impact of the Trade War on the Amsterdam Stock Market

The intensifying trade war has had a multifaceted impact on the Amsterdam Stock Market and the Dutch economy. The direct effects stem from disruptions to international trade, while indirect effects arise from decreased investor confidence and global uncertainty.

-

Decreased investor confidence due to global uncertainty: The ongoing trade disputes create a climate of uncertainty, making investors hesitant to commit capital. This hesitancy is directly reflected in reduced trading volumes and a flight to safety in less volatile assets. The Amsterdam Stock Exchange (AEX), like other global markets, is highly sensitive to shifts in global sentiment.

-

Decline in export-oriented sectors heavily reliant on international trade: The Netherlands, with its strong export-oriented economy, is particularly vulnerable. Sectors such as agriculture, logistics, and manufacturing are experiencing significant challenges due to tariffs and trade restrictions imposed by various countries.

-

Impact on specific Dutch companies heavily involved in international trade: Companies like Philips, Unilever, and ASML, which rely heavily on global supply chains and international markets, have already reported negative impacts on their revenue and profit margins. These impacts ripple through the broader economy, affecting employment and overall growth.

-

Increased volatility and uncertainty in the Amsterdam Stock Exchange (AEX): The AEX index, a key indicator of the Amsterdam Stock Market's performance, reflects the heightened volatility and uncertainty. Daily fluctuations are becoming more pronounced, adding to the anxiety among investors and businesses.

-

Potential ripple effects on related markets within the Netherlands and the EU: The downturn in the Amsterdam Stock Market is not isolated. It can trigger a wider economic slowdown in the Netherlands, impacting related sectors like real estate, finance, and consumer spending. These effects can also spread throughout the European Union, given the Netherlands' significant role in the EU economy.

Analyzing the 7% Drop: Causes and Contributing Factors

The 7% drop in the Amsterdam Stock Market this morning is a culmination of various factors:

-

Specific market indicators demonstrating the drop: The AEX index plummeted to its lowest point in [insert specific data/date], marking the significant 7% drop. This drop represents a substantial loss in market capitalization and investor wealth.

-

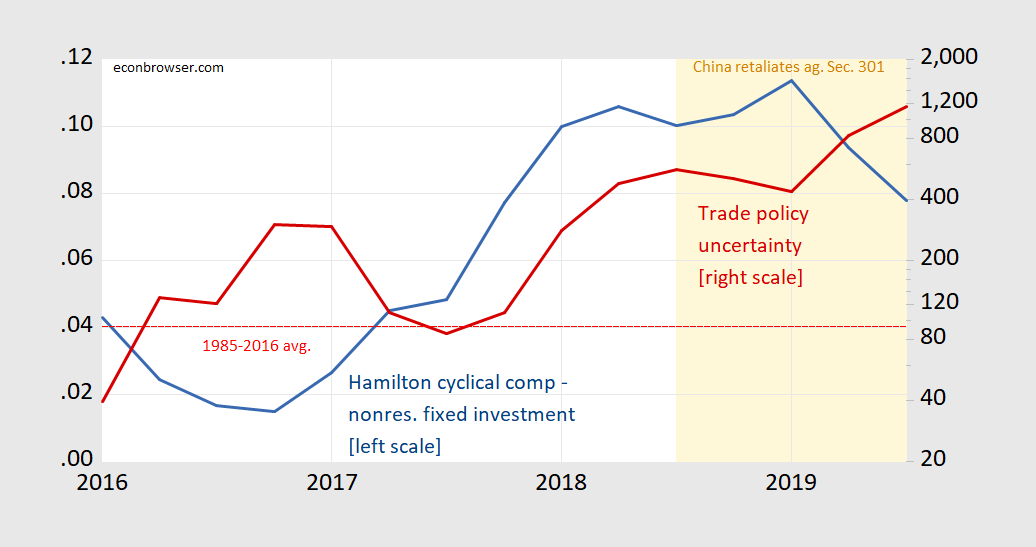

Influence of global news and events on market sentiment: Negative news regarding trade negotiations, escalating tariffs, and retaliatory measures from other countries all contributed to the negative market sentiment. These news events directly influence investor behavior and risk appetite.

-

Role of specific trade policies and their impact on Dutch businesses: The implementation of new tariffs and trade restrictions by major trading partners significantly impacts Dutch exports, leading to lower profits and potentially job losses. This has a direct correlation with the market downturn.

-

Reactions from financial analysts and market experts regarding the drop: Analysts attribute the drop to a combination of factors, including global uncertainty, decreased investor confidence, and the specific vulnerabilities of Dutch businesses in the face of trade tensions.

-

Comparison with other European stock market performances to provide context: While other European markets also experienced declines, the 7% drop in the Amsterdam Stock Market is comparatively more significant, highlighting the Netherlands' heightened sensitivity to the current trade war.

Vulnerability of Dutch Businesses to Trade Wars

Several key sectors within the Dutch economy are particularly vulnerable to the ongoing trade war:

-

Identification of key economic sectors most exposed to international trade: Agriculture, horticulture, logistics, and technology are among the sectors most heavily reliant on international trade and thus most vulnerable to disruptions.

-

Analysis of the dependency of these sectors on specific export markets: Many Dutch businesses rely on specific export markets; disruptions in these markets have a disproportionate impact on these companies.

-

Discussion of the potential for government intervention and support: The Dutch government may implement measures to mitigate the negative consequences of the trade war, such as providing financial assistance to affected businesses or exploring alternative trade partnerships.

-

Explanation of supply chain disruptions and their influence: Trade wars disrupt global supply chains, creating delays, increased costs, and shortages of essential goods. This affects various industries in the Netherlands, resulting in reduced production and economic growth.

Potential Long-Term Consequences for the Amsterdam Stock Market

The long-term implications of this trade war for the Amsterdam Stock Market and the Dutch economy are uncertain but potentially severe:

-

Predictions regarding market recovery and potential timelines: The recovery timeline depends on several factors, including the resolution of trade disputes, government intervention, and global economic conditions. A prolonged trade war could lead to a prolonged downturn.

-

Economic consequences for Dutch consumers and businesses: Higher prices for imported goods, reduced consumer spending, and potential job losses are among the expected consequences for consumers and businesses.

-

Potential government responses and their effectiveness: The effectiveness of government interventions will determine how effectively the negative impacts of the trade war can be mitigated.

-

Long-term implications for foreign investment in the Netherlands: The current uncertainty may deter foreign investment, negatively impacting economic growth and job creation in the long term.

-

Comparison with historical examples of similar market downturns and their recoveries: Examining past instances of market downturns caused by trade conflicts or global crises can provide insights into potential recovery trajectories and the timeframes involved.

Conclusion:

The 7% drop in the Amsterdam Stock Market underscores the severe impact of the intensifying trade war. The vulnerability of Dutch businesses to global trade tensions is clear, and the long-term consequences for the Amsterdam Stock Market and the Dutch economy remain uncertain. Close monitoring of the situation, coupled with strategic planning and potentially government intervention, is crucial to mitigate the negative effects of this global crisis. Stay informed about the latest developments affecting the Amsterdam Stock Market and its performance. Regularly check reliable financial news sources for the most up-to-date information on this evolving situation. Understanding the dynamics of the Amsterdam Stock Exchange (AEX) is key to navigating these turbulent times.

Featured Posts

-

Frankfurt Stock Market Report Dax Suffers Losses

May 24, 2025

Frankfurt Stock Market Report Dax Suffers Losses

May 24, 2025 -

Auto Legendas F1 Es Motorral Szerelt Porsche

May 24, 2025

Auto Legendas F1 Es Motorral Szerelt Porsche

May 24, 2025 -

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025 -

Seeking Change The Potential For Punishment And The Importance Of Strategic Action

May 24, 2025

Seeking Change The Potential For Punishment And The Importance Of Strategic Action

May 24, 2025 -

Must Have Gear For Ferrari Enthusiasts

May 24, 2025

Must Have Gear For Ferrari Enthusiasts

May 24, 2025

Latest Posts

-

Luxury Car Market In China Headwinds For Bmw Porsche And Competitors

May 24, 2025

Luxury Car Market In China Headwinds For Bmw Porsche And Competitors

May 24, 2025 -

The China Factor Examining Luxury Automakers Struggles

May 24, 2025

The China Factor Examining Luxury Automakers Struggles

May 24, 2025 -

Facebooks Trajectory Zuckerbergs Leadership In A Trumpian World

May 24, 2025

Facebooks Trajectory Zuckerbergs Leadership In A Trumpian World

May 24, 2025 -

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 24, 2025

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 24, 2025 -

Accentures 50 000 Promotions Six Month Delay Explained

May 24, 2025

Accentures 50 000 Promotions Six Month Delay Explained

May 24, 2025