Trade War Intensifies: Fresh Losses For Dutch Stocks

Table of Contents

Impact of Tariffs on Dutch Exports

The imposition of tariffs as part of the ongoing trade war has had a demonstrably negative impact on Dutch exports. Several key sectors are feeling the pinch, particularly agriculture and manufacturing. The effects are multifaceted, impacting not only export volumes but also the profitability and competitiveness of Dutch businesses.

-

Specific Sectors Hit Hard: The agricultural sector, a cornerstone of the Dutch economy, has been severely affected by tariffs imposed on agricultural products. Similarly, the manufacturing sector, with its reliance on global supply chains, is facing significant challenges.

-

Export Decline Data: Recent data reveals a concerning decline in Dutch exports, directly correlating with the escalation of the trade war. [Insert data and source here – e.g., Statistics Netherlands data showing percentage drop in exports]. This decline is impacting revenue and profit margins for many companies.

-

Retaliatory Tariffs: The imposition of retaliatory tariffs on Dutch goods by other countries further exacerbates the problem, creating a vicious cycle of reduced trade and economic slowdown. This reciprocal trade aggression limits access to crucial export markets.

-

Company-Specific Examples:

- Company X, a major exporter of agricultural products, saw a 15% drop in exports to Country Y due to new tariffs, impacting their profitability significantly.

- Company Z, a manufacturer of machinery, has reported a 10% decrease in orders from Country Z due to increased import costs resulting from tariffs.

Investor Sentiment and Market Volatility

The escalating trade war has created a climate of fear and uncertainty, significantly impacting investor sentiment. This negativity is directly reflected in declining stock prices across the Dutch stock market.

-

Negative Investor Sentiment: Investors are increasingly hesitant to invest in Dutch companies due to the uncertainty surrounding future export prospects and the overall economic climate. This hesitancy is driving down stock valuations.

-

Increased Market Volatility: The unpredictable nature of the trade war is fueling significant market volatility, making it challenging for investors to make informed decisions. This uncertainty leads to more speculative trading.

-

Impact on Foreign Investment: Foreign investment in Dutch companies has also been negatively impacted. Concerns about the stability of the Dutch economy are deterring foreign investors, reducing capital inflow.

-

Market Indicators:

- The AEX index, a key indicator of the Dutch stock market’s performance, experienced a 3% drop following the announcement of new tariffs.

- Volatility indices are significantly higher, indicating increased uncertainty and risk in the Dutch stock market.

The Role of the Euro in the Trade War

Fluctuations in the euro exchange rate are adding another layer of complexity to the challenges facing Dutch businesses. The euro's relative strength or weakness against other currencies directly impacts the price competitiveness of Dutch exports.

-

Impact of Fluctuating Exchange Rates: A stronger euro makes Dutch exports more expensive in global markets, reducing their competitiveness and potentially leading to further export losses. A weaker euro, however, can inflate the costs of imports.

-

Eurozone Vulnerability: The entire Eurozone is vulnerable to the negative impacts of the trade war. The interconnectedness of the European economies means that the difficulties faced by one member state can quickly spread to others.

-

Potential Government Interventions: The Dutch government may consider interventions to mitigate the effects of fluctuating exchange rates. However, the effectiveness of such interventions is debatable.

Government Response and Mitigation Strategies

The Dutch government is attempting to address the challenges posed by the trade war, but the effectiveness of its measures remains to be seen.

-

Government Response: The government has acknowledged the negative impact of the trade war on Dutch businesses and has implemented some measures to support affected industries. However, more comprehensive actions may be needed.

-

Policies to Support Industries: The government is exploring various policies aimed at strengthening the competitiveness of Dutch businesses and mitigating the impact of tariffs. This could involve tax incentives or investment in research and development.

-

Financial Aid and Subsidies: Financial aid packages and subsidies have been announced to support struggling businesses. For example, the Dutch government announced a €50 million aid package for farmers affected by tariffs.

-

Specific Government Actions:

- [Insert details of specific government actions, such as tax breaks or support programs]

Conclusion

The intensifying trade war is having a significant negative impact on Dutch stocks. Several key sectors, including agriculture and manufacturing, are experiencing substantial export losses due to tariffs and increased market uncertainty. Investor sentiment is weak, and market volatility is high. The Dutch government is taking steps to mitigate the damage, but the overall outlook for Dutch stocks remains uncertain. Monitor Dutch stocks closely, stay informed about the trade war's impact on Dutch companies, and analyze your Dutch stock portfolio in light of the current trade tensions. Further research into specific companies and sectors most affected is advisable for informed investment decisions.

Featured Posts

-

Porsche 956 Nin Tavan Sergisinin Gercek Sebebi

May 24, 2025

Porsche 956 Nin Tavan Sergisinin Gercek Sebebi

May 24, 2025 -

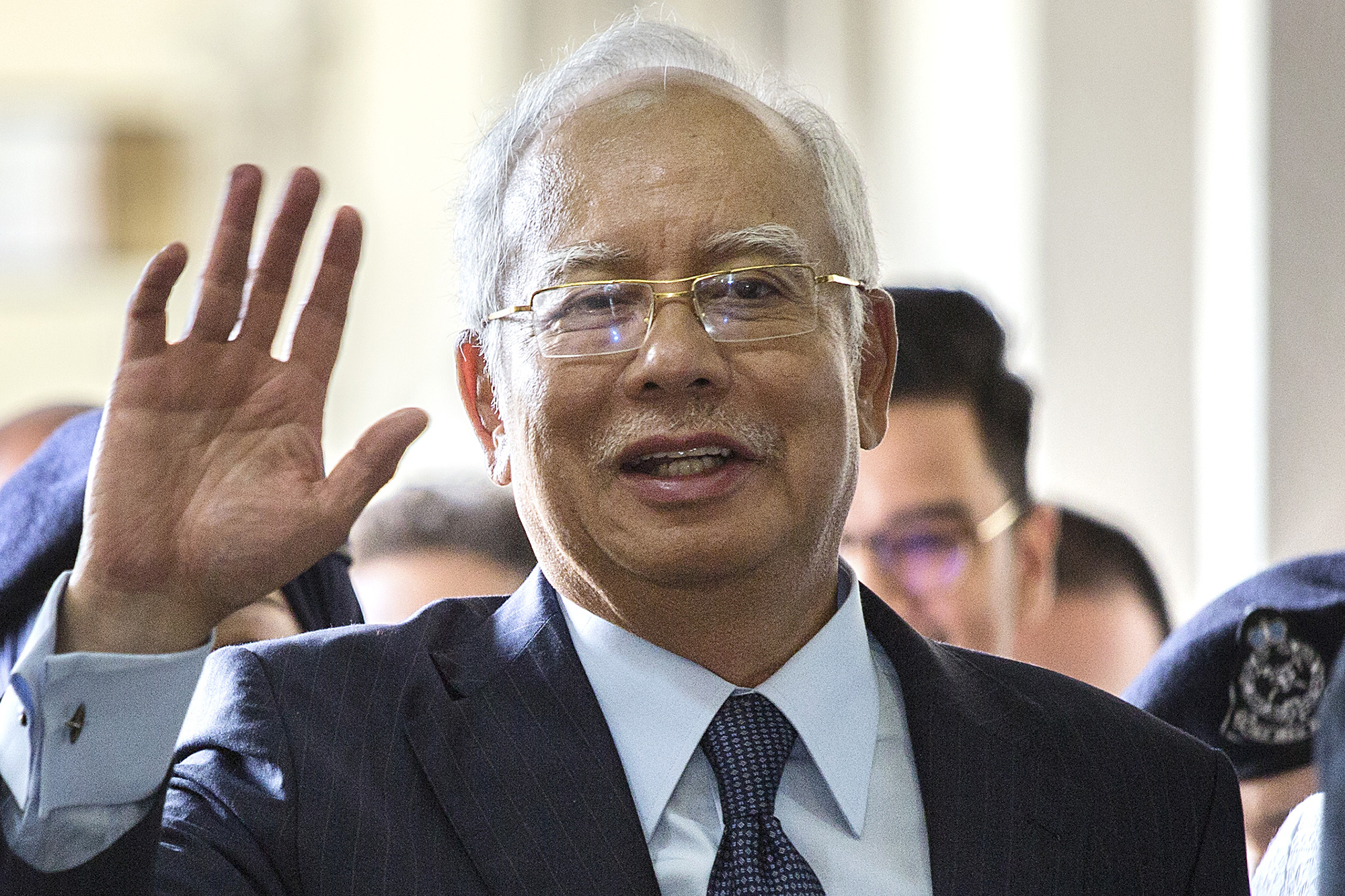

French Prosecutors Implicate Malaysias Ex Pm Najib Razak In Submarine Bribery Case

May 24, 2025

French Prosecutors Implicate Malaysias Ex Pm Najib Razak In Submarine Bribery Case

May 24, 2025 -

Dylan Dreyers Son Post Surgery Hospital Update

May 24, 2025

Dylan Dreyers Son Post Surgery Hospital Update

May 24, 2025 -

Euronext Amsterdam Sees 8 Stock Increase After Trumps Tariff Action

May 24, 2025

Euronext Amsterdam Sees 8 Stock Increase After Trumps Tariff Action

May 24, 2025 -

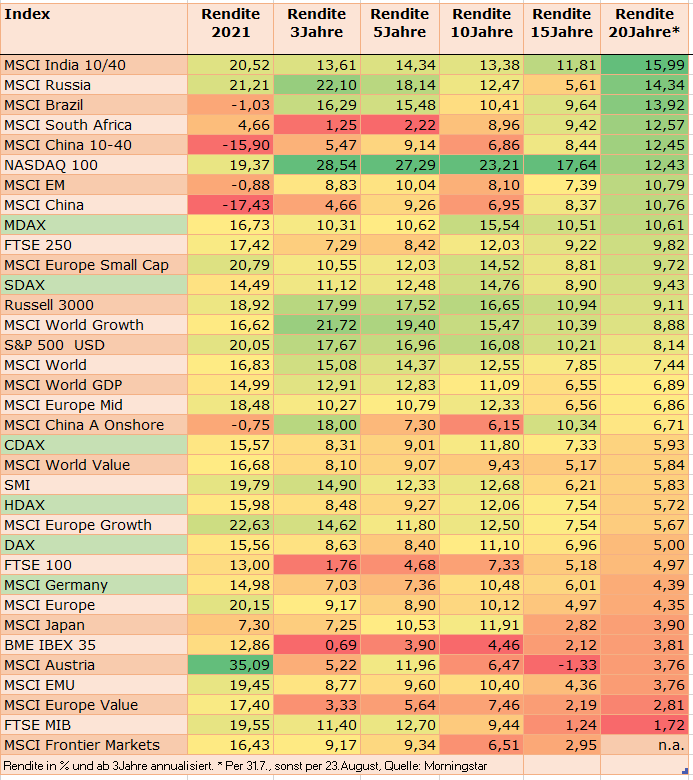

Frankfurt Aktien Dax Entwicklung Und Terminmarkt Auswirkungen 21 Maerz 2025

May 24, 2025

Frankfurt Aktien Dax Entwicklung Und Terminmarkt Auswirkungen 21 Maerz 2025

May 24, 2025

Latest Posts

-

Dylan Dreyers Weight Loss Transformation A Powerful Impression On Nbc

May 24, 2025

Dylan Dreyers Weight Loss Transformation A Powerful Impression On Nbc

May 24, 2025 -

Dylan Dreyers New Post Featuring Husband Brian Fichera Stirs Fan Reaction

May 24, 2025

Dylan Dreyers New Post Featuring Husband Brian Fichera Stirs Fan Reaction

May 24, 2025 -

Dylan Dreyer Faces Unexpected Hardship Today Show Reaction

May 24, 2025

Dylan Dreyer Faces Unexpected Hardship Today Show Reaction

May 24, 2025 -

Dylan Dreyer And Brian Fichera A Celebratory Family Announcement

May 24, 2025

Dylan Dreyer And Brian Fichera A Celebratory Family Announcement

May 24, 2025 -

Today Shows Dylan Dreyer Reveals Difficult Situation

May 24, 2025

Today Shows Dylan Dreyer Reveals Difficult Situation

May 24, 2025