Trump's 100-Day Economic Plan And Its Potential Impact On Bitcoin's Price

Table of Contents

Key Aspects of Trump's 100-Day Economic Plan and Their Relevance to Bitcoin

Trump's 100-day plan, while not strictly adhered to in its entirety, set the tone for his economic approach. Let's examine its core elements and how they might have affected Bitcoin:

Deregulation and its Effect on Financial Markets

Trump's administration championed deregulation across various sectors, aiming to reduce the regulatory burden on businesses and stimulate economic activity. This approach could have several implications for Bitcoin:

- Reduced regulatory burden on businesses: Less stringent regulations could lead to increased investment in riskier assets, potentially including Bitcoin.

- Increased market fluidity: A less regulated financial environment might increase market fluidity, making it easier for investors to enter and exit cryptocurrency markets.

- Potential for increased investment in risky assets like Bitcoin: With less regulatory scrutiny, high-risk, high-reward investments such as Bitcoin could become more appealing to some investors.

- Increased competition in the financial sector: Deregulation could foster competition, leading to innovation and potentially new financial products that interact with or incorporate Bitcoin.

Tax Cuts and their Influence on Bitcoin Investment

Trump's significant tax cuts, particularly for corporations and high-income earners, had a multifaceted impact on investment strategies. This could have influenced Bitcoin investment in several ways:

- Lower corporate tax rates: Corporations might have reinvested a portion of their tax savings, potentially allocating some funds to alternative assets like Bitcoin.

- Potential increase in disposable income for high-income earners: Increased disposable income for high-net-worth individuals could lead to more investment in alternative assets, including cryptocurrencies.

- Increased investment in alternative assets to reduce tax burdens: Investors might have sought alternative assets, such as Bitcoin, to potentially reduce their overall tax burden.

- Impact on capital gains taxes for Bitcoin: The specific tax treatment of Bitcoin gains under Trump's tax plan could have influenced investor behavior, either encouraging or discouraging investment.

Infrastructure Spending and its Indirect Impact on Bitcoin

Trump's proposed infrastructure spending plan aimed to stimulate economic growth through increased government investment in infrastructure projects. While not directly affecting Bitcoin, this could have had an indirect impact:

- Increased government spending: Increased government spending can lead to economic growth and potentially inflationary pressures.

- Job creation and economic stimulus: Positive economic indicators could boost investor confidence, indirectly benefiting the cryptocurrency market.

- Potential inflationary pressures: Inflation could drive investors to seek alternative stores of value, potentially increasing demand for Bitcoin.

- Indirect impact on investor confidence and risk appetite: Positive economic news related to infrastructure spending might improve investor sentiment, making them more open to riskier investments like Bitcoin.

Trade Policies and Their Effect on the Global Economy (and Bitcoin)

Trump's protectionist trade policies, including tariffs and trade wars, created considerable uncertainty in the global economy. This uncertainty could have significantly affected Bitcoin:

- Tariffs and trade barriers: Trade disputes can lead to global economic instability, impacting investor sentiment and potentially driving capital towards safer assets.

- Increased uncertainty in global markets: Economic uncertainty often leads to increased volatility in financial markets, including the cryptocurrency market.

- Potential "flight to safety" into Bitcoin or other assets: During times of economic uncertainty, investors may seek refuge in assets perceived as less correlated with traditional markets, such as Bitcoin.

- Potential for decreased global trade impacting Bitcoin adoption: Reduced global trade could negatively impact the growth and adoption of Bitcoin, especially in international transactions.

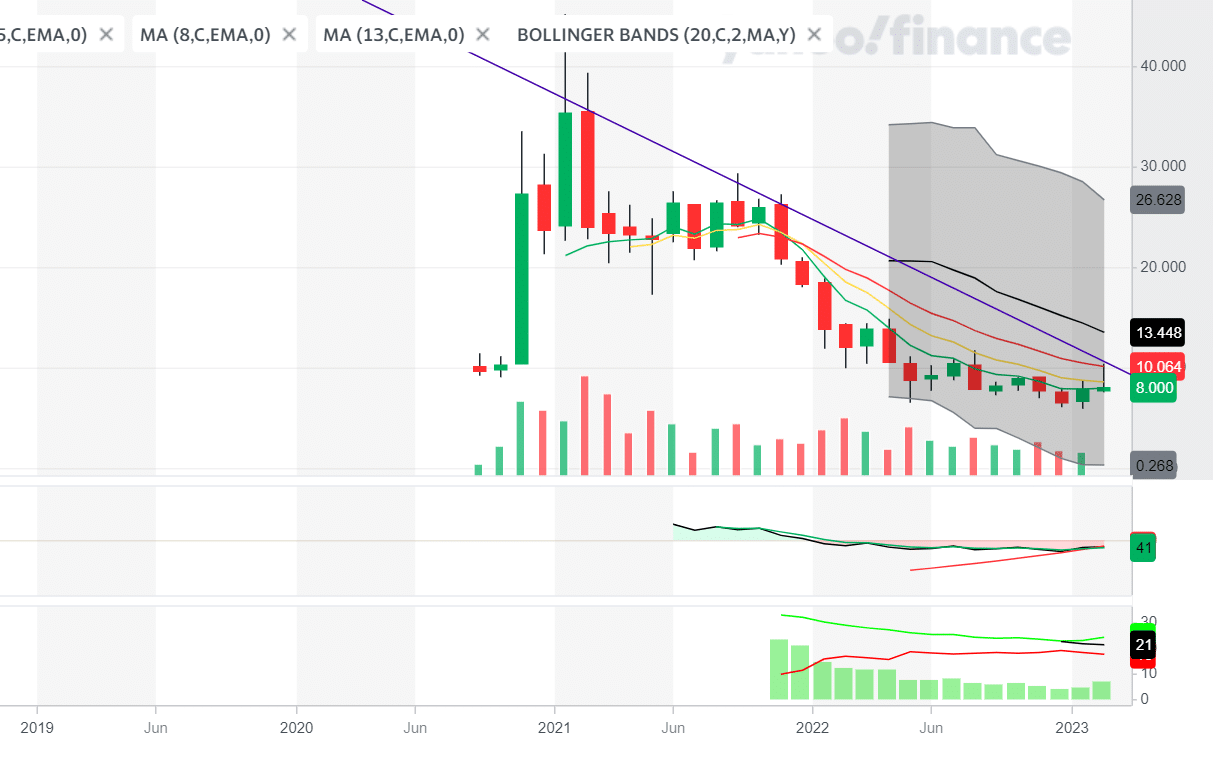

Conclusion: Predicting Bitcoin's Future Under Trump's Economic Policies

Predicting Bitcoin's price with certainty is challenging, given its inherent volatility. Trump's economic policies presented both potential upsides and downsides for Bitcoin. Deregulation and tax cuts could have stimulated investment, while trade wars and economic uncertainty could have driven investors towards or away from it depending on their risk tolerance and perception of Bitcoin as a safe haven. Further research is crucial to understanding the long-term consequences of these policies on the cryptocurrency market. Continue researching "Trump's economic policies" and their impact on "Bitcoin's price" by exploring reputable financial news sources for the latest "Bitcoin price predictions" and to assess your own "Bitcoin investment" strategy while understanding the inherent risks.

Featured Posts

-

Mind The Gap Wheelchair Access On The Elizabeth Line

May 09, 2025

Mind The Gap Wheelchair Access On The Elizabeth Line

May 09, 2025 -

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 09, 2025

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 09, 2025 -

Us Attorney Generals Fox News Presence A Deeper Look Beyond Epstein

May 09, 2025

Us Attorney Generals Fox News Presence A Deeper Look Beyond Epstein

May 09, 2025 -

Analyzing Palantir Stock Investment Strategies Before May 5th

May 09, 2025

Analyzing Palantir Stock Investment Strategies Before May 5th

May 09, 2025 -

Large Scale Alaskan Protest Targets Doge And Trump Administration Actions

May 09, 2025

Large Scale Alaskan Protest Targets Doge And Trump Administration Actions

May 09, 2025

Latest Posts

-

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025 -

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025 -

Largest Fentanyl Seizure In Us History Bondis Role In The Drug Bust

May 10, 2025

Largest Fentanyl Seizure In Us History Bondis Role In The Drug Bust

May 10, 2025 -

The Us Attorney General And Fox News A Daily Occurrence Worth Investigating

May 10, 2025

The Us Attorney General And Fox News A Daily Occurrence Worth Investigating

May 10, 2025 -

Beyond Epstein Examining The Us Attorney Generals Frequent Fox News Interviews

May 10, 2025

Beyond Epstein Examining The Us Attorney Generals Frequent Fox News Interviews

May 10, 2025