Trump's Billionaire Buddies: How Tariffs Impacted Their Fortunes

Table of Contents

Winners: Billionaires Benefiting from Trump's Tariffs

Some billionaires saw their wealth significantly boosted by the Trump administration's tariff policies. This wasn't a uniform effect, however, but rather a consequence of specific industry dynamics and government interventions.

Increased Domestic Production and Demand

Tariffs on imported goods, particularly steel and aluminum, created a surge in domestic demand. This protected domestic producers, allowing them to increase production and capture market share previously held by foreign competitors.

- Example 1: Steel manufacturers like Nucor, whose CEO, Leon Topalian, saw a substantial increase in stock value and profitability during this period, directly benefiting from the increased demand for domestically produced steel. While precise figures are complex, analyses show a significant percentage increase in profit margins compared to pre-tariff periods.

- Example 2: Similar benefits were seen in the aluminum industry, though the magnitude varied across companies and depended on factors beyond just tariffs, such as overall market conditions and production capacity.

The short-term effects were largely positive for these businesses. However, the long-term impact is more nuanced. While domestic producers benefited, consumers faced higher prices for steel and aluminum products, potentially dampening overall economic growth. This highlights the intricate trade-offs inherent in protectionist trade policies.

Government Contracts and Subsidies

Beyond direct protection, some billionaires benefited indirectly through government contracts and subsidies designed to bolster domestic industries impacted by the trade war. These interventions aimed to mitigate the negative effects of tariffs and to support businesses deemed essential to national security.

- Example: Companies involved in defense manufacturing, for instance, might have seen an increase in government contracts, leading to increased profitability for their owners. The ethical implications of such government intervention, however, remain a topic of ongoing debate. Questions arise about whether these subsidies were the most efficient use of taxpayer money and whether they fostered long-term economic competitiveness. A comprehensive cost-benefit analysis is crucial for a complete understanding of this aspect of the Trump tariffs' impact.

Losers: Billionaires Hurt by Trump's Tariffs

Not all billionaires fared well under Trump's tariff regime. Many businesses, particularly those with global supply chains or heavily reliant on imported goods, faced significant challenges.

Retailers and Consumers Facing Higher Prices

Tariffs increased the cost of imported goods, directly impacting consumers who faced higher prices on everyday items. Retailers, in turn, saw reduced profit margins as consumers became more price-sensitive.

- Example 1: Major retailers like Walmart, with their extensive reliance on imported goods, experienced increased costs, which often weren't fully passed on to consumers, squeezing profit margins. Financial reports from this period reflected decreased sales growth and reduced profitability in certain sectors.

- Example 2: The impact varied across retail sectors, with some being hit harder than others. Companies specializing in imported goods were more vulnerable than those primarily focused on domestic products.

The increase in prices for consumers also impacted overall consumer spending and had a ripple effect throughout the economy, further highlighting the complex consequences of such trade policies.

Businesses Relying on Global Supply Chains

Companies with intricate global supply chains were particularly vulnerable to disruptions caused by Trump's tariffs. The added costs and bureaucratic complexities associated with navigating the new trade landscape significantly impacted their profitability and global competitiveness.

- Example: Many manufacturing companies with complex global supply chains experienced delays and increased costs as a result of tariffs and retaliatory measures. This negatively impacted their profit margins and potentially their market share.

- Analysis: The complexity of global supply chains made it difficult for businesses to quickly adapt to the new trade environment, leading to significant challenges in planning and resource allocation.

The Unintended Consequences of Trump's Tariff Policies

The Trump administration's tariff policies triggered a series of unintended consequences, impacting global trade relations and the financial fortunes of many billionaires.

Retaliatory Tariffs from Other Countries

Trump's tariffs provoked retaliatory measures from numerous countries, creating a global trade war. This negatively affected many US businesses and complicated the business strategies of several billionaires.

- Examples: Retaliatory tariffs imposed by China on US agricultural products, for instance, directly impacted the profits of farmers and agricultural businesses. The impact on individual billionaires connected to these sectors varied significantly depending on the specifics of their business models.

- Analysis: These retaliatory tariffs created an unpredictable and unstable trade environment, making it difficult for businesses to plan for the future.

Long-term Economic Impacts

The long-term economic effects of Trump's tariff policies are still being assessed and debated by economists. However, several potential long-term implications exist:

- Inflation: Tariffs can contribute to higher prices for consumers, potentially leading to inflation.

- Economic Growth: The impact on economic growth is complex and debated. Some argue that protectionism can boost domestic industries, while others believe it can stifle overall economic growth.

- Job Creation: The net effect on job creation is also uncertain, with some arguing that tariffs could protect existing jobs, while others suggest they may lead to job losses in other sectors.

Conclusion:

Trump's tariff policies produced a complex and multifaceted impact on the wealth of his billionaire associates. Some profited from increased domestic demand and government support, while others suffered from higher costs and reduced profits due to disruptions in global supply chains and retaliatory measures. The long-term economic repercussions remain a subject of ongoing debate among economists, with differing perspectives on the ultimate impact on economic growth, job creation, and the overall distribution of wealth. Understanding the effects of Trump's tariffs on billionaire wealth provides crucial insight into the broader implications of trade policy and the intricate interplay between government actions and economic outcomes. To learn more about the far-reaching consequences of these policies and their impact on various sectors of the economy, continue exploring the impact of Trump tariffs.

Featured Posts

-

Stiven King U Kh Gostri Slova Na Adresu Trampa Ta Maska

May 09, 2025

Stiven King U Kh Gostri Slova Na Adresu Trampa Ta Maska

May 09, 2025 -

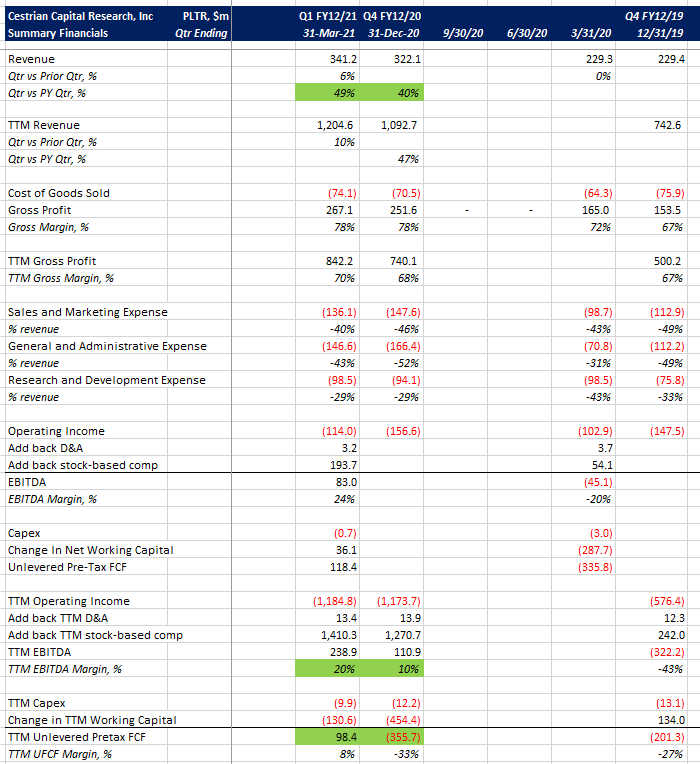

Is Palantir A Buy After A 30 Drop Analyzing The Stock Dip

May 09, 2025

Is Palantir A Buy After A 30 Drop Analyzing The Stock Dip

May 09, 2025 -

Indias First Astronaut Rakesh Sharmas Life After Space

May 09, 2025

Indias First Astronaut Rakesh Sharmas Life After Space

May 09, 2025 -

Space X Valuation Soars Musks Stake Tops Tesla Investment By 43 Billion

May 09, 2025

Space X Valuation Soars Musks Stake Tops Tesla Investment By 43 Billion

May 09, 2025 -

F1 Alpines Message To Doohan And What It Means

May 09, 2025

F1 Alpines Message To Doohan And What It Means

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025