Trump's Trade Policies And The Future Of American Financial Dominance

Table of Contents

Tariff Wars and Their Economic Consequences

The Trump administration's approach to trade was characterized by the widespread imposition of tariffs, sparking what many termed "trade wars." These tariffs, intended to protect American industries and reduce trade deficits, had complex and far-reaching consequences.

Impact on Specific Industries

The impact of tariffs varied significantly across different sectors.

- Agriculture: Farmers faced retaliatory tariffs from key trading partners, leading to decreased exports and lower incomes. The impact was particularly felt in soybean and pork markets. Keywords: agricultural tariffs, farm subsidies, export restrictions.

- Manufacturing: While some manufacturers benefited from protection against cheaper imports, others faced higher input costs due to tariffs on raw materials. This led to increased prices for consumers and potential job losses in industries reliant on global supply chains. Keywords: manufacturing tariffs, import substitution, protectionist policies.

- Technology: The technology sector, heavily reliant on global supply chains, experienced disruptions due to tariffs and retaliatory measures. This impacted the production and pricing of electronics and other technology goods. Keywords: technology tariffs, semiconductor tariffs, global supply chain disruptions.

The steel and aluminum tariffs, for example, while intended to protect domestic producers, led to retaliatory tariffs from trading partners like China and the European Union, impacting US exporters significantly. This highlights the interconnectedness of global trade and the potential for unintended consequences from protectionist measures.

The Role of Trade Deficits

A central tenet of Trump's trade policy was reducing the US trade deficit. The administration argued that tariffs would encourage domestic production and reduce reliance on imports, thereby narrowing the trade gap. Keywords: trade deficit reduction, bilateral trade agreements, protectionism vs free trade.

However, the effectiveness of tariffs in achieving this goal is debatable. While some trade deficits may have decreased in specific sectors, overall trade deficits persisted. Economic models suggest that tariffs can negatively impact overall economic growth by increasing prices and reducing consumer choice. Furthermore, retaliatory tariffs from other countries often offset any gains achieved through protectionist measures. The relationship between tariffs, trade deficits, and overall economic growth remains a complex issue requiring further study.

Renegotiation of Trade Agreements

Trump's administration actively sought to renegotiate existing trade agreements and withdraw from others, viewing them as unfair to the US.

The USMCA and its Implications

The renegotiation of NAFTA into the USMCA (United States-Mexico-Canada Agreement) was a significant undertaking. Keywords: USMCA benefits, USMCA drawbacks, NAFTA replacement.

- Changes from NAFTA: The USMCA included stricter rules of origin for automobiles, increased labor protections in Mexico, and provisions addressing digital trade.

- Impact on North American Trade: The USMCA aimed to strengthen the North American trading bloc while addressing concerns about trade imbalances and labor practices. However, the long-term effects on trade flows and overall economic growth are still being evaluated.

Withdrawal from the Trans-Pacific Partnership (TPP)

The withdrawal from the TPP, a large multilateral trade agreement encompassing countries in the Asia-Pacific region, represented a departure from previous US administrations' pursuit of trade liberalization. Keywords: TPP withdrawal consequences, multilateral trade agreements, regional trade blocs.

- Consequences for US Influence: The withdrawal from the TPP left a vacuum for other countries, notably China, to increase their influence in the Asia-Pacific region. This loss of influence potentially hindered US access to regional markets and strategic partnerships.

- Potential for Future Engagement: While the withdrawal from the TPP was significant, the future role of the US in multilateral trade agreements remains an open question. Rejoining or negotiating new agreements could be critical to maintaining US economic influence and access to global markets.

Impact on Global Financial Markets and the US Dollar

Trump's trade policies introduced significant uncertainty into global financial markets.

Uncertainty and Volatility

The unpredictable nature of the administration's trade actions led to increased market volatility and uncertainty among investors. Keywords: trade policy uncertainty, market volatility impact, investor sentiment.

- Shifts in Investment Flows: Investor confidence fluctuated dramatically in response to trade policy announcements, leading to shifts in investment flows and capital markets.

- Currency Exchange Rates: The US dollar experienced fluctuations in response to trade tensions, reflecting changing investor perceptions of the US economy and its global role.

The Status of the US Dollar as a Reserve Currency

The long-term impact of Trump's trade policies on the US dollar's dominance as the world's primary reserve currency is a subject of ongoing debate. Keywords: US dollar reserve currency status, global monetary system, decline of the dollar.

- Alternative Scenarios: While the US dollar is expected to remain a major reserve currency, increased use of alternative currencies and payment systems could gradually diminish its dominance over time.

- Factors Influencing Future Role: Factors influencing the future role of the US dollar include the strength of the US economy, global geopolitical stability, and the development of alternative international payment systems.

Conclusion

Trump's trade policies represent a significant departure from previous administrations' approaches. While some argue they aimed to level the playing field and protect American industries, the long-term consequences for American financial dominance are still unfolding. The tariff wars created uncertainty, impacting supply chains and global markets. The renegotiation of trade agreements, while altering relationships, did not necessarily solve underlying trade imbalances. The effect on the US dollar's status as a reserve currency is a subject of ongoing debate. Understanding the complexities of these policies is crucial to predicting the future of American financial strength. Further research and analysis of the data are essential to fully grasp the lasting impact of Trump's trade policies and their influence on the future of American financial dominance. Continue to explore this complex issue and stay informed about the evolving landscape of international trade and its impact on the US economy.

Featured Posts

-

Google Faces Doj In Court Renewed Fight Over Search Monopoly

Apr 22, 2025

Google Faces Doj In Court Renewed Fight Over Search Monopoly

Apr 22, 2025 -

5 Key Economic Insights From The English Language Leaders Debate

Apr 22, 2025

5 Key Economic Insights From The English Language Leaders Debate

Apr 22, 2025 -

Wildfire Wagering Exploring The Ethics And Risks Of Betting On The Los Angeles Fires

Apr 22, 2025

Wildfire Wagering Exploring The Ethics And Risks Of Betting On The Los Angeles Fires

Apr 22, 2025 -

The Obamacare Supreme Court Case Analyzing Trumps Involvement And Its Effect On Rfk Jr

Apr 22, 2025

The Obamacare Supreme Court Case Analyzing Trumps Involvement And Its Effect On Rfk Jr

Apr 22, 2025 -

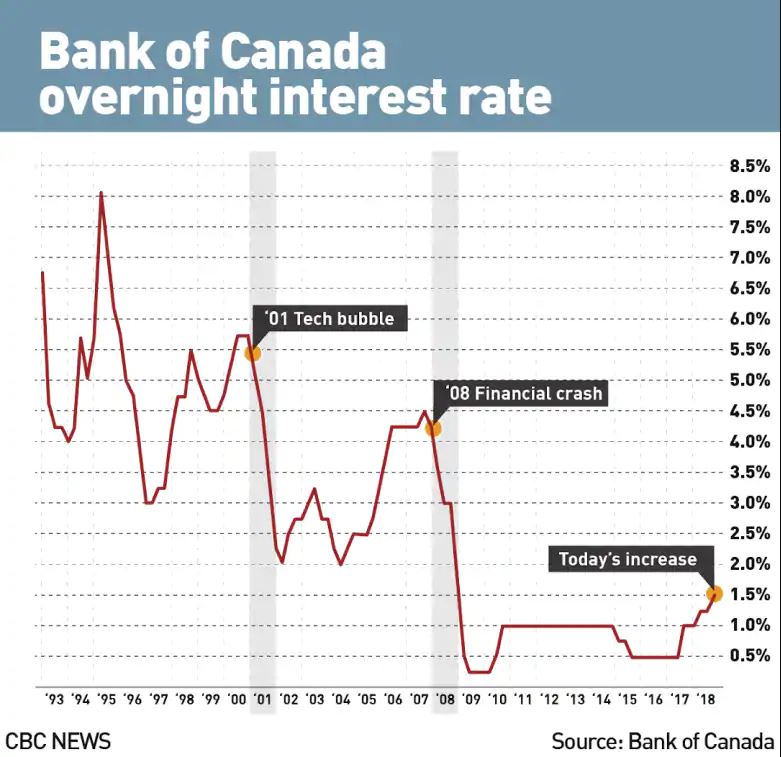

Fp Video Deciphering The Bank Of Canadas Interest Rate Hold

Apr 22, 2025

Fp Video Deciphering The Bank Of Canadas Interest Rate Hold

Apr 22, 2025

Latest Posts

-

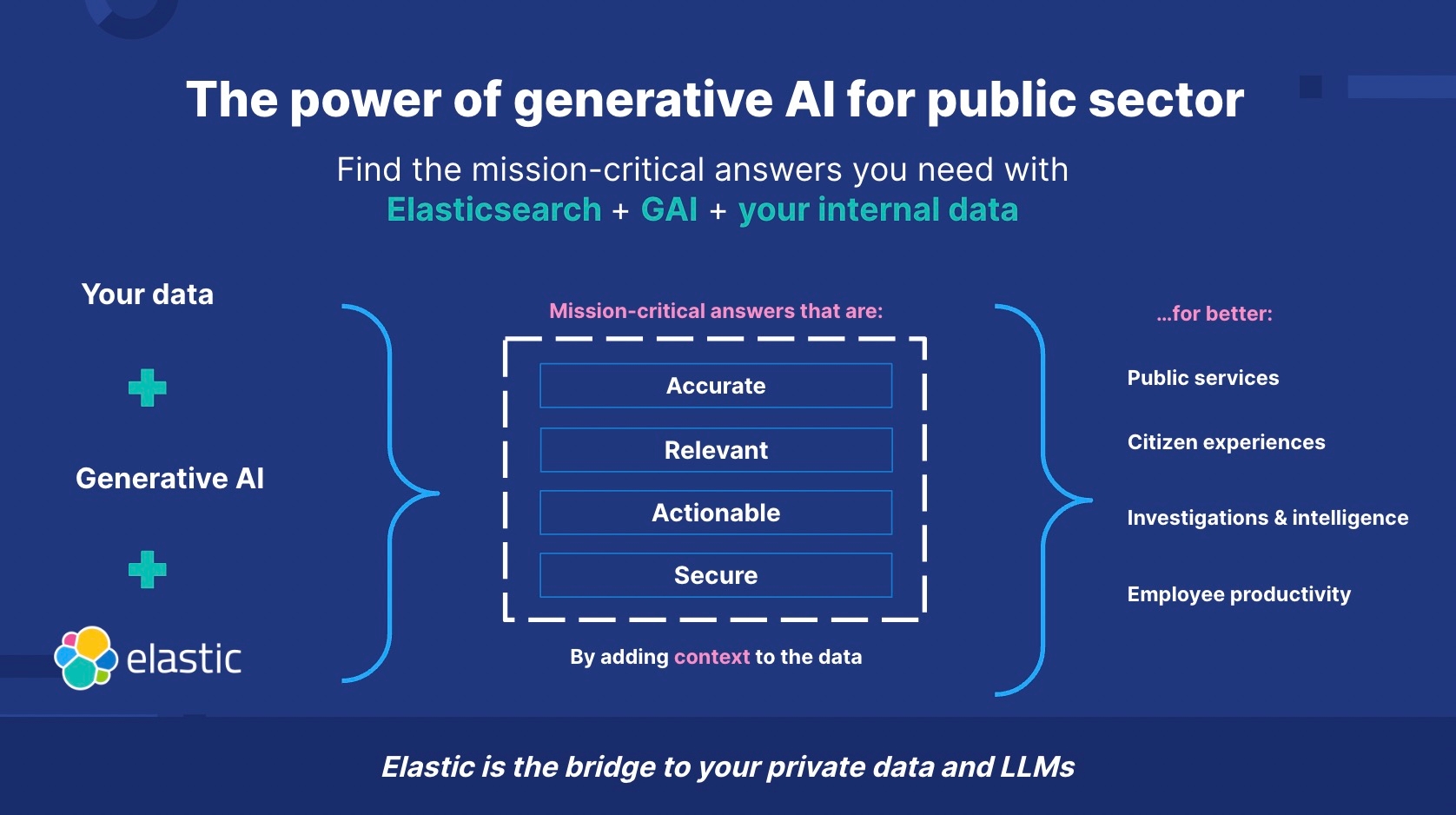

Palantir And Nato How Ai Is Transforming Public Sector Operations

May 10, 2025

Palantir And Nato How Ai Is Transforming Public Sector Operations

May 10, 2025 -

Palantirs Nato Deal A Revolution In Public Sector Ai

May 10, 2025

Palantirs Nato Deal A Revolution In Public Sector Ai

May 10, 2025 -

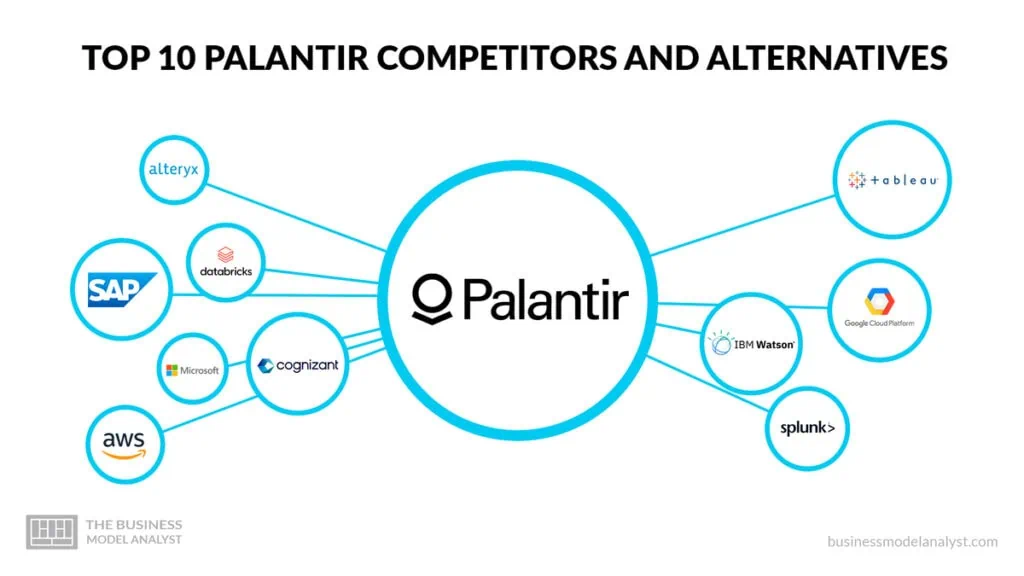

Palantir Competitors 2 Stock Predictions For Superior Growth 3 Year Outlook

May 10, 2025

Palantir Competitors 2 Stock Predictions For Superior Growth 3 Year Outlook

May 10, 2025 -

1889 A Year Of Divine Mercy Across Diverse Religious Communities

May 10, 2025

1889 A Year Of Divine Mercy Across Diverse Religious Communities

May 10, 2025 -

Bundesliga 2 Matchday 27 Results Cologne Dethrones Hamburg

May 10, 2025

Bundesliga 2 Matchday 27 Results Cologne Dethrones Hamburg

May 10, 2025