Ultra-Low Growth Forecast For Canada's Economy In 2024: David Dodge's Prediction

Table of Contents

David Dodge's Rationale: Underlying Factors Contributing to Low Growth

David Dodge, a former Governor of the Bank of Canada, is a highly respected figure in Canadian economics. His prediction of ultra-low growth for 2024 isn't based on speculation; it's rooted in several significant economic headwinds.

-

High Interest Rates: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, have significantly impacted consumer spending and business investment. Higher borrowing costs make it more expensive for individuals to purchase homes, cars, and other goods, while businesses face increased costs for expansion and operations. This dampens overall economic activity.

-

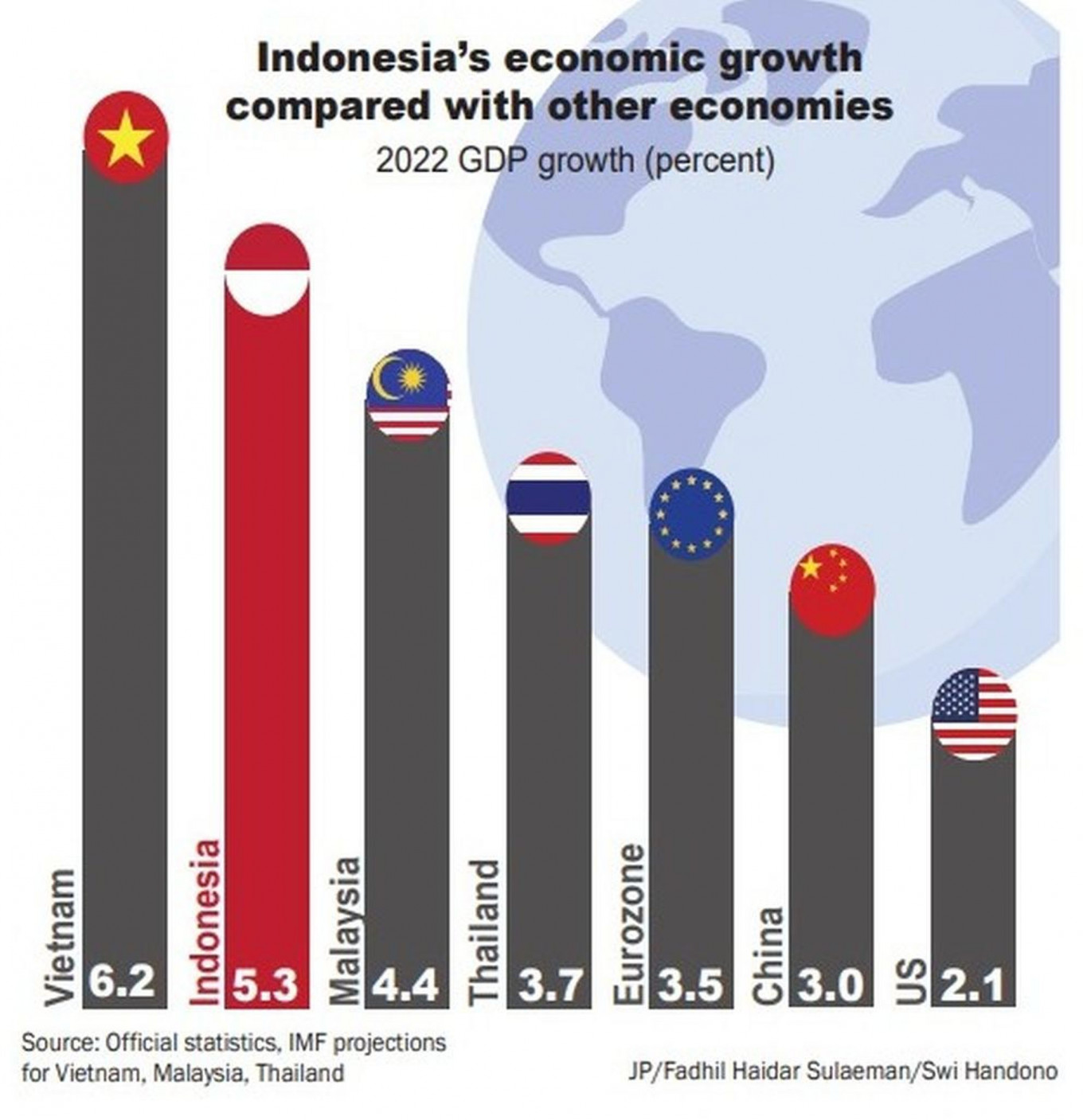

Global Economic Slowdown: Canada's economy is intertwined with the global economy. A slowdown in major trading partners like the United States and the European Union directly impacts Canadian exports, impacting manufacturing and resource sectors. Reduced global demand translates to lower production and potentially job losses in export-oriented industries.

-

Persistent Inflation: Inflation continues to erode purchasing power, forcing households to tighten their belts. This reduces discretionary spending, impacting retailers and service industries. High inflation also contributes to uncertainty, making businesses hesitant to invest.

-

Housing Market Downturn: The once-booming Canadian housing market is experiencing a correction. Falling house prices and reduced construction activity negatively impact related industries, such as real estate, construction, and financial services. This ripple effect extends across the economy.

-

Geopolitical Instability: Global events, such as the ongoing war in Ukraine and heightened geopolitical tensions, create economic uncertainty. This uncertainty discourages investment and can lead to supply chain disruptions, further hindering economic growth. For example, disruptions in energy markets due to geopolitical instability directly impact Canadian energy exports and prices.

Impact of Ultra-Low Growth on Key Sectors

An ultra-low growth forecast for Canada in 2024 will have far-reaching consequences across various sectors:

-

Manufacturing: Reduced export demand due to global slowdown will significantly impact the manufacturing sector. Companies might reduce production, leading to potential job losses and decreased investment in new technologies.

-

Real Estate and Construction: The ongoing housing market correction will continue to impact the construction industry and related businesses. Reduced demand for new homes and commercial properties will translate into lower employment and economic activity in this sector.

-

Retail: Consumers, facing higher interest rates and persistent inflation, will likely reduce their spending. This will negatively affect retailers, who may experience decreased sales and profit margins.

-

Job Market: Slow economic growth typically translates into a slower job market. The potential for increased unemployment and reduced wage growth is a significant concern.

-

Government Finances: Reduced economic activity will impact government tax revenues. This could lead to budgetary challenges and potentially limit the government's ability to implement stimulus measures or social programs.

Comparison with Other Economic Forecasts

While David Dodge's prediction of ultra-low growth is alarming, it's important to consider other forecasts. Several financial institutions and economists have released their own projections for Canada's 2024 economic growth. While some forecasts might be slightly more optimistic, the overall consensus points towards a significant slowdown compared to previous years. [Link to a reputable economic forecast source 1] [Link to a reputable economic forecast source 2]. The range of predictions highlights the uncertainty surrounding the Canadian economy's trajectory.

Potential Mitigation Strategies and Government Response

The Canadian government has several tools at its disposal to mitigate the impact of ultra-low growth. Fiscal policies, such as targeted tax cuts or increased infrastructure spending, could stimulate demand. However, the effectiveness of such measures depends on various factors, including the severity of the slowdown and the government's fiscal capacity. Monetary policy adjustments by the Bank of Canada, while already underway, could also play a role. The likelihood and effectiveness of government intervention remain to be seen and will depend on the evolving economic situation.

Conclusion: Navigating Canada's Uncertain Economic Future

David Dodge's prediction of ultra-low growth for Canada's economy in 2024 underscores the significant challenges facing the country. High interest rates, a global economic slowdown, persistent inflation, a housing market correction, and geopolitical uncertainty are all contributing factors. The impact will likely be felt across various sectors, with potential negative consequences for employment and government finances. While mitigation strategies exist, their effectiveness remains uncertain. Staying informed about the evolving economic situation is crucial. Continue researching the "ultra-low growth forecast for Canada's economy in 2024," and follow reputable sources like the Bank of Canada and Statistics Canada for updates. Consider subscribing to a financial news newsletter for regular insights. Understanding this forecast is essential for navigating Canada's uncertain economic future.

Featured Posts

-

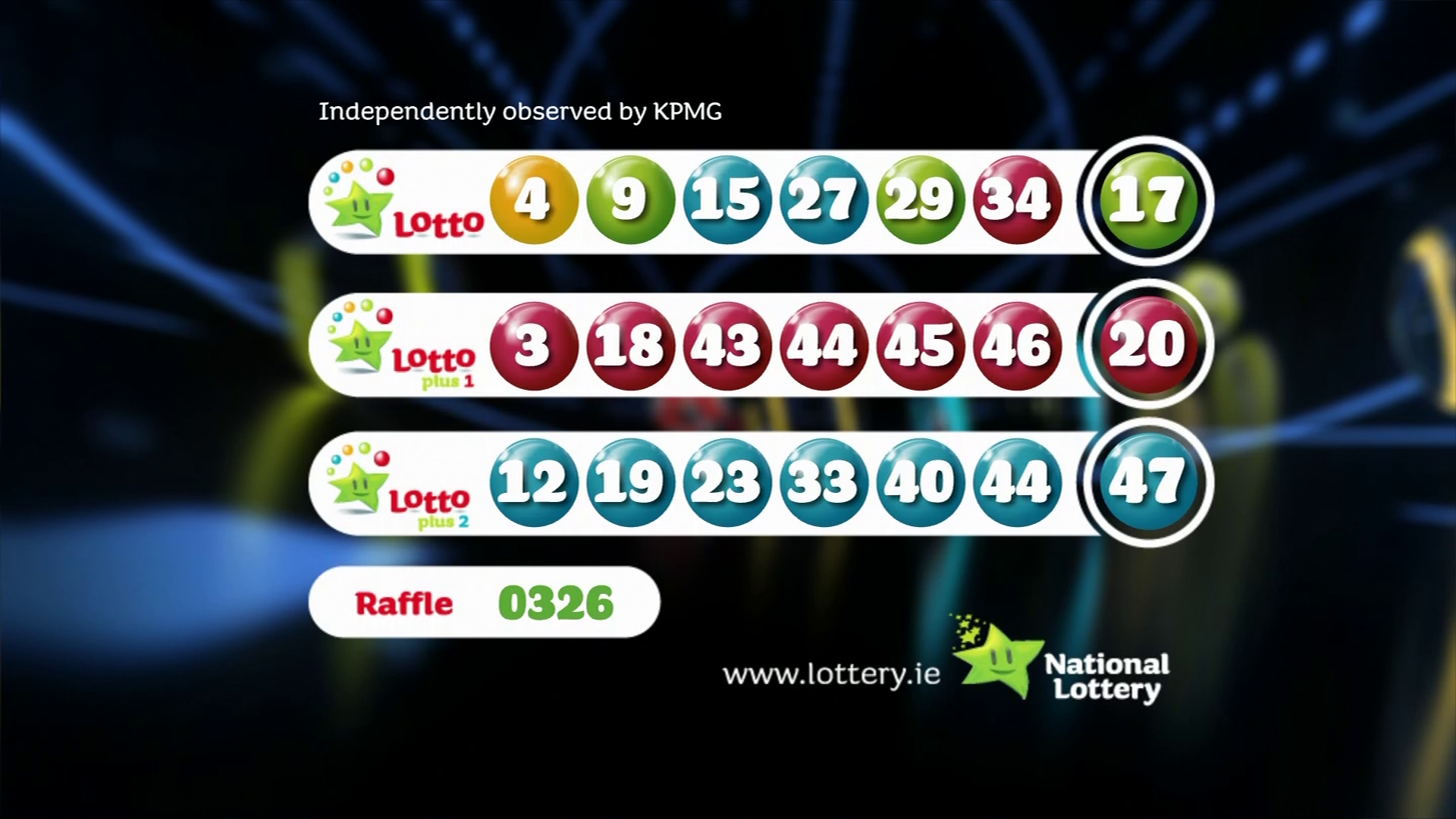

15 April 2025 Daily Lotto Winning Numbers Announced

May 02, 2025

15 April 2025 Daily Lotto Winning Numbers Announced

May 02, 2025 -

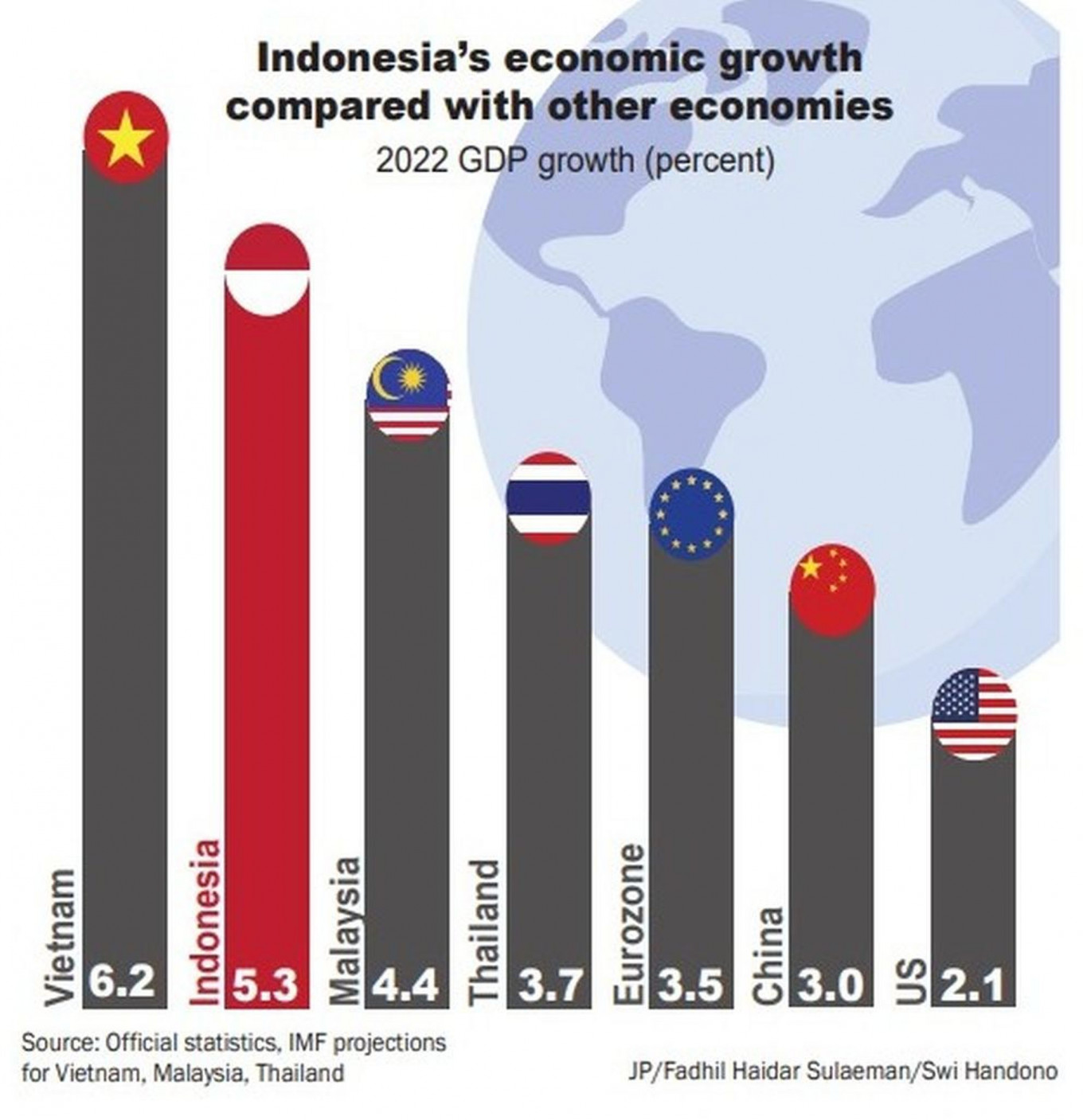

Troubleshooting Fortnite Matchmaking Error 1 Power Up Your Gaming

May 02, 2025

Troubleshooting Fortnite Matchmaking Error 1 Power Up Your Gaming

May 02, 2025 -

2024 Glastonbury Frustration Mounts Over Overlapping Performances

May 02, 2025

2024 Glastonbury Frustration Mounts Over Overlapping Performances

May 02, 2025 -

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results Here

May 02, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results Here

May 02, 2025 -

Activist Investor Fails In Bid To End Rio Tintos Dual Listing

May 02, 2025

Activist Investor Fails In Bid To End Rio Tintos Dual Listing

May 02, 2025

Latest Posts

-

Snls Harry Styles Impression The Singers Reaction

May 10, 2025

Snls Harry Styles Impression The Singers Reaction

May 10, 2025 -

Harry Styles Response To A Bad Snl Impression Disappointed

May 10, 2025

Harry Styles Response To A Bad Snl Impression Disappointed

May 10, 2025 -

The Snl Harry Styles Impression A Disappointing Reaction

May 10, 2025

The Snl Harry Styles Impression A Disappointing Reaction

May 10, 2025 -

Snls Failed Harry Styles Impression His Response

May 10, 2025

Snls Failed Harry Styles Impression His Response

May 10, 2025 -

Harry Styles On That Awful Snl Impression His Response

May 10, 2025

Harry Styles On That Awful Snl Impression His Response

May 10, 2025