Uncertainty Rises: Inflation And Unemployment Risks Increase

Table of Contents

The Inflationary Pressure Cooker

Inflation rates are currently soaring across the globe, impacting consumers with rising prices for essential goods and services. This persistent inflationary pressure is fueled by a confluence of factors, creating a challenging economic environment. Keywords: Inflation rates, rising prices, consumer price index (CPI), supply chain disruptions, energy prices, interest rates, monetary policy.

-

Analyzing Current Inflation Rates and Projections: The Consumer Price Index (CPI), a key measure of inflation, continues to show significant increases in many countries. Projections for the coming year vary, but many economists predict persistent inflation, albeit potentially at a slower rate than recently experienced.

-

The Impact of Rising Energy and Food Prices on Consumers: The sharp increase in energy prices, particularly oil and natural gas, is significantly impacting transportation, heating, and electricity costs. Similarly, rising food prices, driven by supply chain issues and unfavorable weather patterns, are squeezing household budgets.

-

The Role of Monetary Policy in Combating Inflation (Interest Rate Hikes): Central banks worldwide are responding to inflation by raising interest rates. This monetary policy aims to cool down the economy by making borrowing more expensive, reducing consumer spending and investment. However, this approach carries its own risks.

-

The Potential for Stagflation (High Inflation and Slow Economic Growth): The simultaneous occurrence of high inflation and slow economic growth, known as stagflation, is a significant concern. This scenario is particularly challenging to manage, as traditional economic policies designed to address one issue may exacerbate the other.

The Looming Threat of Unemployment

As central banks aggressively raise interest rates to combat inflation, there's a growing risk of a significant economic slowdown, potentially leading to widespread job losses. Keywords: Unemployment rate, job losses, layoffs, recession, economic slowdown, hiring freezes, workforce participation rate.

-

Analyzing Current Unemployment Figures and Predictions: While current unemployment figures may remain relatively low in some regions, predictions suggest a potential rise in unemployment as the impact of interest rate hikes ripples through the economy.

-

Sectors Most Vulnerable to Job Losses: Sectors heavily reliant on consumer spending, such as retail and hospitality, are particularly vulnerable to economic downturns. Additionally, industries facing significant technological disruption may experience increased layoffs.

-

The Impact of Rising Interest Rates on Business Investment and Hiring: Higher interest rates increase the cost of borrowing for businesses, making expansion and hiring less attractive. This can lead to hiring freezes and even layoffs as companies strive to cut costs.

-

Government Policies Aimed at Mitigating Unemployment: Governments are implementing various policies aimed at mitigating the impact of rising unemployment, such as job training programs and unemployment benefits. However, the effectiveness of these measures remains to be seen.

The Interplay Between Inflation and Unemployment

The relationship between inflation and unemployment is complex and not always straightforward. While the traditional Phillips curve suggests an inverse relationship, this model's limitations are increasingly apparent in the current economic climate. Keywords: Phillips curve, stagflation risk, economic trade-offs, policy challenges, fiscal policy, monetary policy coordination.

-

Explaining the Traditional Inverse Relationship Between Inflation and Unemployment: The Phillips curve traditionally suggests that lower unemployment leads to higher inflation, and vice-versa. This relationship stems from the idea that a tight labor market leads to increased wage demands, pushing up prices.

-

Discussing the Limitations of the Phillips Curve in the Current Economic Climate: The current economic climate challenges the traditional Phillips curve. We are seeing high inflation alongside relatively low unemployment in some regions, suggesting a more complex interplay than the traditional model suggests.

-

Analyzing the Challenges of Coordinating Fiscal and Monetary Policy Responses: Governments and central banks face the difficult task of coordinating fiscal and monetary policies to address both inflation and unemployment simultaneously. A poorly coordinated response could exacerbate both problems.

-

Exploring Potential Scenarios, Including Best-Case and Worst-Case Outcomes: Several scenarios are possible. A best-case scenario would involve a gradual slowing of inflation with minimal impact on employment. A worst-case scenario could involve prolonged high inflation combined with significant job losses, leading to a deep recession.

Protecting Yourself During Times of Economic Uncertainty

Navigating this period of economic uncertainty requires proactive financial planning. Keywords: Financial planning, budgeting, investing, savings, debt management, risk mitigation.

-

Create a Realistic Budget and Track Expenses: Carefully monitor your spending and identify areas where you can cut back. A detailed budget will help you manage your finances effectively.

-

Diversify Your Investment Portfolio: Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk.

-

Pay Down High-Interest Debt: High-interest debt can significantly impact your financial well-being. Prioritize paying down these debts to reduce your financial burden.

-

Build an Emergency Fund: Having a readily available emergency fund can provide a crucial safety net during unexpected economic downturns.

-

Consider Professional Financial Advice: Seeking advice from a qualified financial advisor can provide valuable insights and personalized guidance.

Conclusion

The intertwined risks of inflation and unemployment present a significant challenge to the global economy. The interconnectedness of these challenges necessitates a nuanced approach from policymakers and proactive financial management from individuals. Understanding the risks of inflation and unemployment is crucial for navigating these uncertain times. Prepare for economic uncertainty by implementing sound financial strategies, including budgeting, diversifying investments, and building an emergency fund. Take control of your financial future in the face of rising inflation and unemployment by staying informed and taking proactive steps to protect your financial well-being. For further resources on managing your finances during economic uncertainty, consult your financial advisor or explore reputable financial literacy websites.

Featured Posts

-

Massive Transfer Bid Rejected Man United Star Committed To Old Trafford

May 30, 2025

Massive Transfer Bid Rejected Man United Star Committed To Old Trafford

May 30, 2025 -

Trumps Reaction To The Taco Trade A Comprehensive Overview

May 30, 2025

Trumps Reaction To The Taco Trade A Comprehensive Overview

May 30, 2025 -

Anchor Brewing Company 127 Years Of Brewing History Concludes

May 30, 2025

Anchor Brewing Company 127 Years Of Brewing History Concludes

May 30, 2025 -

Izrail Mada Preduprezhdaet Ob Ekstremalnykh Pogodnykh Usloviyakh Zhara Kholod I Shtorm

May 30, 2025

Izrail Mada Preduprezhdaet Ob Ekstremalnykh Pogodnykh Usloviyakh Zhara Kholod I Shtorm

May 30, 2025 -

Guide Des Droits De Douane Declaration Et Procedures Simplifiees

May 30, 2025

Guide Des Droits De Douane Declaration Et Procedures Simplifiees

May 30, 2025

Latest Posts

-

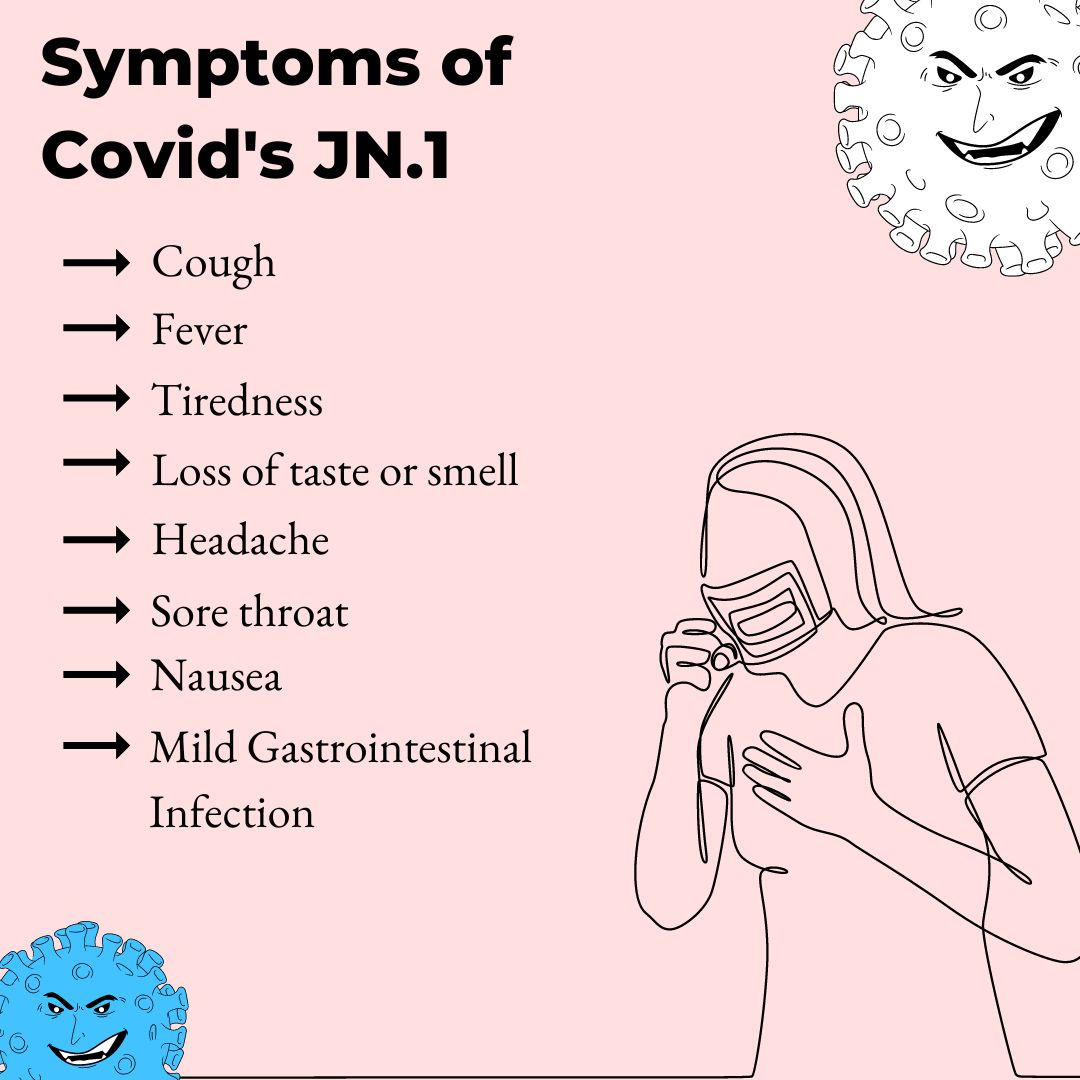

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025 -

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025 -

Covid 19 Variant Lp 8 1 A Comprehensive Overview

May 31, 2025

Covid 19 Variant Lp 8 1 A Comprehensive Overview

May 31, 2025 -

The Jn 1 Covid 19 Variant A Guide For Individuals And Communities

May 31, 2025

The Jn 1 Covid 19 Variant A Guide For Individuals And Communities

May 31, 2025 -

New Covid 19 Variant Jn 1 Rapid Spread In India And Warning Symptoms

May 31, 2025

New Covid 19 Variant Jn 1 Rapid Spread In India And Warning Symptoms

May 31, 2025