Uncovering Hidden Value In News Corp: An Investment Perspective

Table of Contents

News Corp's Diversified Portfolio: A Key Strength

News Corp's strength lies in its surprisingly diverse portfolio, offering resilience against market downturns and opportunities for growth across multiple sectors. This diversification minimizes risk and maximizes potential returns for the shrewd investor.

Real Estate Holdings: Significant Untapped Value in News Corp's Real Estate Assets

News Corp possesses a substantial real estate portfolio, a significant asset often overlooked in traditional News Corp stock valuations. These properties, located strategically across key global markets, represent substantial untapped value.

- Scale and Location: News Corp owns prime commercial real estate in major cities, including substantial holdings in New York City and London. These locations offer significant potential for appreciation and future development.

- Development Potential: Many of these properties are underutilized, offering opportunities for redevelopment, leasing to high-value tenants, or even outright sale at a substantial profit.

- Comparable Market Values: Comparing News Corp's real estate holdings to similar properties in their respective markets reveals a significant potential for asset valuation increase, which isn't fully reflected in the current News Corp stock price. This "hidden value" presents a compelling argument for investment. Analyzing News Corp real estate holdings offers a unique angle on the company's overall valuation.

Digital Media Dominance: Growth Potential in Digital News and Subscription Models

While News Corp maintains a strong presence in print media, its digital properties are rapidly expanding, presenting exciting growth opportunities. News Corp digital properties are aggressively pursuing subscription revenue models and leveraging their brand recognition to attract new subscribers.

- Key Digital Properties: News Corp boasts a strong portfolio of digital news sites and platforms, reaching a broad and engaged audience. These digital assets provide consistent revenue streams and exhibit significant growth potential.

- Subscription Growth Strategies: The company is actively investing in building robust subscription models, leveraging exclusive content and advanced digital features to boost subscriber numbers. This strategy is crucial for long-term sustainability and increased profitability.

- Future Revenue Streams: Expanding into new digital ventures and partnerships can unlock additional revenue streams, further enhancing the value of News Corp digital assets. This makes News Corp digital a particularly exciting area for investment.

Print Media's Resiliency: Analyzing the Ongoing Profitability and Potential for Future Adaptation

Despite the rise of digital media, News Corp's print media holdings remain profitable. By focusing on cost-cutting measures and strategic adaptations, News Corp demonstrates the potential for resilience and future profitability within this sector.

- Core Readership: News Corp’s print publications retain a loyal and engaged readership, a crucial asset in a changing media landscape. This core audience is a valuable foundation for future diversification.

- Cost-Cutting Measures: News Corp has implemented effective cost-cutting measures to improve margins and enhance profitability in its print operations.

- Diversification within Print: Exploring avenues for diversification, such as creating special editions, targeting niche markets with specialized publications, and focusing on targeted advertising, presents opportunities for growth and stability within the print media segment. The ongoing profitability of News Corp print presents a valuable and underappreciated aspect of the overall investment picture.

Understanding News Corp's Financial Performance and Valuation

A thorough analysis of News Corp’s financial performance and valuation is crucial for any investor. This section will delve into key metrics to determine the true worth of this often-underestimated investment opportunity.

Analyzing Key Financial Metrics: A Deep Dive into Revenue Streams, Profit Margins, and Debt Levels

Examining News Corp financials offers valuable insights into the company's financial health and future prospects. A detailed analysis of key metrics is essential for a comprehensive investment assessment.

- Revenue Streams Diversification: Examining News Corp’s diverse revenue streams—from print and digital media to real estate—provides a more complete picture of its financial stability.

- Profit Margins and Growth: Analyzing profit margins and their growth trajectories reveals the efficiency and profitability of the company's operations.

- Debt Levels and Management: Assessing News Corp's debt levels and its management of debt provides essential information regarding its financial risk profile. Comparing these metrics to industry averages and competitors allows for a more informed investment decision.

Assessing Market Sentiment and Stock Price: Explain Current Market Perception of News Corp and its Stock Price

The current market perception of News Corp and its stock price is often influenced by short-term market fluctuations and sentiment. However, a deeper analysis reveals a potential disconnect between the market's perception and the company's intrinsic value.

- Market Trends and News Events: Short-term news cycles and market trends can impact the stock price, obscuring the long-term value.

- Investor Sentiment: Understanding current investor sentiment towards News Corp is crucial, as it can influence the stock price significantly.

- Intrinsic Value vs. Market Price: A careful analysis of News Corp's assets, revenue streams, and future growth potential allows for a more accurate assessment of its intrinsic value, which may differ significantly from the current market price. Understanding this discrepancy is key to making an informed News Corp investment.

Risks and Potential Downsides of Investing in News Corp

While News Corp presents significant opportunities, it's crucial to acknowledge potential risks and downsides. A thorough understanding of these factors is vital for any responsible investor.

Industry Challenges: Address Challenges Faced by the Media Industry (e.g., Competition, Advertising Revenue Fluctuations)

The media industry faces numerous challenges, including intense competition and fluctuations in advertising revenue. News Corp is actively mitigating these risks through diversification and strategic innovation.

- Competition Mitigation: News Corp’s diversified portfolio reduces its reliance on any single segment, thereby mitigating the risks associated with intense competition.

- Advertising Revenue Fluctuations: The company is diversifying its revenue streams, reducing its dependence on advertising revenue alone and minimizing the impact of fluctuations.

Geopolitical Factors: Discuss the Impact of Geopolitical Events on News Corp's Operations

Geopolitical events can significantly impact News Corp's operations, particularly in international markets. Understanding and assessing these risks is crucial for informed investment decisions.

- Political Instability: Political instability in key markets can disrupt operations and impact revenue generation. News Corp mitigates this risk by diversifying its geographic footprint and focusing on resilient business segments.

- Economic Downturns: Global economic downturns can negatively affect advertising revenue and consumer spending, impacting the profitability of News Corp’s various business units.

Conclusion: Unlocking the Potential of News Corp Investment

News Corp offers a compelling investment opportunity for those willing to look beyond the surface. Its diversified portfolio, encompassing valuable real estate, growing digital media assets, and resilient print operations, presents significant potential for long-term growth. While industry challenges and geopolitical factors pose risks, News Corp's strategic initiatives demonstrate a capacity to navigate these hurdles. By carefully analyzing News Corp financials and understanding the market dynamics, investors can unlock the hidden value within this often-underestimated company. Explore News Corp investment options, discover hidden value in News Corp, and assess your News Corp investment strategy today. The potential for strong returns makes News Corp a compelling addition to any well-diversified investment portfolio.

Featured Posts

-

Ccmf 2025 High Demand Leads To Complete Ticket Sell Out

May 25, 2025

Ccmf 2025 High Demand Leads To Complete Ticket Sell Out

May 25, 2025 -

Eddie Jordan Ha Fallecido Noticias De Ultima Hora

May 25, 2025

Eddie Jordan Ha Fallecido Noticias De Ultima Hora

May 25, 2025 -

Where To Invest Mapping The Countrys New Business Hot Spots

May 25, 2025

Where To Invest Mapping The Countrys New Business Hot Spots

May 25, 2025 -

Public Outrage Over Thames Water Executive Bonuses

May 25, 2025

Public Outrage Over Thames Water Executive Bonuses

May 25, 2025 -

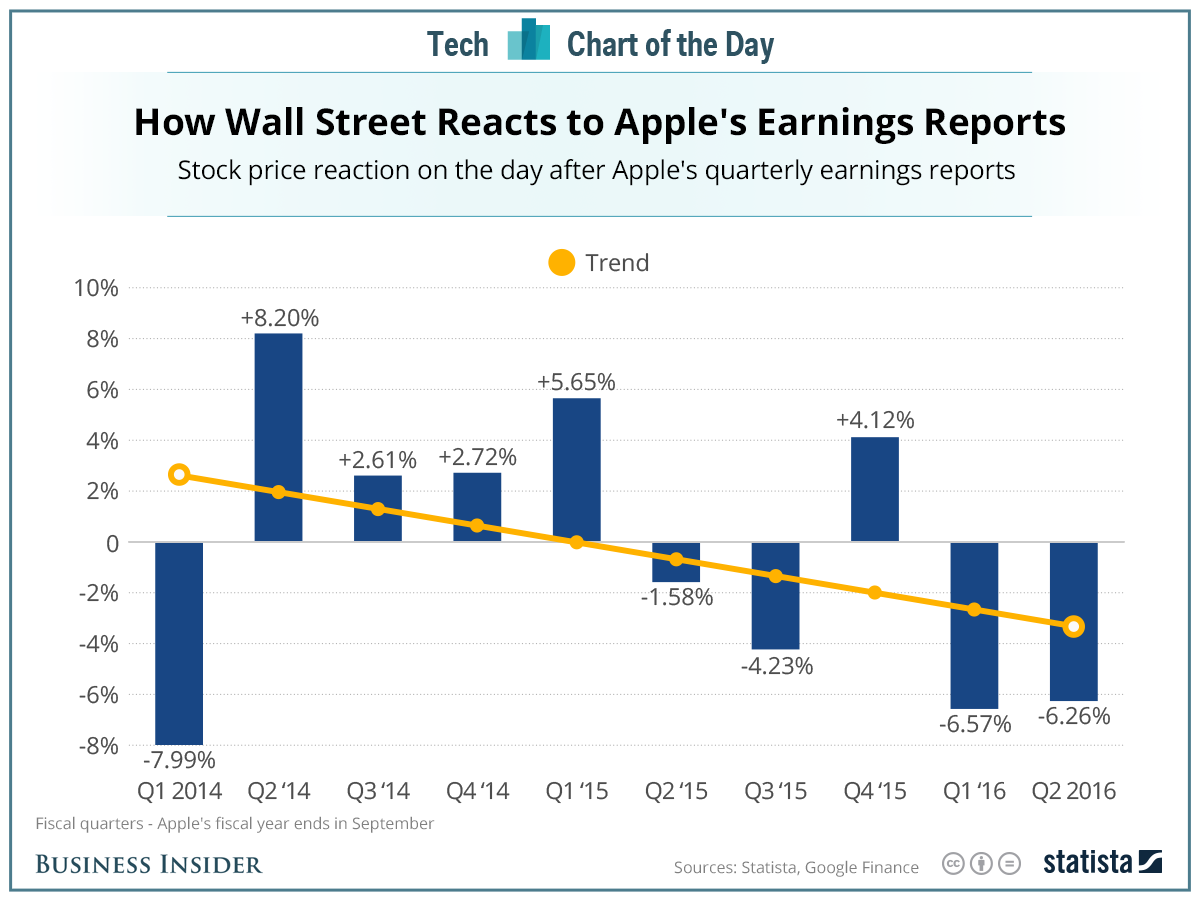

Apples Q2 Earnings Impact On Stock Price

May 25, 2025

Apples Q2 Earnings Impact On Stock Price

May 25, 2025