Understanding The India Market Rally: A Deep Dive Into Nifty's Performance

Table of Contents

Macroeconomic Factors Fueling the Nifty Rally

Several macroeconomic factors have fueled the recent India market rally and contributed to the impressive Nifty 50 performance.

Robust GDP Growth

India's robust GDP growth is a primary driver of the positive market sentiment. This strong economic expansion creates a favorable environment for businesses and attracts investment.

- Recent GDP figures: India's GDP growth consistently exceeded expectations in recent quarters, showcasing the resilience of the Indian economy. For example, [insert recent GDP growth data with source].

- Projected growth rates: Forecasts predict continued strong growth in the coming years, further boosting investor confidence. [Insert projected growth rates with source]

- Government initiatives: Government initiatives like “Make in India” and infrastructure development projects are stimulating economic activity and contributing to the overall positive outlook. These initiatives are directly impacting sectors contributing significantly to the Nifty 50's growth.

- Keyword integration: Indian GDP growth, economic growth India, Nifty 50 growth, India economic outlook

Foreign Institutional Investor (FII) Inflows

Significant Foreign Institutional Investor (FII) inflows have played a crucial role in boosting the Nifty. Increased FII investment reflects growing global confidence in the Indian economy.

- Amount of FII investment: FIIs have poured billions of dollars into the Indian stock market recently. [Insert data on FII investment with source]. This surge in foreign investment reflects global investors' belief in the long-term growth potential of the Indian economy.

- Reasons for increased interest: The factors driving this increased interest include India's strong economic fundamentals, improving corporate earnings, and a relatively stable political environment.

- Targeted sectors: FIIs are particularly focused on sectors like technology, financials, and consumer goods, further driving the performance of specific Nifty 50 components.

- Keyword integration: FII investment India, foreign investment Nifty, India stock market inflow, global investment India

Positive Government Policies

Government policies and reforms have significantly influenced market confidence and contributed to the Nifty's growth.

- Key reforms: Initiatives such as the Goods and Services Tax (GST) simplification, the focus on infrastructure development, and various tax benefits have fostered a business-friendly environment.

- Ease of doing business: Improvements in the ease of doing business ranking have made India a more attractive destination for both domestic and foreign investments.

- Impact on market confidence: These policy measures have boosted investor confidence, leading to increased investment and driving the Nifty's upward trajectory.

- Keyword integration: India government policies, market reforms India, Nifty policy impact, India business environment

Sector-Specific Performance Driving the Nifty Rally

The Nifty rally isn't solely driven by macroeconomic factors; strong performance in specific sectors also plays a vital role.

IT Sector Boom

The Indian IT sector has significantly contributed to the Nifty's performance, driven by global demand for IT services.

- Global demand: Increased global demand for IT services, particularly from North America and Europe, has fueled robust earnings growth for Indian IT companies.

- Robust earnings: Strong earnings reports from leading IT companies have further enhanced investor sentiment and boosted the Nifty 50.

- Sector outlook: The outlook for the Indian IT sector remains positive, with projections indicating continued growth in the coming years.

- Keyword integration: Indian IT sector, Nifty IT stocks, technology stocks India, IT sector growth India

Financials and Banking Sector Strength

The improved health of the financial sector, including banks, has significantly supported the market rally.

- Improved asset quality: Indian banks have witnessed an improvement in asset quality, reducing Non-Performing Assets (NPAs).

- Increasing credit growth: Rising credit growth indicates increased economic activity and supports the overall positive market sentiment.

- Banking system health: The overall health and stability of the Indian banking system are contributing to the confidence of investors.

- Keyword integration: Indian banking sector, Nifty bank stocks, financial sector India, India banking reforms

Infrastructure and Consumption Growth

Government investments in infrastructure and rising consumer spending have had a positive ripple effect.

- Government investments: Massive government investments in infrastructure projects are creating jobs and stimulating economic activity.

- Improved consumer confidence: Improved consumer confidence and rising disposable incomes are driving consumption, benefiting related sectors.

- Effect on related sectors: This growth positively impacts cement, steel, and other related sectors, further bolstering the Nifty's performance.

- Keyword integration: India infrastructure growth, consumer spending India, Nifty infrastructure stocks, India consumption growth

Understanding the Risks and Potential Challenges

While the current outlook is positive, investors must acknowledge potential risks.

Inflationary Pressures

Inflationary pressures pose a potential challenge to the Nifty's performance and the broader Indian economy.

- Inflation rates: While inflation has been relatively contained, any significant surge could impact consumer spending and market sentiment. [Insert data on inflation rates with source].

- RBI's monetary policy response: The Reserve Bank of India (RBI)'s monetary policy response to inflation will be crucial in managing the situation.

- Effect on market sentiment: High inflation could negatively impact investor sentiment and potentially curb the Nifty's growth.

- Keyword integration: India inflation rate, RBI monetary policy, Nifty inflation impact, India inflation control

Geopolitical Risks

Global geopolitical events could influence the Indian stock market and impact investor confidence.

- Global uncertainties: Global uncertainties, including geopolitical tensions and potential economic slowdowns in other major economies, could affect investor sentiment.

- Impact on investor confidence: Negative global events could lead to capital outflows and increased market volatility.

- Nifty's trajectory: These external factors could significantly impact the Nifty's trajectory.

- Keyword integration: Geopolitical risk India, global market impact Nifty, India market volatility, global economic uncertainty

Valuation Concerns

Assessing whether current market valuations are sustainable is critical for long-term investment strategies.

- Price-to-Earnings ratios: Analyzing Price-to-Earnings (P/E) ratios and other valuation metrics can help determine whether the market is overvalued. [Insert relevant data and analysis].

- Other valuation metrics: Considering other valuation metrics provides a more comprehensive assessment of potential risks.

- Potential risks: High valuations can increase the risk of a market correction.

- Keyword integration: Nifty valuation, India market valuation, stock market valuation, India market risk

Conclusion

The India market rally, strongly reflected in the Nifty 50's performance, is a result of robust GDP growth, substantial FII inflows, supportive government policies, and robust sector-specific performance. However, inflationary pressures, geopolitical risks, and valuation concerns require careful consideration. Understanding these interwoven factors is crucial for navigating the Indian stock market effectively. Stay informed about the India market rally and the Nifty's performance to make well-informed investment decisions. Continue monitoring the Nifty 50 and other key Indian market indicators for insights into the ongoing performance and potential future trends. Understanding the nuances of the India market rally is key to successful investing.

Featured Posts

-

Anchor Brewing Companys Closure 127 Years Of Brewing History Concludes

Apr 24, 2025

Anchor Brewing Companys Closure 127 Years Of Brewing History Concludes

Apr 24, 2025 -

Navigating The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigating The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 24, 2025 -

California Gas Prices Governor Newsom Seeks Industry Collaboration To Lower Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Industry Collaboration To Lower Costs

Apr 24, 2025 -

Chat Gpt Chief Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025

Chat Gpt Chief Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025 -

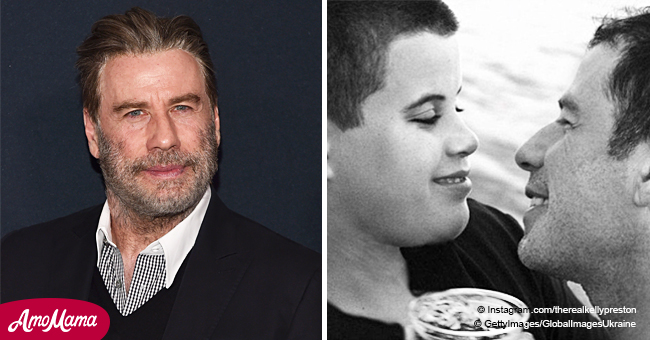

John Travolta Shares A Photo To Remember Late Son Jetts Birthday

Apr 24, 2025

John Travolta Shares A Photo To Remember Late Son Jetts Birthday

Apr 24, 2025