Unpacking The Distributional Effects Of Trump's Economic Goals

Table of Contents

The Impact of Tax Cuts on Income Inequality

The 2017 Tax Cuts and Jobs Act, a cornerstone of the Trump administration's economic agenda, significantly altered the US tax code. While proponents touted the "trickle-down" effect, its distributional impact was far from uniform, exacerbating existing income inequality.

Winners and Losers: Analyzing the 2017 Tax Cuts

The 2017 tax cuts resulted in a significant reduction in corporate tax rates, from 35% to 21%. This measure overwhelmingly benefited corporations and high-income earners who own significant shares of corporate stock. Meanwhile, the benefits for low and middle-income families were comparatively minimal.

- Significant reduction in corporate tax rates: This led to increased corporate profits and shareholder returns, disproportionately benefiting wealthy individuals.

- Increased after-tax income for high-income brackets: Tax cuts targeted specific deductions and loopholes used by higher earners, resulting in substantial tax savings.

- Limited impact on low and middle-income tax brackets: Many lower-income individuals received only modest tax reductions or saw no change at all.

- Discussion of the "trickle-down" effect and its efficacy: Empirical evidence suggests that the trickle-down effect – the idea that tax cuts for corporations and the wealthy will stimulate the economy and benefit everyone – did not materialize to the extent predicted. Studies consistently showed that the benefits were concentrated at the top.

- Data and statistics supporting the claims: Numerous studies from organizations like the Congressional Budget Office and the Tax Policy Center provide detailed analyses showing the disproportionate benefits of the 2017 tax cuts accruing to high-income households.

Long-term effects on national debt and economic growth

The 2017 tax cuts significantly increased the national debt. The reduction in government revenue, coupled with increased spending, led to a substantial rise in the budget deficit. This raises concerns about long-term economic growth and the sustainability of the nation's fiscal position.

- Analysis of increased national debt due to tax cuts: The tax cuts added trillions to the national debt over the following years.

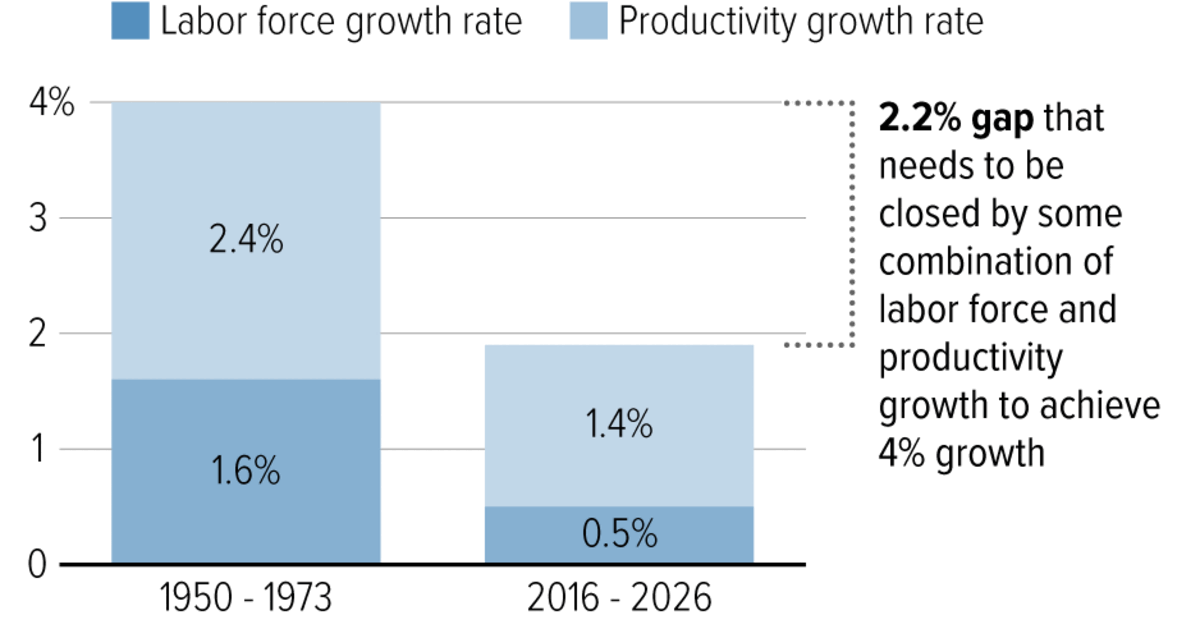

- Discussion of the potential for decreased future economic growth: High national debt can crowd out private investment and lead to higher interest rates, potentially hindering future economic expansion.

- Comparative analysis with other periods of tax cuts: Historical data on tax cuts and their impact on debt and growth can provide valuable context and insights.

- Expert opinions and economic models: Economists have differing perspectives on the long-term consequences of the tax cuts, with some arguing that the potential economic stimulus outweighs the debt increase, while others express considerable concern.

Trade Wars and Their Distributional Consequences

The Trump administration's imposition of tariffs and engagement in trade wars had significant distributional consequences, impacting different sectors and populations unevenly.

Impact on specific industries and workers

Tariffs imposed as part of the trade war primarily affected specific industries, resulting in job losses and economic hardship for workers in those sectors. The agricultural sector, for instance, faced retaliatory tariffs from other countries, significantly impacting farmers and related businesses.

- Case studies of specific industries impacted by trade disputes: Analyzing the impact on industries like agriculture, steel, and manufacturing provides concrete examples of the distributional effects.

- Job losses and gains in various sectors: While some sectors might have experienced short-term gains, many others faced significant job losses due to reduced exports and increased input costs.

- Analysis of the impact on small businesses: Small businesses, often lacking the resources to adapt to changing trade conditions, were disproportionately affected.

- Regional disparities in the effects of trade policies: The impact of trade wars varied across regions, with some areas experiencing more severe economic consequences than others.

Consumer prices and the impact on low-income households

Tariffs led to higher prices for imported goods, increasing the cost of living for all consumers. However, this impact was particularly felt by low-income households, who spend a larger proportion of their income on essential goods and services, making them more vulnerable to price increases.

- Statistical analysis of price increases due to tariffs: Data on inflation and consumer prices can be used to quantify the impact of tariffs on the cost of living.

- Discussion of the impact on the cost of living for low-income families: Low-income families often face difficult choices when prices rise, potentially sacrificing necessities or falling further into debt.

- Comparison to previous periods of trade protectionism: Historical data on the effects of tariffs can inform our understanding of the current situation.

- Analysis of consumer spending patterns: Examining changes in consumer spending habits provides insights into how consumers adapt to higher prices.

Deregulation and its Distributional Effects

The Trump administration pursued a policy of deregulation across various sectors, with distributional consequences that are complex and often debated.

Environmental regulations and their impact on specific communities

Rolling back environmental regulations disproportionately affected low-income communities and minority groups, who often live near polluting industries and lack the resources to mitigate the associated health risks.

- Examples of specific environmental regulations rolled back: Identifying specific instances of deregulation and their consequences is crucial for understanding the distributional impact.

- Analysis of the environmental and health consequences for vulnerable communities: Studies linking pollution to health outcomes can demonstrate the disproportionate effects on vulnerable populations.

- Discussion of the concept of environmental justice: Environmental justice emphasizes the fairness and equity in the distribution of environmental benefits and burdens.

- Statistics on pollution levels and health outcomes in affected communities: Quantitative data strengthens the argument by providing evidence of environmental disparities.

Financial deregulation and its impact on financial stability

Deregulation in the financial sector, while intended to stimulate economic activity, also carried the risk of increased systemic instability. This instability could have significant distributional consequences, potentially leading to another financial crisis that would disproportionately affect vulnerable populations.

- Discussion of specific deregulatory measures: Identifying specific examples of financial deregulation is important for understanding the potential risks.

- Analysis of potential risks to financial stability: Examining the potential for increased systemic risk is crucial for assessing the long-term consequences.

- Discussion of the impact on different income groups: Assessing the distributional impact of potential financial crises is necessary for a complete understanding.

- Comparison with previous periods of financial deregulation: Looking at past examples can provide valuable lessons and context.

Conclusion

Trump's economic policies, while aiming for broad-based growth, resulted in uneven distributional effects. Tax cuts primarily benefited high-income earners, trade wars impacted specific industries and consumers, and deregulation created risks and uneven environmental impacts. Understanding these distributional consequences is crucial for evaluating the long-term success and fairness of such economic approaches. Further research into the lasting effects of these policies on various segments of the population is needed. Continue to analyze the distributional effects of Trump's economic goals to fully grasp their impact on American society.

Featured Posts

-

English Language Leaders Debate 5 Top Economic Takeaways For Voters

Apr 22, 2025

English Language Leaders Debate 5 Top Economic Takeaways For Voters

Apr 22, 2025 -

Pope Francis Dead At 88 Following Pneumonia Battle

Apr 22, 2025

Pope Francis Dead At 88 Following Pneumonia Battle

Apr 22, 2025 -

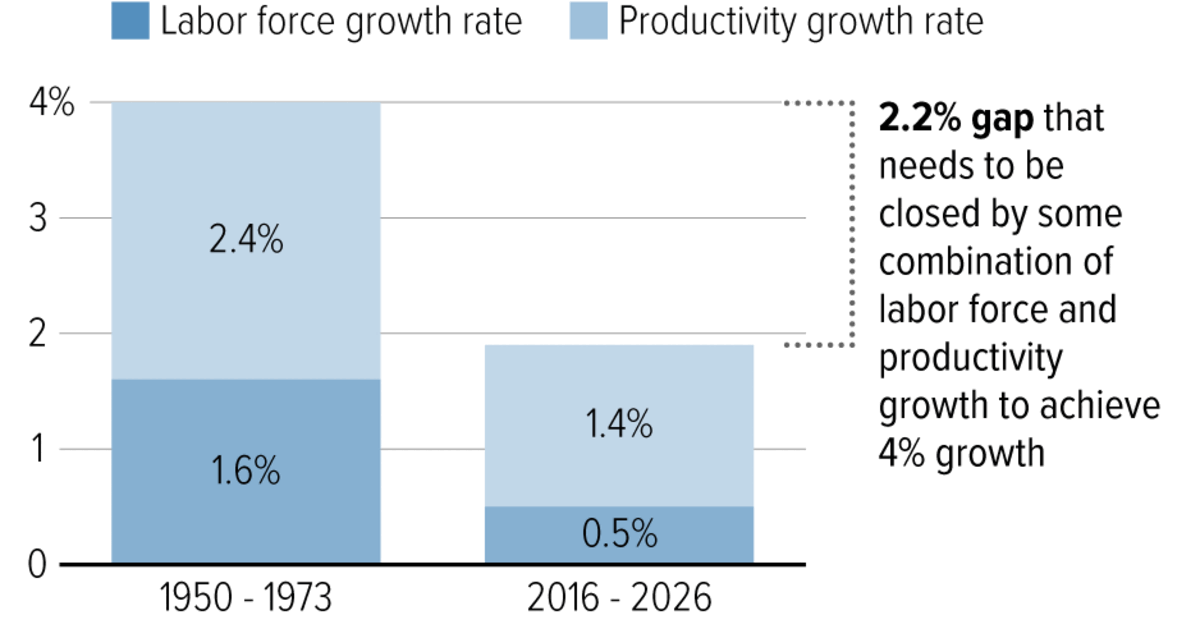

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

Apr 22, 2025

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

Apr 22, 2025 -

The English Language Leaders Debate 5 Economic Issues That Matter

Apr 22, 2025

The English Language Leaders Debate 5 Economic Issues That Matter

Apr 22, 2025 -

1 Billion Funding Cut Planned For Harvard Trump Administrations Anger

Apr 22, 2025

1 Billion Funding Cut Planned For Harvard Trump Administrations Anger

Apr 22, 2025

Latest Posts

-

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Odds

May 10, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Odds

May 10, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Picks

May 10, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Picks

May 10, 2025 -

Oilers Vs Kings Game 1 Playoffs Prediction Picks And Betting Odds

May 10, 2025

Oilers Vs Kings Game 1 Playoffs Prediction Picks And Betting Odds

May 10, 2025 -

Oilers Vs Kings Prediction Game 1 Playoffs Best Bets And Picks

May 10, 2025

Oilers Vs Kings Prediction Game 1 Playoffs Best Bets And Picks

May 10, 2025 -

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025