BofA Reassures Investors: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Key Arguments for a Positive Market Outlook

BofA's positive outlook rests on several pillars, suggesting that the current market conditions, while volatile, aren't indicative of an imminent downturn.

Strong Corporate Earnings and Profitability

BofA's analysis points to robust corporate earnings and profitability as a key driver of a positive market outlook. Despite economic headwinds, many companies are exceeding expectations, showcasing resilience and adaptability.

- Examples of Strong Performers: Several sectors, including technology and energy, have reported surprisingly strong earnings, defying pessimistic predictions. Companies like [insert example of a strong performing company in a relevant sector] have shown impressive growth, exceeding analyst estimates and bolstering investor confidence. This positive trend suggests that the underlying fundamentals of the economy remain strong.

- Positive Earnings Surprises: A significant number of companies have delivered positive earnings surprises, exceeding market expectations. This indicates that businesses are effectively navigating the current economic climate and maintaining strong profitability. This positive momentum is a crucial factor supporting current stock valuations.

- Impact on Stock Prices: Strong earnings directly translate to higher stock prices, countering concerns about overvaluation. As long as corporate profits continue to demonstrate resilience, stock prices are likely to remain supported, defying purely valuation-based concerns.

Resilient Consumer Spending and Economic Growth

BofA highlights resilient consumer spending as a significant factor supporting economic growth and, consequently, stock market valuations. While inflation has impacted purchasing power, consumer spending remains surprisingly robust.

- Data Supporting Resilient Spending: Data on retail sales, consumer confidence indices, and employment figures point towards a sustained level of consumer spending despite rising prices.

- Addressing Counterarguments (Inflation & Interest Rates): While inflation and rising interest rates pose challenges, BofA's analysis suggests that these factors are being effectively managed, and their impact on consumer spending is less severe than initially feared. The firm's economic forecasts predict continued, albeit moderated, growth.

- BofA's Economic Forecasts: BofA's economic forecasts project continued GDP growth, albeit at a slower pace than in previous years. This moderate growth, coupled with resilient consumer spending, indicates a healthy economic environment capable of supporting current stock market valuations.

Favorable Interest Rate Environment (Potential for Moderation)

BofA anticipates a potential moderation in the pace of interest rate hikes, which could positively impact stock valuations. While the Federal Reserve (Fed) continues to combat inflation, there's growing speculation that the rate of increases will slow down.

- Potential for Slower Rate Hikes: The Fed's future policy decisions will depend on economic data, but indications suggest a less aggressive approach to interest rate increases in the near future.

- BofA's Predictions for Future Interest Rate Changes: BofA's analysts predict a gradual slowing of interest rate hikes, culminating in a potential pause or even rate cuts depending on economic conditions.

- Impact on Investor Behavior and Stock Prices: A less aggressive interest rate environment reduces the uncertainty surrounding borrowing costs for businesses and consumers, fostering investor confidence and potentially leading to higher stock prices. This expectation contributes to the overall positive market outlook.

Addressing Investor Concerns About High Valuations

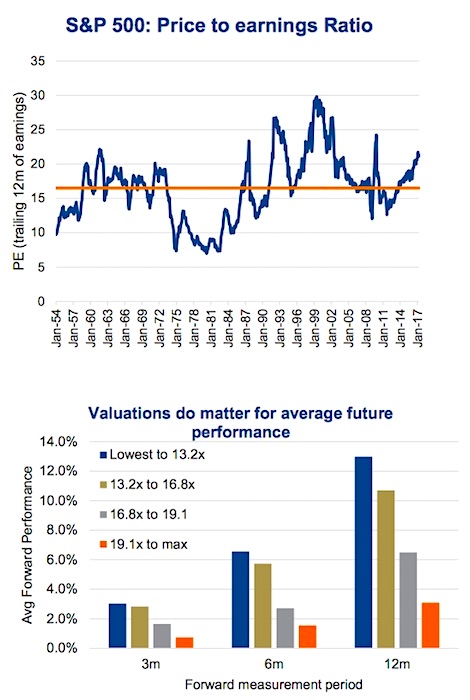

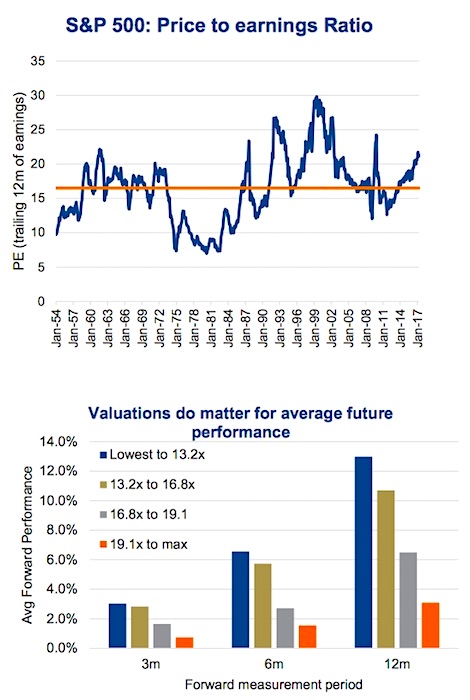

While some argue that current stock market valuations are high, BofA addresses these concerns by emphasizing the limitations of traditional metrics and focusing on long-term growth prospects.

Valuation Metrics and Their Limitations

Traditional valuation metrics like the Price-to-Earnings ratio (P/E) can be misleading in the current environment. Several factors affect their accuracy.

- Why Traditional Metrics Might Be Misleading: Traditional valuation metrics often fail to adequately capture the impact of technological advancements, future innovation, and the potential for significant growth in emerging markets.

- Alternative Valuation Approaches: BofA suggests considering alternative valuation approaches, such as discounted cash flow (DCF) analysis, which takes into account future growth projections. This more forward-looking approach provides a more nuanced picture of a company’s intrinsic value.

- Impact of Technological Advancements and Future Growth Potential: The potential for disruptive technological advancements and substantial growth in emerging markets significantly impacts long-term value and isn't fully reflected in traditional valuation metrics.

The Role of Long-Term Growth Potential

BofA stresses the importance of considering the long-term growth potential of the market, highlighting the significant influence of technological innovation and future growth prospects.

- Future Innovations and Technological Advancements: Breakthroughs in areas such as artificial intelligence, biotechnology, and renewable energy contribute significantly to long-term growth prospects.

- Importance of Considering Long-Term Investment Horizons: Short-term market volatility should not deter investors with a long-term perspective. Focusing on long-term growth and value creation is crucial.

- Why Short-Term Volatility Shouldn't Deter Long-Term Investors: Focusing on short-term fluctuations can lead to suboptimal investment decisions. A long-term perspective is essential to weather market volatility and capitalize on long-term growth opportunities.

Conclusion

BofA's analysis presents a compelling case that current stock market valuations, while seemingly high based on traditional metrics, are not necessarily a cause for immediate concern. The bank highlights strong corporate earnings, resilient consumer spending, a potentially moderating interest rate environment, and significant long-term growth potential as supportive factors. These positive factors suggest that the market is well-positioned for continued, albeit moderated, growth.

Don't let short-term market fluctuations dictate your long-term investment strategy. Understand the factors influencing current stock market valuations and make informed decisions based on credible analysis like BofA's. Consider diversifying your portfolio and adjusting your investment strategy based on a thorough understanding of the current market dynamics and long-term growth prospects. Review your investment strategy and consider the perspectives offered by financial institutions like BofA to build a resilient and successful long-term investment plan.

Featured Posts

-

The China Market Headwinds For Bmw Porsche And Other Automakers

Apr 22, 2025

The China Market Headwinds For Bmw Porsche And Other Automakers

Apr 22, 2025 -

Secret Service Investigation Concludes Cocaine Found At White House

Apr 22, 2025

Secret Service Investigation Concludes Cocaine Found At White House

Apr 22, 2025 -

Trumps Trade Policies And The Future Of American Financial Dominance

Apr 22, 2025

Trumps Trade Policies And The Future Of American Financial Dominance

Apr 22, 2025 -

How Is A New Pope Chosen A Comprehensive Guide To Papal Conclaves

Apr 22, 2025

How Is A New Pope Chosen A Comprehensive Guide To Papal Conclaves

Apr 22, 2025 -

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025

Latest Posts

-

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025 -

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025 -

Largest Fentanyl Seizure In Us History Bondis Role In The Drug Bust

May 10, 2025

Largest Fentanyl Seizure In Us History Bondis Role In The Drug Bust

May 10, 2025 -

The Us Attorney General And Fox News A Daily Occurrence Worth Investigating

May 10, 2025

The Us Attorney General And Fox News A Daily Occurrence Worth Investigating

May 10, 2025 -

Beyond Epstein Examining The Us Attorney Generals Frequent Fox News Interviews

May 10, 2025

Beyond Epstein Examining The Us Attorney Generals Frequent Fox News Interviews

May 10, 2025