US Debt Limit: August Deadline Raises Concerns, Says Treasury's Bessent

Table of Contents

The Imminent August Deadline and its Potential Impact

The US debt ceiling, also known as the debt limit, is the total amount of money that the US government is legally allowed to borrow to meet its existing obligations. Historically, Congress has periodically raised or suspended the debt ceiling to avoid exceeding this limit. However, the current political climate has created significant uncertainty surrounding the upcoming deadline. Treasury Secretary Yellen has warned of a potential default as early as August if Congress fails to act, triggering a so-called "X-date" – the day the government can no longer meet all its obligations.

A US default would have catastrophic consequences:

- Increased Interest Rates: The cost of borrowing for the US government would skyrocket, impacting everything from federal programs to individual mortgages.

- Damage to the US Credit Rating: A default would severely damage the US's creditworthiness, making it more expensive to borrow money in the future. This could also trigger a global financial crisis as the US dollar is the world's reserve currency.

- Market Volatility and Potential Recession: Investor confidence would plummet, leading to significant market volatility and a potential recession. The ripple effects could be felt globally.

- Loss of Investor Confidence: International investors may lose faith in the US economy, potentially leading to capital flight and a decline in the value of the dollar.

Treasury Secretary Yellen has repeatedly stressed the urgency of the situation, stating, “[Insert a direct quote from Secretary Yellen or another relevant official highlighting the urgency and potential consequences of not raising the debt ceiling].” The potential for a debt ceiling crisis is undeniably serious and requires immediate attention from Congress.

Political Wrangling and the Path to a Solution

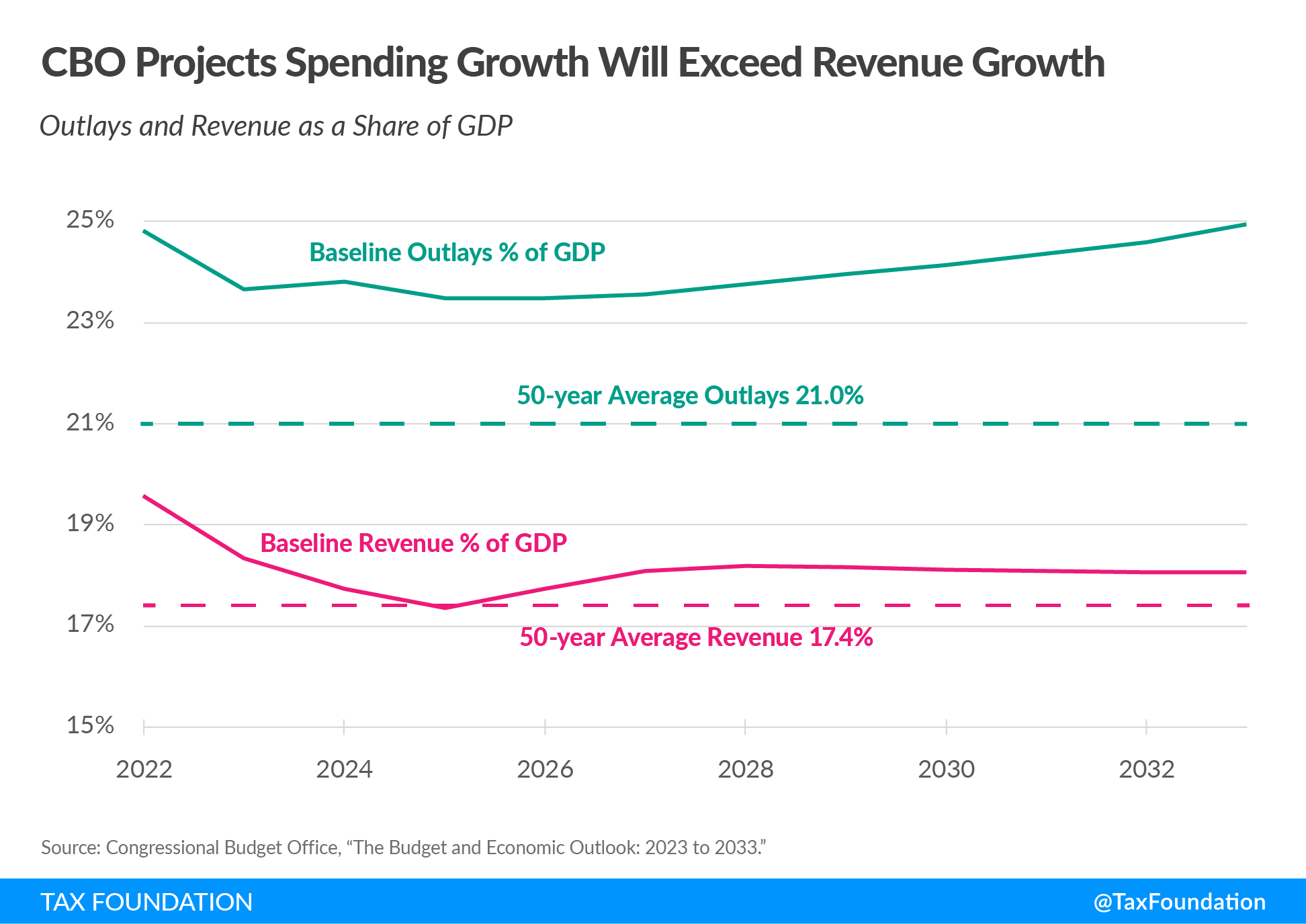

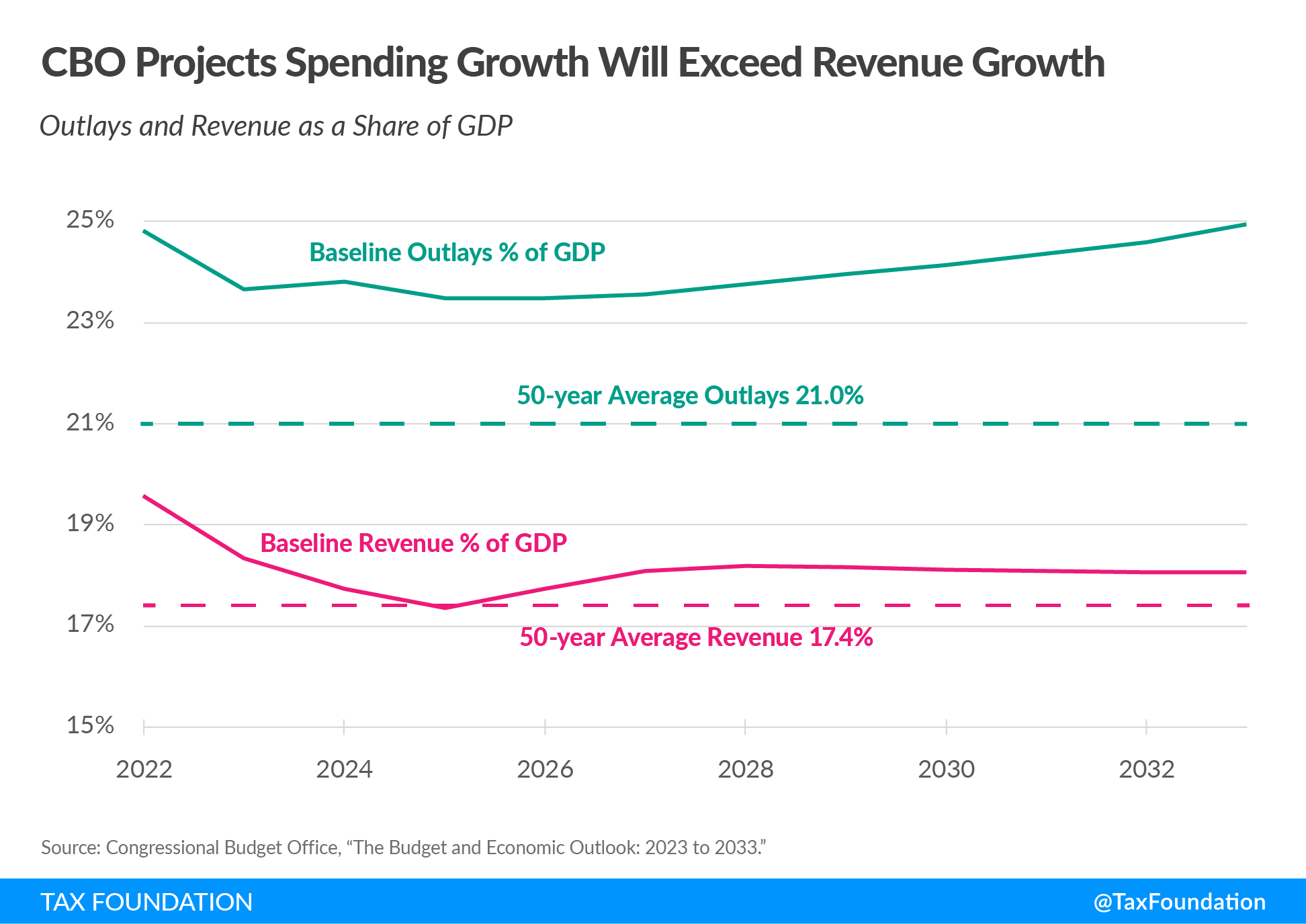

Raising the debt ceiling is typically a routine process, but the current political climate has made it highly contentious. Deep partisan divides between Democrats and Republicans have made finding common ground extremely challenging. Republicans are demanding significant spending cuts in exchange for raising the debt ceiling, while Democrats are pushing for a clean increase without conditions.

Potential solutions being debated include:

- Bipartisan Negotiations: Finding common ground on budget cuts and spending priorities to secure bipartisan support for raising the debt ceiling.

- Short-Term Extensions: A temporary increase to buy time for further negotiations, although this is often criticized for delaying the necessary long-term solution.

- Targeted Spending Cuts: Identifying areas where spending can be reduced without negatively impacting essential government programs.

- Revenue Increases: Exploring options to increase government revenue, such as tax reforms or closing tax loopholes, although this remains a contentious issue.

The White House plays a crucial role in mediating these negotiations and finding a compromise that can garner enough votes in Congress. The history of past debt ceiling debates reveals a pattern of last-minute deals, often leading to increased market volatility and economic uncertainty.

The Role of the Treasury Department

The Treasury Department is actively working to manage the situation by employing various "extraordinary measures" to avoid default. These measures include delaying certain payments and prioritizing spending, but they are temporary and unsustainable. The Treasury Department's ability to use these measures is limited and dependent on the unpredictable timing of revenue inflows and outflows. Once these measures are exhausted, the US government will face a default. The Treasury Secretary's communication with Congress and the public is vital in emphasizing the gravity of the situation and urging immediate action. The transparency of the Treasury's cash management strategies is essential in building confidence amongst investors and the public.

Economic Impacts and Global Implications

The potential consequences of a US debt ceiling crisis extend far beyond US borders. A default would likely trigger global market turmoil, shaking investor confidence and causing ripple effects throughout the international financial system.

Potential global impacts include:

- Global Market Volatility: A US default would likely trigger a sell-off in global markets, impacting stock prices, bond yields, and currency values.

- Impact on the US Dollar: The value of the US dollar could decline significantly, affecting international trade and potentially leading to inflation.

- Contagion Effects: The crisis could trigger financial instability in other countries, potentially leading to a global recession.

- Ratings Agency Downgrades: Credit rating agencies could downgrade the US credit rating, further increasing borrowing costs and harming investor sentiment.

Conclusion

The approaching August deadline for the US debt limit presents a serious risk to the US and the global economy. Failure to raise the debt ceiling could trigger a financial crisis with far-reaching consequences. Political gridlock and the need for a bipartisan solution highlight the complexity of this challenge. The Treasury's efforts to manage the situation underscore the urgency of a swift resolution.

Understanding the intricacies of the US debt limit debate is crucial for all citizens. Stay informed about the latest developments and urge your representatives to prioritize a responsible and timely solution to avoid a potential economic catastrophe. Engage in the conversation surrounding the debt ceiling and demand action from your elected officials. The future of the US economy depends on it.

Featured Posts

-

Jeanine Pirros North Idaho Visit Dates Location And Details

May 10, 2025

Jeanine Pirros North Idaho Visit Dates Location And Details

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025 -

Europa League Preview Brobbeys Strength A Key Factor

May 10, 2025

Europa League Preview Brobbeys Strength A Key Factor

May 10, 2025 -

Bodycam Captures Police Saving Toddler Choking On Tomato

May 10, 2025

Bodycam Captures Police Saving Toddler Choking On Tomato

May 10, 2025 -

Postponed Bbc Meeting Wynne Evans Finds Comfort With Girlfriend Liz On A Day Date

May 10, 2025

Postponed Bbc Meeting Wynne Evans Finds Comfort With Girlfriend Liz On A Day Date

May 10, 2025