US Stock Futures: Trump's Words And Market Volatility

Table of Contents

Understanding the Impact of Trump's Statements on Market Sentiment

Trump's presidency was characterized by unpredictable pronouncements that frequently sent shockwaves through the financial markets. A single tweet could trigger massive sell-offs or rallies, highlighting the profound psychological impact of his communication style on investor behavior. This volatility wasn't solely based on the content of his statements; the timing and manner of delivery also played a significant role. The uncertainty created by this unpredictable communication led to increased market volatility, directly impacting US stock futures.

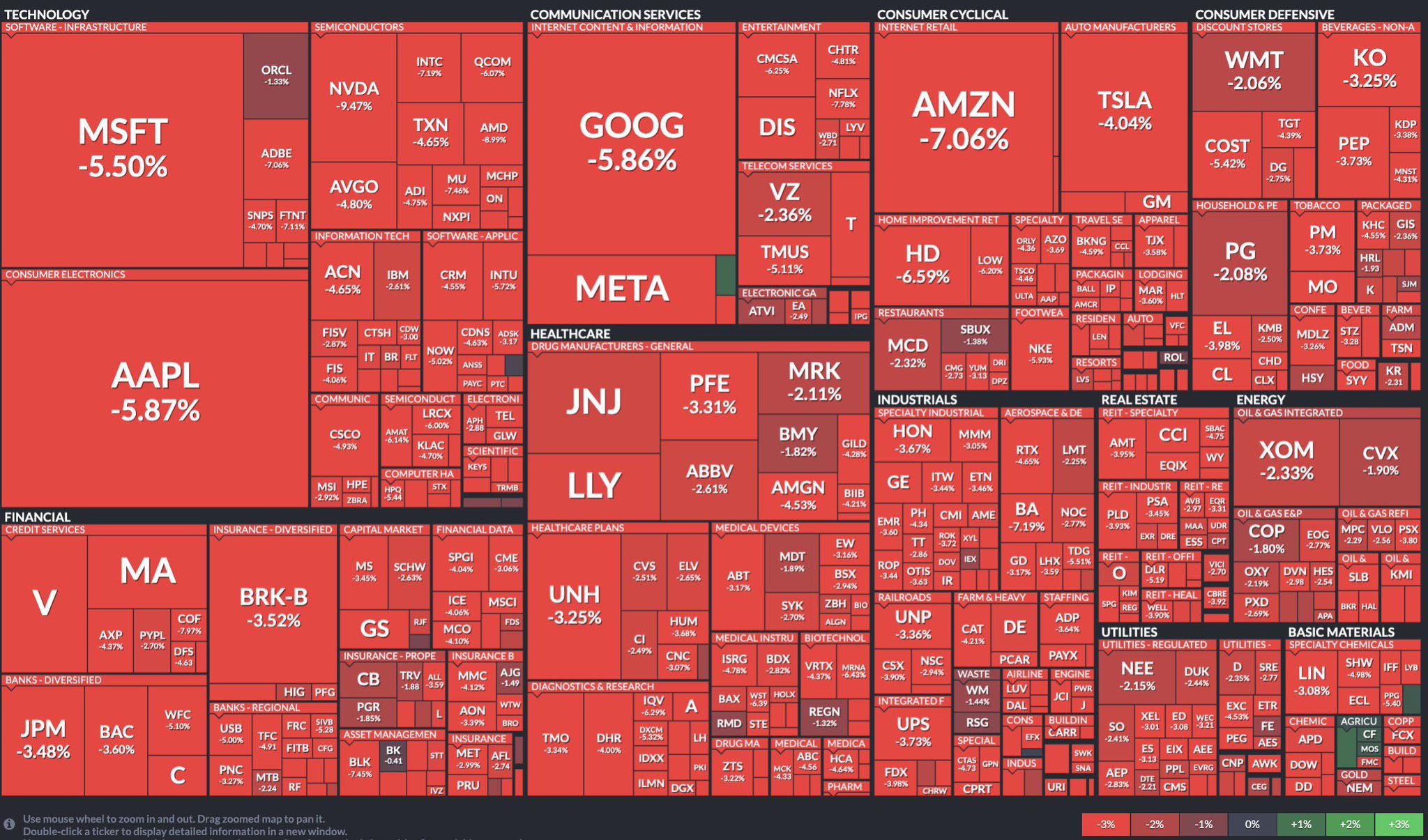

- Examples of Market Reactions: Trump's threats of trade wars, particularly with China, consistently led to sharp declines in US stock futures. Conversely, announcements of tax cuts often resulted in temporary surges. The unexpected firing of key officials also caused significant market jitters.

- Investor Behavior Analysis: Investors often reacted with knee-jerk responses, driven by fear and uncertainty. This led to increased trading activity, with many adopting short-term trading strategies in response to the perceived unpredictability of the political climate. This heightened volatility increased the risk associated with holding US stock futures contracts.

- Influenced Economic Indicators: Political uncertainty fueled by Trump's statements impacted key economic indicators such as consumer confidence, business investment, and inflation expectations, all of which directly influence the pricing of US stock futures.

Analyzing the Correlation Between Trump's Actions and US Stock Futures

While the correlation isn't always direct or immediate, certain policy decisions and executive actions undertaken by Trump demonstrably influenced the trajectory of US stock futures. The media played a significant role in amplifying or mitigating these effects, shaping public perception and consequently investor sentiment.

- Statistical Data: While definitively proving a direct correlation is complex, studies have shown a statistically significant relationship between specific Trump pronouncements and short-term fluctuations in US stock futures indices, especially those with high exposure to sectors particularly sensitive to trade policy.

- Policy Impact Examples: The imposition of tariffs during the trade wars initially caused significant drops in US stock futures, particularly affecting sectors like manufacturing and technology. Conversely, the tax cuts initially boosted market sentiment and led to increases in futures prices.

- Sensitive Market Sectors: Sectors heavily reliant on international trade, such as technology and manufacturing, were particularly sensitive to Trump's trade policies, experiencing more pronounced volatility in their associated US stock futures contracts.

Strategies for Managing Risk in Volatile US Stock Futures Markets

Navigating the volatility inherent in US stock futures during periods of political uncertainty requires a robust risk management strategy. This involves understanding your risk tolerance and employing appropriate techniques to mitigate potential losses.

- Risk Tolerance and Strategies: Conservative investors might prefer diversification across asset classes and employing hedging techniques, reducing their exposure to any single sector heavily influenced by political events. More aggressive investors might use options strategies to profit from short-term price swings.

- Investment Vehicles: Exchange-traded funds (ETFs) tracking broad market indices can offer a diversified approach, while sector-specific ETFs might be chosen with caution. Options contracts and futures contracts themselves can be employed as hedging tools or leveraged trading instruments, depending on your strategy and risk appetite.

- Importance of Informed Decision-Making: Staying informed about political and economic developments through reliable news sources and market analysis is crucial for successful navigation of this volatile landscape. Understanding the potential impact of political events on different market sectors enables more targeted investment choices.

The Long-Term Implications of Political Uncertainty on US Stock Futures

The long-term impact of political uncertainty on the US stock market remains a subject of ongoing debate. However, prolonged periods of volatility can discourage foreign investment and negatively influence economic growth, affecting the overall stability of US stock futures.

- Future Scenarios: Different political climates could result in varying degrees of market stability. Consistent policymaking that fosters predictability could encourage long-term investment and stabilize US stock futures. Conversely, continuing uncertainty could lead to prolonged volatility and reduced investor confidence.

- Role of Regulatory Bodies: The Federal Reserve and other regulatory bodies play a critical role in mitigating market risks through monetary policy and intervention measures during periods of extreme volatility. Their actions significantly influence the behavior of US stock futures.

- Long-Term Sectoral Impacts: Certain sectors, heavily dependent on government regulation or international trade, are more susceptible to long-term consequences of political instability. Understanding these sensitivities is key to formulating a long-term investment strategy for US stock futures.

Mastering the Volatility of US Stock Futures

Trump's presidency highlighted the significant impact of political rhetoric and policy decisions on the volatility of US stock futures. Understanding this dynamic, employing effective risk management strategies, and staying informed about political and economic developments are crucial for successful investment in this market. The inherent volatility presents both challenges and opportunities; successful navigation requires a careful balance of risk and reward. Stay informed about the latest developments affecting US Stock Futures and develop a robust investment strategy to manage the inherent volatility. Continuous research and monitoring are essential to making informed investment decisions in this dynamic environment.

Featured Posts

-

William Watson Examining The Liberal Platform Before You Vote

Apr 24, 2025

William Watson Examining The Liberal Platform Before You Vote

Apr 24, 2025 -

La Fires Landlords Accused Of Price Gouging Amidst Crisis

Apr 24, 2025

La Fires Landlords Accused Of Price Gouging Amidst Crisis

Apr 24, 2025 -

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025 -

Los Angeles Wildfires And The Gambling Industry A Troubling Trend

Apr 24, 2025

Los Angeles Wildfires And The Gambling Industry A Troubling Trend

Apr 24, 2025 -

Understanding The Crucial Role Of Middle Management In Todays Workplace

Apr 24, 2025

Understanding The Crucial Role Of Middle Management In Todays Workplace

Apr 24, 2025