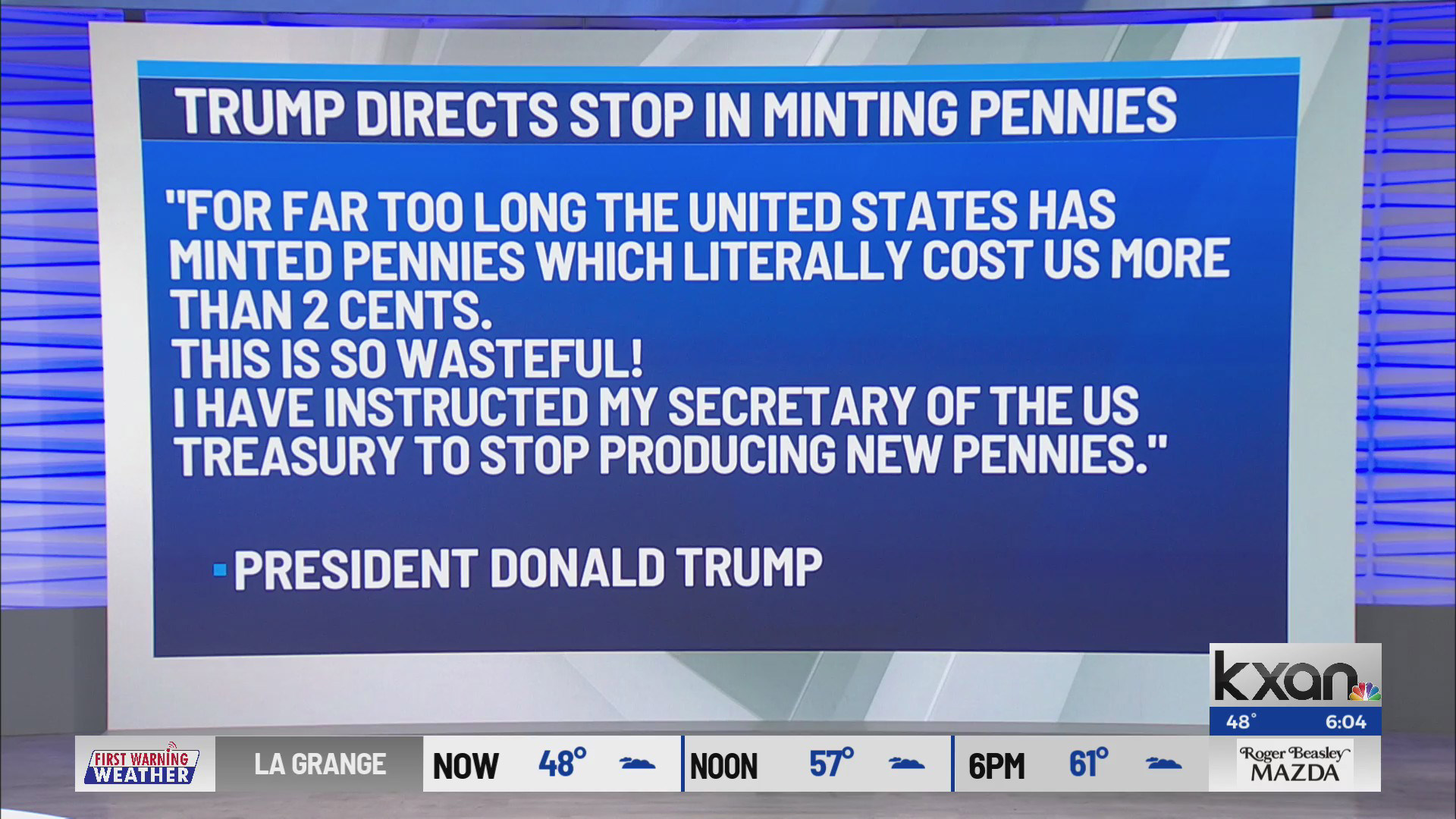

US To Stop Minting Pennies: What This Means For The Economy By 2026

Table of Contents

The Cost of Keeping Pennies

Production Costs vs. Face Value

The simple truth is that producing a penny costs more than a penny is worth. The US Mint's expenses go far beyond the cost of the raw materials – copper and zinc – used in its creation.

- Material Costs: Fluctuating metal prices significantly impact the production cost.

- Minting Process: The machinery, labor, and energy required for minting are substantial.

- Transportation and Storage: Moving and storing billions of pennies annually adds a significant overhead.

While the exact cost varies, it's consistently reported that producing a single penny exceeds its one-cent value. This difference, multiplied by billions of coins, results in a substantial financial drain on the US Mint and, ultimately, taxpayers.

The Environmental Impact of Penny Production

Beyond the financial burden, penny production carries a significant environmental cost.

- Resource Depletion: Mining copper and zinc requires extensive resource extraction, harming the environment.

- Pollution: Mining and manufacturing processes generate pollution, impacting air and water quality.

- Carbon Footprint: The transportation and storage of pennies contribute to greenhouse gas emissions.

Numerous environmental studies highlight the negative ecological impact of continued penny production. The environmental cost of maintaining the penny far outweighs its negligible economic contribution.

Economic Impacts of Eliminating the Penny

Inflationary Pressure?

A common concern surrounding the elimination of the penny revolves around potential inflationary pressure due to rounding up prices. While some price increases are possible, the impact is likely to be minimal.

- Minor Price Adjustments: Most price increases would be fractions of a cent, unlikely to significantly affect consumer spending.

- Business Adaptation: Businesses are likely to absorb minor price increases to avoid alienating customers.

The historical experience of countries that have eliminated their lowest denomination coin suggests that inflationary pressure is largely manageable.

Impact on Businesses and Cash Transactions

The transition to a pennyless system would necessitate adaptations for businesses, primarily regarding cash registers and pricing strategies.

- Cash Register Updates: Software updates or new cash registers will be necessary to handle rounding.

- Pricing Strategies: Businesses may round prices to the nearest nickel or dime, potentially leading to small adjustments in pricing.

- Customer Behavior: Consumers will need to adapt to the changes in transaction values.

Countries like Canada and Australia provide examples of successful transitions, demonstrating that businesses can effectively adapt to a pennyless system.

Potential Savings for the Government and the Mint

Eliminating the penny would lead to considerable cost savings for the government and the US Mint.

- Reduced Production Costs: The most significant saving would come from eliminating the minting process itself.

- Reduced Transportation and Storage Costs: The expense of transporting and storing billions of pennies annually would be eliminated.

Estimates suggest potential annual savings in the hundreds of millions of dollars, which could be reinvested elsewhere.

Alternative Solutions and the Future of Cash

Digital Payment Systems and the Decline of Cash

The rise of digital payment methods is already reducing reliance on physical currency.

- Credit and Debit Cards: Widespread adoption reduces the need for physical coins.

- Mobile Payment Apps: Services like Apple Pay and Google Pay further diminish the role of cash.

Statistics demonstrate a consistent upward trend in digital transactions, suggesting that a move away from physical currency is already underway.

Rounding Practices in Other Countries

Many countries have successfully implemented rounding practices after eliminating their lowest denomination coin.

- Rounding to Nearest Nickel/Dime: Common practice in numerous countries, this proves effective and simple.

- Consumer Acceptance: Generally, consumers adapt quickly and accept the change with minimal disruption.

Examining the experiences of other nations can provide valuable insights for a smooth transition in the US.

Conclusion: The Penny's Uncertain Future and a Call to Action

The arguments for eliminating the penny largely center around significant cost savings and environmental benefits. While concerns about inflation exist, they appear manageable based on international precedents. Stopping penny production could yield substantial financial benefits for the government and a positive environmental impact.

What are your thoughts on the future of the penny? The potential elimination of the penny by 2026 presents a significant economic and environmental opportunity. Share your opinions on this proposed change and let's discuss the implications of eliminating the penny. Join the conversation and help shape the future of US currency!

Featured Posts

-

West Ham Submits Bid For Kyle Walker Peters

May 24, 2025

West Ham Submits Bid For Kyle Walker Peters

May 24, 2025 -

Former French Pm Disagrees With Macrons Decisions

May 24, 2025

Former French Pm Disagrees With Macrons Decisions

May 24, 2025 -

Pameran Seni Dan Otomotif Porsche Classic Art Week Indonesia 2025

May 24, 2025

Pameran Seni Dan Otomotif Porsche Classic Art Week Indonesia 2025

May 24, 2025 -

Seeking Change The Potential For Punishment And The Importance Of Strategic Action

May 24, 2025

Seeking Change The Potential For Punishment And The Importance Of Strategic Action

May 24, 2025 -

Land Your Dream Private Credit Role 5 Dos And Don Ts To Follow

May 24, 2025

Land Your Dream Private Credit Role 5 Dos And Don Ts To Follow

May 24, 2025

Latest Posts

-

Are Memorial Day Gas Prices The Lowest In Years

May 24, 2025

Are Memorial Day Gas Prices The Lowest In Years

May 24, 2025 -

Low Gas Prices Expected For Memorial Day Weekend Travel

May 24, 2025

Low Gas Prices Expected For Memorial Day Weekend Travel

May 24, 2025 -

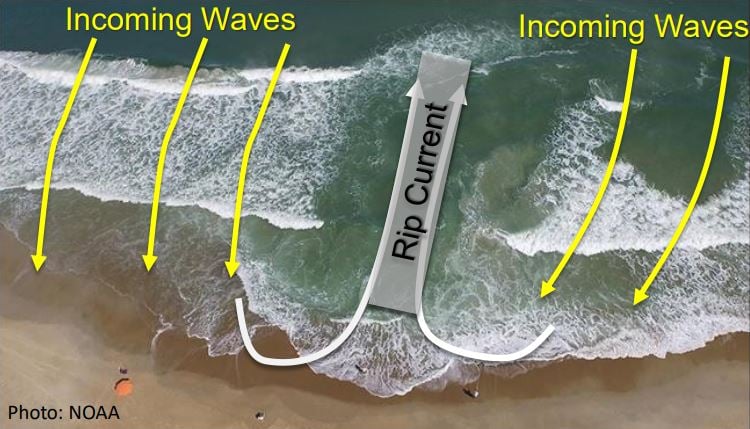

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Outlook

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Outlook

May 24, 2025 -

2025 Memorial Day Weekend Beach Weather Prediction For Ocean City Rehoboth And Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Weather Prediction For Ocean City Rehoboth And Sandy Point

May 24, 2025 -

University Of Maryland Commencement A Famous Amphibians Inspiring Address

May 24, 2025

University Of Maryland Commencement A Famous Amphibians Inspiring Address

May 24, 2025