Warren Buffett's Canadian Successor: A Billionaire Without Many Berkshire Hathaway Shares

Table of Contents

Identifying the Canadian Billionaire

Let's begin by setting the stage. This individual, a prominent figure in the Canadian business landscape, has amassed a considerable net worth, cementing their position as a successful Canadian entrepreneur and billionaire investor. We'll withhold their name for a moment to enhance the intrigue—but rest assured, their story is compelling.

- Early Life and Career: This individual's journey began with [insert very general, non-revealing details about early life, education, or early career. Keep it vague to avoid accidental identification while still establishing a narrative]. This early experience instilled a [describe general entrepreneurial or business-related trait, e.g., "strong work ethic" or "deep understanding of market dynamics"].

- Divergence from Berkshire Hathaway: Unlike the famed value investing style closely associated with Warren Buffett and Berkshire Hathaway, this Canadian billionaire's approach incorporates a [mention a contrasting investment style element, e.g., "stronger emphasis on growth stocks" or "more active portfolio management"]. Their investment philosophy is characterized by [describe unique aspects of their investment strategy].

Investment Strategies Diverging from Berkshire Hathaway

While Warren Buffett famously favors long-term investments in established companies, often with a focus on value investing and a buy-and-hold strategy, this Canadian billionaire's approach is more nuanced. Their strategy significantly departs from the traditional Berkshire Hathaway model in several key areas:

- Stock Picking: Instead of focusing solely on undervalued, established companies, this investor actively seeks out [explain the type of companies they favor, e.g., "high-growth technology firms" or "companies poised to benefit from emerging market trends"]. Their stock picking criteria differ significantly, with [mention specific factors, e.g., "a strong emphasis on technological innovation" or "a focus on sustainable business practices"].

- Risk Management: While both Buffett and this Canadian billionaire understand the importance of risk management, their approaches differ. Buffett often employs a more conservative, long-term approach, while the Canadian investor may take on [explain a different approach to risk; e.g., "calculated risks in emerging sectors" or "a more active hedging strategy"].

- Portfolio Composition: The Canadian billionaire's portfolio likely boasts a higher concentration of [mention asset types, e.g., "technology stocks," "real estate investments," or "private equity holdings"] compared to a typical Berkshire Hathaway portfolio, demonstrating a strategic focus on diversification across various asset classes and geographical regions beyond just the US market.

The Canadian Billionaire's Success Story

The Canadian billionaire's success speaks for itself. Their shrewd investment decisions have propelled their net worth to [mention general range without exact numbers]. This impressive financial achievement is a result of:

- Successful Investments: [Give some very generalized examples of successful investment strategies or sectors without specific company names to maintain anonymity but still show achievement, e.g., "early investments in the Canadian tech sector" or "strategic acquisitions in the renewable energy industry"].

- Investment Returns: While precise figures are unavailable publicly, it's evident their portfolio has generated [describe a general range of performance, e.g., "substantial and consistent returns" or "above-average market performance"].

- Philanthropy: [Mention any generalized philanthropic contributions to showcase their broader impact if applicable].

The "Why" Behind Limited Berkshire Hathaway Holdings

The notable absence of significant Berkshire Hathaway shares in this Canadian billionaire's portfolio is not necessarily an indicator of disapproval but rather a strategic decision.

- Diversification: Holding a limited number of Berkshire Hathaway shares allows for greater diversification across various sectors, geographies, and asset classes, mitigating overall portfolio risk. The Canadian market, with its unique opportunities and challenges, naturally plays a larger role in this billionaire's strategy.

- Alternative Investment Vehicles: Their portfolio likely includes investments in other areas, such as [give general examples of alternative investments, e.g., "venture capital," "private equity," or "real estate"]. This demonstrates a proactive approach to identifying less conventional growth opportunities.

- Contrarian Approach: This Canadian investor's success demonstrates that a portfolio does not need to be heavily weighted with Berkshire Hathaway shares to achieve remarkable results. The focus should be on a well-diversified strategy tailored to individual market understanding and risk tolerance.

Conclusion

This article has explored the unique investment strategies of a successful Canadian billionaire, showcasing an approach that significantly deviates from the Warren Buffett model despite achieving impressive financial success. Their limited holdings in Berkshire Hathaway highlight the importance of diversification and the exploration of alternative investment approaches. This Canadian investor proves that building wealth requires vision, adaptability, and a deep understanding of market dynamics, offering a compelling alternative perspective to traditional investment strategies. Learn from the success of Warren Buffett's Canadian successor and discover how to build your own portfolio based on innovative investment strategies. By studying alternative investment approaches and diversifying your portfolio, you can potentially achieve similar success.

Featured Posts

-

Apple At A Crossroads The Challenge Of Ai Leadership

May 10, 2025

Apple At A Crossroads The Challenge Of Ai Leadership

May 10, 2025 -

Crack The Code 5 Dos And Don Ts For A Private Credit Career

May 10, 2025

Crack The Code 5 Dos And Don Ts For A Private Credit Career

May 10, 2025 -

Wall Streets Resurgence A Look At Failed Bear Market Predictions

May 10, 2025

Wall Streets Resurgence A Look At Failed Bear Market Predictions

May 10, 2025 -

Debate Sobre Derechos Trans Arresto De Universitaria Por Usar Bano De Mujeres

May 10, 2025

Debate Sobre Derechos Trans Arresto De Universitaria Por Usar Bano De Mujeres

May 10, 2025 -

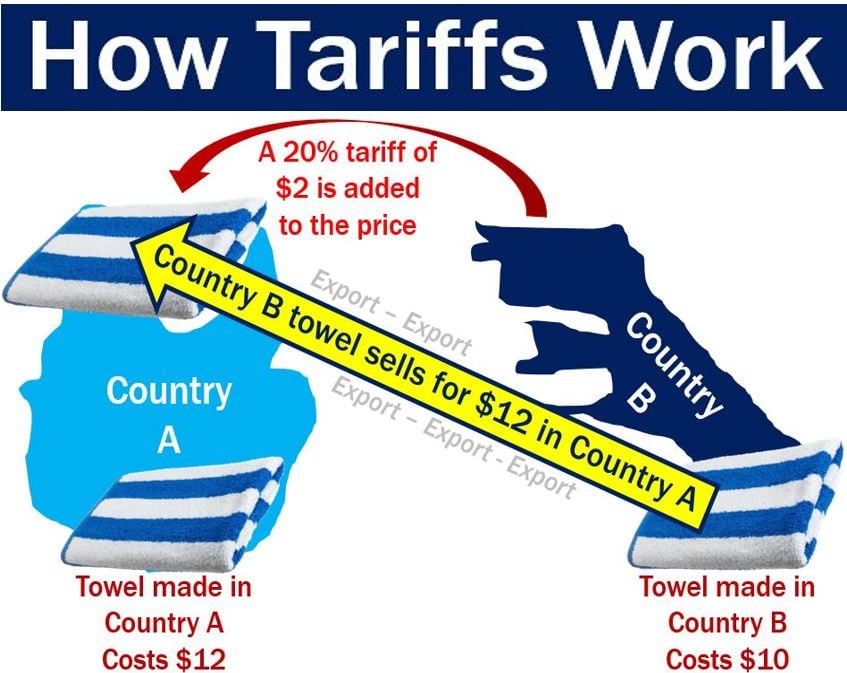

Todays Stock Market China Tariff Impact And Uk Trade Deal Uncertainty

May 10, 2025

Todays Stock Market China Tariff Impact And Uk Trade Deal Uncertainty

May 10, 2025