Weak Retail Sales Signal Potential Bank Of Canada Rate Cuts

Table of Contents

The Impact of Weak Retail Sales on the Canadian Economy

Retail sales figures act as a powerful barometer of consumer spending, a major driver of economic growth. A sustained decline in retail sales signals weakening consumer confidence and potentially broader economic slowdown.

Consumer Confidence and Spending

Consumer confidence is intricately linked to retail spending. When consumers feel optimistic about the economy and their personal finances, they are more likely to spend, boosting retail sales. Conversely, decreased confidence leads to reduced spending. Currently, Canadian consumer sentiment is wavering due to several factors:

- High Inflation: Persistent inflation erodes purchasing power, forcing consumers to cut back on non-essential purchases.

- Rising Interest Rates: Increased borrowing costs make it more expensive to finance purchases, further dampening consumer spending.

- Job Security Concerns: Uncertainty about job security can make consumers hesitant to spend, preferring to save for potential economic hardship.

Recent consumer confidence surveys paint a concerning picture. For instance, the Conference Board of Canada's Consumer Confidence Index showed a significant drop in the last quarter, reflecting this growing apprehension.

Inflationary Pressures and Retail Sales

Weak retail sales can be a double-edged sword concerning inflation. While initially concerning, a significant drop in demand could ease inflationary pressures.

- Decreased Demand, Lower Prices: Lower demand for goods and services can force businesses to reduce prices to attract customers, ultimately contributing to lower inflation rates.

- Inflation Rate and Retail Sales Correlation: Historical data often demonstrates an inverse relationship between retail sales growth and inflation. Periods of strong retail sales are frequently accompanied by higher inflation, while periods of weak retail sales tend to correlate with lower inflation. The recent dip in retail sales might signal to the Bank of Canada that inflationary pressures are starting to ease.

The Bank of Canada's Response to Weak Economic Indicators

The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. To achieve this, it utilizes various monetary policy tools, with interest rate adjustments being the most prominent.

The Role of Interest Rates in Economic Growth

Interest rate cuts are a powerful tool to stimulate economic activity. By lowering the overnight rate (the target for the Bank of Canada's key lending rate), borrowing becomes cheaper for businesses and consumers.

- Stimulating Investment and Spending: Lower interest rates incentivize businesses to invest in expansion and consumers to borrow for larger purchases, thereby boosting economic activity.

- Historical Examples: The Bank of Canada has historically responded to economic downturns by lowering interest rates. For example, during the 2008-2009 financial crisis, the Bank significantly reduced interest rates to mitigate the economic impact.

Potential Scenarios Following Weak Retail Sales Data

Given the recent weak retail sales data, several scenarios are plausible regarding the Bank of Canada's response:

- Scenario 1: A 25 basis point cut: A modest rate cut could signal a cautious approach, allowing the Bank to assess the effectiveness of the reduction before making further adjustments.

- Scenario 2: A 50 basis point cut: A more aggressive cut could indicate a greater concern about the economic outlook and a need for more forceful stimulus.

Each scenario carries implications for the economy: A rate cut could boost consumer spending and investment, but it could also potentially fuel inflation if implemented too aggressively.

Alternative Economic Factors Influencing the Bank of Canada's Decision

While weak retail sales are a significant factor, the Bank of Canada considers other economic indicators when making policy decisions.

Global Economic Conditions

Global economic uncertainty significantly impacts the Canadian economy. A global recession or slowdown in major trading partners could negatively affect Canadian exports and economic growth, influencing the Bank's decision.

- Global Recession Risks: The current global economic climate presents potential risks that could influence the Bank’s decision.

- Impact on Canadian Economy: These external factors can significantly influence the Bank of Canada’s decision-making process, potentially leading them to adopt a more cautious approach to rate cuts.

Labor Market Conditions

The health of the Canadian labor market is another crucial factor. Strong employment numbers and wage growth might suggest the economy is resilient enough to withstand a period of weaker retail sales, reducing the need for immediate rate cuts. Conversely, high unemployment could signal a more urgent need for stimulus.

- Unemployment Rate and Wage Growth: The current unemployment rate and wage growth statistics will heavily influence the Bank’s assessment of the situation.

- Labor Market Influence on Rate Cuts: A strong labor market might deter rate cuts, whereas a weakening labor market might necessitate more aggressive action.

Conclusion

Weak retail sales in Canada raise concerns about the strength of the economy and the potential for a slowdown. This decline, coupled with other economic indicators, could lead the Bank of Canada to implement rate cuts to stimulate economic activity. However, the decision will also depend on global economic conditions and the state of the Canadian labor market. The magnitude of any potential rate cut remains uncertain, with scenarios ranging from a modest 25 basis point reduction to a more significant 50 basis point cut. The interplay between weak retail sales, inflation, and other economic factors will ultimately shape the Bank of Canada's response. Stay updated on the latest information regarding weak retail sales and potential Bank of Canada rate cuts by visiting [link to relevant resource].

Featured Posts

-

Yankees Rally Past Opponent Rodon Shuts Down Opponent S Offense

Apr 28, 2025

Yankees Rally Past Opponent Rodon Shuts Down Opponent S Offense

Apr 28, 2025 -

Abwzby Tstdyf Mntda Rayda Llabtkar Fy Tb Alhyat Alshyt Almdydt

Apr 28, 2025

Abwzby Tstdyf Mntda Rayda Llabtkar Fy Tb Alhyat Alshyt Almdydt

Apr 28, 2025 -

Analysis At And Ts Concerns Over Broadcoms Extreme V Mware Pricing

Apr 28, 2025

Analysis At And Ts Concerns Over Broadcoms Extreme V Mware Pricing

Apr 28, 2025 -

Top Chefs Fishermans Stew A Culinary Masterpiece For Eva Longoria

Apr 28, 2025

Top Chefs Fishermans Stew A Culinary Masterpiece For Eva Longoria

Apr 28, 2025 -

Musks X How The Debt Sale Is Reshaping The Companys Finances

Apr 28, 2025

Musks X How The Debt Sale Is Reshaping The Companys Finances

Apr 28, 2025

Latest Posts

-

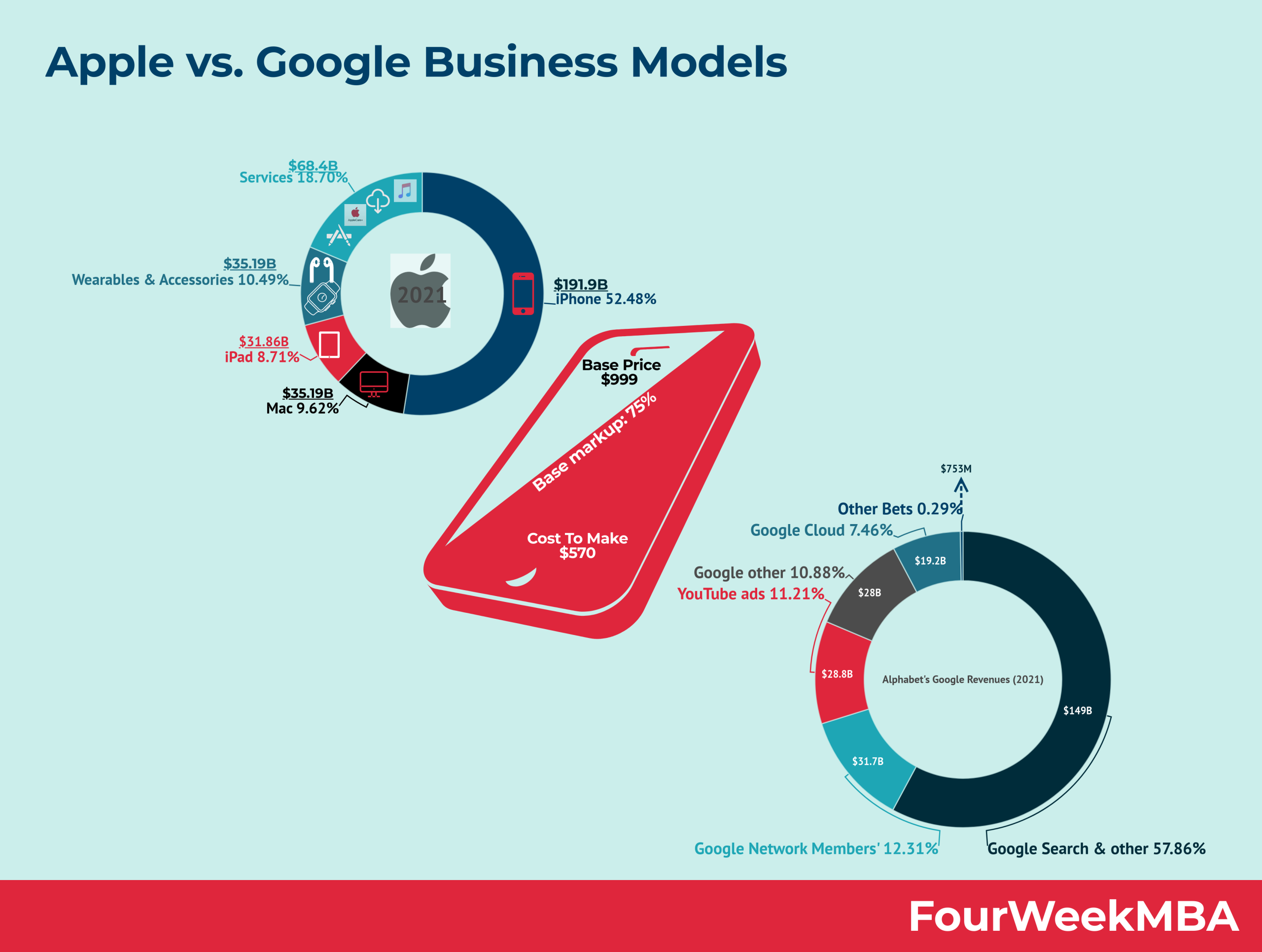

Analyzing Apples Impact On Googles Long Term Strategy

May 11, 2025

Analyzing Apples Impact On Googles Long Term Strategy

May 11, 2025 -

Apples Influence On Googles Market Dominance

May 11, 2025

Apples Influence On Googles Market Dominance

May 11, 2025 -

How Apples Actions Could Impact Googles Future

May 11, 2025

How Apples Actions Could Impact Googles Future

May 11, 2025 -

The Complex Relationship Between Apple And Googles Success

May 11, 2025

The Complex Relationship Between Apple And Googles Success

May 11, 2025 -

Apple And Google An Unlikely Partnership For Survival

May 11, 2025

Apple And Google An Unlikely Partnership For Survival

May 11, 2025