Analysis: AT&T's Concerns Over Broadcom's Extreme VMware Pricing

Table of Contents

Broadcom's Acquisition Strategy and Potential for Price Hikes

Broadcom's acquisition of VMware represents a significant shift in the enterprise software landscape. This deal raises concerns about Broadcom's potential to leverage its market power to substantially increase VMware's pricing.

The Deal's Impact on VMware's Pricing Model

The integration of VMware into Broadcom's portfolio creates a scenario ripe for price increases. Broadcom has a history of acquiring companies and subsequently raising prices on key products and services. This strategy, while potentially lucrative for Broadcom, could severely impact VMware's vast customer base, including major players like AT&T.

- Potential price increases: We can expect increases across the VMware product line, including vSphere (virtualization), vSAN (storage), and NSX (networking). These are core products for many enterprises, making price hikes particularly impactful.

- Maintenance contract implications: Existing customers with maintenance contracts may also face increased renewal costs, adding to the overall financial burden.

- Analyst predictions: Several analysts predict significant price increases, ranging from a modest 10% to a potentially substantial 30% or more, depending on the specific product and licensing agreement.

Antitrust Concerns and Regulatory Scrutiny

The sheer size and scope of the Broadcom-VMware deal have attracted significant regulatory scrutiny. Antitrust concerns are paramount, as the acquisition could potentially stifle competition and lead to monopolistic practices.

- Regulatory bodies: The U.S. Department of Justice (DOJ), the Federal Trade Commission (FTC), and various international regulatory bodies are likely to scrutinize the deal and its potential impact on pricing.

- Ongoing investigations: While investigations are ongoing, any potential findings could significantly influence Broadcom's ability to implement aggressive price increases. Legal challenges could delay or even prevent certain pricing strategies.

- Potential outcomes: If regulatory bodies find the acquisition anti-competitive, they could impose remedies, potentially including restrictions on price increases or even a forced divestiture of certain VMware assets.

AT&T's Perspective and the Impact on its Infrastructure

AT&T is a significant user of VMware technology, making them particularly vulnerable to potential price increases. Their concerns are representative of many large enterprises.

AT&T's Reliance on VMware Technology

AT&T utilizes VMware products extensively throughout its network infrastructure and data centers. This heavy reliance positions them as a crucial customer, and also makes them especially sensitive to any price adjustments.

- VMware products used: AT&T likely employs a broad range of VMware products, including vSphere, vSAN, NSX, and potentially others, to manage and virtualize their vast IT infrastructure.

- Scale of deployment: The exact scale of AT&T's VMware deployment is not publicly available, but given their size, it is undoubtedly substantial, representing a considerable investment.

- Investment in VMware: AT&T’s significant existing investment in VMware infrastructure underscores the potential financial impact of increased costs.

Financial Implications of Increased VMware Costs

The potential price increases from Broadcom could represent a considerable financial burden for AT&T, impacting their budgets and potentially their profitability.

- Estimated cost increase: Depending on the extent of the price hikes, AT&T could face millions of dollars in additional annual costs. Precise figures are impossible to estimate without access to their internal contracts.

- Impact on budget and profitability: These additional costs could force AT&T to reassess their IT spending and potentially cut back on other areas. It could also negatively affect their bottom line.

- Alternative solutions: Faced with significantly increased costs, AT&T may explore alternative virtualization and cloud solutions, potentially shifting away from VMware.

The Broader Implications for the Enterprise Market

The potential price increases stemming from Broadcom's acquisition are not limited to AT&T; they have far-reaching consequences for the entire enterprise market.

Impact on Enterprise Cloud Strategies

Increased VMware pricing could significantly impact enterprise cloud strategies. Companies may re-evaluate their cloud adoption plans and vendor selections.

- Vendor selection: Enterprises might accelerate their search for alternative virtualization platforms and cloud providers to mitigate the risk of inflated VMware pricing.

- Impact on cloud adoption rates: Higher costs could potentially slow down the adoption rate of cloud computing, particularly for smaller and mid-sized businesses.

- Increased competition: The situation may spur increased innovation and competition in the virtualization market as enterprises seek out more affordable alternatives.

Alternative Virtualization and Cloud Solutions

In response to potential VMware price increases, many enterprises are already investigating alternative solutions.

- Competing virtualization platforms: Microsoft Hyper-V, Red Hat Virtualization, and Citrix offer competitive virtualization solutions that enterprises can explore.

- Cloud-native alternatives: Major cloud providers like AWS, Azure, and GCP provide their own cloud-native virtualization services, which may prove to be more cost-effective alternatives.

Conclusion

AT&T's concerns regarding Broadcom's VMware pricing strategy are valid and reflect a broader concern within the enterprise market. Broadcom's acquisition and potential for significant price hikes have created uncertainty and prompted many companies to reassess their reliance on VMware. The impact extends beyond individual companies, potentially altering the entire competitive landscape of cloud computing and virtualization.

Call to Action: Stay informed about the ongoing developments surrounding Broadcom's VMware acquisition and its impact on pricing. Closely monitoring AT&T's VMware pricing concerns, and the broader implications for the enterprise cloud market, is crucial for making informed decisions about your own virtualization and cloud strategies. Continue to monitor this developing story for updates on Broadcom’s VMware pricing strategy and its effects on the enterprise software market.

Featured Posts

-

Attorney Generals Transgender Athlete Ban Minnesota Under Pressure To Comply

Apr 28, 2025

Attorney Generals Transgender Athlete Ban Minnesota Under Pressure To Comply

Apr 28, 2025 -

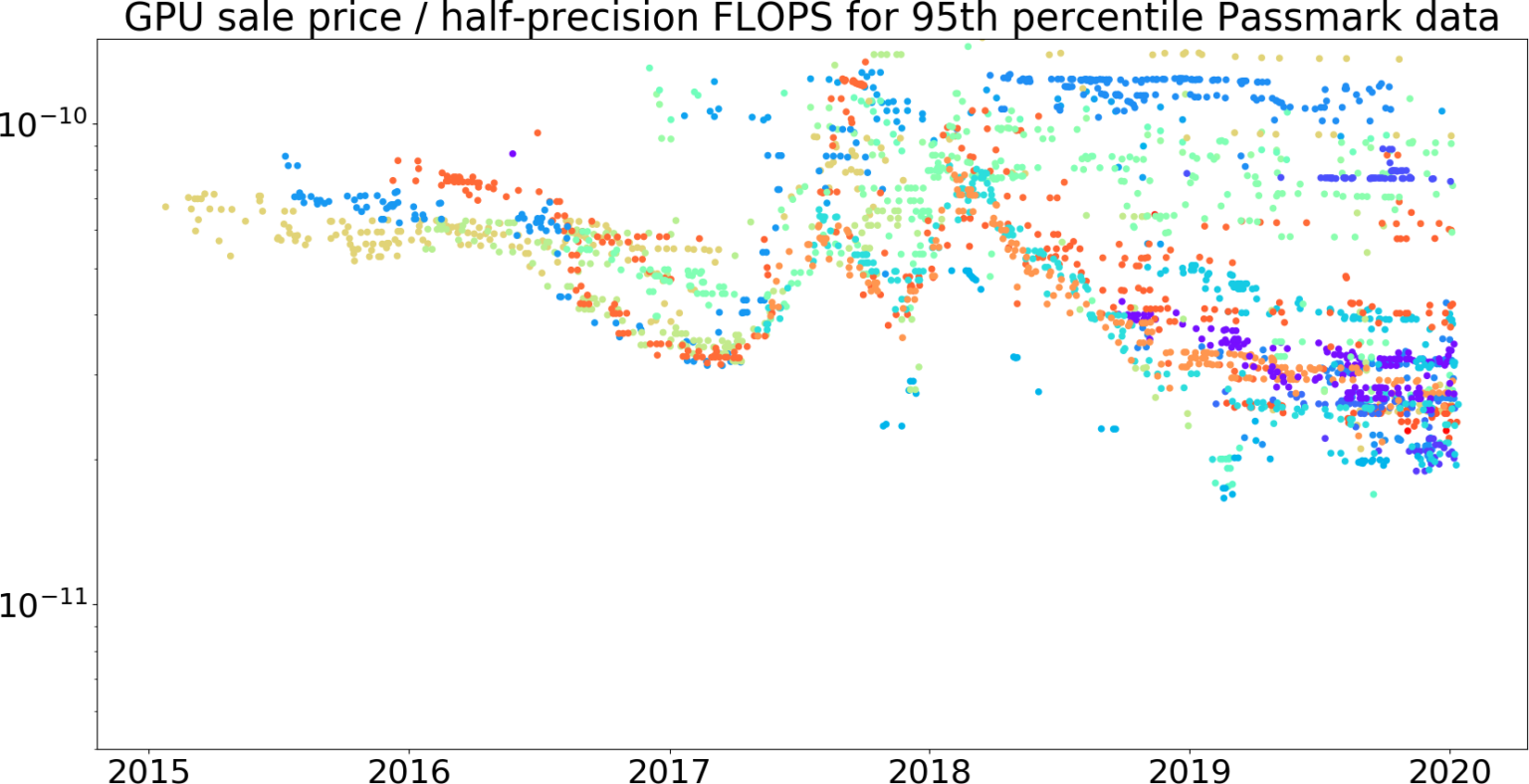

Navigating The Current Gpu Price Increases

Apr 28, 2025

Navigating The Current Gpu Price Increases

Apr 28, 2025 -

Abu Dhabi 2024 1 1bn Investments 26 2bn Real Estate Boom And Ai Advancements

Apr 28, 2025

Abu Dhabi 2024 1 1bn Investments 26 2bn Real Estate Boom And Ai Advancements

Apr 28, 2025 -

Mets Biggest Rival Dominant Pitcher Performance

Apr 28, 2025

Mets Biggest Rival Dominant Pitcher Performance

Apr 28, 2025 -

Boston Red Sox Lineup Changes Casas Demoted Position Outfielder Back In Action

Apr 28, 2025

Boston Red Sox Lineup Changes Casas Demoted Position Outfielder Back In Action

Apr 28, 2025

Latest Posts

-

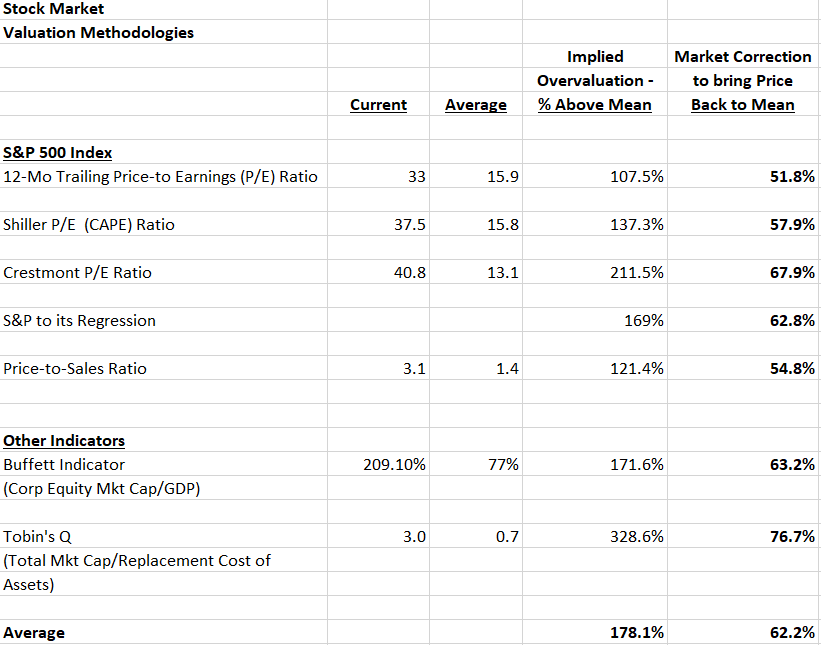

Stock Market Valuation Concerns A Rebuttal From Bof A

May 10, 2025

Stock Market Valuation Concerns A Rebuttal From Bof A

May 10, 2025 -

Are High Stock Market Valuations A Concern Bof As Analysis

May 10, 2025

Are High Stock Market Valuations A Concern Bof As Analysis

May 10, 2025 -

High Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 10, 2025

High Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 10, 2025 -

Invest Smart A Guide To The Countrys Rising Business Hot Spots

May 10, 2025

Invest Smart A Guide To The Countrys Rising Business Hot Spots

May 10, 2025 -

The Shifting Sands Of The Chinese Automotive Market Impact On Bmw Porsche And Others

May 10, 2025

The Shifting Sands Of The Chinese Automotive Market Impact On Bmw Porsche And Others

May 10, 2025