Where To Invest: A Map Of The Country's Promising Business Areas

Table of Contents

Tech Hubs: Thriving Digital Economies

The technology sector continues to be a powerful engine of economic growth, creating numerous opportunities for investors. Smart investors are looking beyond Silicon Valley to discover emerging tech centers offering high growth potential and attractive investment incentives.

Silicon Valley South: Emerging Tech Centers

Several regions are rapidly emerging as significant players in the tech landscape, often dubbed "Silicon Valley South." These areas boast a growing concentration of tech startups, established tech giants, and a supportive ecosystem.

- Focus on specific cities/regions experiencing rapid tech growth. Austin, Texas; Denver, Colorado; Seattle, Washington; and Raleigh-Durham, North Carolina are all experiencing explosive tech sector growth, attracting significant investment.

- Highlight available incentives and tax breaks for tech businesses. Many state and local governments offer tax breaks, grants, and other incentives to attract tech companies, making these areas particularly attractive for investment. Research specific incentives offered in your area of interest.

- Discuss the talent pool and infrastructure supporting the tech sector. A skilled workforce and robust infrastructure are crucial for tech sector success. These emerging tech hubs are investing heavily in education and infrastructure to support this growth.

- Examples: Mention specific successful startups or tech giants in these areas. Companies like Tesla (Austin), Amazon (Seattle), and numerous successful startups in each of these locations demonstrate the strength of these emerging tech ecosystems.

Biotech and Pharmaceuticals: Investing in Innovation

The biotech and pharmaceutical industry represents another sector poised for significant growth. Investment in this field offers the potential for high returns, driven by ongoing research and development, aging populations, and the increasing demand for advanced healthcare solutions.

- Identify key regions with strong biotech clusters and research facilities. Boston, Massachusetts; San Diego, California; and the Research Triangle Park in North Carolina are renowned for their concentration of biotech companies and research institutions.

- Discuss government funding and support for biotech initiatives. Government funding and grants play a crucial role in supporting research and development in this sector, creating attractive investment opportunities.

- Analyze the market potential and future growth prospects of the sector. The aging global population and continuous advancements in medical technology ensure strong long-term growth potential for this sector.

- Mention specific companies or research institutions driving innovation. Focusing on successful companies and institutions within these regions will showcase the viability and strength of these investment opportunities.

Renewable Energy: A Sustainable Investment Landscape

The global shift towards renewable energy sources presents a compelling investment opportunity. Governments worldwide are increasingly supporting the transition to cleaner energy, creating a favorable environment for investment in this sector.

Solar and Wind Power: Capitalizing on Green Energy

Solar and wind energy are at the forefront of the renewable energy revolution. Investment in solar panel manufacturing, wind turbine production, and energy storage solutions is expected to see substantial growth in the coming years.

- Highlight regions with favorable government policies for renewable energy. Many countries and states offer significant tax credits, subsidies, and other incentives to promote renewable energy development. Research these incentives before committing to investment in this area.

- Discuss the growing demand for renewable energy and its long-term potential. The long-term viability of renewable energy is undeniable, creating a sustainable and responsible investment opportunity.

- Analyze investment opportunities in solar panel manufacturing, wind turbine production, and energy storage solutions. Each of these sub-sectors presents unique investment opportunities with varying levels of risk and reward.

- Mention successful renewable energy projects and companies in these areas. Researching successful projects and companies in your area of interest will help you gauge the potential returns of this type of investment.

Green Technologies: Investing in a Sustainable Future

Beyond solar and wind, the broader green technology sector offers diverse investment opportunities. Areas like waste management, sustainable agriculture, and green building materials are attracting increasing investment as businesses and consumers prioritize environmental sustainability.

- Focus on areas with strong support for eco-friendly businesses. Look for regions with supportive government policies, robust infrastructure, and a strong commitment to environmental sustainability.

- Highlight opportunities in areas like waste management, sustainable agriculture, and green building materials. Each of these sectors holds immense potential for growth and innovation.

- Discuss potential government grants and incentives for green tech investments. Many governments offer grants and incentives to support the development and adoption of green technologies.

- Examples: Showcase successful green tech startups and their contributions. Highlighing successful green tech startups will give you a clearer picture of potential returns on investment.

Real Estate: Analyzing Market Trends and Prime Locations

Real estate continues to be a popular investment vehicle, offering both stability and potential for significant returns. However, thorough market analysis is essential to identify high-growth markets and mitigate risks.

Commercial Real Estate: Identifying High-Growth Markets

Commercial real estate encompasses a wide range of properties, including office buildings, retail spaces, and industrial facilities. Identifying high-growth markets is crucial for maximizing returns.

- Analyze current market trends in commercial real estate, focusing on high-demand sectors. Analyze current market trends to determine the demand for particular types of commercial property.

- Highlight areas with robust economic growth and a strong tenant base. Focusing on areas with a healthy economy and high occupancy rates will mitigate risk.

- Discuss potential risks and rewards associated with commercial real estate investment. Weigh the risks and rewards carefully before investing in commercial real estate.

- Examples: Focus on specific cities with promising commercial real estate markets. Highlighting specific areas will give investors a clearer understanding of where to direct their investment.

Residential Real Estate: Investing in Growing Communities

Residential real estate offers another avenue for investment, driven by population growth and increasing housing demand. Analyzing market trends and identifying growing communities is crucial for success.

- Identify regions with population growth and increasing housing demand. Population growth is a key indicator of a strong residential real estate market.

- Analyze factors influencing property values, such as location, amenities, and infrastructure. Consider all the factors that influence property values.

- Discuss strategies for mitigating risks and maximizing returns in residential real estate. Develop strategies to maximize your return and mitigate risk.

- Examples: Mention successful real estate developments in key areas. Highlighing successful real estate projects will give investors a better understanding of successful developments.

Conclusion:

This comprehensive guide has illuminated some of the most promising business areas across the country, offering a clearer picture of where to invest your capital for optimal returns. From the burgeoning tech hubs to the sustainable energy sector and thriving real estate markets, opportunities abound. Remember to conduct thorough due diligence and seek professional financial advice before making any investment decisions. Start your investment journey today by exploring these promising areas and discover the best places to invest your money and build a brighter financial future. Begin your search for the ideal investment opportunity by using this map of the country's promising business areas as your guide.

Featured Posts

-

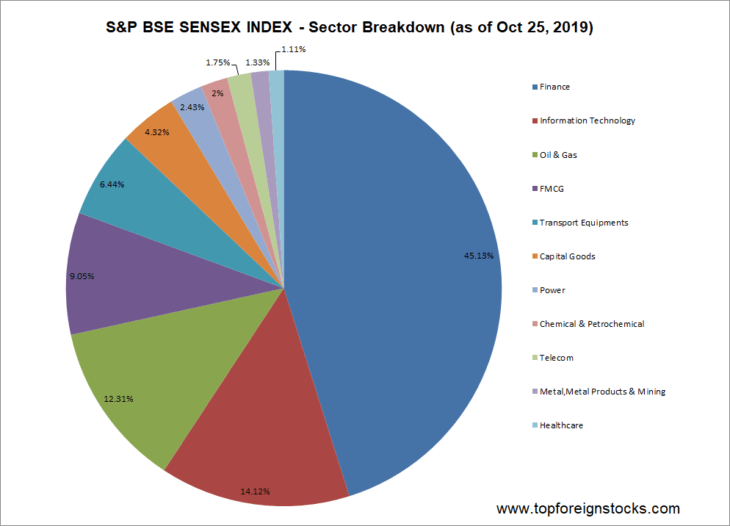

Sensex Soars Top Bse Stocks That Surged Over 10

May 15, 2025

Sensex Soars Top Bse Stocks That Surged Over 10

May 15, 2025 -

Etf Sales Practices Under Scrutiny Taiwan Regulator Launches Investigation

May 15, 2025

Etf Sales Practices Under Scrutiny Taiwan Regulator Launches Investigation

May 15, 2025 -

San Diego Padres News Roster Moves Ahead Of Game Merrill And Campusano

May 15, 2025

San Diego Padres News Roster Moves Ahead Of Game Merrill And Campusano

May 15, 2025 -

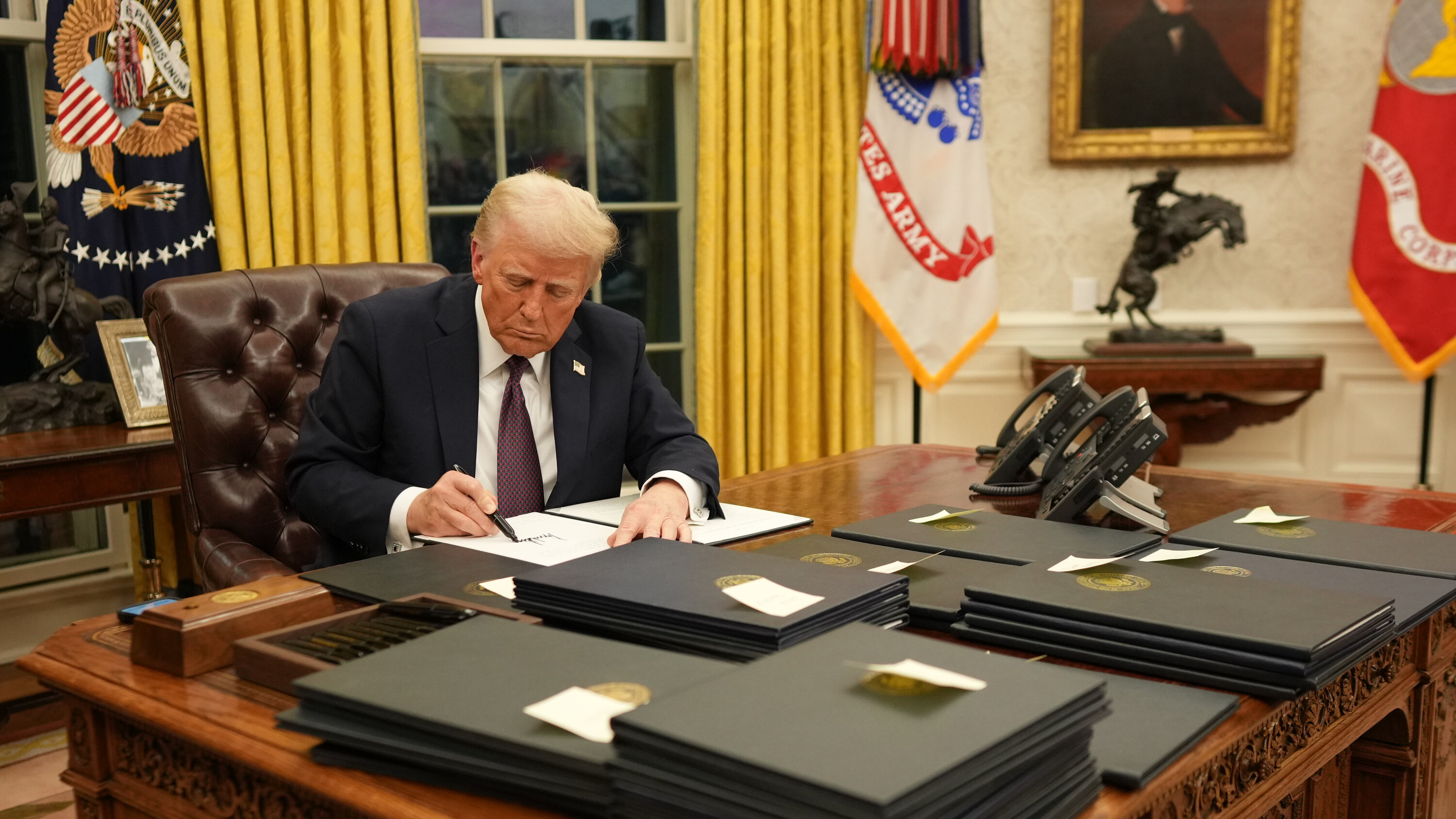

Understanding The 16 Billion Impact Trumps Tariffs On California Revenue

May 15, 2025

Understanding The 16 Billion Impact Trumps Tariffs On California Revenue

May 15, 2025 -

Foot Locker Sneaker Sale Nike Air Dunks Jordans 40 Off

May 15, 2025

Foot Locker Sneaker Sale Nike Air Dunks Jordans 40 Off

May 15, 2025