Who Will Succeed Warren Buffett? A Look At Potential Canadian Candidates

Table of Contents

Assessing the Qualities of a Potential Buffett Successor

Finding a successor to Warren Buffett requires identifying someone who embodies his unique blend of investment acumen and leadership skills. This individual needs to be more than just a skilled investor; they must be a visionary leader capable of managing a vast and diverse conglomerate like Berkshire Hathaway.

Investment Philosophy

Buffett's investment philosophy centers around value investing: identifying undervalued companies with strong fundamentals and holding them for the long term. Key aspects include:

- Intrinsic Value: Focusing on a company's true worth, not just its market price.

- Margin of Safety: Buying assets significantly below their intrinsic value to mitigate risk.

- Long-Term Vision: Holding investments for years, even decades, to allow for compounding returns.

Several Canadian investors share aspects of this philosophy. For example, [mention a specific Canadian value investor and their firm], demonstrates a dedication to long-term value creation, showcasing a similar patient approach to investing.

Leadership and Management Skills

Beyond investment expertise, a successful Buffett successor needs exceptional leadership and management skills. These include:

- Strategic Thinking: The ability to identify and capitalize on long-term opportunities.

- Team Building: Creating and fostering a high-performing team across various industries.

- Crisis Management: Effectively navigating unexpected challenges and market downturns.

Canadian CEOs like [mention a Canadian CEO known for strong leadership] exemplify the type of strategic thinking and decisive action required to manage a complex global enterprise. Their ability to foster a culture of excellence would be crucial in leading a company of Berkshire Hathaway's scale.

Potential Canadian Candidates

While finding a perfect replacement for Warren Buffett is a near-impossible task, several prominent Canadian investors possess some of the necessary qualities.

Mark Wiseman: A Potential Contender?

Mark Wiseman, a seasoned investor with a strong track record, has experience managing significant portfolios and navigating complex financial markets. His career demonstrates:

- Extensive Experience: Years of experience in various investment roles, including leadership positions at major financial institutions.

- Proven Track Record: A history of delivering strong returns across diverse asset classes.

- Investment Philosophy: While his style might differ from Buffett's in some areas, he shares a focus on long-term value creation.

While his style may not perfectly mirror Buffett's, his focus on disciplined value investing and strong leadership qualities make him a potential candidate worthy of consideration in the conversation surrounding a Warren Buffett successor Canada.

Kevin O'Leary: A Different Approach

Kevin O'Leary, known for his sharp business acumen and appearances on "Shark Tank," represents a different investment style compared to Buffett and Wiseman. His focus is often on:

- Aggressive Growth: Seeking higher-risk, higher-reward opportunities.

- Active Management: Frequently trading investments to capitalize on market fluctuations.

- Deal-Making Expertise: A proven ability to negotiate and structure complex transactions.

O'Leary's style is notably different from Buffett's patient, long-term approach. However, his business acumen and entrepreneurial drive demonstrate traits valuable in a leadership role.

Identifying Other Potential Candidates

Finding someone to fill Buffett's shoes is an enormous challenge. The combination of exceptional investment skills, strategic thinking, and leadership capabilities is exceptionally rare. To uncover other potential candidates, exploring resources like:

- Financial news websites (e.g., the Globe and Mail, Bloomberg)

- Canadian investment industry publications

- University business schools and investment programs

is crucial. Who do you think could potentially be a Warren Buffett successor in Canada? Share your suggestions in the comments!

Challenges and Considerations for a Canadian Successor

Even with the abundance of talent in the Canadian investment landscape, a Canadian successor to Warren Buffett would face unique challenges.

Geographical Limitations

Managing a global conglomerate like Berkshire Hathaway from Canada presents logistical difficulties:

- Time Zone Differences: Coordinating with teams and businesses across multiple time zones.

- Cultural Nuances: Understanding and navigating diverse cultural contexts in international markets.

- Increased Travel Demands: The necessity for extensive international travel to maintain oversight of Berkshire Hathaway's diverse holdings.

Building a Legacy

Following in Buffett's footsteps means more than just achieving financial success. It includes upholding a legacy of:

- Philanthropy: Buffett's commitment to giving back to society through significant charitable contributions.

- Corporate Social Responsibility: Berkshire Hathaway's track record of ethical and responsible business practices.

- Long-Term Value Creation: Building lasting value for shareholders and stakeholders alike.

Conclusion

Finding a direct "Warren Buffett successor Canada" is highly unlikely. However, this exploration highlights the impressive talent within the Canadian investment community. While individuals like Mark Wiseman and Kevin O'Leary present unique strengths, the qualities needed—a blend of exceptional investment prowess, visionary leadership, and unwavering ethical standards—are exceptionally rare. Who do you think possesses the necessary skills and experience to potentially follow in Buffett's footsteps? Share your thoughts in the comments below! Keep the discussion going – let's explore more potential Warren Buffett successors from Canada and beyond.

Featured Posts

-

The Us Attorney General And Fox News A Daily Occurrence Worth Investigating

May 10, 2025

The Us Attorney General And Fox News A Daily Occurrence Worth Investigating

May 10, 2025 -

A Simple High Profit Dividend Investing Strategy

May 10, 2025

A Simple High Profit Dividend Investing Strategy

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

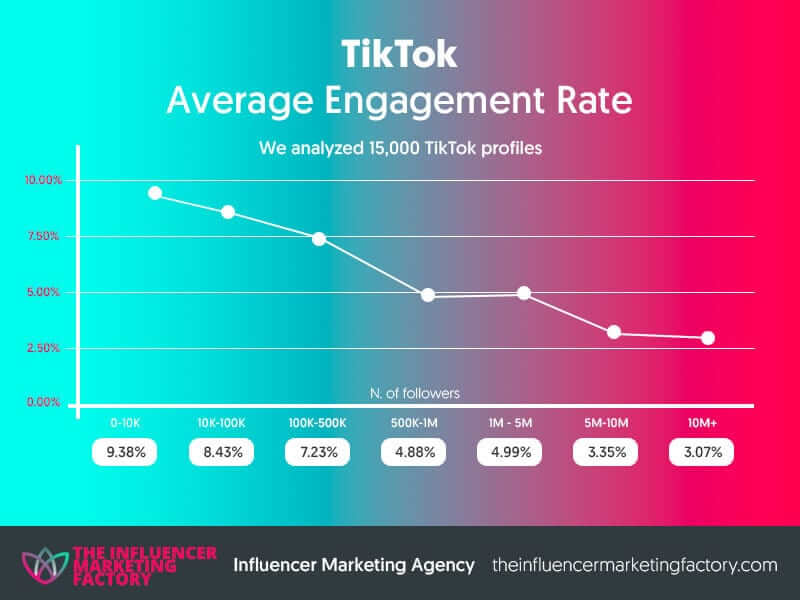

Instagrams Growth Strategy Ceo Addresses Tik Toks Impact

May 10, 2025

Instagrams Growth Strategy Ceo Addresses Tik Toks Impact

May 10, 2025 -

Young Thugs Uy Scuti Album Expected Release Date And Tracklist Rumors

May 10, 2025

Young Thugs Uy Scuti Album Expected Release Date And Tracklist Rumors

May 10, 2025