Why Did Investors Sell Leveraged Semiconductor ETFs Before The Surge?

Table of Contents

The Impact of Macroeconomic Uncertainty

The period leading up to the semiconductor surge was marked by significant macroeconomic uncertainty. High inflation, aggressive interest rate hikes by central banks, and persistent recessionary fears created a challenging investment environment. This negative sentiment spilled over into even high-growth sectors like semiconductors, impacting the performance of leveraged semiconductor ETFs.

- High inflation erodes purchasing power: Inflation's impact on consumer spending is significant. As prices rise, consumers cut back on discretionary spending, including purchases of electronics, directly impacting demand for semiconductors.

- Rising interest rates increase borrowing costs: Higher interest rates make borrowing more expensive for businesses, impacting capital expenditures and potentially slowing down semiconductor production and innovation. This also makes alternative, less risky investments more attractive compared to leveraged ETFs.

- Recessionary fears lead to risk aversion: The looming threat of a recession encourages investors to shift their portfolios towards safer, more conservative assets. Leveraged semiconductor ETFs, with their inherent volatility, are often the first to be sold during periods of risk aversion.

- Uncertainty about future demand for semiconductors: Fluctuations in global demand, driven by factors like geopolitical instability and supply chain disruptions, add to the uncertainty surrounding semiconductor stocks and their leveraged counterparts.

This confluence of macroeconomic factors created a climate of pessimism, leading many investors to reduce their exposure to riskier assets, including leveraged semiconductor ETFs, regardless of the long-term growth potential of the semiconductor industry. Data from [insert source, e.g., a reputable financial news site] shows a significant drop in investor confidence during this period, reflected in decreased investment in technology sector ETFs.

Concerns Regarding Volatility in Leveraged ETFs

Leveraged ETFs, by their very nature, amplify both gains and losses. This inherent volatility is a significant concern for many investors, particularly in a fluctuating market like the one experienced before the recent semiconductor surge.

- Daily resetting of leverage amplifies both gains and losses: Leveraged ETFs aim to deliver a multiple (e.g., 2x or 3x) of the daily performance of the underlying index. However, this daily resetting of leverage means that losses can compound quickly, especially during periods of market downturn.

- Volatility drag can significantly reduce returns over longer periods: The constant rebalancing inherent in leveraged ETFs can lead to a phenomenon known as "volatility drag," where the amplified daily fluctuations reduce overall returns over the long term, even in a generally upward-trending market.

- The risk of substantial losses during periods of market downturn: A small downturn in the underlying semiconductor index can translate into significantly larger losses in a leveraged ETF, potentially wiping out a substantial portion of an investor's capital.

- Difficulty in predicting market direction for optimal leveraged ETF timing: Successfully utilizing leveraged ETFs requires accurate prediction of market direction. Mistiming the investment can lead to substantial losses, which is a challenge even for seasoned investors.

For example, a 10% drop in the underlying semiconductor index could translate to a 20% or 30% drop in a 2x or 3x leveraged ETF, respectively. This amplified loss potential makes leveraged ETFs unsuitable for risk-averse investors or those with shorter investment horizons.

The Role of Short-Term Market Sentiment and News Cycles

Short-term market sentiment and negative news cycles significantly impact investor decisions, especially when it comes to leveraged investments. Even if the long-term outlook for the semiconductor sector remains positive, negative news can trigger a sell-off.

- Negative news about specific semiconductor companies: Negative earnings reports, production issues, or management changes in key semiconductor companies can trigger a broader sell-off in the sector, affecting leveraged ETFs.

- Geopolitical tensions and supply chain disruptions: Geopolitical events and disruptions to global supply chains can negatively impact investor confidence and lead to a flight from riskier assets like leveraged semiconductor ETFs.

- Analyst downgrades or negative forecasts: Negative analyst reports and forecasts can influence investor sentiment, leading to a sell-off, even if the underlying fundamentals remain strong.

- Short-term market corrections unrelated to the long-term prospects of the sector: Market corrections, driven by broader macroeconomic factors, often impact even strong sectors like semiconductors, leading to selling pressure on leveraged ETFs.

The herd mentality often plays a role. When investors see others selling, they may follow suit, amplifying the sell-off and creating a self-fulfilling prophecy.

Technical Indicators and Trading Strategies

Technical indicators and short-term trading strategies also played a role in the pre-surge sell-off.

- Overbought conditions indicated by technical indicators: Some technical indicators might have suggested that the semiconductor market was overbought, prompting investors using these indicators to take profits.

- Profit-taking after a period of gains: After a period of strong performance, some investors might have chosen to take profits, leading to selling pressure.

- Algorithmic trading strategies triggering sell-offs based on predefined parameters: Algorithmic trading strategies, based on predefined parameters, can automatically trigger sell-offs when certain conditions are met, potentially exacerbating market volatility.

Technical analysis provides a valuable tool for some investors but should be considered in conjunction with fundamental analysis and a clear understanding of the inherent risks of leveraged ETFs.

Conclusion

The sell-off in leveraged semiconductor ETFs before the recent surge was a complex event driven by a combination of factors. Macroeconomic uncertainty, the inherent volatility of leveraged ETFs, negative short-term market sentiment, and the use of technical analysis and trading strategies all contributed to the pre-surge decline. While leveraged semiconductor ETFs offer the potential for significant returns, they also carry substantial risk. Before investing in leveraged semiconductor ETFs or any leveraged investment, carefully consider your risk tolerance, investment timeframe, and your understanding of the market dynamics influencing this asset class. Thorough research and a realistic understanding of the risks associated with leveraged semiconductor ETFs are crucial for making informed investment decisions.

Featured Posts

-

Trumps State Of The Union Local Community Voices Strong Opposition

May 13, 2025

Trumps State Of The Union Local Community Voices Strong Opposition

May 13, 2025 -

I Skarlet Gioxanson Kleinei To Kefalaio Tis Black Widow

May 13, 2025

I Skarlet Gioxanson Kleinei To Kefalaio Tis Black Widow

May 13, 2025 -

Skarlet Gioxanson I Black Widow Kleinei Oristika Ton Kyklo Tis

May 13, 2025

Skarlet Gioxanson I Black Widow Kleinei Oristika Ton Kyklo Tis

May 13, 2025 -

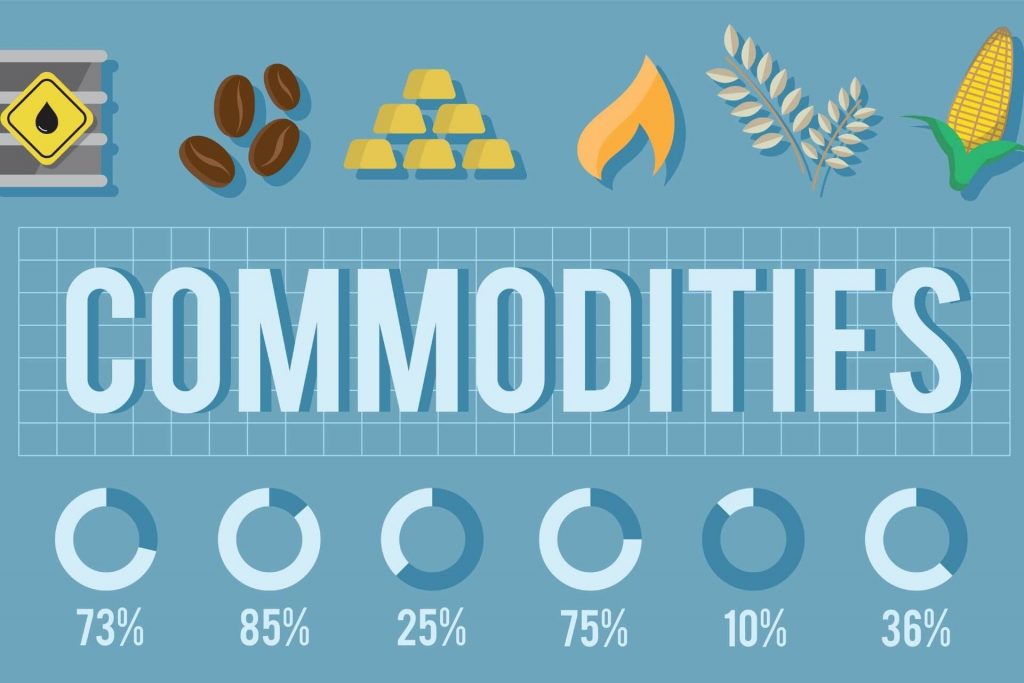

Optimizing Commodity Trading Walleyes Credit Strategy For Core Clients

May 13, 2025

Optimizing Commodity Trading Walleyes Credit Strategy For Core Clients

May 13, 2025 -

Predlozheniya Deputatov Osnova Predvybornoy Programmy Edinoy Rossii

May 13, 2025

Predlozheniya Deputatov Osnova Predvybornoy Programmy Edinoy Rossii

May 13, 2025