Why Investors Shouldn't Be Alarmed By Elevated Stock Market Valuations: BofA

Table of Contents

The Role of Low Interest Rates in Supporting High Valuations

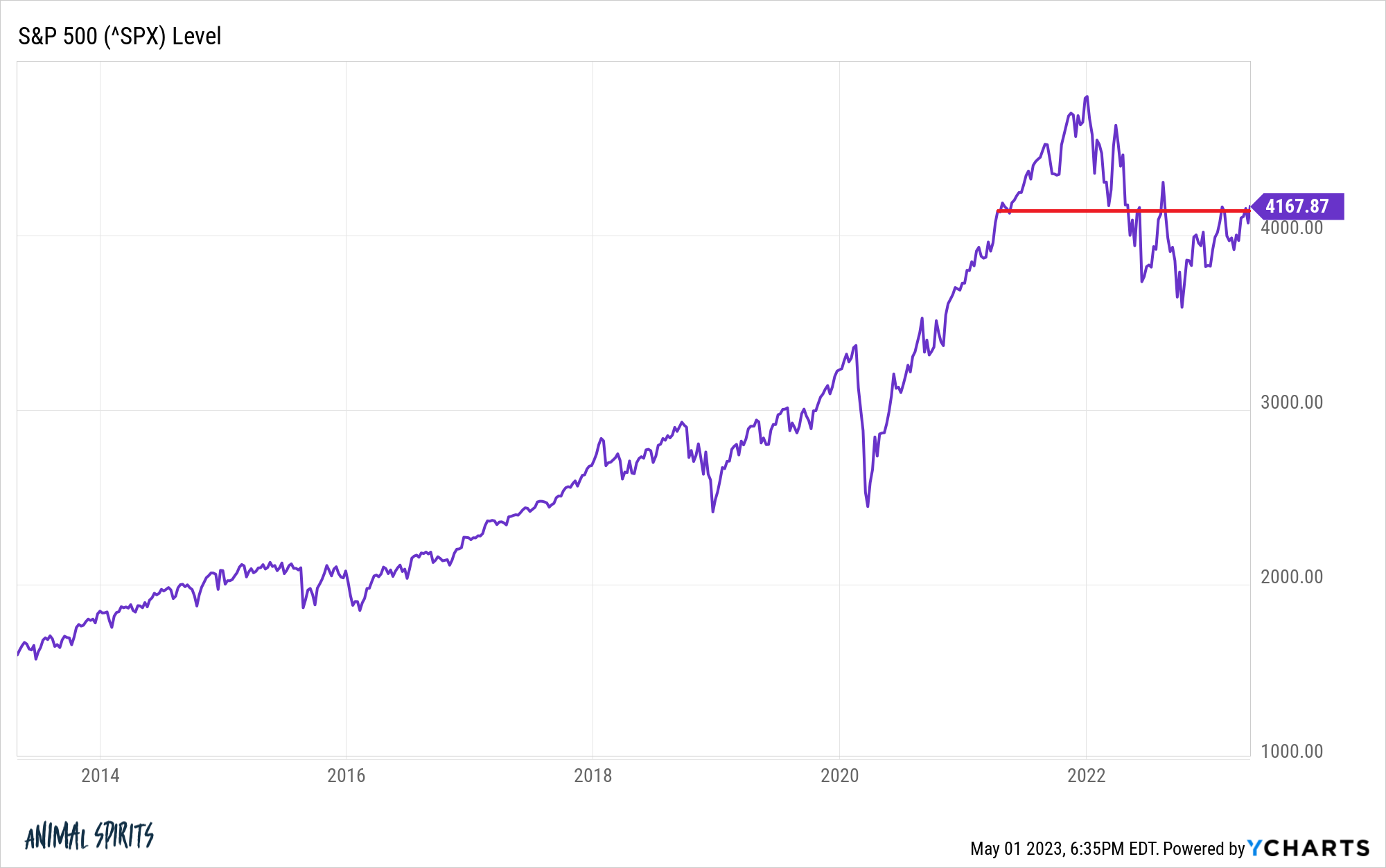

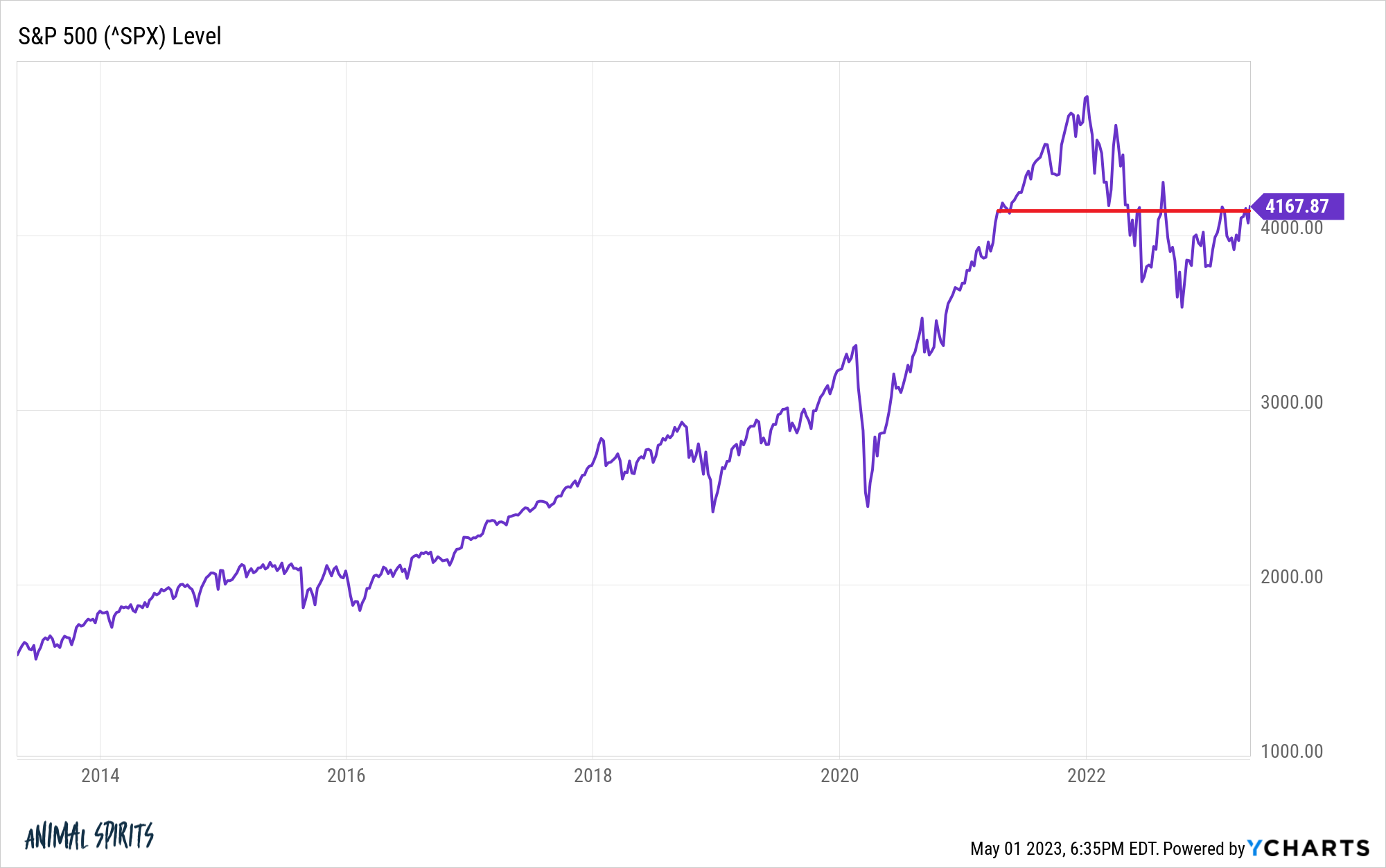

The relationship between interest rates and stock valuations is inversely proportional. When interest rates are low, the opportunity cost of investing in stocks – as opposed to bonds or other fixed-income securities – decreases. This makes stocks a comparatively more attractive investment.

- Lower discount rates increase the present value of future earnings. Low interest rates reduce the discount rate used in discounted cash flow (DCF) models, inflating the present value of a company's projected future earnings, thus supporting higher valuations.

- Reduced borrowing costs benefit companies, leading to higher profits. Lower interest rates make it cheaper for companies to borrow money, allowing them to invest in growth initiatives, expand operations, and ultimately increase profitability. This increased profitability often justifies higher stock prices.

- Low rates incentivize investors to seek higher returns in the stock market. With bond yields remaining low, investors often seek higher potential returns in the equity market, driving up demand and stock prices.

BofA's research consistently highlights the significant impact of low interest rate environments on stock valuations. Their reports often demonstrate a strong correlation between historically low interest rates and periods of elevated market valuations.

Strong Corporate Earnings and Profitability as a Counterbalance

Despite elevated stock market valuations, many companies continue to report strong earnings and profitability. This solid performance helps to justify, to some extent, the higher price-to-earnings (P/E) ratios observed across the market.

- Examples of sectors or companies exhibiting strong earnings growth: While the picture is not uniform across all sectors, technology, healthcare, and certain consumer staples have shown resilient earnings growth, even amid economic uncertainty. Specific company performance should be investigated independently.

- Factors contributing to robust corporate profits: Cost-cutting measures, increased efficiency, and strong consumer demand in certain sectors have all contributed to healthy corporate profit margins.

- Comparison of current earnings to historical trends: While P/E ratios may be elevated compared to historical averages, earnings themselves are also stronger in many cases, suggesting that the valuations are not entirely unjustified.

Visual representations of earnings data, such as charts comparing current earnings per share (EPS) to historical trends, can effectively illustrate this point.

Long-Term Growth Potential and Future Earnings Expectations

Looking beyond current market conditions, the long-term growth potential of the global economy plays a crucial role in shaping current stock valuations. Investors often pay a premium for companies expected to deliver significant future earnings growth.

- Technological advancements and their impact on future growth: Technological innovation continues to drive productivity improvements and create new markets, contributing to long-term economic expansion and justifying higher valuations for companies positioned to benefit from these trends.

- Emerging markets and their contribution to global economic expansion: The continued growth of emerging markets offers significant opportunities for global companies, further supporting positive long-term growth expectations and influencing current valuations.

- Analysis of industry trends and their implications for stock valuations: Analyzing industry-specific trends, such as the increasing adoption of renewable energy or the growth of the e-commerce sector, helps in understanding the long-term prospects of different companies and their valuations.

BofA's forward-looking analyses often incorporate these factors to project future earnings and assess the sustainability of current market valuations.

Addressing Potential Risks and Volatility

While the arguments presented above suggest that elevated valuations aren't necessarily a cause for immediate panic, it's crucial to acknowledge the inherent risks associated with investing in the stock market. Market corrections and periods of volatility are normal occurrences.

- Diversification strategies to reduce portfolio volatility: Diversifying your portfolio across different asset classes and sectors is a key risk management strategy.

- Importance of long-term investment horizons: A long-term perspective is essential for weathering short-term market fluctuations.

- Risk management techniques for navigating market uncertainty: Employing stop-loss orders and regularly reviewing your investment strategy can help manage risk effectively.

It's vital to remember that market corrections are a natural part of a healthy market cycle. While they can be unsettling, they present opportunities for long-term investors.

Conclusion: Navigating Elevated Stock Market Valuations – A Balanced Perspective

In summary, while elevated stock market valuations may seem alarming, a balanced perspective reveals that they aren't necessarily a cause for immediate concern. Low interest rates, strong corporate earnings, and significant long-term growth potential all contribute to a more nuanced understanding of the current market environment. Understanding elevated stock market valuations requires a comprehensive analysis of these interwoven factors.

Investing wisely despite high valuations necessitates a long-term strategy, incorporating diversification and risk management techniques. Consult with a qualified financial advisor to develop a personalized investment plan that aligns with your risk tolerance and financial goals. Continue your research by exploring resources from reputable sources, including BofA's publications, to stay informed about market trends and make informed investment decisions. Managing your portfolio in a high-valuation market requires careful planning and a balanced approach.

Featured Posts

-

Political Row Erupts Farage And Lowe Exchange Accusations

May 02, 2025

Political Row Erupts Farage And Lowe Exchange Accusations

May 02, 2025 -

New Saudi Rules Unleash Untapped Potential In The Abs Market A Market Larger Than Spains

May 02, 2025

New Saudi Rules Unleash Untapped Potential In The Abs Market A Market Larger Than Spains

May 02, 2025 -

Microsoft Activision Deal Faces Ftc Appeal After Court Loss

May 02, 2025

Microsoft Activision Deal Faces Ftc Appeal After Court Loss

May 02, 2025 -

Steekincident Groningen Meer Informatie Over De Aanhouding Van Malek F

May 02, 2025

Steekincident Groningen Meer Informatie Over De Aanhouding Van Malek F

May 02, 2025 -

Souness Criticises Rice Arsenal Midfielder Needs To Sharpen Final Third Play

May 02, 2025

Souness Criticises Rice Arsenal Midfielder Needs To Sharpen Final Third Play

May 02, 2025

Latest Posts

-

Your Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025

Your Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025 -

Find The Best Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025

Find The Best Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025 -

The Luis Enrique Effect A Winning Strategy For Paris Saint Germain

May 10, 2025

The Luis Enrique Effect A Winning Strategy For Paris Saint Germain

May 10, 2025 -

Ghettoisation Fears A Uk Citys Struggle With Transient Populations

May 10, 2025

Ghettoisation Fears A Uk Citys Struggle With Transient Populations

May 10, 2025 -

Paris Saint Germains Winning Formula Luis Enriques Impact On The French Champions

May 10, 2025

Paris Saint Germains Winning Formula Luis Enriques Impact On The French Champions

May 10, 2025