Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Necessarily Overvalued

BofA argues that the narrative of an "overvalued" market is overly simplistic and doesn't fully account for several crucial economic factors. Their analysis suggests that current stock market valuation levels are justifiable, given the present economic landscape.

-

Strong Corporate Earnings: BofA points to robust corporate earnings growth as a key supporting factor. Many companies are exceeding expectations, demonstrating strong fundamentals that justify current price levels. This sustained profitability counters the argument that valuations are detached from reality.

-

Low Interest Rates: The prolonged period of low interest rates has significantly impacted stock valuations. Lower borrowing costs incentivize investment and contribute to higher company valuations. BofA's models incorporate the impact of this monetary policy.

-

Technological Advancements: Technological innovation continues to drive productivity and growth across various sectors. BofA’s analysis incorporates this factor, highlighting the long-term growth potential fueled by these advancements. This long-term perspective is crucial for understanding their valuation models.

-

Sophisticated Valuation Models: BofA employs sophisticated valuation models that incorporate a range of factors beyond simple price-to-earnings ratios. These models consider factors like future earnings growth, cash flow projections, and risk assessments, providing a more nuanced picture of market valuation. Their recent reports detail these methodologies.

-

Long-Term Growth Potential: BofA emphasizes the long-term growth potential of the global economy. They believe that focusing solely on short-term market fluctuations overlooks the substantial opportunities available for long-term investors. Their forecasts indicate a positive trajectory for sustained growth.

Addressing the Risks Associated with High Stock Market Valuations

While BofA presents a positive outlook, it's crucial to acknowledge the legitimate risks associated with high stock market valuations.

-

Market Corrections: High valuations increase the potential for market corrections, where prices experience a significant and sudden drop.

-

Inflation: Rising inflation can erode the value of investments and potentially lead to interest rate hikes.

-

Interest Rate Hikes: Increases in interest rates can impact company profitability and decrease the attractiveness of equities relative to fixed-income investments.

BofA suggests several mitigation strategies:

-

Diversification: A well-diversified portfolio across different asset classes and sectors can help reduce overall risk.

-

Long-Term Investment Horizon: A long-term investment perspective allows investors to weather short-term market fluctuations and benefit from long-term growth.

-

Active Risk Management: Regular portfolio reviews and adjustments based on changing market conditions are essential.

By proactively managing risk, investors can effectively navigate the challenges presented by high valuations.

The Role of Interest Rates in Shaping Stock Market Valuations

The relationship between interest rates and stock valuations is inversely proportional. Lower interest rates generally lead to higher stock valuations, and vice versa. BofA's analysis closely examines the impact of interest rates on the stock market.

-

Interest Rate Predictions: BofA's predictions regarding future interest rate movements play a crucial role in shaping their view on stock market valuations. Their analysis considers the likelihood of interest rate hikes and their potential impact on market sentiment.

-

Monetary Policy Influence: BofA carefully examines the impact of central bank monetary policy decisions on stock prices. Understanding the influence of monetary policy is crucial for interpreting their analysis of current stock market valuation levels.

Sector-Specific Analysis: Where BofA Sees Opportunities Despite High Valuations

Despite the overall high valuations, BofA identifies specific sectors poised for significant growth.

-

Technology: BofA sees continued growth potential in the technology sector, driven by ongoing innovation and the increasing digitalization of the global economy. Specific examples include companies focused on artificial intelligence, cloud computing, and cybersecurity.

-

Healthcare: The aging global population and advancements in medical technology support BofA’s positive outlook for the healthcare sector. They point to growth opportunities in pharmaceuticals, biotechnology, and medical devices.

BofA's rationale for these sectors is based on factors like long-term secular trends and robust growth forecasts. They offer specific company recommendations within these sectors.

Investing Smartly Despite High Stock Market Valuations – A BofA-Informed Approach

BofA's analysis suggests that fear of high stock market valuations shouldn't prevent investors from pursuing opportunities. While acknowledging the inherent risks, BofA highlights the importance of a well-diversified portfolio, a long-term investment horizon, and active risk management. They see substantial opportunities in certain sectors like technology and healthcare.

Don't let fear of high stock market valuations paralyze your investment decisions. Take a data-driven approach, understand the risks, and implement effective mitigation strategies. Further research into BofA's reports and analysis on managing high stock market valuations, understanding stock market valuations, and navigating high stock valuations will provide a more comprehensive understanding of the current market landscape and equip you to make informed investment choices.

Featured Posts

-

The China Market Headwinds For Bmw Porsche And Other Automakers

Apr 22, 2025

The China Market Headwinds For Bmw Porsche And Other Automakers

Apr 22, 2025 -

Pope Francis Passes Away At Age 88 After Pneumonia Illness

Apr 22, 2025

Pope Francis Passes Away At Age 88 After Pneumonia Illness

Apr 22, 2025 -

Uncovering The Countrys Next Big Business Centers

Apr 22, 2025

Uncovering The Countrys Next Big Business Centers

Apr 22, 2025 -

The Obamacare Supreme Court Case Analyzing Trumps Involvement And Its Effect On Rfk Jr

Apr 22, 2025

The Obamacare Supreme Court Case Analyzing Trumps Involvement And Its Effect On Rfk Jr

Apr 22, 2025 -

Cassidy Hutchinson Key Witness To Reveal All In Upcoming Memoir

Apr 22, 2025

Cassidy Hutchinson Key Witness To Reveal All In Upcoming Memoir

Apr 22, 2025

Latest Posts

-

Uk Immigration Rules Tightened Fluent English Now Mandatory For Residency

May 10, 2025

Uk Immigration Rules Tightened Fluent English Now Mandatory For Residency

May 10, 2025 -

Uk Visa Crackdown Increased Scrutiny For Nigerian And Other Nationals

May 10, 2025

Uk Visa Crackdown Increased Scrutiny For Nigerian And Other Nationals

May 10, 2025 -

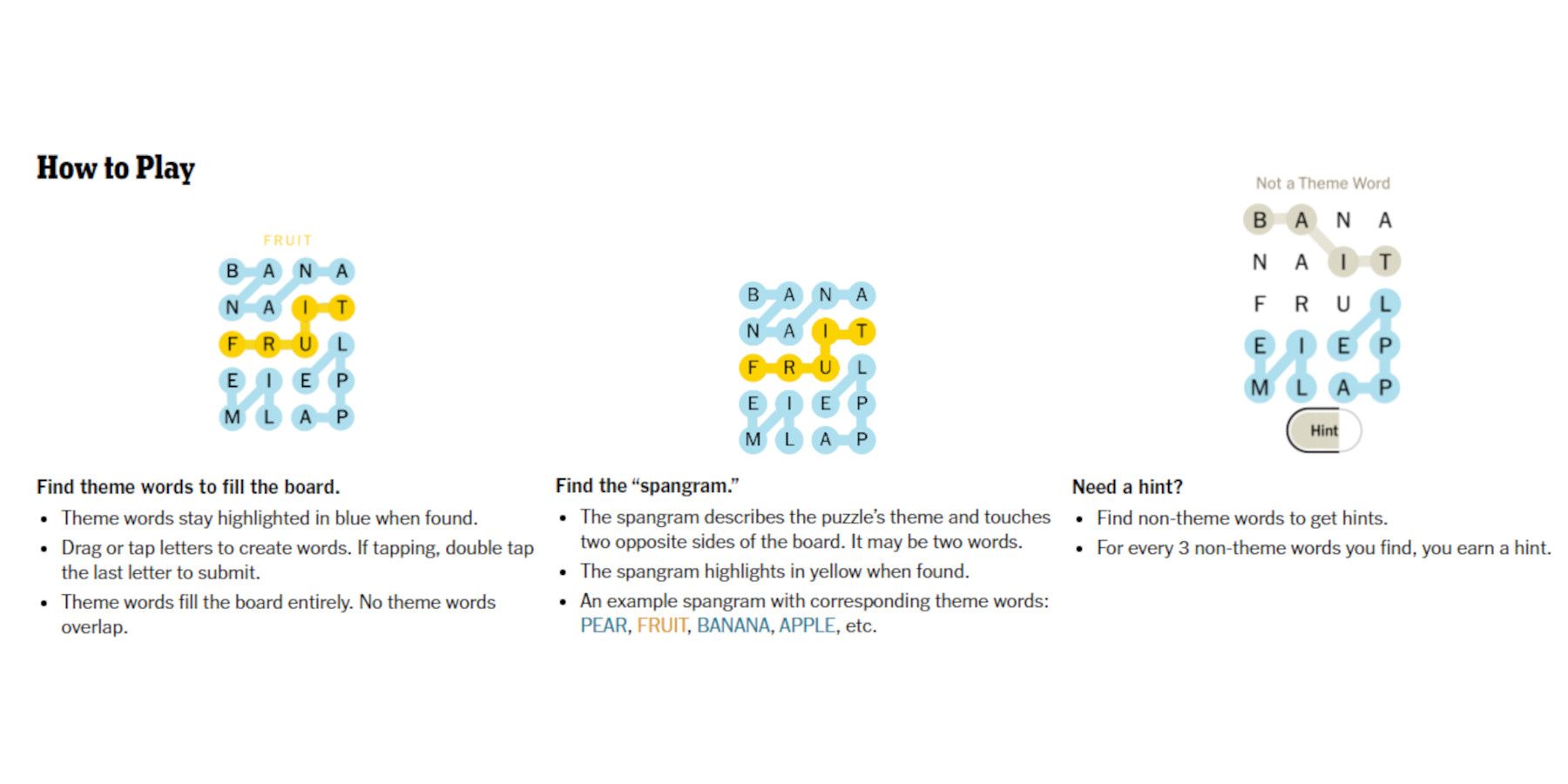

Nyt Strands Game 377 Hints And Answers For March 15th

May 10, 2025

Nyt Strands Game 377 Hints And Answers For March 15th

May 10, 2025 -

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 10, 2025

Nyt Strands Hints And Answers Saturday March 15 Game 377

May 10, 2025 -

Nyt Spelling Bee April 4 2025 Find The Pangram And All Answers

May 10, 2025

Nyt Spelling Bee April 4 2025 Find The Pangram And All Answers

May 10, 2025