The China Market: Headwinds For BMW, Porsche, And Other Automakers

Table of Contents

Intensifying Competition from Domestic Brands

The rise of Chinese automakers is arguably the most significant challenge facing established luxury brands in China. This competition manifests in two key areas: the explosive growth of electric vehicle (EV) manufacturers and the substantial improvement in quality and features offered by domestic brands overall.

Rise of Chinese EV Manufacturers

The rapid ascent of Chinese EV manufacturers like BYD, NIO, Xpeng, and Li Auto is reshaping the automotive landscape. These companies are not just offering electric cars; they are leveraging cutting-edge technology, aggressive marketing, and competitive pricing to capture significant market share.

- Increased market share of EVs in China: The Chinese EV market is booming, with domestic brands leading the charge. This rapid adoption of EVs is directly impacting the sales of traditional internal combustion engine (ICE) vehicles offered by luxury foreign brands.

- Technological advancements by Chinese EV makers: Chinese EV manufacturers are consistently innovating in areas such as battery technology, autonomous driving systems, and connected car features, often surpassing established players in specific areas.

- Aggressive pricing strategies impacting profitability: Competitive pricing is a key strategy employed by Chinese EV manufacturers, putting pressure on the profit margins of luxury brands accustomed to commanding premium prices. This price competition is forcing luxury brands to reconsider their pricing strategies and value propositions.

Improved Quality and Features of Domestic Brands

Beyond EVs, the overall quality and features offered by Chinese automakers have dramatically improved. No longer are domestic brands perceived as inferior; they are now directly competing with established luxury brands on features, design, and build quality.

- Enhanced safety features and technological integrations: Modern Chinese vehicles often boast advanced safety features, sophisticated infotainment systems, and advanced driver-assistance systems (ADAS), making them attractive to tech-savvy Chinese consumers.

- Improved build quality and reliability: Significant investments in manufacturing and quality control have led to considerable improvements in the reliability and build quality of Chinese vehicles, eroding the perceived quality advantage of foreign luxury brands.

- Targeted marketing strategies resonating with Chinese consumers: Chinese brands are expertly tailoring their marketing campaigns to resonate with the preferences and values of Chinese consumers, often outperforming foreign brands in brand awareness and consumer loyalty.

Economic Slowdown and Shifting Consumer Preferences

The China market is not immune to global economic fluctuations. Coupled with evolving consumer demands, this creates a dynamic and challenging environment for luxury automakers.

Impact of Economic Uncertainty

Recent economic headwinds in China have dampened consumer confidence and reduced spending on discretionary items, including luxury automobiles. This economic uncertainty presents a considerable challenge for brands heavily reliant on the Chinese market.

- Decreased consumer spending on discretionary items: The slowdown in economic growth has led to a decrease in consumer spending on non-essential goods, impacting sales of luxury vehicles.

- Impact of geopolitical factors on the Chinese economy: Geopolitical tensions and global uncertainties have further contributed to the economic slowdown, creating additional headwinds for the luxury automotive sector.

- Uncertainty around future economic growth: The uncertainty surrounding future economic growth in China adds to the challenges faced by luxury automakers, making long-term planning and investment decisions more difficult.

Evolving Consumer Demands

Chinese consumers are increasingly sophisticated and demanding. They are not just looking for luxury; they are seeking unique brand experiences, personalized services, and vehicles that reflect their values.

- Increased demand for advanced driver-assistance systems (ADAS): Chinese consumers are increasingly interested in advanced safety and driver assistance features, putting pressure on luxury brands to offer cutting-edge technology.

- Focus on digital connectivity and in-car entertainment: Seamless connectivity, intuitive infotainment systems, and personalized entertainment experiences are becoming crucial factors in the purchasing decisions of Chinese consumers.

- Importance of sustainable and environmentally friendly vehicles: There is a growing emphasis on sustainability and environmental responsibility, increasing the demand for electric vehicles and vehicles with lower carbon footprints.

Regulatory Hurdles and Supply Chain Disruptions

Navigating the regulatory landscape and mitigating supply chain disruptions are further challenges facing luxury automakers in China.

Stringent Emission Regulations

China's commitment to reducing emissions and promoting electric vehicles has resulted in increasingly stringent regulations for automakers. Meeting these regulations requires significant investments and adaptations.

- Compliance costs associated with meeting emission standards: The costs of complying with China's stringent emission regulations can be substantial, impacting profitability.

- Investment in electric vehicle technology and infrastructure: Automakers need to invest heavily in electric vehicle technology, charging infrastructure, and battery production to meet regulatory requirements.

- Shifting production strategies to meet regulatory demands: Automakers need to adapt their production strategies to focus on electric vehicles and comply with evolving emission standards.

Supply Chain Challenges

Global supply chain disruptions, component shortages (like microchips), and geopolitical uncertainties continue to impact the availability of parts and materials, affecting production schedules and delivery times.

- Microchip shortages and their impact on production: The ongoing global microchip shortage continues to disrupt production lines, leading to delays and impacting sales.

- Disruptions to global logistics and transportation networks: Global logistics disruptions can significantly impact the timely delivery of parts and vehicles, affecting production and sales.

- Increased costs associated with sourcing parts and materials: Supply chain disruptions have led to increased costs for sourcing parts and materials, impacting the profitability of automakers.

Conclusion

The China market presents a complex and evolving landscape for luxury automakers like BMW and Porsche. Intensifying competition, economic headwinds, shifting consumer preferences, and regulatory hurdles all demand strategic adaptation. To thrive in this vital market, these companies must prioritize investment in electric vehicle technology, focus on creating unique and personalized brand experiences, proactively navigate regulatory complexities, and develop robust strategies to mitigate supply chain disruptions. Ignoring these headwinds in the China market will severely impact future growth and profitability. Understanding these challenges is the first step toward developing successful strategies for navigating the complexities of the China market and maintaining a strong presence in this crucial automotive market.

Featured Posts

-

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 22, 2025

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 22, 2025 -

Hear From Protesters Anti Trump Rallies Across The Us

Apr 22, 2025

Hear From Protesters Anti Trump Rallies Across The Us

Apr 22, 2025 -

V Mware Pricing At And T Exposes Broadcoms Proposed 1 050 Hike

Apr 22, 2025

V Mware Pricing At And T Exposes Broadcoms Proposed 1 050 Hike

Apr 22, 2025 -

Millions Made From Exec Office365 Hacks Fbi Alleges

Apr 22, 2025

Millions Made From Exec Office365 Hacks Fbi Alleges

Apr 22, 2025 -

Assessing The Combined Military Capabilities Of Sweden And Finland

Apr 22, 2025

Assessing The Combined Military Capabilities Of Sweden And Finland

Apr 22, 2025

Latest Posts

-

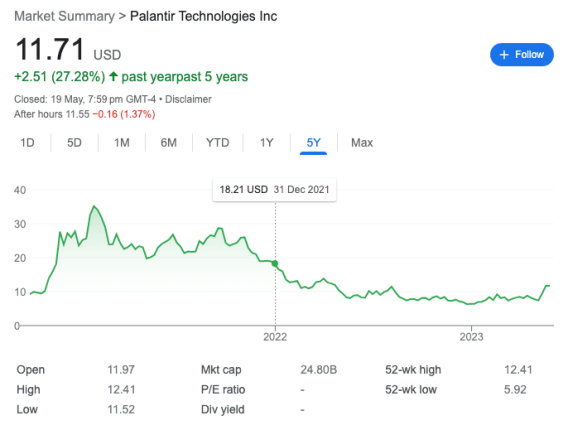

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 10, 2025 -

Investing In Palantir Before May 5th What To Consider

May 10, 2025

Investing In Palantir Before May 5th What To Consider

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th Analyst Ratings And Future Outlook

May 10, 2025

Is Palantir Stock A Buy Before May 5th Analyst Ratings And Future Outlook

May 10, 2025 -

Palantir Technologies Stock Should You Invest Before May 5th

May 10, 2025

Palantir Technologies Stock Should You Invest Before May 5th

May 10, 2025 -

Palantir Stock Weighing The Risks Before May 5th

May 10, 2025

Palantir Stock Weighing The Risks Before May 5th

May 10, 2025