Will Canadian Tire Thrive Under Hudson's Bay Ownership? A Cautious Analysis

Table of Contents

Synergies and Potential Benefits of a Canadian Tire Hudson's Bay Merger

A successful Canadian Tire Hudson's Bay merger could unlock significant synergies across various operational areas. The combined entity would possess a formidable presence in the Canadian retail market.

Enhanced Retail Footprint and Market Reach

-

Increased Store Presence: Combining the existing networks of both retailers would dramatically increase their collective retail footprint across Canada. This expanded physical presence translates to potentially higher market share and increased accessibility for consumers. A larger network means reaching more customers in more locations, particularly in areas currently underserved by either company individually.

-

Geographic Expansion: Hudson's Bay's stronger presence in certain regions could complement Canadian Tire's existing network, leading to geographic expansion and reduced reliance on specific markets. This diversification reduces risk and opens doors to new customer demographics.

-

Cross-Promotion and Bundled Offerings: The opportunity for strategic cross-promotion is substantial. Imagine bundled offers combining Canadian Tire's automotive products with Hudson's Bay's home goods, creating attractive packages for consumers. This collaborative marketing approach could significantly boost sales for both brands. Keywords: Canadian retail market, market share, retail footprint, geographic expansion

Supply Chain Optimization and Cost Savings

Merging operations presents substantial opportunities for streamlining the supply chain.

-

Economies of Scale: A larger, combined entity can leverage economies of scale in procurement, negotiating better prices from suppliers and reducing the cost of goods sold. This increased buying power translates directly into higher profit margins.

-

Streamlined Operations: Combining logistics and distribution networks can lead to significant efficiency gains and reduced overhead costs. Consolidating warehousing and transportation could minimize redundancies and optimize delivery times.

-

Improved Inventory Management: Integrating inventory management systems allows for better forecasting and reduced waste due to improved stock control. This refined approach minimizes storage costs and prevents losses from obsolete or damaged inventory. Keywords: Supply chain management, cost savings, economies of scale, inventory optimization

Leveraging Complementary Brands and Customer Bases

While both companies cater to a broad consumer base, their strengths lie in slightly different segments.

-

Targeting Overlapping Yet Distinct Demographics: Canadian Tire appeals to a practical, DIY-oriented customer, while Hudson's Bay attracts a more fashion-conscious shopper. The combined entity can leverage this to expand their reach to a wider demographic.

-

Wider Product and Service Range: The merger could broaden the product and service offerings available to each existing customer base. This expanded selection could enhance customer loyalty and attract new customers seeking a more comprehensive shopping experience.

-

Creating a More Comprehensive Retail Ecosystem: The combined company could develop a more integrated and interconnected retail ecosystem, potentially offering loyalty programs and services that span both brands. This interconnectedness could further enhance customer engagement and retention. Keywords: Customer demographics, brand synergy, retail ecosystem, product diversification

Challenges and Potential Risks of the Canadian Tire Hudson's Bay Merger

Despite the potential synergies, a Canadian Tire Hudson's Bay merger faces significant hurdles.

Integration Difficulties and Brand Identity Conflicts

Merging two large organizations is never easy.

-

Brand Dilution: Maintaining the distinct brand identities of Canadian Tire and Hudson's Bay is crucial. Poorly managed integration could lead to brand dilution, eroding the value and appeal of both brands.

-

Culture Clash: Merging corporate cultures can be challenging. Differences in operational procedures, management styles, and employee expectations could create internal conflict and hinder integration efforts.

-

Customer Alienation: Significant changes to either brand’s identity or service levels could alienate existing customers. Maintaining customer loyalty during the transition is paramount. Keywords: Brand management, corporate culture, integration challenges, brand dilution

Regulatory Hurdles and Antitrust Concerns

The merger would undoubtedly face intense regulatory scrutiny.

-

Regulatory Scrutiny and Delays: Government agencies will carefully assess the potential impact on competition within the Canadian retail market. This process could result in lengthy delays or even rejection of the merger.

-

Monopolistic Practices: Concerns about the creation of a monopolistic entity and reduced competition within specific retail sectors are likely to arise. This necessitates careful consideration of antitrust regulations.

-

Competition Law Compliance: Navigating complex competition laws and demonstrating compliance is crucial to avoid penalties and ensure regulatory approval. Keywords: Antitrust regulations, regulatory hurdles, mergers and acquisitions, competition law

Financial Risks and Debt Burden

The financial implications of the merger require careful evaluation.

-

Increased Debt Levels: Financing the acquisition could lead to significantly increased debt levels for the combined entity, increasing financial vulnerability.

-

Economic Downturn Impact: An economic downturn could severely impact the financial performance of the merged company, particularly given the increased debt burden.

-

Financial Planning and Risk Management: Robust financial planning and effective risk management are critical to mitigate potential financial risks and ensure the long-term viability of the merged entity. Keywords: Financial risk, debt management, economic downturn, financial performance

Conclusion

The potential Canadian Tire Hudson's Bay merger presents a complex scenario rife with both significant opportunities and substantial risks. While the synergies in supply chain optimization, expanded market reach, and a more diverse brand portfolio are undeniable advantages, the integration challenges, regulatory hurdles, and financial risks cannot be underestimated. The success of this potential Canadian Tire Hudson's Bay merger will depend on meticulous planning, flawless execution of the integration process, and a clearly defined strategy for navigating the inherent complexities. Continuous monitoring and further analysis are essential to fully gauge the long-term effects on Canadian Tire and the broader Canadian retail sector. Will this merger ultimately fortify Canadian Tire or impede its growth? Only time will provide the definitive answer. Stay informed on this evolving situation by continuing your research into the Canadian Tire Hudson's Bay merger.

Featured Posts

-

Bespomoschnoe Polozhenie Shumakhera Drug Raskryvaet Pravdu O Ego Zdorove

May 20, 2025

Bespomoschnoe Polozhenie Shumakhera Drug Raskryvaet Pravdu O Ego Zdorove

May 20, 2025 -

Angely I Restorany Biznes Imperii Plyuschenko Sikharulidze I Kuznetsovoy

May 20, 2025

Angely I Restorany Biznes Imperii Plyuschenko Sikharulidze I Kuznetsovoy

May 20, 2025 -

Vyskum Home Office Vs Kancelaria Preferencie Zamestnancov A Manazerov

May 20, 2025

Vyskum Home Office Vs Kancelaria Preferencie Zamestnancov A Manazerov

May 20, 2025 -

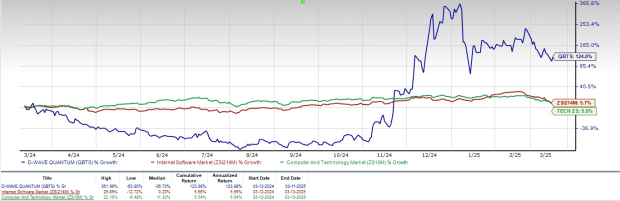

How Will Qbts Earnings Impact Stock Performance

May 20, 2025

How Will Qbts Earnings Impact Stock Performance

May 20, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentillae Ja Niiden Ulkopuolella

May 20, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentillae Ja Niiden Ulkopuolella

May 20, 2025