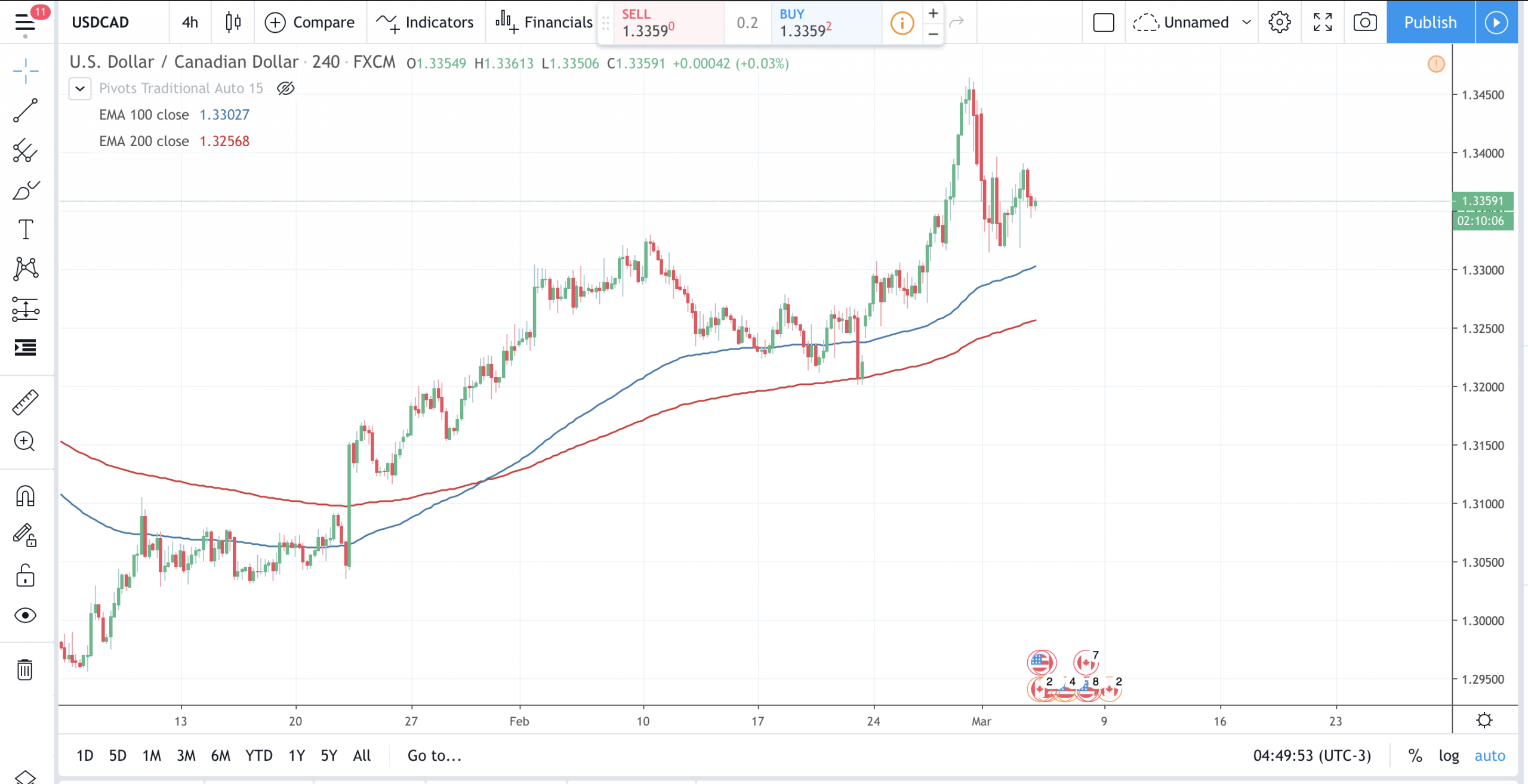

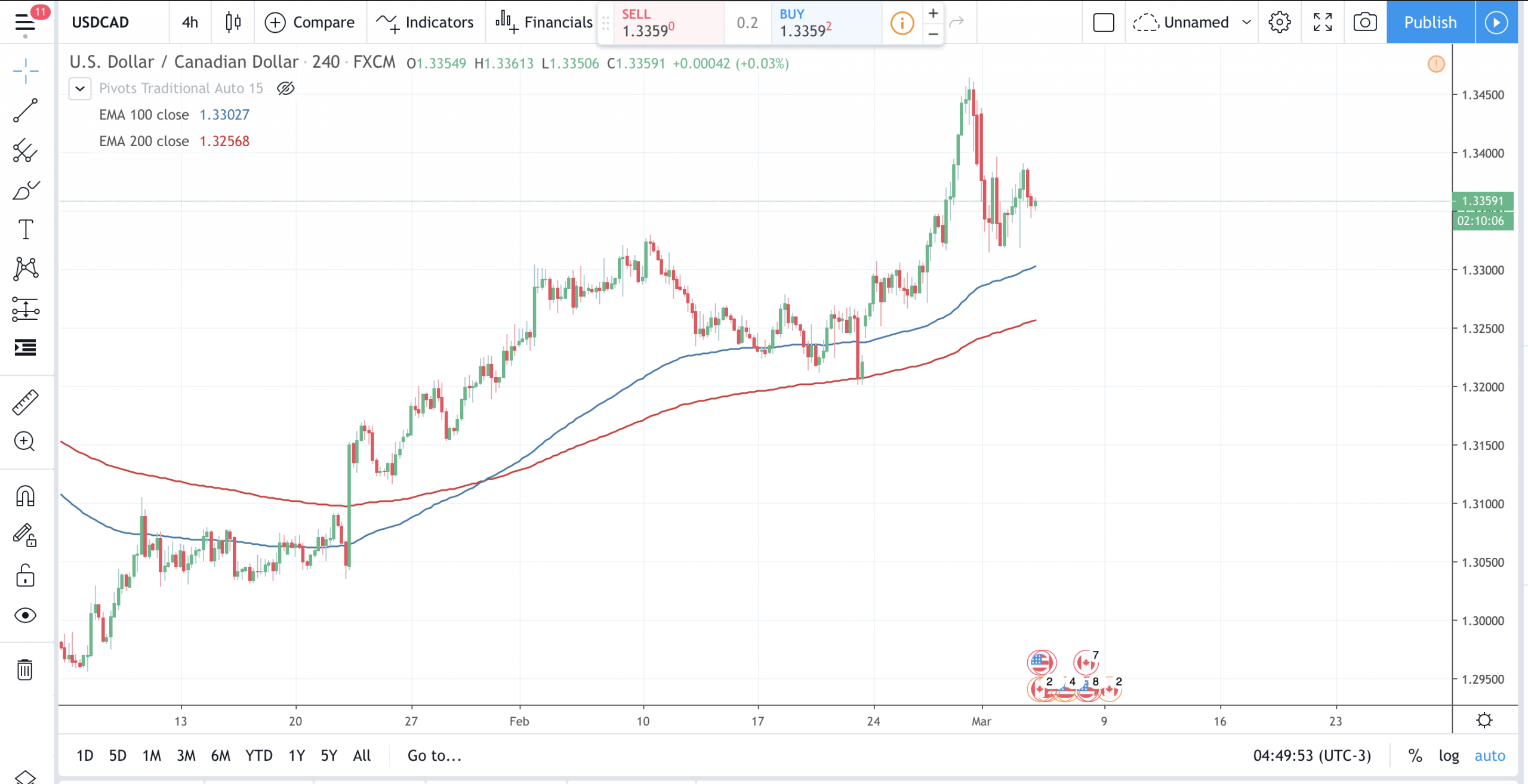

Will The Bank Of Canada Cut Rates Again? Tariff Impacts And Economic Outlook

Table of Contents

The Current Economic Landscape in Canada

The Canadian economy is currently navigating a period of moderate growth, facing headwinds from both domestic and international sources. GDP growth, while positive, has shown signs of slowing in recent quarters. Inflation remains a key concern, hovering around the BoC's target range but with potential for fluctuation. The unemployment rate, while relatively low, warrants close monitoring for any signs of significant shifts.

- Recent Economic Indicators: Recent data reveals a mixed bag. While consumer spending remains relatively robust, business investment has shown some hesitancy. Exports are impacted by global trade tensions.

- Global Economic Slowdown: The global economic slowdown, particularly in key trading partners like the US and China, casts a shadow over Canada's export-oriented economy. This impacts demand for Canadian goods and services.

- BoC Statements: The Bank of Canada has recently indicated a cautious approach to monetary policy, emphasizing its data-dependent decision-making process. Their statements often allude to a careful balancing act between stimulating growth and managing inflation.

The Impact of Tariffs on the Canadian Economy

The ongoing trade disputes, particularly the US-China trade war, have had a tangible impact on the Canadian economy. Tariffs imposed by various countries create uncertainty and disrupt established supply chains. This affects both Canadian businesses engaged in international trade and Canadian consumers who face higher prices on imported goods.

- Impact on Specific Sectors: The agricultural sector, for example, has been significantly impacted by trade disputes, facing challenges in exporting key products. The manufacturing sector is also vulnerable to disruptions in global supply chains and reduced demand.

- Inflation and Consumer Spending: Tariffs contribute to increased import costs, leading to inflationary pressures and potentially dampening consumer spending. This reduces aggregate demand and can slow economic growth.

- Supply Chain Disruptions: Tariffs and trade restrictions often lead to significant disruptions in global supply chains, forcing businesses to adjust their operations and potentially leading to increased production costs.

Inflation and its Influence on BoC Decisions

Inflation is a central consideration in the BoC's decision-making process. The BoC's mandate is to maintain price stability, typically aiming for an inflation rate of around 2%. Therefore, the current inflation rate and its trajectory significantly influence the likelihood of interest rate cuts or hikes.

- Current Inflation Rate: The current inflation rate in Canada needs to be carefully analyzed against the BoC's target range. Any significant deviation, either above or below the target, will impact monetary policy decisions.

- BoC Inflation Target: The BoC's commitment to its inflation target is paramount. Deviations from this target will trigger appropriate responses, aiming to steer inflation back towards the desired level.

- Inflation Pressures: Persistent upward inflation pressures would typically make a rate cut less likely, while persistently low inflation might encourage the BoC to consider a rate cut to stimulate the economy.

Housing Market and Consumer Confidence

The Canadian housing market plays a crucial role in the overall economic stability. Changes in interest rates directly impact housing affordability and consumer confidence, which in turn affects overall economic activity.

- Interest Rates and Housing Affordability: Lower interest rates generally make borrowing cheaper, potentially increasing housing demand. Conversely, higher interest rates can reduce affordability and cool down the market.

- Consumer Confidence Levels: Consumer confidence is a key indicator of economic health. Positive consumer sentiment generally translates to increased spending, while negative sentiment can lead to decreased spending and economic slowdown.

- Housing Market Downturn: A significant downturn in the housing market could have broader economic ripple effects, potentially impacting consumer spending and overall economic confidence.

Alternative Economic Scenarios and Their Implications

Predicting the future is inherently challenging, but considering various economic scenarios helps to understand the potential impacts on the BoC's decisions.

- Best-Case Scenario: A scenario of strong global growth, moderate inflation, and robust consumer spending might make a rate cut less necessary.

- Worst-Case Scenario: A scenario involving a significant global recession, high inflation, and a housing market correction could prompt the BoC to consider more aggressive rate cuts to stimulate the economy.

- Most Likely Scenario: The most likely scenario probably involves a continuation of moderate growth, with inflation remaining within the BoC's target range. This scenario might lead to the BoC maintaining its current interest rate or making small adjustments depending on the economic data.

Conclusion

The decision of whether the Bank of Canada will cut rates again hinges on a complex interplay of factors. The impact of tariffs on the Canadian economy, the trajectory of inflation, the health of the housing market, and the overall economic outlook all contribute to the decision-making process. Understanding these interconnected elements is crucial for businesses and individuals alike. Stay informed about the crucial question – Will the Bank of Canada cut rates again? – by regularly checking for updated economic data and BoC announcements. Understanding the complexities surrounding potential interest rate changes is vital for navigating the Canadian economic landscape.

Featured Posts

-

Will Aaron Judge Repeat Yankees Magazine Predicts His 2024 Performance

May 12, 2025

Will Aaron Judge Repeat Yankees Magazine Predicts His 2024 Performance

May 12, 2025 -

Bank Of Canada Rate Cuts Economists Predict Renewed Reductions Amidst Tariff Job Losses

May 12, 2025

Bank Of Canada Rate Cuts Economists Predict Renewed Reductions Amidst Tariff Job Losses

May 12, 2025 -

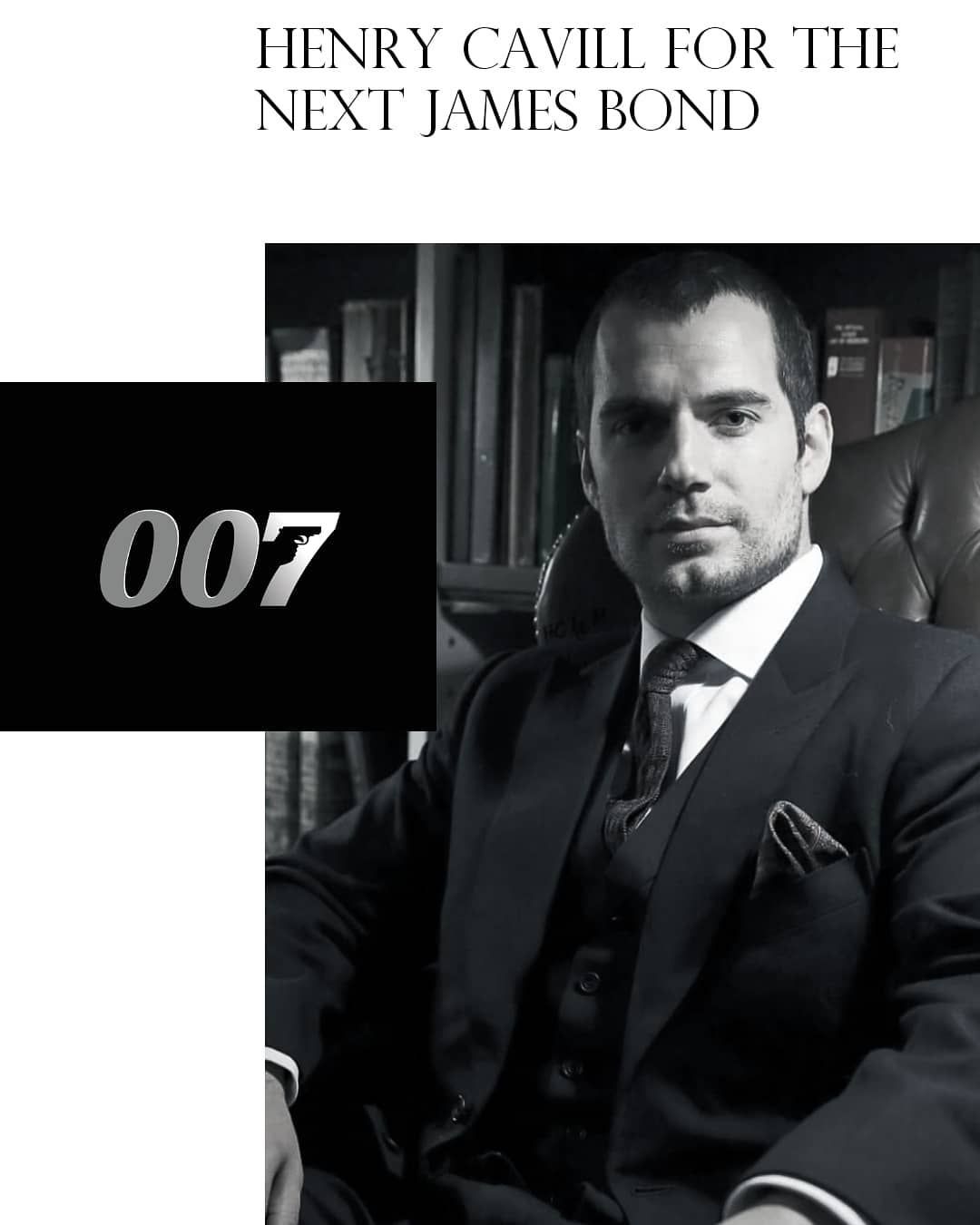

Is Henry Cavill The Next James Bond His Cryptic Comment Explained

May 12, 2025

Is Henry Cavill The Next James Bond His Cryptic Comment Explained

May 12, 2025 -

Anunoby Lidera A Knicks Con 27 Puntos En Victoria Sobre Sixers

May 12, 2025

Anunoby Lidera A Knicks Con 27 Puntos En Victoria Sobre Sixers

May 12, 2025 -

Streaming Success Henry Cavills Night Hunter Action Thriller

May 12, 2025

Streaming Success Henry Cavills Night Hunter Action Thriller

May 12, 2025

Latest Posts

-

Ou Investir Son Argent En 2024 Meilleurs Placements

May 12, 2025

Ou Investir Son Argent En 2024 Meilleurs Placements

May 12, 2025 -

Reussir Son Budget Des Solutions Concretes Pour Economiser

May 12, 2025

Reussir Son Budget Des Solutions Concretes Pour Economiser

May 12, 2025 -

Dans Quoi Investir Le Guide Complet Pour Vos Placements

May 12, 2025

Dans Quoi Investir Le Guide Complet Pour Vos Placements

May 12, 2025 -

Budget Serre Conseils Pour Faire Des Economies

May 12, 2025

Budget Serre Conseils Pour Faire Des Economies

May 12, 2025 -

Doze D Economie Un Budget A Maitriser

May 12, 2025

Doze D Economie Un Budget A Maitriser

May 12, 2025