World Trading Tournament (WTT): AIMSCAP's Participation And Results

Table of Contents

AIMSCAP's Preparation for the World Trading Tournament (WTT)

Team Selection and Training Methodology

Selecting the right team for the World Trading Tournament (WTT) was paramount. AIMSCAP employed a rigorous selection process, evaluating candidates based on their proven track record, in-depth market knowledge, and proficiency in various trading strategies. The chosen team comprised experienced analysts and traders with expertise in diverse asset classes, including equities, forex, and derivatives.

- Extensive Background Checks: Each candidate underwent thorough background checks to ensure a high level of integrity and competence.

- Simulated Trading Environments: The team underwent extensive training using sophisticated simulated trading environments that mirrored real-world market conditions, allowing them to hone their skills and test various trading strategies under pressure.

- Advanced Risk Management Training: A significant portion of the training focused on risk management, employing advanced techniques to mitigate potential losses and optimize returns. This included scenario planning and stress testing across different market regimes.

- Proprietary Trading Software and Tools: AIMSCAP leveraged its proprietary trading software, incorporating advanced algorithms and machine learning models to enhance market analysis and decision-making. These tools provided real-time market data, predictive analytics, and automated trade execution capabilities.

Strategic Approach and Trading Plan

AIMSCAP's strategic approach to the World Trading Tournament (WTT) was multifaceted. The team adopted a diversified trading plan, focusing on both short-term and long-term opportunities across various asset classes. The core of their strategy involved:

- Identifying Market Inefficiencies: The team concentrated on identifying and exploiting market inefficiencies through meticulous fundamental and technical analysis.

- Algorithmic Trading Strategies: AIMSCAP relied heavily on its advanced algorithmic trading systems, allowing for rapid order execution and portfolio optimization.

- Dynamic Asset Allocation: The team employed a dynamic asset allocation strategy, adapting their portfolio based on real-time market conditions and risk assessments.

- Stringent Risk Management Protocols: Risk management was central to AIMSCAP's approach, with rigorous protocols in place to limit potential losses and protect capital. This included position sizing, stop-loss orders, and regular portfolio rebalancing.

AIMSCAP's Performance in the World Trading Tournament (WTT)

Daily Performance and Key Trading Decisions

AIMSCAP demonstrated consistent performance throughout the World Trading Tournament (WTT). While daily fluctuations were inevitable, the team's strategic approach and risk management expertise ensured a steady accumulation of profits. (Insert Chart/Graph depicting daily performance here).

- Successful Navigation of Volatility: The team effectively navigated periods of increased market volatility, capitalizing on short-term opportunities while protecting against significant losses.

- Key Trading Decisions: Several key trading decisions, such as the timely entry and exit from specific positions, proved particularly impactful on the overall results. For example, (insert specific example of a successful trade and its rationale).

- Effective Use of Algorithmic Trading: The use of proprietary algorithms enabled the team to identify and execute trades with high speed and precision, leading to significant advantages in dynamic market environments.

Challenges Faced and Lessons Learned

Despite its overall success, AIMSCAP faced certain challenges during the World Trading Tournament (WTT). Unexpected geopolitical events and sudden shifts in market sentiment presented hurdles.

- Responding to Unforeseen Events: The team demonstrated adaptability by adjusting its trading strategy to respond effectively to unforeseen market events, including a sudden spike in oil prices and an unexpected interest rate hike.

- Learning from Setbacks: While the majority of trades were profitable, a few less successful trades highlighted areas for improvement in risk assessment and market timing. These setbacks provided valuable lessons in refining their strategies for future competitions.

- Continuous Improvement: AIMSCAP emphasizes continuous improvement, and the World Trading Tournament (WTT) experience provided valuable data for further refining its trading algorithms and risk management procedures.

Final Results and Overall Assessment of AIMSCAP's World Trading Tournament (WTT) Participation

AIMSCAP achieved a highly respectable [Insert Ranking/Score] in the World Trading Tournament (WTT), outperforming a significant number of competitors. This success underscores the effectiveness of AIMSCAP's rigorous training methodologies, sophisticated trading strategies, and advanced technology. While AIMSCAP’s performance was excellent, analysis of the results highlighted opportunities for refining specific aspects of the investment strategy to improve the overall outcome in future competitions.

Conclusion: AIMSCAP's World Trading Tournament (WTT) Journey: Key Takeaways and Future Implications

AIMSCAP's participation in the World Trading Tournament (WTT) was a significant success, demonstrating its expertise in algorithmic trading, risk management, and market analysis. The competition provided invaluable experience, highlighting the importance of adaptability, continuous improvement, and rigorous risk management in achieving consistent success in the dynamic world of trading. AIMSCAP plans to leverage the lessons learned to further enhance its trading strategies and compete even more effectively in future World Trading Tournaments (WTT) and similar events. Learn more about AIMSCAP's success in the World Trading Tournament (WTT) and discover how you can improve your trading strategies by visiting our website [Insert Website Link Here].

Featured Posts

-

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Beklentiler Ve Tahminler

May 21, 2025

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Beklentiler Ve Tahminler

May 21, 2025 -

Real Madrid Manager Search Klopps Agent Speaks Out

May 21, 2025

Real Madrid Manager Search Klopps Agent Speaks Out

May 21, 2025 -

Was Liverpool Fortunate Against Psg Arne Slot And Alissons Crucial Roles

May 21, 2025

Was Liverpool Fortunate Against Psg Arne Slot And Alissons Crucial Roles

May 21, 2025 -

Chat Gpt Developer Open Ai Under Ftc Investigation

May 21, 2025

Chat Gpt Developer Open Ai Under Ftc Investigation

May 21, 2025 -

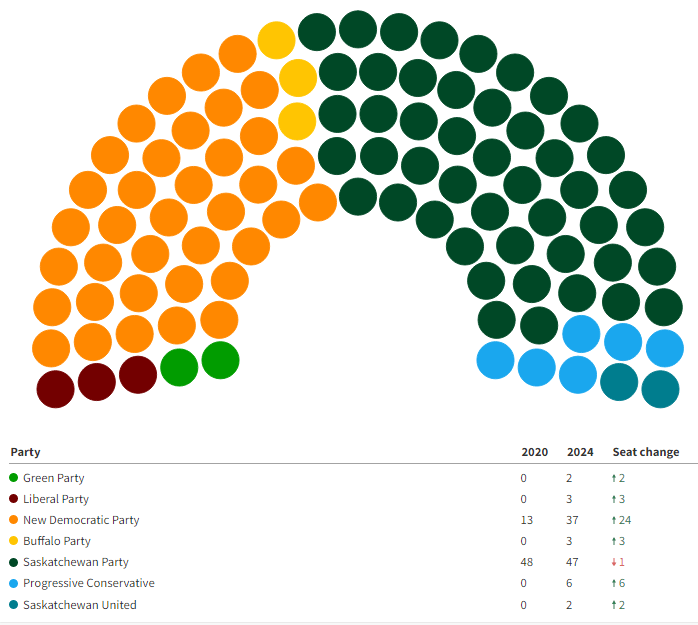

How The Federal Election Results Reshape Saskatchewans Political Future

May 21, 2025

How The Federal Election Results Reshape Saskatchewans Political Future

May 21, 2025

Latest Posts

-

Bof As View Addressing Investor Anxiety Over High Stock Market Valuations

May 21, 2025

Bof As View Addressing Investor Anxiety Over High Stock Market Valuations

May 21, 2025 -

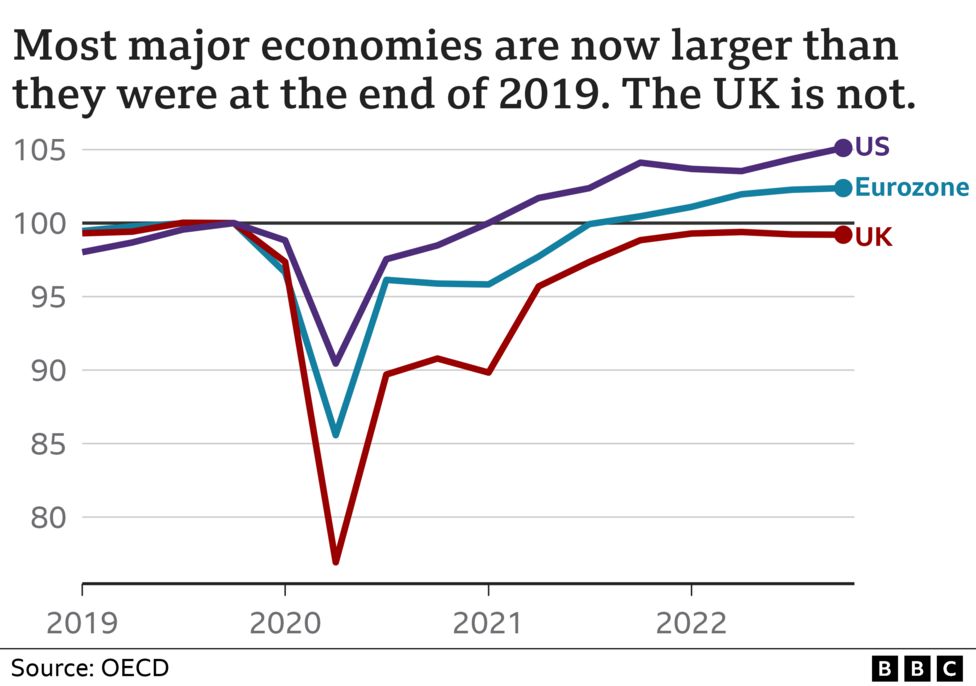

Brexits Lingering Impact Uk Luxury Sector Faces Export Headwinds To The Eu

May 21, 2025

Brexits Lingering Impact Uk Luxury Sector Faces Export Headwinds To The Eu

May 21, 2025 -

Investor Concerns About Stock Market Valuations Bof As Reassurance

May 21, 2025

Investor Concerns About Stock Market Valuations Bof As Reassurance

May 21, 2025 -

How Brexit Is Hampering Uk Luxury Exports To The Eu

May 21, 2025

How Brexit Is Hampering Uk Luxury Exports To The Eu

May 21, 2025 -

The Brexit Effect Slowing Growth In Uk Luxury Exports To The Eu

May 21, 2025

The Brexit Effect Slowing Growth In Uk Luxury Exports To The Eu

May 21, 2025