XRP Up 400% In Three Months: Time To Buy Or Hold?

Table of Contents

Understanding XRP's Recent Price Surge

Factors Contributing to the XRP Rally

Several factors have contributed to XRP's remarkable rally. Understanding these contributing factors is crucial for assessing its future trajectory.

- Positive Ripple Legal Developments: The ongoing legal battle between Ripple and the SEC has significantly impacted XRP's price. Positive developments in the case, such as favorable court rulings or settlements, often lead to increased investor confidence and price appreciation. [Link to reputable news source on Ripple legal developments]

- Increasing Institutional Adoption: Growing interest from institutional investors, including large financial firms exploring XRP's potential for cross-border payments, has fueled demand and price increases. [Link to source on institutional adoption of XRP]

- Broader Cryptocurrency Market Trends: The overall performance of the cryptocurrency market also plays a role. A bullish market sentiment often lifts the prices of most cryptocurrencies, including XRP. [Link to source on overall crypto market trends]

- Growing Use Cases for XRP in Cross-border Payments: Ripple's technology continues to gain traction in the financial sector, with increasing adoption for faster and cheaper international transactions. This growing utility strengthens XRP's position and attracts further investment. [Link to source on XRP use cases]

- Market Sentiment and Speculation: Significant price increases often fuel further speculation and FOMO (fear of missing out), driving even more demand and pushing prices higher. This speculative element contributes to XRP's volatility.

Analyzing the Volatility of XRP

XRP, like most cryptocurrencies, is inherently volatile. Its price can fluctuate dramatically in short periods. Examining historical price charts reveals significant ups and downs. [Insert historical price chart with proper attribution]. This volatility presents both opportunities and significant risks for investors. Understanding and managing this risk is paramount.

Is Now the Right Time to Buy XRP?

Assessing Current Market Conditions

Before considering buying XRP, it's essential to assess the current market landscape.

- Overall Cryptocurrency Market Sentiment: Is the broader crypto market experiencing a bull run or a bear market? A bearish market could negatively impact even the strongest cryptocurrencies. [Link to source on current crypto market sentiment]

- Regulatory Uncertainty: Regulatory changes and uncertainty in the cryptocurrency space can significantly impact XRP's price. Changes in regulations could affect its usage and adoption. [Link to source on crypto regulation]

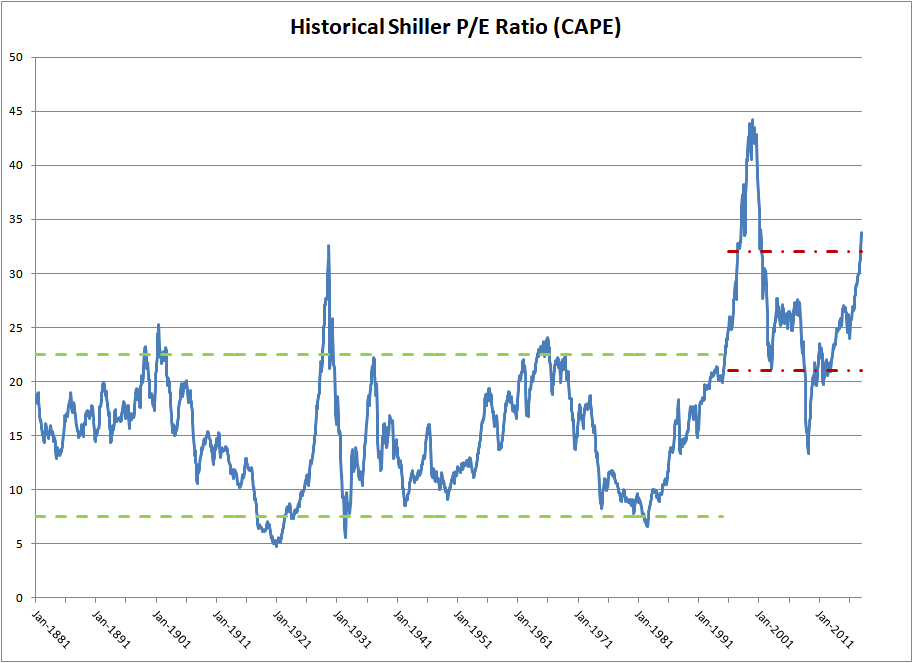

- Macroeconomic Conditions: Global economic factors, like inflation and interest rates, also influence investor behavior and cryptocurrency prices. [Link to source on macroeconomic conditions affecting crypto]

Weighing the Risks and Rewards of XRP Investment

Investing in XRP involves inherent risks and potential rewards.

- Potential for Future Growth: The success of Ripple's technology and the resolution of its legal battles could lead to substantial price appreciation for XRP.

- Downsides and Risks: The ongoing legal uncertainty, competition from other payment solutions, and the inherent volatility of the cryptocurrency market present considerable risks.

- Risk/Reward Ratio: Investors need to carefully assess their own risk tolerance and determine whether the potential rewards justify the risks associated with XRP investment.

Strategies for XRP Investors: Buy, Hold, or Sell?

The Case for Buying XRP

Buying XRP may be a viable strategy for:

- Long-Term Investment: Investors with a long-term horizon and a belief in Ripple's technology and future prospects may view the current price as an attractive entry point.

- High-Risk, High-Reward Tolerance: Investors with a high tolerance for risk may find the potential for substantial returns outweigh the risks.

The Case for Holding XRP

Holding XRP may be suitable for investors who:

- Already Own XRP: Those who already hold XRP may choose to hold onto it, anticipating future price appreciation.

- Diversification: XRP can be a part of a diversified cryptocurrency portfolio, helping to spread risk.

The Case for Selling XRP

Selling XRP might be considered if:

- Profit-Taking: Investors may choose to sell and secure their profits after the recent significant price surge.

- Risk Aversion: Investors with lower risk tolerance may decide to sell due to the inherent volatility of the cryptocurrency market.

- Changing Market Conditions: Significant shifts in market sentiment or regulatory developments could trigger a sell decision.

XRP's Future: Time to Buy, Hold, or Sell?

XRP's recent price surge is undeniably impressive, driven by a combination of positive legal developments, increased institutional adoption, and broader market trends. However, the cryptocurrency market remains inherently volatile, and regulatory uncertainty persists. The decision to buy, hold, or sell XRP depends on individual risk tolerance, investment goals, and a thorough understanding of the factors influencing its price. Before making any decisions regarding your XRP investments, conduct your own thorough research and consult with a financial advisor. Remember, responsible investing in XRP and any cryptocurrency requires careful consideration and ongoing market monitoring.

Featured Posts

-

Stock Market Valuations Bof A Says Dont Panic

May 07, 2025

Stock Market Valuations Bof A Says Dont Panic

May 07, 2025 -

Simone Biles Stunning New Hair Photos With Jonathan Owens

May 07, 2025

Simone Biles Stunning New Hair Photos With Jonathan Owens

May 07, 2025 -

Khokkey Rekordsmen Po Silovym Priemam Obyavlyaet O Zavershenii Karery

May 07, 2025

Khokkey Rekordsmen Po Silovym Priemam Obyavlyaet O Zavershenii Karery

May 07, 2025 -

Xrp Price Surge 400 Increase In 3 Months Should You Buy Now

May 07, 2025

Xrp Price Surge 400 Increase In 3 Months Should You Buy Now

May 07, 2025 -

Pandemic Fraud Lab Owner Convicted For Falsified Covid Test Results

May 07, 2025

Pandemic Fraud Lab Owner Convicted For Falsified Covid Test Results

May 07, 2025