5 Essential Do's And Don'ts: Securing A Private Credit Role

Table of Contents

DO: Network Strategically Within the Private Credit Industry

Building a strong network is paramount in the competitive world of private credit. Active networking can uncover hidden opportunities and provide invaluable insights into the industry.

Leverage LinkedIn and Industry Events

- Actively engage on LinkedIn: Join relevant groups like "Private Credit Professionals," "Alternative Investment Professionals," and others focused on finance and investment management. Follow key influencers and firms in the private credit space.

- Attend industry conferences and networking events: Participate in conferences like the SuperReturn series, PEI conferences, and regional finance industry gatherings. These events offer unparalleled networking opportunities with professionals from various private credit firms.

- Attend webinars and online events: Many firms and organizations host webinars covering topics relevant to private credit. These offer opportunities to learn and network virtually.

Networking provides invaluable insights into current market trends, reveals unadvertised private credit jobs, and allows you to build relationships that can lead to job referrals. Remember to follow up with connections made at events and online.

Informational Interviews are Key

Reaching out for informational interviews is a powerful tool for career exploration.

- Prepare targeted questions: Research the person you're contacting and formulate specific questions relevant to their experience in private credit. Focus on their career path, insights into the industry, and advice for aspiring professionals.

- Express gratitude and follow up: Always send a thank-you note after the interview, reiterating your appreciation for their time and insights. Maintain contact and engage in future conversations.

- Target professionals at various levels: Speak with analysts, associates, and senior professionals to gain a diverse perspective within the private credit industry.

Informational interviews offer a unique opportunity to gain valuable knowledge and build relationships that can significantly enhance your job search.

DO: Tailor Your Resume and Cover Letter for Specific Roles

Generic applications rarely succeed in the competitive private credit market. You need to show that you understand the specific requirements and nuances of each role.

Highlight Relevant Skills and Experience

- Quantify your achievements: Use numbers to demonstrate your impact (e.g., "Improved team efficiency by 15% through process optimization"). Highlight quantifiable results whenever possible.

- Use keywords from the job description: Analyze the job description carefully and incorporate relevant keywords from the posting into your resume and cover letter.

- Showcase relevant projects and accomplishments: Focus on experiences demonstrating your skills in financial modeling, credit analysis, and understanding of relevant regulations.

Tailoring each application ensures that your skills and experiences align directly with the specific requirements of each private credit job opening.

Showcase your Understanding of Private Credit

Demonstrate a clear understanding of the private credit industry, its strategies, and market dynamics.

- Research the specific firm: Understand their investment strategies, portfolio composition, and recent activities.

- Mention relevant industry news or publications: Demonstrate you're up-to-date on current trends and developments in private credit.

- Express your passion: Convey your genuine interest in private credit and why you are a suitable candidate.

Showing a deep understanding of the industry sets you apart from other candidates applying for private credit jobs.

DON'T: Neglect the Importance of Financial Modeling Skills

Proficiency in financial modeling is non-negotiable in a private credit role. Investment decisions hinge on accurate financial projections and analysis.

Master Financial Modeling Software

- Practice building complex financial models: Develop your skills in building models using Excel, Argus, or other relevant software.

- Familiarize yourself with industry-standard models: Understand the various types of financial models used in private credit and their applications.

- Develop your proficiency in data analysis: Develop your ability to interpret and analyze financial data to derive actionable insights.

Mastering financial modeling software is a crucial skill for any aspiring Private Credit Analyst or Private Credit Associate.

Underestimate the Value of Accuracy and Attention to Detail

Inaccurate modeling can have significant financial consequences. Attention to detail is critical.

- Develop strong QC (Quality Control) procedures: Implement robust procedures to check your work for errors.

- Utilize peer review wherever possible: Have colleagues review your models to identify potential mistakes.

- Seek feedback on your models to improve accuracy: Actively seek feedback to enhance the quality and accuracy of your models.

Accuracy and attention to detail are paramount in private credit roles.

DON'T: Underprepare for Interviews

Thorough interview preparation is critical. You need to be ready for both behavioral and technical questions.

Practice Behavioral Questions

- Use the STAR method: Structure your answers using the STAR method (Situation, Task, Action, Result) to clearly and effectively communicate your experiences.

- Practice your answers aloud: Practice your responses to common behavioral questions to ensure you can articulate your experiences confidently.

- Anticipate potential questions: Research the firm and the interviewers to predict potential questions.

Behavioral questions assess your soft skills, problem-solving abilities, and how you've handled past challenges.

Neglect Technical Interview Preparation

- Review relevant concepts and formulas: Brush up on your knowledge of financial modeling, credit analysis, and private credit strategies.

- Practice solving case studies: Practice solving case studies to demonstrate your analytical abilities.

- Research the firm's investment portfolio: Familiarize yourself with their investment strategies and portfolio holdings.

Technical questions assess your knowledge and understanding of the private credit industry.

DON'T: Settle for the First Offer

Receiving a job offer is exciting, but don't rush into accepting the first one.

Evaluate Multiple Offers

- Compare compensation and benefits: Carefully consider salary, benefits, and bonuses.

- Consider the firm’s culture and reputation: Research the firm's culture, values, and reputation within the industry.

- Evaluate the team you’ll be working with: Assess your potential team members and the work environment.

Consider the long-term growth opportunities and career prospects offered by each firm.

Negotiate Your Compensation

- Research industry salary benchmarks: Know the typical compensation range for similar roles in private credit.

- Prepare a list of your accomplishments and contributions: Be ready to justify your salary expectations.

- Be confident and professional during negotiations: Approach the negotiation process with confidence and professionalism.

Don't be afraid to negotiate—it can significantly impact your long-term earning potential.

Conclusion

Securing a private credit role requires diligent preparation and a strategic approach. By following these essential dos and don'ts, you can significantly improve your chances of landing your dream private credit job. Remember to tailor your application materials, master financial modeling, prepare thoroughly for interviews, and don't settle for the first offer. Start networking and refining your skills today – your successful private credit career awaits!

Featured Posts

-

Climate Risk Understanding The Potential Impact On Your Home Buying Credit Score

May 21, 2025

Climate Risk Understanding The Potential Impact On Your Home Buying Credit Score

May 21, 2025 -

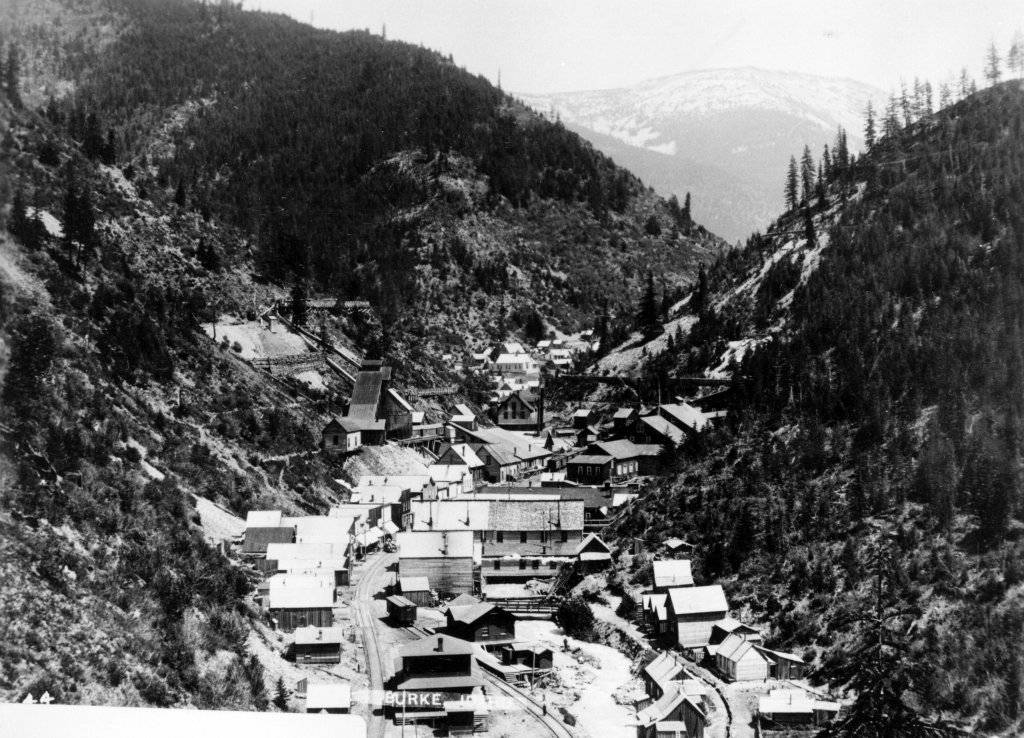

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025 -

The Critical Role Of Middle Managers In Bridging The Gap Between Leadership And Employees

May 21, 2025

The Critical Role Of Middle Managers In Bridging The Gap Between Leadership And Employees

May 21, 2025 -

The Resilience Mindset Building Mental Strength And Wellbeing

May 21, 2025

The Resilience Mindset Building Mental Strength And Wellbeing

May 21, 2025 -

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 21, 2025

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 21, 2025

Latest Posts

-

Goretzka Returns To Germany Squad Nagelsmanns Nations League Call Up

May 21, 2025

Goretzka Returns To Germany Squad Nagelsmanns Nations League Call Up

May 21, 2025 -

Quarterfinal Preview Germanys Path To Victory Against Italy

May 21, 2025

Quarterfinal Preview Germanys Path To Victory Against Italy

May 21, 2025 -

Germany Italy Quarterfinal A Clash Of Titans

May 21, 2025

Germany Italy Quarterfinal A Clash Of Titans

May 21, 2025 -

Bangladeshinfo Com Reliable Information And Data On Bangladesh

May 21, 2025

Bangladeshinfo Com Reliable Information And Data On Bangladesh

May 21, 2025 -

Live Bundesliga Schedules Teams And Top Performers

May 21, 2025

Live Bundesliga Schedules Teams And Top Performers

May 21, 2025