$500 Million Settlement Looms In Historic Canadian Bread Price-Fixing Case

Table of Contents

The Allegations: How the Bread Price-Fixing Scheme Allegedly Worked

The Canadian Competition Bureau alleges a sophisticated price-fixing scheme within the Canadian bread industry, accusing major bakery companies of colluding to artificially inflate bread prices for years. This alleged cartel activity constitutes anti-competitive behaviour, violating Canada's Competition Act. The scheme allegedly involved:

- Coordination of pricing strategies: The Competition Bureau alleges that major players secretly coordinated pricing, preventing healthy competition and ensuring consistently high prices for consumers.

- Market allocation: It's alleged that companies agreed to divide market territories, limiting competition in specific regions. This allowed them to maintain inflated prices without fear of undercutting from rivals.

- Information sharing: Evidence suggests the companies engaged in the illegal sharing of sensitive pricing and sales data, enabling them to maintain their collusive agreement. Specific details on which companies were involved and the exact methods used are still emerging as the case unfolds.

- Impact on bread types and regional pricing: The alleged price-fixing impacted various bread types, from standard white loaves to specialty breads, and affected pricing across different regions of Canada. Consumers across the country may have unknowingly paid inflated prices for years.

The Players Involved: Major Bakeries Facing Scrutiny

While the specifics of company involvement are still subject to legal proceedings, several major Canadian bakery companies are implicated in the bread price-fixing lawsuit. The Competition Bureau’s investigation has focused on companies holding significant market share within the Canadian bread industry. Their alleged participation has raised concerns about:

- Market dominance: The implicated companies’ combined market share suggests a considerable capacity to manipulate bread prices.

- Reputation damage: This investigation has undoubtedly tarnished the reputations of these companies, potentially affecting consumer trust and brand loyalty.

- Financial penalties: Besides the potential $500 million settlement, these companies face significant fines and potential legal repercussions. The long-term impact on their market position and profitability remains to be seen.

The Potential $500 Million Settlement: Implications for Consumers and the Industry

The proposed $500 million settlement represents a significant development in the Canadian bread price-fixing case. The implications are far-reaching:

- Consumer compensation: A crucial aspect of the settlement will be the distribution of funds to consumers affected by the alleged price-fixing through a class-action lawsuit. Details on how this compensation will be structured and accessed are yet to be fully disclosed.

- Adequacy of compensation: Debate surrounds whether the $500 million settlement adequately compensates consumers for years of potentially inflated bread prices. Many feel it's a mere fraction of the total overcharge incurred.

- Industry reform: This settlement could lead to significant changes within the Canadian bakery industry. Companies may face increased scrutiny, potentially resulting in altered pricing strategies and greater transparency. The case could set a precedent for stronger regulatory oversight and enforcement of anti-competitive practices.

Long-Term Effects: Preventing Future Price Fixing in the Canadian Bread Market

The Canadian bread price-fixing case provides an opportunity to strengthen consumer protection and prevent similar incidents in the future. Moving forward, several crucial steps could be implemented:

- Enhanced industry regulation: Increased oversight and enforcement by the Competition Bureau are vital to deter future price-fixing attempts.

- Strengthened consumer protection laws: Clearer regulations and increased transparency could empower consumers to challenge unfair pricing practices.

- Independent market monitoring: Establishing independent bodies to monitor bread prices and industry practices could act as a deterrent against collusion.

- Promoting competition: Initiatives to foster greater competition in the bread market, such as supporting smaller, independent bakeries, could reduce the power of large corporations to manipulate prices.

Conclusion

The potential $500 million settlement in the historic Canadian bread price-fixing case highlights the significant impact of anti-competitive behavior on consumers and the economy. The allegations of collusion among major bakery companies, the potential for consumer compensation, and the long-term implications for industry regulation underscore the gravity of this situation. This Canadian bread price-fixing case serves as a stark reminder of the importance of fair competition and strong consumer protection.

Call to Action: Stay informed about the ongoing developments in this historic Canadian bread price-fixing case. Monitor updates from the Competition Bureau and be prepared for potential changes in bread prices and industry regulations. Learn more about your consumer rights and how to participate in any class-action lawsuit related to this case. The ongoing impact of this Canadian bread price-fixing case is significant and requires continued attention.

Featured Posts

-

Anchor Brewing Company To Shutter A Legacy Concludes After 127 Years

Apr 22, 2025

Anchor Brewing Company To Shutter A Legacy Concludes After 127 Years

Apr 22, 2025 -

The Shifting Sands Trumps Trade Wars And Americas Financial Future

Apr 22, 2025

The Shifting Sands Trumps Trade Wars And Americas Financial Future

Apr 22, 2025 -

V Mware Cost Surge At And T Reports 1 050 Price Hike From Broadcom

Apr 22, 2025

V Mware Cost Surge At And T Reports 1 050 Price Hike From Broadcom

Apr 22, 2025 -

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Developer Conference

Apr 22, 2025

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Developer Conference

Apr 22, 2025 -

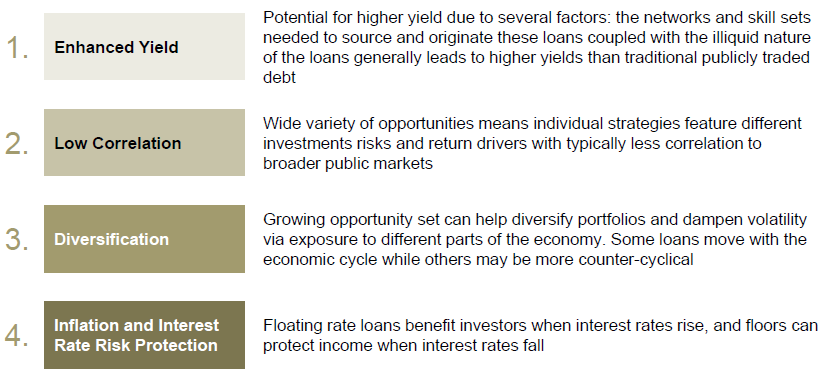

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

Latest Posts

-

Sensex And Nifty Today Robust Gains Across Sectors Live Stock Market Report

May 10, 2025

Sensex And Nifty Today Robust Gains Across Sectors Live Stock Market Report

May 10, 2025 -

Indian Stock Market Update Sensex Nifty And Key Movers Today

May 10, 2025

Indian Stock Market Update Sensex Nifty And Key Movers Today

May 10, 2025 -

Pre May 5th Palantir Stock Outlook Is It A Good Investment Opportunity

May 10, 2025

Pre May 5th Palantir Stock Outlook Is It A Good Investment Opportunity

May 10, 2025 -

Palantir Stock Plunge Should You Buy The Dip

May 10, 2025

Palantir Stock Plunge Should You Buy The Dip

May 10, 2025 -

Indian Stock Market Update Sensex And Nifty Rally Detailed Market Analysis

May 10, 2025

Indian Stock Market Update Sensex And Nifty Rally Detailed Market Analysis

May 10, 2025