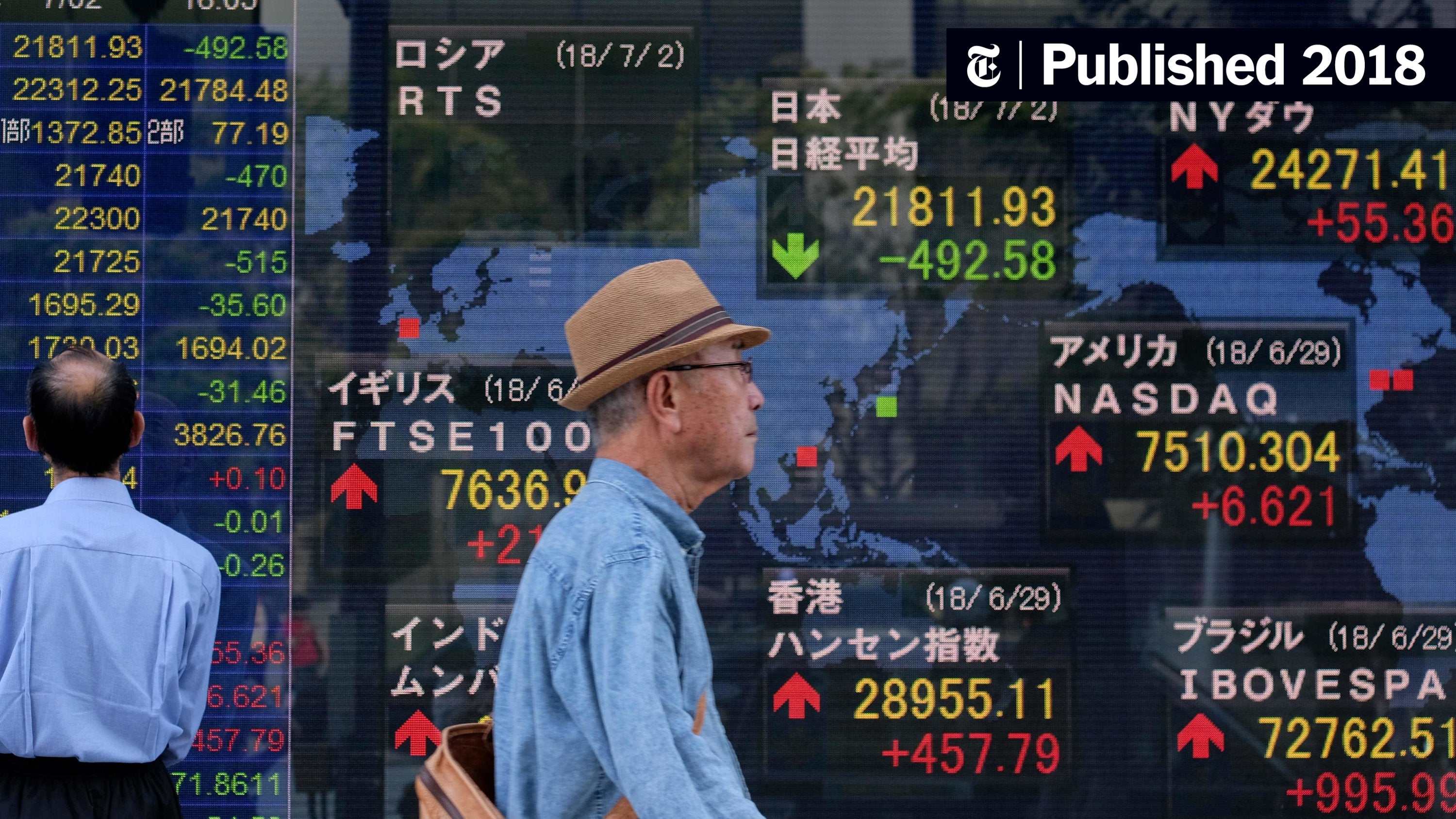

7% Plunge For Amsterdam Stocks As Trade War Fears Escalate

Table of Contents

The Impact of Trade War Fears on Global Markets

Trade wars, characterized by escalating tariffs and trade restrictions between major economies, create a ripple effect across global financial markets. This uncertainty significantly impacts investor sentiment, leading to decreased confidence and increased market volatility. The fear of reduced international trade and slower economic growth triggers sell-offs as investors seek to protect their assets. This isn't isolated to Amsterdam; similar concerns have negatively affected stock markets worldwide, including those in the US, China, and Europe.

- Decreased investor confidence: Uncertainty surrounding trade policies forces investors to reassess their portfolios, leading to widespread selling.

- Increased market volatility: The unpredictable nature of trade disputes creates a volatile market environment, making investment planning more challenging.

- Negative impact on international trade and economic growth: Trade wars disrupt established supply chains and hinder the flow of goods and services, leading to slower economic growth globally.

Specific Factors Affecting Amsterdam Stocks

The Amsterdam stock exchange, like others, possesses unique vulnerabilities that amplify the effects of trade wars. The Dutch economy, with its reliance on international trade and specific export-oriented sectors like technology and agriculture, is particularly susceptible. Companies heavily involved in global trade face significant challenges from tariffs and trade restrictions, directly impacting their profitability and stock prices.

- High reliance on international trade: Many Dutch companies depend on exporting goods and services, making them highly vulnerable to trade disruptions.

- Impact of tariffs and trade restrictions: Increased tariffs on Dutch exports can reduce competitiveness and negatively impact revenue streams.

- Analysis of specific stock performances: Specific companies within sectors highly exposed to international trade, experienced disproportionately large drops in their stock prices during the recent market downturn.

Investor Reactions and Strategies

The 7% plunge in Amsterdam stocks triggered a range of investor reactions, primarily characterized by a shift towards risk aversion. Many investors opted to sell off assets perceived as high-risk, while others employed hedging strategies to mitigate potential losses. The increased uncertainty led to a surge in demand for safe-haven assets like gold and government bonds.

- Increased demand for safe-haven assets: Investors sought refuge in assets considered less volatile during times of market uncertainty.

- Diversification strategies: Investors diversified their portfolios to reduce exposure to specific sectors or regions heavily impacted by the trade war.

- Short-term vs. long-term investment perspectives: Some investors adopted a short-term strategy, focusing on quick profits, while others maintained a long-term outlook, believing the market would eventually recover.

Potential Outcomes and Future Predictions

The future trajectory of Amsterdam stocks hinges on several factors, primarily the resolution (or escalation) of trade tensions. Positive developments, such as de-escalation of trade disputes and a return to more predictable trade policies, could lead to market recovery. Conversely, a further escalation of the trade war could trigger further declines. Close monitoring of economic indicators like GDP growth, inflation, and consumer confidence is crucial for predicting future market movements. Government interventions, such as economic stimulus packages, could also play a significant role in influencing market trends.

- Scenarios for resolution (or escalation) of trade tensions: The outcome of ongoing trade negotiations will significantly impact the Amsterdam stock market.

- Economic indicators to watch: Tracking key economic indicators provides insights into the overall health of the economy and potential market trends.

- Potential policy responses: Government policies aimed at mitigating the economic impact of the trade war can influence market recovery.

Conclusion: Navigating the Uncertainty of Amsterdam Stocks Amidst Trade Wars

The 7% plunge in Amsterdam stocks highlights the significant impact of escalating trade war fears on investor confidence and market stability. The high reliance on international trade within the Dutch economy and the specific vulnerabilities of certain sectors make the Amsterdam stock market particularly sensitive to global trade dynamics. While future scenarios remain uncertain, understanding the interplay of trade tensions, investor behavior, and potential policy responses is crucial for navigating this challenging environment.

To make informed investment decisions relating to Amsterdam stocks and manage risk during periods of trade uncertainty, stay informed about global trade developments and consult with financial advisors. Understanding the Amsterdam stock market outlook requires diligent monitoring of economic indicators and a keen awareness of evolving global trade relations.

Featured Posts

-

Ace Your Private Credit Job Interview 5 Essential Tips

May 24, 2025

Ace Your Private Credit Job Interview 5 Essential Tips

May 24, 2025 -

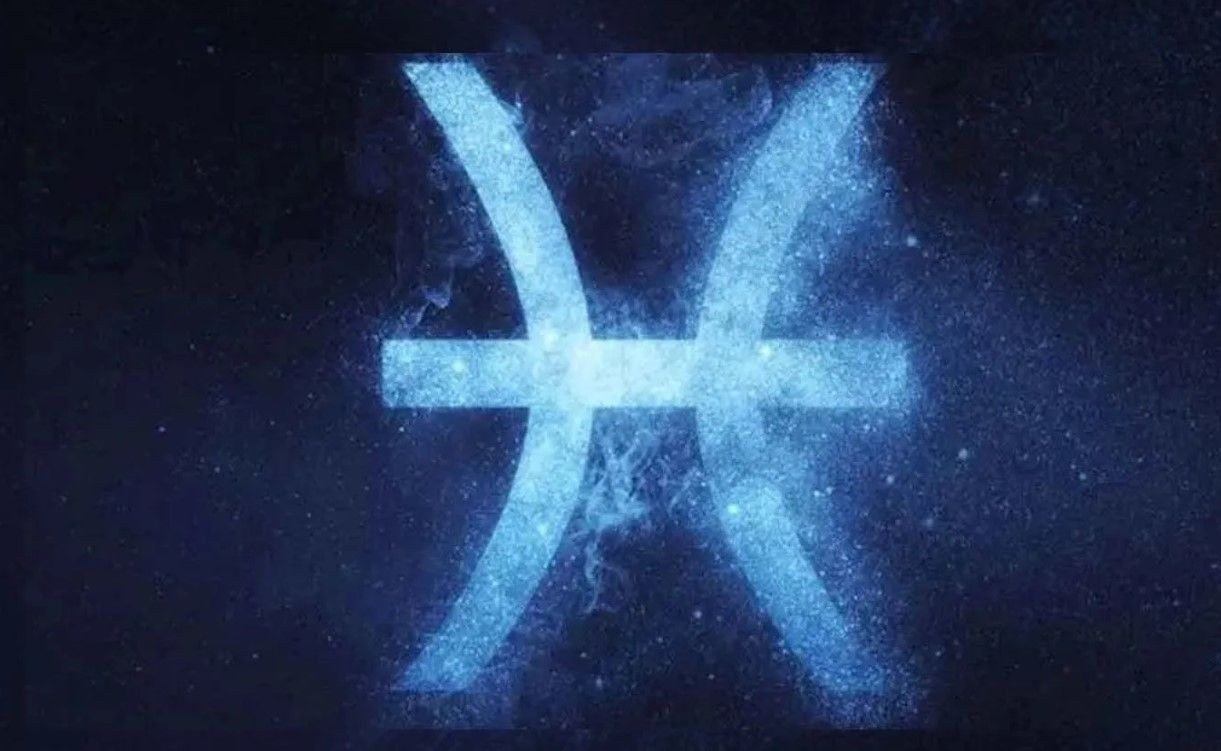

Mayis Ta Aski Bulmaya En Yakin 3 Burc

May 24, 2025

Mayis Ta Aski Bulmaya En Yakin 3 Burc

May 24, 2025 -

A Married Couples Fight Over Joe Jonas And His Reaction

May 24, 2025

A Married Couples Fight Over Joe Jonas And His Reaction

May 24, 2025 -

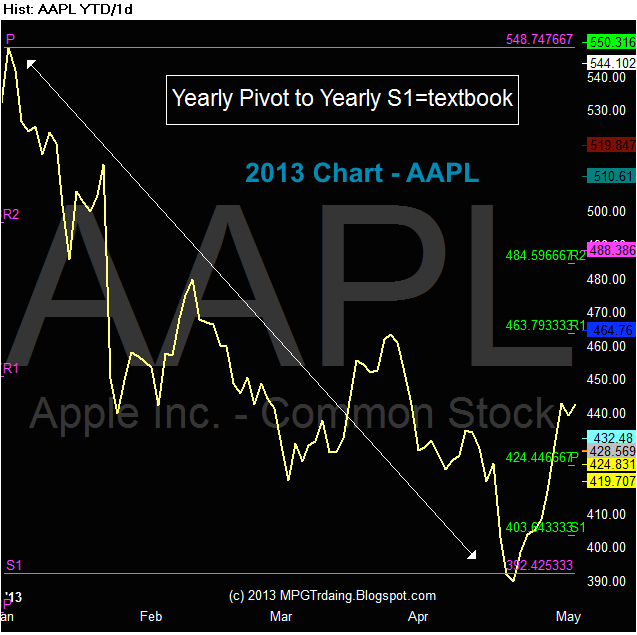

Apple Stock Aapl Price Targets Key Levels And Technical Analysis

May 24, 2025

Apple Stock Aapl Price Targets Key Levels And Technical Analysis

May 24, 2025 -

16 Mart Ta Dogmus Olanlarin Burcu Ve Oezellikleri Nelerdir

May 24, 2025

16 Mart Ta Dogmus Olanlarin Burcu Ve Oezellikleri Nelerdir

May 24, 2025

Latest Posts

-

Avoid Memorial Day Travel Delays 2025s Busiest Flight Days

May 25, 2025

Avoid Memorial Day Travel Delays 2025s Busiest Flight Days

May 25, 2025 -

The Financial Aspects Of Your Escape To The Country

May 25, 2025

The Financial Aspects Of Your Escape To The Country

May 25, 2025 -

Escape To The Country Making The Move To Rural Living

May 25, 2025

Escape To The Country Making The Move To Rural Living

May 25, 2025 -

Building Inspiration Lego Master Manny Garcia At Veterans Memorial Elementary

May 25, 2025

Building Inspiration Lego Master Manny Garcia At Veterans Memorial Elementary

May 25, 2025 -

Manny Garcias Lego Workshop At Veterans Memorial Elementary School Photos

May 25, 2025

Manny Garcias Lego Workshop At Veterans Memorial Elementary School Photos

May 25, 2025