ABN Amro Bonus Scheme Under Investigation: Potential For Significant Fine

Table of Contents

Allegations of Misconduct within the ABN Amro Bonus Scheme

The core of the ABN Amro bonus scheme investigation centers around allegations of serious misconduct. These breaches reportedly involve failures in several key areas, potentially leading to significant regulatory penalties. The alleged irregularities within the ABN Amro bonus structure include:

-

Failure to comply with anti-money laundering (AML) regulations: Reports suggest that the bonus scheme may have incentivized behaviors that overlooked or even facilitated AML violations. This could involve insufficient due diligence on clients or insufficient reporting of suspicious transactions. The lack of robust AML compliance within the bonus structure is a major concern for regulators.

-

Inappropriate risk management practices related to bonus payouts: Concerns have been raised about the bank's risk assessment and management processes concerning bonus payments. It is alleged that the bonus structure may have encouraged excessive risk-taking, potentially destabilizing the bank's financial position. This aspect of the ABN Amro bonus scheme investigation is crucial as it relates directly to financial stability.

-

Unethical conduct leading to excessive bonus payments: Allegations include that bonuses were awarded disproportionately, disregarding performance or even in cases of demonstrable misconduct. This suggests a breakdown in ethical standards and corporate governance within ABN Amro. The investigation will undoubtedly scrutinize the criteria used for bonus allocation and whether they aligned with ethical banking practices.

The sources of these allegations are multifaceted, encompassing internal whistleblowers, external investigations initiated by regulatory bodies, and media reports that have brought this issue to public attention. Specific examples of problematic bonus payments are expected to emerge as the investigation progresses, potentially further detailing the severity of the alleged misconduct.

The Regulatory Response and Ongoing Investigation

Multiple regulatory bodies are actively involved in the ABN Amro bonus scheme investigation. This includes, but is not limited to, De Nederlandsche Bank (DNB), the Dutch central bank, and potentially the European Central Bank (ECB), given the international reach of ABN Amro's operations.

The timeline of events is crucial. The investigation likely began with initial reports or internal audits that uncovered suspicious activities. Key milestones will include inspections of ABN Amro's internal documentation, interviews with employees, and the eventual issuance of findings and potential penalties.

The investigative methods employed by the regulatory bodies are thorough and comprehensive. These involve detailed inspections of the bank's internal processes, extensive interviews with employees at various levels, and a rigorous review of relevant documentation, including emails, financial records, and bonus payment records.

The potential penalties are substantial and could include:

- Significant financial fines: The magnitude of the fine will depend on the severity of the alleged breaches and the cooperation provided by ABN Amro during the investigation.

- Restrictions on operations: Regulators may impose limitations on certain ABN Amro activities, such as specific types of lending or investment banking.

- Reputational damage: This is perhaps the most enduring consequence. The negative publicity surrounding the investigation will likely impact ABN Amro's brand image and customer trust.

Impact on ABN Amro's Reputation and Share Price

The ABN Amro bonus scheme investigation has already had a noticeable impact on the bank's reputation. Public perception has been negatively affected, with concerns raised about corporate governance and ethical standards. This negative sentiment translates directly into investor confidence. The investigation has led to share price fluctuations, reflecting market uncertainty and investor apprehension. The long-term effects on the bank's business and profitability remain uncertain but could be substantial, impacting future growth prospects and potentially leading to a loss of market share.

Potential Implications for ABN Amro Employees Involved

The implications for ABN Amro employees potentially involved in the alleged misconduct are far-reaching. They could face:

- Disciplinary actions: This could range from formal warnings to termination of employment.

- Legal repercussions: Individuals could face legal action, including civil lawsuits or even criminal charges depending on the nature and severity of their involvement.

This situation underscores the vital role of corporate governance and robust internal controls. A strong ethical framework and effective oversight mechanisms are crucial in preventing such incidents. The investigation will likely examine the adequacy of ABN Amro's internal controls and whether these failed to prevent or detect the alleged misconduct. The impact on employee morale and retention is also a significant concern. The investigation and its aftermath could negatively impact the overall working environment and potentially lead to a loss of talented employees.

Conclusion

The investigation into the ABN Amro bonus scheme highlights the significant risks associated with inadequate risk management and compliance failures within financial institutions. The potential for a substantial fine underscores the importance of robust internal controls and ethical conduct. This case serves as a cautionary tale for other banks and financial institutions.

Call to Action: Stay informed about the developments in the ABN Amro bonus scheme investigation. Follow reputable news sources for updates on this important case and the implications for the future of banking regulations and compensation structures. Understanding the complexities of the ABN Amro bonus scheme investigation and its potential consequences is crucial for anyone invested in or affected by the financial sector.

Featured Posts

-

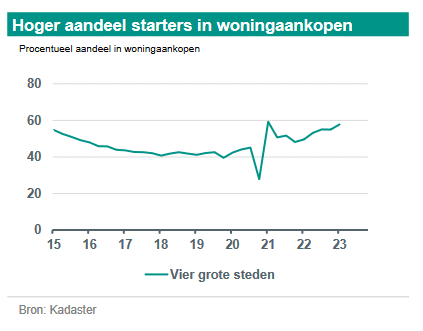

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhogingen

May 21, 2025

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhogingen

May 21, 2025 -

Meet Peppa Pigs New Baby Everything We Know So Far

May 21, 2025

Meet Peppa Pigs New Baby Everything We Know So Far

May 21, 2025 -

La Rental Market Exploits Price Gouging After Recent Fires

May 21, 2025

La Rental Market Exploits Price Gouging After Recent Fires

May 21, 2025 -

Former Liverpool Managers Impact Hout Bay Fcs Improved Fortunes

May 21, 2025

Former Liverpool Managers Impact Hout Bay Fcs Improved Fortunes

May 21, 2025 -

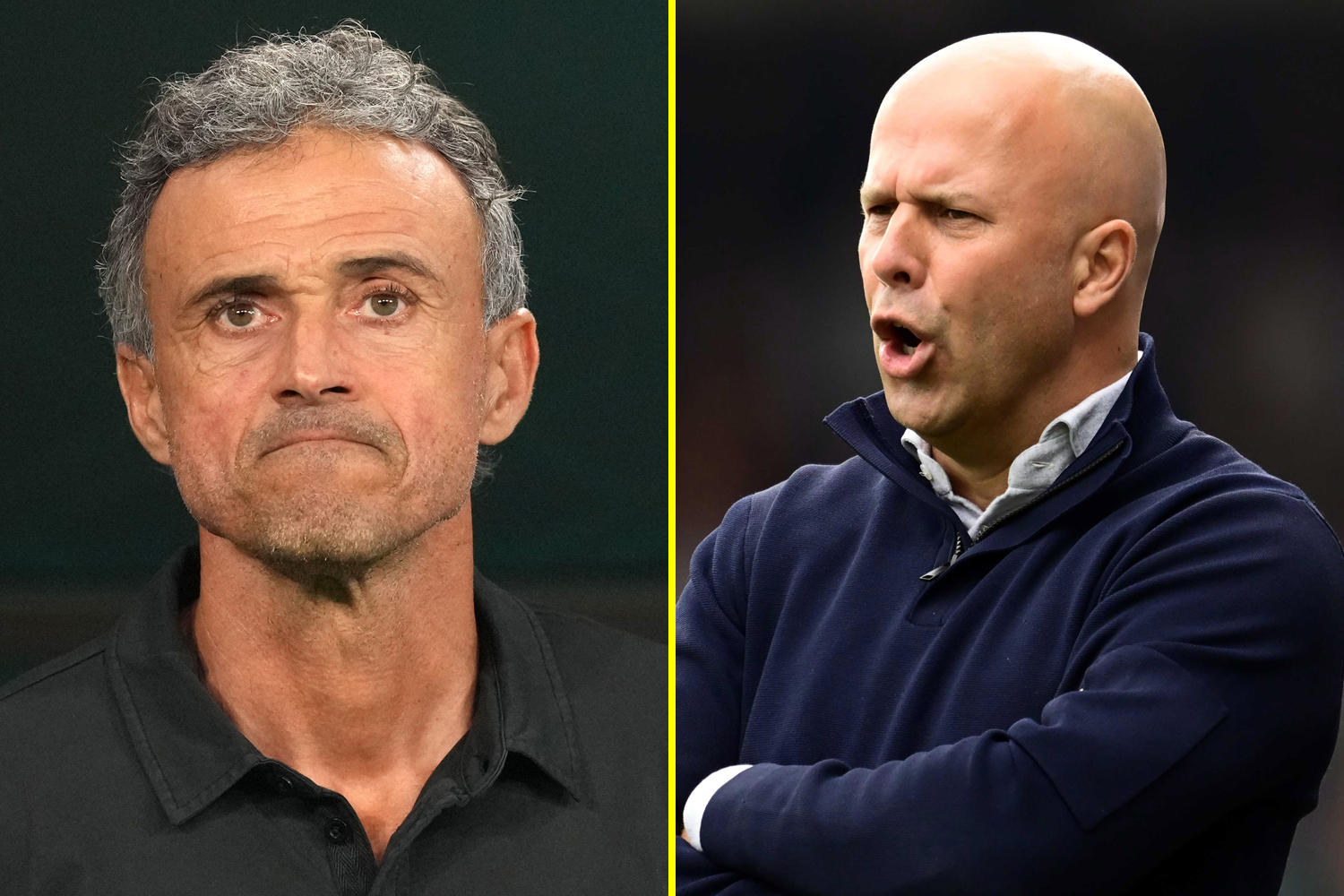

Analysis Arne Slot And Luis Enrique On Liverpools Win And Alissons Role

May 21, 2025

Analysis Arne Slot And Luis Enrique On Liverpools Win And Alissons Role

May 21, 2025

Latest Posts

-

Analyzing Trumps Aerospace Agreements Big Promises Limited Transparency

May 21, 2025

Analyzing Trumps Aerospace Agreements Big Promises Limited Transparency

May 21, 2025 -

Trumps Aerospace Deals A Critical Examination Of Substance Vs Spectacle

May 21, 2025

Trumps Aerospace Deals A Critical Examination Of Substance Vs Spectacle

May 21, 2025 -

Hudsons Bay And Canadian Tire Examining The Synergies And Challenges Of A Merger

May 21, 2025

Hudsons Bay And Canadian Tire Examining The Synergies And Challenges Of A Merger

May 21, 2025 -

Will Canadian Tires Acquisition Of Hudsons Bay Succeed A Cautious Analysis

May 21, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Succeed A Cautious Analysis

May 21, 2025 -

Solve The Nyt Mini Crossword March 13 Solutions And Tips

May 21, 2025

Solve The Nyt Mini Crossword March 13 Solutions And Tips

May 21, 2025