AEX Index Falls Below Key Support Level; One-Year Low Reached

Table of Contents

Technical Analysis of the AEX Index Decline

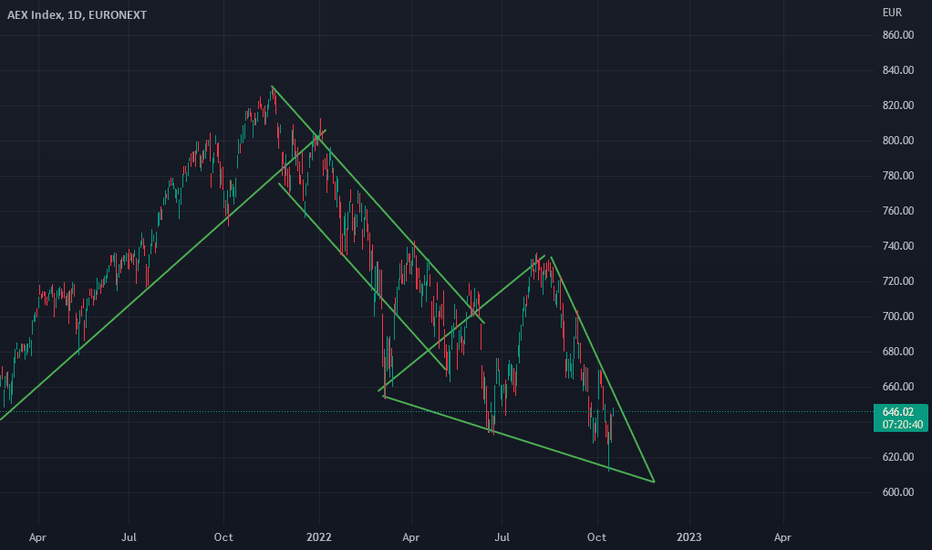

The recent drop in the AEX Index is evident in its breach of a key support level, a significant technical indicator signaling a shift in market momentum. This support level, historically around 700 points, had provided resistance to previous downward pressure. Its breach suggests a weakening trend and increased selling pressure. Several other technical indicators confirm this downward trajectory.

- Moving Averages: Both the 50-day and 200-day moving averages have shown a bearish crossover, further confirming the negative trend. This suggests a sustained downward momentum is likely to continue.

- Relative Strength Index (RSI): The RSI has fallen below 30, indicating oversold conditions. While this could signal a potential rebound, it also suggests the market is significantly weak.

- Chart Patterns: The chart displays characteristics suggestive of a potential "head and shoulders" pattern, a bearish reversal pattern often predicting further declines. Confirmation of this pattern would solidify the bearish outlook.

Underlying Economic Factors Contributing to the AEX Drop

The decline in the AEX Index isn't isolated; it's interconnected with broader macroeconomic factors and global events. Several key influences have contributed to this downturn.

- Inflation and Interest Rates: Persistently high inflation rates have prompted central banks, including the European Central Bank, to implement aggressive interest rate hikes. This increased borrowing cost impacts company profitability and reduces investor appetite for riskier assets, thereby negatively impacting stock valuations.

- Geopolitical Tensions: Ongoing geopolitical instability, particularly the war in Ukraine and its effects on energy prices and supply chains, creates uncertainty and risk aversion in the market, leading to capital flight and downward pressure on stock markets worldwide, including the AEX.

- Sectoral Performance: The energy sector has experienced significant volatility, while the financial and technology sectors have also underperformed, contributing to the overall decline of the AEX. Specific companies within these sectors, experiencing their own financial difficulties, have significantly impacted the index.

Investor Sentiment and Market Reaction

The prevailing investor sentiment is characterized by significant fear and uncertainty. This is reflected in increased market volatility and high trading volumes. The sharp decline has triggered considerable market activity as investors react to the changing market conditions.

- Increased Volatility: Daily price fluctuations have become more extreme, reflecting the heightened uncertainty and nervous investor behavior.

- High Trading Volumes: The increased trading volume indicates significant investor activity, with many attempting to exit their positions or adjust their portfolios in response to the market downturn.

- Analyst Predictions: Many analysts predict further downward pressure on the AEX in the short term, though long-term forecasts vary depending on the resolution of underlying economic and geopolitical issues.

- Impact on Investor Confidence: The one-year low reached has significantly eroded investor confidence in the Dutch stock market, leading many to adopt more cautious approaches.

Strategies for Investors in a Falling AEX Market

Navigating a falling market like the current AEX requires careful risk management and strategic decision-making.

- Diversification: Diversifying investments across different asset classes (e.g., bonds, real estate) and geographical regions can mitigate losses during market downturns.

- Defensive Investment Options: Shifting towards more defensive investment options, such as high-quality dividend-paying stocks or government bonds, can provide stability during periods of market uncertainty.

- Value Investing Opportunities: The current market presents potential opportunities for value investors to identify undervalued companies poised for future growth. Thorough due diligence is crucial in this scenario.

- Long-Term Investment Strategy: Maintaining a long-term investment horizon is crucial. Short-term market fluctuations shouldn't derail a well-defined, long-term investment strategy.

Conclusion: Navigating the AEX Index's Decline – A Look Ahead

The AEX Index's fall to a one-year low is a result of a confluence of factors, including the breach of a key support level, macroeconomic headwinds, and weakened investor sentiment. The significant market decline underscores the importance of carefully monitoring the AEX index and understanding the underlying economic forces at play. While short-term predictions remain uncertain, investors should prioritize risk management, diversify their portfolios, and consider defensive strategies. To stay updated on AEX market trends and make informed investment decisions, monitor the AEX index closely and consult with a financial advisor for personalized guidance. Subscribe to our newsletter for further updates on AEX index analysis and related market news to effectively navigate this challenging market environment.

Featured Posts

-

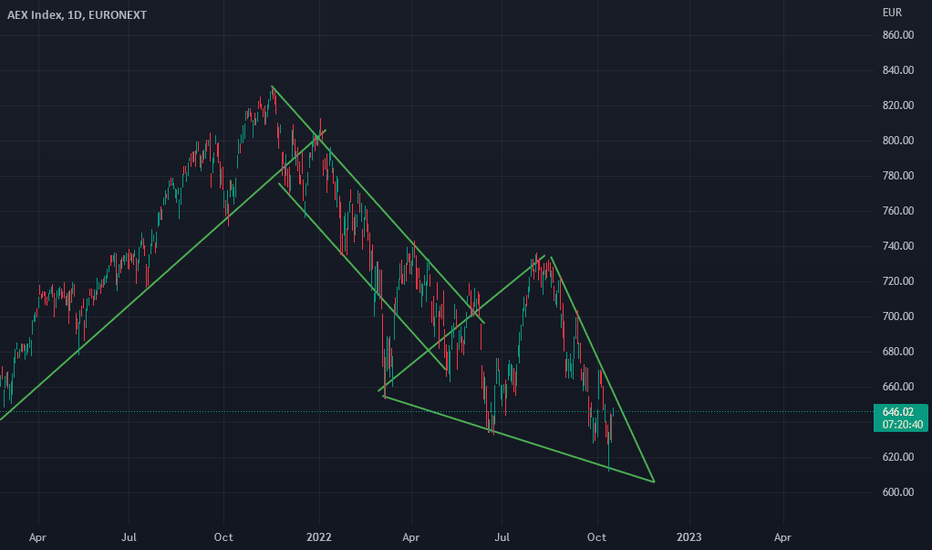

Konchita Vurst Zhivott Sled Bradatata Pobeda Na Evroviziya

May 24, 2025

Konchita Vurst Zhivott Sled Bradatata Pobeda Na Evroviziya

May 24, 2025 -

Gear Essentials For Ferrari Owners A Comprehensive Guide

May 24, 2025

Gear Essentials For Ferrari Owners A Comprehensive Guide

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Analysis And Implications

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Analysis And Implications

May 24, 2025 -

Footballer Kyle Walkers Post Match Activities In Milan Spark Speculation

May 24, 2025

Footballer Kyle Walkers Post Match Activities In Milan Spark Speculation

May 24, 2025 -

2024 Philips Annual General Meeting A Summary Of Proceedings

May 24, 2025

2024 Philips Annual General Meeting A Summary Of Proceedings

May 24, 2025

Latest Posts

-

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025 -

One Analyst Predicts Apple Stock At 254 Is It A Buy Around 200

May 24, 2025

One Analyst Predicts Apple Stock At 254 Is It A Buy Around 200

May 24, 2025 -

900 Million Tariff Bite How It Affects Apple Stock

May 24, 2025

900 Million Tariff Bite How It Affects Apple Stock

May 24, 2025 -

Apple Stock Forecast 254 Price Target Should You Buy Now

May 24, 2025

Apple Stock Forecast 254 Price Target Should You Buy Now

May 24, 2025 -

Apple Stock Price Drop The Impact Of New Tariffs

May 24, 2025

Apple Stock Price Drop The Impact Of New Tariffs

May 24, 2025