Amsterdam AEX Index Suffers Sharpest Decline In Over A Year

Table of Contents

Causes of the Amsterdam AEX Index Decline

Several interconnected factors contributed to the sharpest decline in the Amsterdam AEX Index in over a year. These can be broadly categorized into global economic uncertainty, the underperformance of specific AEX companies, and the weakening of the Euro.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty. Rising inflation, aggressive interest rate hikes by central banks worldwide, and persistent geopolitical risks, particularly the ongoing war in Ukraine, have created a volatile environment for investors.

- Specific examples: The surge in energy prices due to the war in Ukraine, persistent supply chain disruptions, and the ongoing inflationary pressures in major economies.

- Impact on investor sentiment: This uncertainty has led to increased risk aversion among investors, prompting many to reduce their exposure to riskier assets, including equities. Market volatility has increased significantly, leading to sharp price swings in the AEX. This is impacting the AEX performance negatively.

- Keywords: Global market volatility, inflation, interest rates, geopolitical risk, AEX performance.

Performance of Specific AEX Companies

The decline in the Amsterdam AEX Index is not solely attributable to global factors; the underperformance of several key AEX constituent stocks has also played a significant role.

- Specific companies and sectors: For example, several energy companies listed on the AEX have experienced setbacks due to fluctuating energy prices and regulatory changes. Technology companies have also faced headwinds due to slowing global growth and increased competition. Financial institutions have been impacted by rising interest rates and reduced lending activity.

- Reasons for poor performance: Decreased earnings, supply chain disruptions, and increased competition all contributed to the weaker-than-expected performance of many AEX companies.

- Keywords: AEX constituent stocks, company performance, sector performance, stock market decline.

Impact of the Euro's Weakening

The weakening of the Euro against other major currencies, such as the US dollar, has also negatively impacted the AEX. A weaker Euro can make Dutch exports more expensive, thus hindering international trade and impacting the profitability of Dutch companies.

- Correlation between Euro and AEX: A weakening Euro often translates to reduced earnings for companies that rely heavily on exports, leading to lower stock valuations and a decline in the AEX.

- Implications of a weaker Euro: A weaker Euro makes imports more expensive, potentially fueling inflation within the Netherlands and putting further pressure on consumer spending.

- Keywords: Euro exchange rate, currency fluctuations, international trade, AEX volatility.

Investor Sentiment and Market Reactions

The sharp decline in the Amsterdam AEX Index has significantly impacted investor sentiment and market reactions.

Investor Confidence

Investor confidence has eroded considerably following the recent downturn. We've seen a clear flight to safety, with investors shifting their investments to less risky assets like government bonds.

- Investor behavior: Many investors have adopted more conservative strategies, reducing their equity holdings and increasing their cash positions.

- Investment flows: We've seen a significant outflow of funds from the Dutch equity market, indicating a lack of confidence in the near-term prospects of the AEX.

- Keywords: Investor sentiment, market sentiment, risk aversion, portfolio diversification.

Analyst Predictions and Outlook

Financial analysts offer mixed predictions regarding the future performance of the Amsterdam AEX Index.

- Analyst predictions: Some analysts believe that the current downturn represents a buying opportunity, predicting a recovery in the coming months. Others remain cautious, citing ongoing global uncertainties and potential further declines.

- Potential scenarios: The outlook depends heavily on developments in the global economy, including inflation, interest rates, and geopolitical stability. A resolution to the war in Ukraine could positively impact investor sentiment and the AEX. Conversely, escalating global tensions or persistent inflation could lead to further declines.

- Keywords: AEX forecast, market outlook, stock market prediction, expert analysis.

Conclusion

The sharpest decline of the Amsterdam AEX Index in over a year is a result of a complex interplay of global economic uncertainty, underperforming AEX companies, and a weakening Euro. The resulting decline in investor confidence highlights the need for a cautious approach to investing in the current volatile market. Understanding these factors is crucial for informed decision-making. Stay updated on the latest developments in the Amsterdam AEX Index to make informed investment decisions and monitor the Amsterdam AEX Index closely for potential opportunities and risks. Consult reputable financial news sources for the most up-to-date information and analysis.

Featured Posts

-

Prehlad Nemecke Firmy A Vlna Prepustania V Roku 2024

May 25, 2025

Prehlad Nemecke Firmy A Vlna Prepustania V Roku 2024

May 25, 2025 -

Deutscher Aktienmarkt Dax Eroeffnungskurs Und Einfluss Des Faelligkeitstermins 21 Maerz 2025

May 25, 2025

Deutscher Aktienmarkt Dax Eroeffnungskurs Und Einfluss Des Faelligkeitstermins 21 Maerz 2025

May 25, 2025 -

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 25, 2025

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 25, 2025 -

Kering Sales Dip Demnas Gucci Debut In September

May 25, 2025

Kering Sales Dip Demnas Gucci Debut In September

May 25, 2025 -

Frankfurt Dax Days Trading Ends With Losses Below 24 000

May 25, 2025

Frankfurt Dax Days Trading Ends With Losses Below 24 000

May 25, 2025

Latest Posts

-

The Impact Of Economic Slowdown Sse Reduces Spending By 3 Billion

May 25, 2025

The Impact Of Economic Slowdown Sse Reduces Spending By 3 Billion

May 25, 2025 -

Slowing Growth Forces Sse To Cut Spending By 3 Billion

May 25, 2025

Slowing Growth Forces Sse To Cut Spending By 3 Billion

May 25, 2025 -

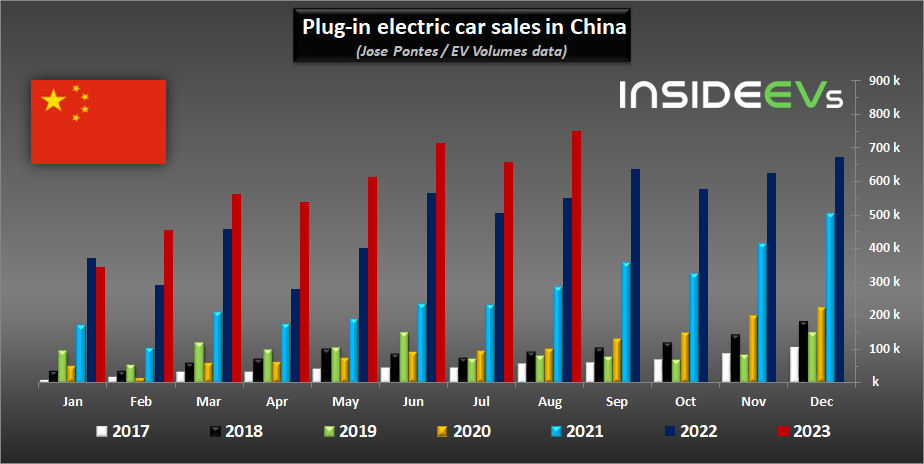

The Future Of Luxury Car Sales In China Lessons From Bmw And Porsches Experience

May 25, 2025

The Future Of Luxury Car Sales In China Lessons From Bmw And Porsches Experience

May 25, 2025 -

The Pilbara Debate Rio Tintos Response To Forrests Wasteland Allegations

May 25, 2025

The Pilbara Debate Rio Tintos Response To Forrests Wasteland Allegations

May 25, 2025 -

Analysis Sses 3 Billion Spending Reduction And Its Implications

May 25, 2025

Analysis Sses 3 Billion Spending Reduction And Its Implications

May 25, 2025