Amsterdam Stock Market: Three Days Of Significant Declines Totaling 11%

Table of Contents

The Amsterdam Stock Market (AEX Index), a key indicator of the Netherlands' economic health, suffered a significant setback this week, plummeting 11% over three consecutive trading days. This dramatic decline has sent shockwaves through the Dutch economy and left investors grappling with uncertainty. This article aims to dissect the contributing factors to this sharp downturn, explore the affected sectors, and analyze the potential short-term and long-term implications for the Dutch economy and investors. We will examine the causes, consequences, and potential future outlook for the Amsterdam Stock Market, providing insights for navigating this volatile period.

Analyzing the Causes of the Amsterdam Stock Market Decline

Global Economic Uncertainty

The recent decline in the Amsterdam Stock Market is inextricably linked to growing global economic uncertainty. Several interconnected factors have contributed to this negative investor sentiment:

-

Rising Inflation: Persistent high inflation rates across major economies are eroding purchasing power and dampening consumer spending, leading to fears of a potential recession. The impact of inflation on business profitability and consumer confidence is a significant driver of market volatility.

-

Recessionary Fears: Concerns about a looming recession in key global markets, particularly the US and Europe, are prompting investors to adopt a more risk-averse approach, leading to significant sell-offs. The anticipation of further interest rate hikes exacerbates this concern.

-

Geopolitical Tensions: The ongoing war in Ukraine and the resulting energy crisis have created significant geopolitical instability, fueling uncertainty and impacting investor confidence worldwide. This uncertainty directly translates to reduced investment in riskier assets, including those listed on the Amsterdam Stock Exchange.

-

Interest Rate Hikes: Central banks globally are aggressively raising interest rates to combat inflation, increasing borrowing costs for businesses and potentially stifling economic growth. This tightening monetary policy contributes to a less favorable investment climate.

These global factors have collectively fueled a climate of fear and uncertainty, prompting investors to withdraw from riskier assets, including many stocks listed on the Amsterdam Stock Exchange, leading to the observed decline.

Specific Sectoral Impacts

The 11% drop in the Amsterdam Stock Exchange wasn't felt equally across all sectors. Certain sectors proved more vulnerable than others:

-

Energy: The energy sector, already facing significant volatility due to the war in Ukraine and global supply chain disruptions, experienced particularly sharp declines. Companies reliant on volatile energy prices were disproportionately affected. For example, [mention specific energy company and its percentage drop, if data is available].

-

Technology: The technology sector, sensitive to interest rate hikes and macroeconomic uncertainty, also saw significant losses. Increased borrowing costs and a decrease in consumer spending directly impact the profitability of tech companies. [Mention specific tech company and its percentage drop, if data is available].

-

Finance: Financial institutions, facing increased regulatory scrutiny and potential loan defaults amidst economic uncertainty, were also impacted by the downturn. The interconnectedness of the global financial system means that weakness in one area can quickly spread to others.

These sectors were particularly vulnerable due to their sensitivity to broader economic conditions and specific industry-related headwinds.

Investor Sentiment and Market Psychology

The dramatic decline in the Amsterdam Stock Market reflects a palpable shift in investor sentiment. A combination of factors contributed to this negative psychology:

-

Panic Selling: As the market began to fall, a wave of panic selling amplified the downturn, with investors rushing to liquidate their holdings to minimize potential losses. This herd behavior further accelerated the decline.

-

Risk Aversion: Investors shifted towards safer assets, such as government bonds, further exacerbating the sell-off in the stock market. Risk appetite decreased significantly in response to global uncertainty.

-

Negative News Cycles: Negative news coverage of the market downturn, further fueled by social media, contributed to a self-reinforcing cycle of fear and uncertainty among investors.

This combination of panic selling, risk aversion, and negative media coverage created a perfect storm, amplifying the initial decline and leading to the significant drop in the AEX Index.

The Impact on Key Economic Indicators in the Netherlands

AEX Index Performance

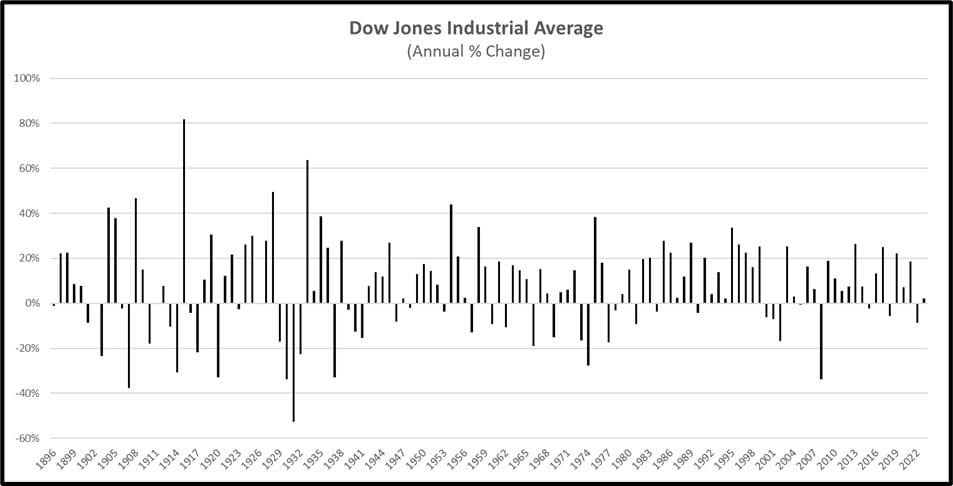

The AEX Index experienced a steep decline over the three-day period: [Insert chart/graph showing the daily percentage changes]. This performance contrasts sharply with other major European indices like the DAX (Germany) and CAC 40 (France) – [include comparative data if available and context on the differences]. This divergence indicates that factors specific to the Dutch economy may have also played a role, beyond the global trends.

Impact on Dutch Businesses and Consumers

The market downturn in Amsterdam will likely have a significant impact on the Netherlands economy, affecting both businesses and consumers:

-

Consumer Confidence: The market volatility could erode consumer confidence, leading to reduced spending and potentially slowing economic growth.

-

Business Investment: Uncertainty in the market may discourage businesses from making significant investments, hindering economic expansion.

-

Economic Growth: The overall impact on economic growth will depend on the duration and severity of the market decline, as well as the government's response. The ripple effects will be felt across various sectors.

The long-term consequences remain uncertain and depend heavily on the speed and strength of any market recovery.

Potential Future Outlook for the Amsterdam Stock Market

Analyst Predictions and Market Forecasts

Expert opinions on the future outlook for the Amsterdam Stock Market are varied, but many analysts anticipate a period of continued volatility: [Include summary of expert opinions and forecasts if available, citing sources]. Potential catalysts for recovery include:

-

Easing of Global Tensions: A de-escalation of geopolitical conflicts and increased global stability could improve investor sentiment.

-

Inflation Control: Successful efforts to control inflation and stabilize interest rates could help restore investor confidence.

However, the path to recovery is not guaranteed and further declines are possible depending on evolving global economic conditions.

Strategies for Investors

Navigating the current market volatility requires a cautious and strategic approach:

-

Risk Management: Investors should carefully assess their risk tolerance and diversify their portfolios to mitigate potential losses.

-

Diversification: Spreading investments across different asset classes and sectors can help to reduce overall portfolio risk.

-

Long-Term Perspective: Maintaining a long-term investment strategy and avoiding impulsive decisions based on short-term market fluctuations is crucial.

Adopting a prudent and well-informed approach is vital for investors in the current uncertain environment.

Conclusion

The 11% decline in the Amsterdam Stock Market over three days reflects a confluence of global economic uncertainty, specific sectoral vulnerabilities, and negative investor sentiment. The impact on the Dutch economy is significant, with potential consequences for consumer confidence, business investment, and overall economic growth. The affected sectors, including energy, technology, and finance, experienced disproportionate losses. While the future outlook remains uncertain, investors can mitigate risks through prudent diversification, risk management, and a long-term investment strategy. Staying informed about developments in the Amsterdam Stock Market and monitoring the AEX Index is crucial for making informed investment decisions. For more in-depth analysis on the Amsterdam Stock Market and investment strategies, [link to relevant resource or further reading].

Featured Posts

-

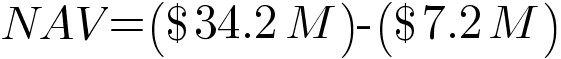

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Glastonbury 2025 Charli Xcx Neil Young And The Lineups Top Contenders

May 24, 2025

Glastonbury 2025 Charli Xcx Neil Young And The Lineups Top Contenders

May 24, 2025 -

Za Kulisami Garazha Borba Ryazanova S Tsenzuroy Pri Brezhneve

May 24, 2025

Za Kulisami Garazha Borba Ryazanova S Tsenzuroy Pri Brezhneve

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf How To Interpret Its Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf How To Interpret Its Net Asset Value

May 24, 2025 -

Tik Tok Crowds Spark Lawsuit Against Amsterdam City By Annoyed Residents Near Snack Bar

May 24, 2025

Tik Tok Crowds Spark Lawsuit Against Amsterdam City By Annoyed Residents Near Snack Bar

May 24, 2025

Latest Posts

-

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Frank Sinatras Marital History His Wives And Their Stories

May 24, 2025

Frank Sinatras Marital History His Wives And Their Stories

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 24, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 24, 2025 -

The Four Women Who Loved Frank Sinatra Exploring His Marriages

May 24, 2025

The Four Women Who Loved Frank Sinatra Exploring His Marriages

May 24, 2025 -

From Grace To Disgrace 17 Celebrity Reputations Ruined Overnight

May 24, 2025

From Grace To Disgrace 17 Celebrity Reputations Ruined Overnight

May 24, 2025