Analyzing Bitcoin's Recent Rebound: What Does It Mean For Investors?

Table of Contents

Understanding Bitcoin's Recent Price Movement

Technical Analysis of the Rebound

Bitcoin's recent rebound can be analyzed through several technical indicators. A breakout above a key support level, often accompanied by increased trading volume, suggests a shift in market momentum.

- Chart Patterns: Observe the formation of bullish patterns like ascending triangles or cup and handle formations, indicating potential upward price movements.

- Key Indicators: The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can provide signals confirming the strength and sustainability of the rebound. A rising RSI above 50 and a bullish crossover in the MACD suggest positive momentum.

- Resistance Levels and Price Targets: Identifying potential resistance levels (previous price highs) is crucial for projecting future price targets. A successful break above these levels indicates a strong, sustained rebound. [Insert relevant chart showing price action, support/resistance levels, and indicators].

Market Sentiment and Investor Confidence

The recent rebound is often mirrored by a shift in market sentiment. Analyzing this shift is key to understanding the sustainability of the price increase.

- Social Media Sentiment: Positive social media mentions and increased engagement on cryptocurrency forums indicate growing investor confidence.

- News Coverage: Positive news coverage, highlighting institutional adoption or technological advancements, often fuels a bullish market sentiment.

- Whale Activity: The actions of large Bitcoin holders ("whales") can significantly influence price movements. Large-scale purchases can trigger upward pressure, while selling can lead to corrections.

Macroeconomic Factors Influencing Bitcoin's Rebound

Inflation and its Impact on Bitcoin

Bitcoin's value proposition as a hedge against inflation plays a crucial role in its price movements.

- Inflation as a Driver: High inflation rates often lead investors to seek alternative assets, including Bitcoin, to preserve their purchasing power.

- Impact of Inflation Data: Recent inflation data releases can either bolster or dampen Bitcoin's price, depending on whether the data aligns with market expectations.

- Future Inflationary Pressures: Projections of future inflation significantly influence the demand for Bitcoin and other inflation hedges.

Regulatory Landscape and its Influence

The regulatory environment surrounding Bitcoin significantly impacts investor confidence and price stability.

- Positive Regulatory Developments: Clearer regulatory frameworks and increased institutional acceptance can boost investor confidence and drive price increases.

- Negative Regulatory Impacts: Stricter regulations or outright bans can negatively impact Bitcoin's price and adoption.

- Future Regulatory Uncertainty: Uncertainty about future regulations contributes to market volatility.

Analyzing the Risks and Opportunities for Investors

Potential Risks Associated with Bitcoin Investment

Investing in Bitcoin involves significant risks, and understanding these risks is crucial for informed decision-making.

- Volatility: Bitcoin's price is notoriously volatile, susceptible to sharp price swings in both directions.

- Market Manipulation: The relatively smaller market capitalization compared to traditional markets makes Bitcoin more susceptible to manipulation.

- Security Risks: Risks associated with cryptocurrency exchanges, wallets, and personal security must be carefully considered. Diversification and the use of secure storage solutions are paramount.

Opportunities Presented by the Rebound

Despite the risks, Bitcoin's recent rebound presents potential opportunities for investors with a long-term perspective.

- Long-Term Growth Potential: Many analysts believe Bitcoin has significant long-term growth potential, driven by increasing adoption and technological advancements.

- Higher Returns on Investment: Successful timing of entry and exit points during a rebound can yield significant returns.

- Strategies for Capitalizing on the Rebound: Dollar-cost averaging, strategic accumulation during dips, and setting stop-loss orders can mitigate risk and enhance returns.

Conclusion: Navigating Bitcoin's Future After the Rebound

Bitcoin's recent rebound is a complex phenomenon influenced by technical factors, market sentiment, macroeconomic conditions, and the regulatory landscape. While the rebound presents potential opportunities for investors, it's crucial to understand and manage the inherent risks associated with Bitcoin investment. The potential trajectory of Bitcoin's price depends on a confluence of these factors, making continuous monitoring and informed decision-making essential. Stay informed about Bitcoin's future price movements by following our regular updates on the crypto market. Understanding Bitcoin's rebound is crucial for navigating your investment strategy.

Featured Posts

-

Morgans 5 Biggest Mistakes In High Potential Season 1

May 09, 2025

Morgans 5 Biggest Mistakes In High Potential Season 1

May 09, 2025 -

Ev Mandate Faces Strong Opposition From Car Dealers

May 09, 2025

Ev Mandate Faces Strong Opposition From Car Dealers

May 09, 2025 -

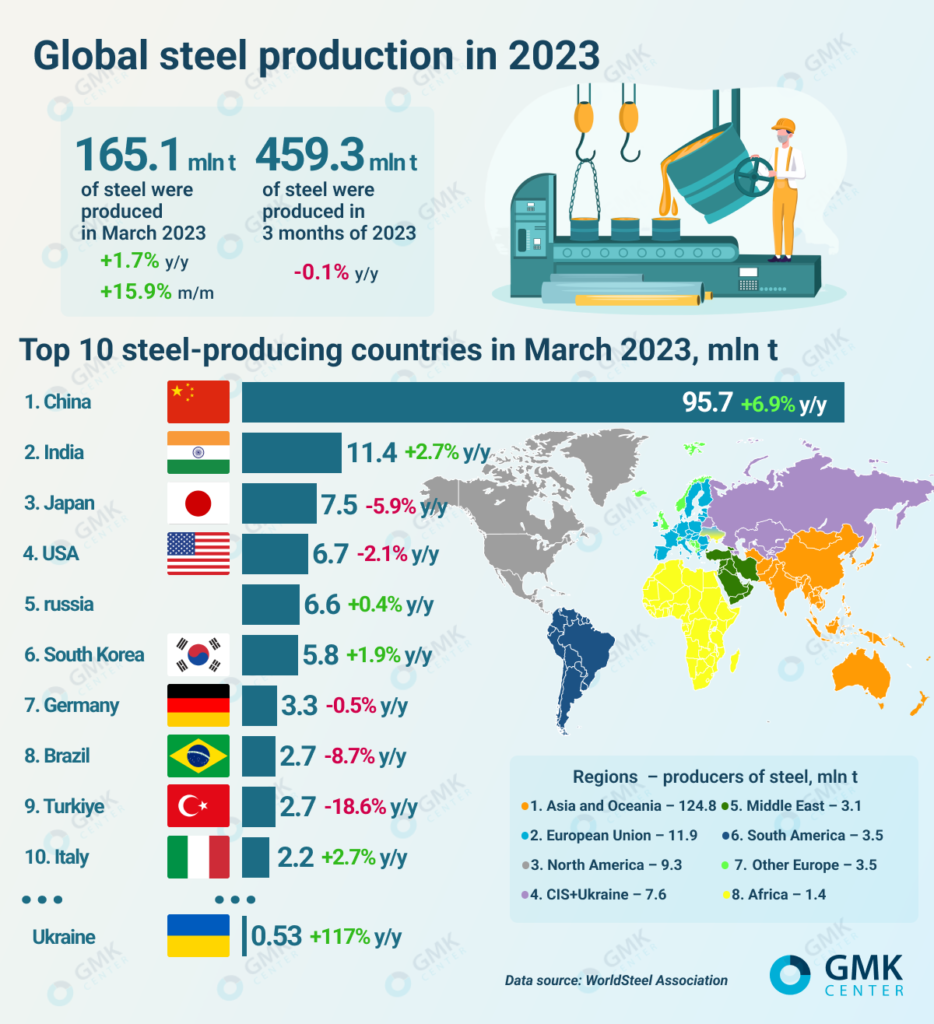

Iron Ore Falls Chinas Steel Production Cuts Impact Global Markets

May 09, 2025

Iron Ore Falls Chinas Steel Production Cuts Impact Global Markets

May 09, 2025 -

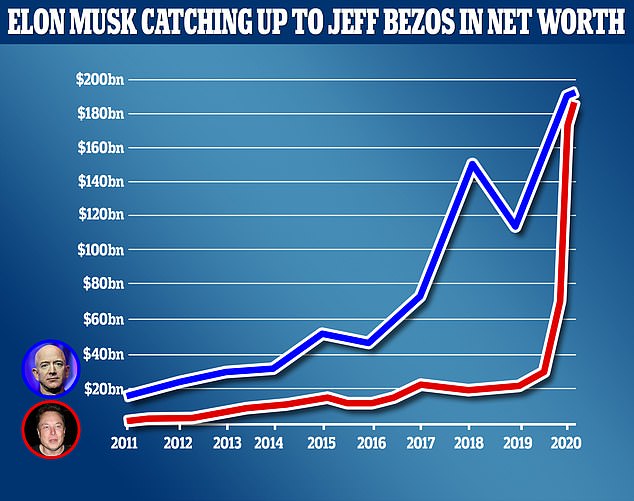

Understanding Elon Musks Wealth Strategies And Investments

May 09, 2025

Understanding Elon Musks Wealth Strategies And Investments

May 09, 2025 -

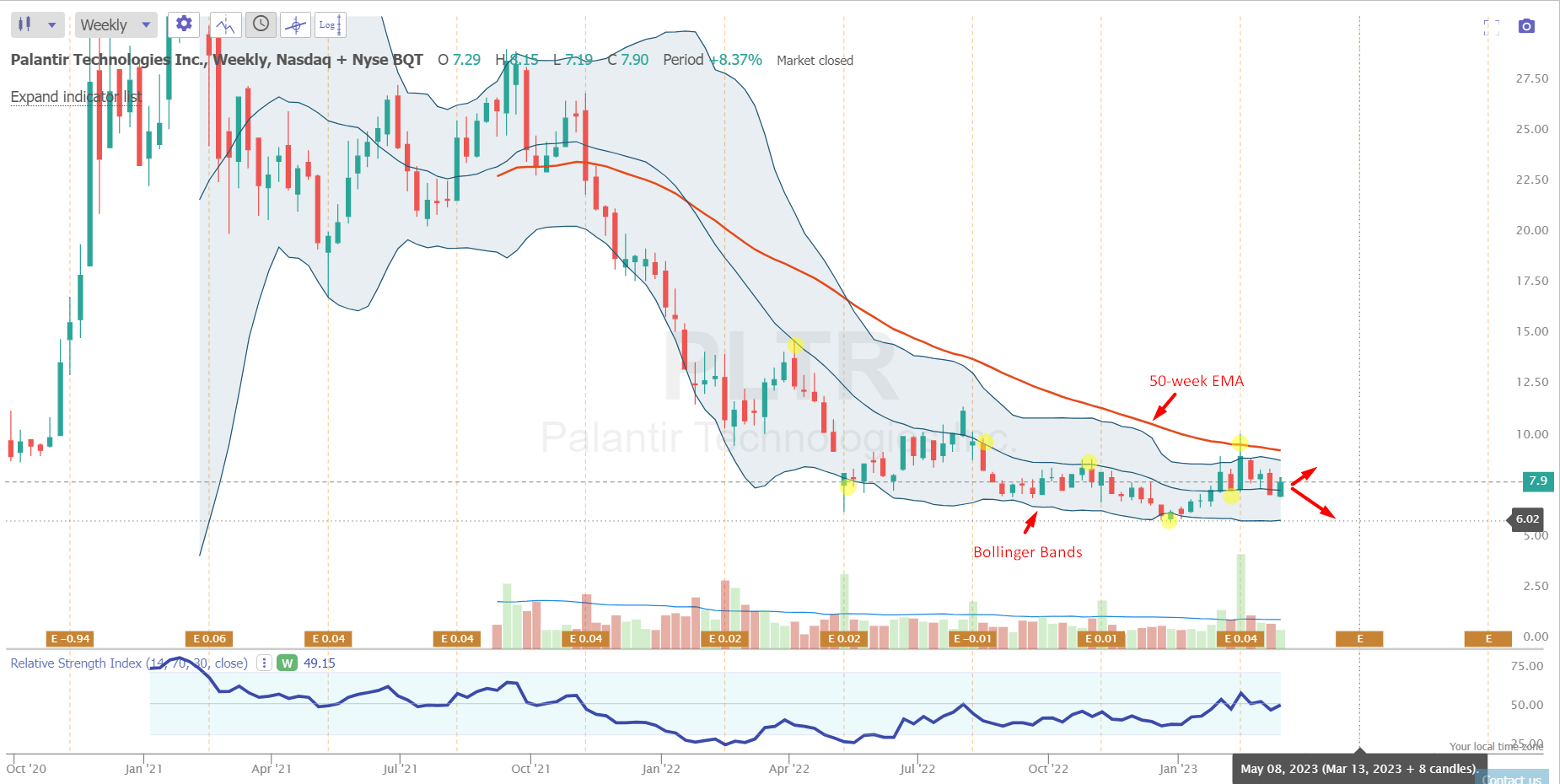

Analysts Reset Palantir Stock Forecast Rally Impact Analyzed

May 09, 2025

Analysts Reset Palantir Stock Forecast Rally Impact Analyzed

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025