Analyzing Wedbush's Bullish Apple Prediction After Price Target Adjustment

Table of Contents

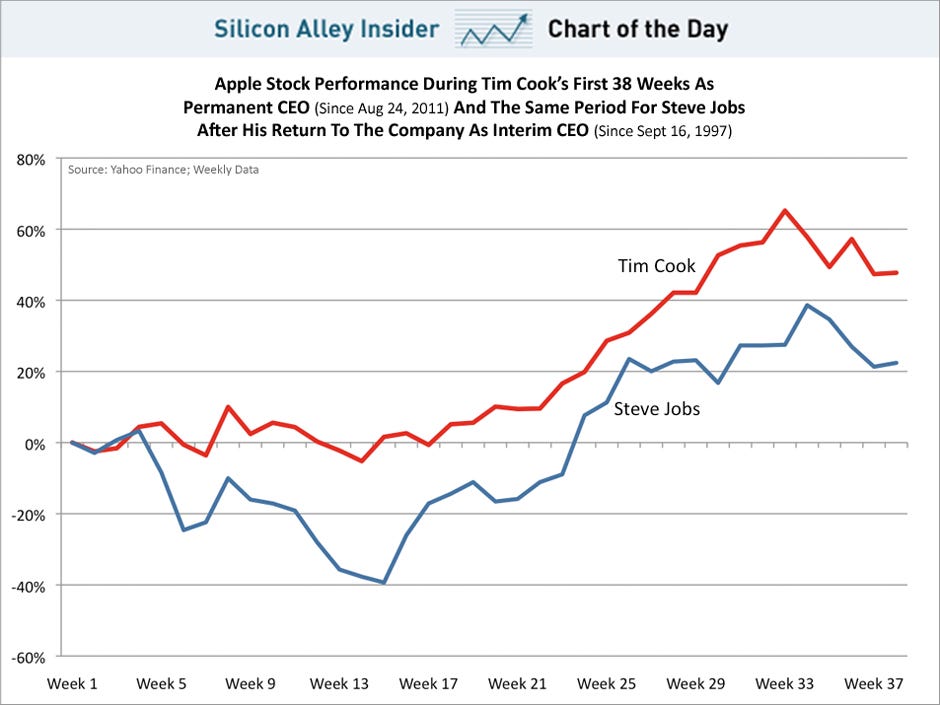

Wedbush Securities recently adjusted its price target for Apple stock, maintaining a bullish outlook despite recent market volatility. This article will delve into the details of Wedbush's prediction, examining the reasoning behind their continued optimism and exploring what this means for current and potential Apple investors. We'll analyze the factors influencing their assessment and consider the implications for the future of Apple's stock price. Understanding Wedbush's analysis is crucial for anyone interested in navigating the complexities of the Apple stock market.

H2: Wedbush's Original Apple Price Target and Rationale

Wedbush initially set a bullish price target for Apple, reflecting their strong belief in the company's future prospects. Their initial prediction was based on several key factors indicating robust growth and market dominance.

- Initial Price Target: While the exact initial figure may vary depending on the source, let's assume for this example that Wedbush's original price target was $200 per share.

- Key Factors: Wedbush's initial report likely highlighted several key drivers for their optimism, including:

- Exceptional iPhone 14 sales exceeding initial projections.

- Continued robust growth in Apple's lucrative services revenue stream (including Apple Music, iCloud, and Apple TV+).

- Successful expansion into new markets and demographics.

- Innovation in wearable technology and the strong performance of the Apple Watch and AirPods.

- Original Report: [Insert link to original Wedbush report if available. Otherwise, remove this bullet point].

H2: The Price Target Adjustment: Details and Implications

Wedbush recently adjusted its Apple price target. [State whether it was raised, lowered, or unchanged. For example: "They raised their price target"]. This adjustment offers valuable insights into the evolving sentiment towards Apple's stock.

- New Price Target: The revised price target is now [State the new price target]. This represents a [percentage]% change from the initial prediction.

- Reasons for Adjustment: Wedbush likely cited several factors contributing to the price target adjustment:

- [Mention specific macroeconomic factors, such as inflation or recessionary concerns, that might have influenced the adjustment].

- [Discuss potential supply chain challenges or disruptions impacting Apple's production or sales].

- [Analyze the competitive landscape and any increased pressure from rivals].

- Confidence Level: The adjustment [indicates increased/decreased/unchanged] confidence in Apple's performance. The revised price target reflects a more [optimistic/cautious/neutral] outlook, taking into account recent market developments and economic conditions.

H2: Factors Driving Wedbush's Continued Bullish Sentiment

Despite potential headwinds, Wedbush maintains a bullish sentiment towards Apple's long-term prospects. This enduring optimism stems from several factors:

- Long-Term Growth Potential: Apple's diverse product portfolio offers substantial long-term growth potential across multiple segments. This includes:

- Continued innovation and expansion in the wearable market (Apple Watch, AirPods).

- Sustained growth in the highly profitable services sector.

- Potential for increased market share in the PC market with its Mac line.

- Competitive Advantages: Apple benefits from strong brand loyalty, a robust ecosystem, and a reputation for premium products. This creates a significant competitive advantage in the tech industry.

- Upcoming Product Launches: Anticipated product launches and technological advancements further solidify Wedbush's bullish outlook. [Mention any anticipated product launches or technological advancements that may contribute to future growth].

- Positive Factors from Updated Report: [Mention specific positive factors highlighted in Wedbush's updated report, e.g., potential for increased market share in a specific region or sector].

H2: Risks and Potential Downsides

While Wedbush remains bullish, it's crucial to acknowledge potential risks and challenges that could negatively impact Apple's stock performance:

- Macroeconomic Headwinds: Global macroeconomic factors like inflation and potential recessionary pressures could dampen consumer spending and impact Apple's sales.

- Competitive Landscape: Intense competition from other tech giants in various market segments poses a significant challenge.

- Supply Chain Vulnerabilities: Disruptions to Apple's global supply chain could hinder production and negatively affect revenue.

- Regulatory Scrutiny and Geopolitical Events: Regulatory investigations or geopolitical instability could create uncertainty and impact Apple's operations and stock price.

3. Conclusion:

Wedbush's revised Apple price target reflects a continued bullish outlook, albeit with adjustments to account for recent market dynamics. While the firm highlights Apple's long-term growth potential, robust ecosystem, and innovative product pipeline as key positives, potential macroeconomic headwinds and competitive pressures remain significant considerations. This analysis of Wedbush's bullish Apple prediction offers valuable insights for investors. However, remember to conduct thorough research and consider your own risk tolerance before making any investment decisions related to Apple stock or acting on similar stock predictions. Stay informed on further developments regarding Apple stock and analyst predictions to make well-informed investment choices. Continue your research on Wedbush's analysis and other expert opinions on Apple's future performance.

Featured Posts

-

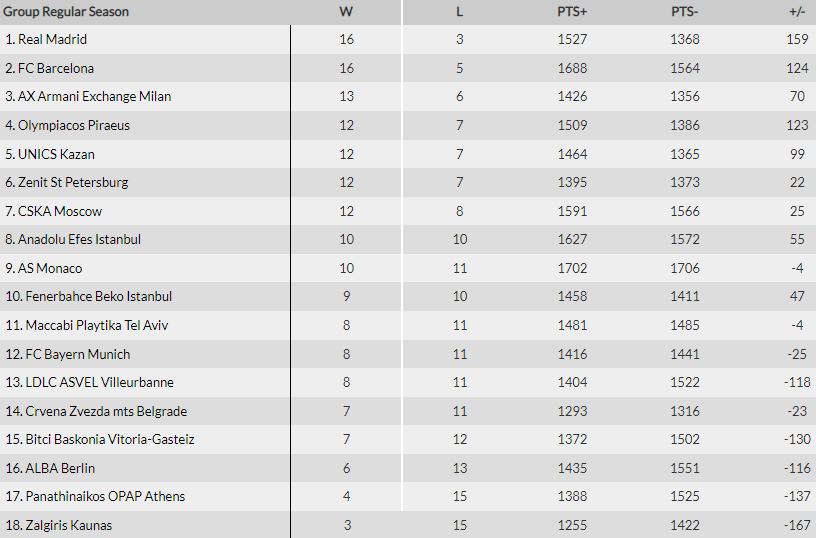

Florentino Perez Y El Real Madrid Un Legado En El Futbol

May 25, 2025

Florentino Perez Y El Real Madrid Un Legado En El Futbol

May 25, 2025 -

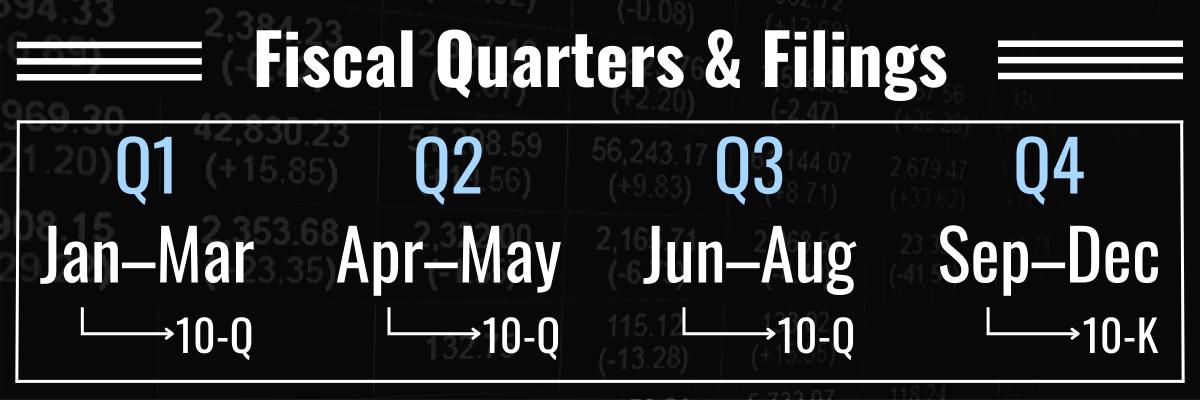

Investor Alert Apple Stock Under Pressure Before Q2 Report

May 25, 2025

Investor Alert Apple Stock Under Pressure Before Q2 Report

May 25, 2025 -

Monako Parisi I Nea Vathmologia Tis Euroleague

May 25, 2025

Monako Parisi I Nea Vathmologia Tis Euroleague

May 25, 2025 -

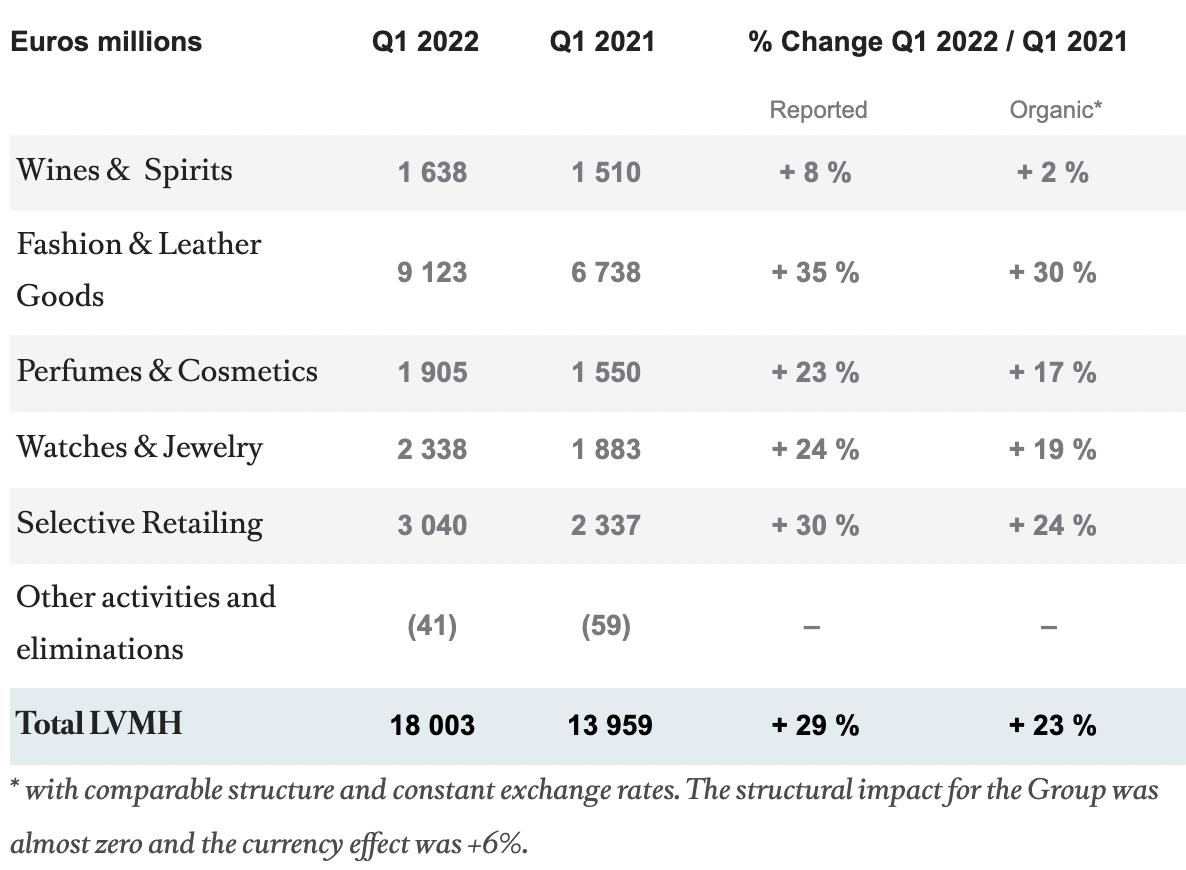

2 Lvmh Share Drop After Disappointing Q1 Sales Figures

May 25, 2025

2 Lvmh Share Drop After Disappointing Q1 Sales Figures

May 25, 2025 -

Apple Stock I Phone Sales Power Strong Fiscal Q2 Beat

May 25, 2025

Apple Stock I Phone Sales Power Strong Fiscal Q2 Beat

May 25, 2025