Apple Stock And Tariffs: Assessing The Risks To Buffett's Portfolio

Table of Contents

Understanding the Impact of Tariffs on Apple's Supply Chain

Tariffs, essentially taxes on imported goods, directly increase the cost of components sourced internationally, significantly impacting companies like Apple with globally dispersed supply chains. Apple's manufacturing and assembly are heavily reliant on China, a nation frequently at the center of tariff disputes. This reliance introduces considerable risk.

- Increased manufacturing costs in China: Tariffs on imported components manufactured in China, then shipped to other countries for final assembly or directly to consumers, directly inflate Apple's production costs. This includes vital components such as processors and displays.

- Potential relocation of manufacturing – challenges and opportunities: The escalating cost of manufacturing in China due to tariffs has prompted discussions around relocating production. However, this presents considerable logistical and economic challenges, including finding skilled labor, establishing new infrastructure, and managing potential disruptions to the supply chain. While it offers opportunities for diversification, it is a complex undertaking.

- Impact on Apple's pricing strategy and profitability margins: Higher production costs inevitably affect Apple’s pricing strategy. The company faces the difficult choice between absorbing increased costs, reducing profit margins, or passing them on to consumers through higher prices, risking decreased sales.

- Specific components affected by tariffs: Tariffs on specific components like displays sourced from Asian manufacturers and specialized processors have a cascading effect, impacting the overall cost of iPhones, iPads, and other Apple products.

Analyzing the Sensitivity of Apple Stock to Tariff Changes

The relationship between tariff announcements and Apple's stock price is complex and often volatile. Historically, escalations in trade wars have led to significant stock price fluctuations, reflecting investor sentiment and uncertainty about future profitability.

- Stock price volatility in response to trade war escalations: News of new or increased tariffs often leads to immediate market reactions, with Apple's stock price often exhibiting significant volatility. Investors react swiftly to perceived threats to Apple's earnings.

- Impact on investor confidence and future growth projections: Uncertainty surrounding tariffs directly impacts investor confidence, leading to revised growth projections and potential downward pressure on the stock price. Negative news regarding trade tensions can trigger sell-offs.

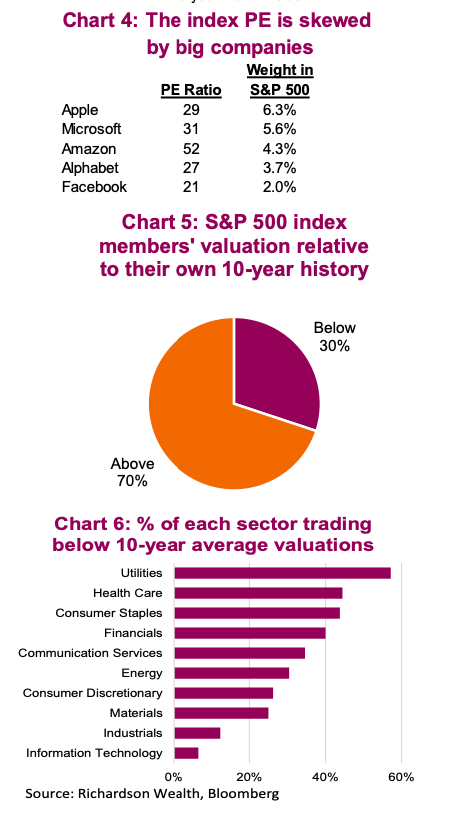

- Relevant financial metrics (e.g., P/E ratio, market capitalization): Key financial metrics like the Price-to-Earnings (P/E) ratio and market capitalization are sensitive to tariff-related news. Negative impacts on earnings directly translate to changes in these metrics, influencing investor decisions.

Diversification and Risk Mitigation Strategies within Buffett's Portfolio

While Apple represents a substantial portion of Berkshire Hathaway's portfolio, its diversification mitigates the risk associated with a single stock's volatility. Buffett's long-term investment philosophy further cushions against short-term market fluctuations.

- Berkshire Hathaway's diversified portfolio as a buffer against Apple-specific risks: Berkshire Hathaway's broad investment portfolio, encompassing various sectors and asset classes, acts as a buffer against losses concentrated solely in Apple.

- Long-term investment approach and potential for recovery from short-term tariff impacts: Buffett's renowned long-term investment strategy allows for weathering short-term market downturns caused by tariff-related events. He anticipates long-term growth, not immediate returns.

- Other significant holdings in Berkshire Hathaway's portfolio and their relationship to global trade: The performance of other Berkshire Hathaway holdings, some of which may also be affected by global trade dynamics, further balances the overall portfolio performance.

Potential Long-Term Implications for Apple and Buffett's Investment

Prolonged trade disputes could force significant long-term shifts in Apple's manufacturing and supply chain strategies, potentially reshaping the global economic landscape.

- Potential for increased automation and domestic manufacturing in the US: Tariffs may incentivize Apple to increase automation in existing facilities and explore domestic manufacturing in the US, reducing reliance on China.

- Impact on Apple's innovation and competitiveness in the long run: Disruptions to the supply chain and increased production costs could hinder Apple's innovation and long-term competitiveness, affecting its ability to launch new products and maintain its market leadership.

- The evolving geopolitical landscape and its impact on international trade: The ongoing evolution of global trade relations and geopolitical tensions will continue to impact Apple and other multinational corporations, requiring adaptive strategies to manage risks.

Conclusion: Assessing the Future of Apple Stock and Tariffs in Buffett's Portfolio

The analysis of "Apple Stock and Tariffs" reveals considerable risks to Apple's business and, consequently, to Buffett's investment. However, Berkshire Hathaway's diversification and Buffett's long-term investment strategy provide a degree of resilience against short-term market volatility. Understanding the interconnectedness of global trade and investment is crucial for informed decision-making. While tariffs pose challenges, Apple's adaptability and innovative capacity offer a degree of optimism for its long-term prospects. To further enhance your understanding of the interplay between Apple Stock and Tariffs, we encourage you to conduct thorough research and consult diverse financial resources. [Link to relevant resources here]

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Significance

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Significance

May 24, 2025 -

Sean Penns Allegiance To Woody Allen A Me Too Case Study

May 24, 2025

Sean Penns Allegiance To Woody Allen A Me Too Case Study

May 24, 2025 -

Actor Sean Penn Expresses Doubts About Dylan Farrows Account

May 24, 2025

Actor Sean Penn Expresses Doubts About Dylan Farrows Account

May 24, 2025 -

18 Brazilian Nationals Charged Over 100 Firearms Seized In Mass Gun Trafficking Crackdown

May 24, 2025

18 Brazilian Nationals Charged Over 100 Firearms Seized In Mass Gun Trafficking Crackdown

May 24, 2025 -

Guccis New Designer Demna Gvasalias Impact On The Brand

May 24, 2025

Guccis New Designer Demna Gvasalias Impact On The Brand

May 24, 2025

Latest Posts

-

Universals Epic Theme Park Investment A 7 Billion Challenge To Disney

May 24, 2025

Universals Epic Theme Park Investment A 7 Billion Challenge To Disney

May 24, 2025 -

The End Of The Nfls Butt Ban The Tush Push Lives On

May 24, 2025

The End Of The Nfls Butt Ban The Tush Push Lives On

May 24, 2025 -

Nfls Controversial Tush Push History Controversy And Survival

May 24, 2025

Nfls Controversial Tush Push History Controversy And Survival

May 24, 2025 -

The Nfls Tush Push A Celebratory Look At A Surviving Tradition

May 24, 2025

The Nfls Tush Push A Celebratory Look At A Surviving Tradition

May 24, 2025 -

Navigating High Stock Market Valuations Advice From Bof A

May 24, 2025

Navigating High Stock Market Valuations Advice From Bof A

May 24, 2025