Apple Stock Price Prediction: Analyst Targets $254 – Should You Buy Now?

Table of Contents

Apple (AAPL) stock has been a source of significant interest for investors, with recent analyst predictions pointing towards a potential price surge. Many analysts are targeting a price of $254, leading to a critical question for potential investors: should you buy Apple stock now? This article explores the key factors driving these predictions and helps you determine if investing in Apple stock aligns with your financial goals.

Current Apple Stock Performance and Market Trends

Apple's stock price, like any other publicly traded company, is subject to constant fluctuation. Understanding the current market conditions and Apple's recent performance is crucial before considering any investment. As of today, [Insert Current Apple Stock Price and Date - This needs to be updated regularly for accuracy]. This price reflects a [Insert percentage change from a relevant benchmark, e.g., 52-week high/low] movement.

The overall market trend, particularly the performance of major indices like the S&P 500, significantly impacts Apple's stock. A bullish S&P 500 usually correlates with positive performance for Apple, while a bearish market can lead to price declines. Let's look at some key indicators:

- Recent Apple stock price fluctuations: [Insert recent price movements and their potential causes, e.g., earnings reports, news events].

- Key financial performance indicators: Apple's recent quarterly earnings reports have shown [Insert summary of key financial metrics – revenue growth, earnings per share (EPS), etc.].

- Impact of broader market trends: [Discuss the impact of factors like interest rate hikes, inflation, or geopolitical events on Apple's stock price].

- Comparison to competitor stock performance: Comparing Apple's performance against competitors like Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN) provides valuable context. [Insert brief comparison].

Factors Influencing the $254 Apple Stock Price Prediction

The $254 Apple stock price prediction stems from a confluence of factors, many of which are based on analyst projections and expectations for future growth. These projections are not guarantees, but rather educated estimates based on available data and market analysis.

- Analyst reports and their methodologies: Various financial institutions employ different analytical models to predict stock prices. These models often consider factors like discounted cash flow (DCF), comparable company analysis, and precedent transactions.

- Impact of new product launches and innovations: Apple's upcoming product releases, including new iPhones, Apple Watches, and potential advancements in other areas like augmented reality (AR) and virtual reality (VR), are key drivers of anticipated growth. Innovation is central to Apple's continued success.

- Growth prospects in key market segments: Apple's Services segment, encompassing subscriptions like Apple Music and iCloud, has shown impressive growth potential. Similarly, wearables like AirPods and Apple Watch are expected to continue their upward trajectory.

- Potential risks and challenges impacting the prediction: While the outlook is positive, several factors could impact the $254 prediction. These include supply chain disruptions, increased competition, and macroeconomic headwinds.

Analyzing Apple's Financial Health

A comprehensive assessment of Apple's financial health is crucial for understanding the validity of the $254 prediction. Analyzing the balance sheet, income statement, and cash flow statement provides a clear picture of the company's financial strength and future prospects.

- Key financial ratios and their implications: Analyzing ratios such as the price-to-earnings ratio (P/E), return on equity (ROE), and debt-to-equity ratio offers insights into Apple's profitability, efficiency, and financial risk.

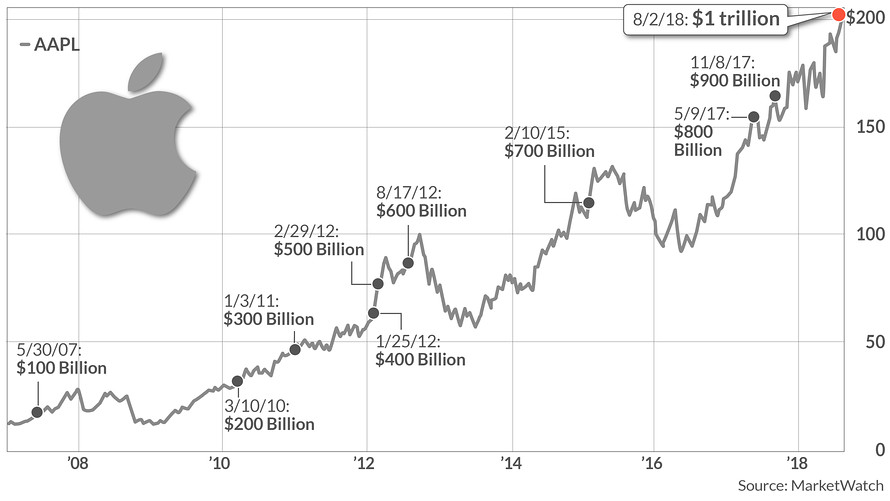

- Comparison to historical financial performance: Comparing current financial performance to past trends reveals whether the company is maintaining its growth trajectory or experiencing a shift.

- Debt-to-equity ratio and its significance: A low debt-to-equity ratio indicates a strong financial position and reduced risk.

- Free cash flow generation and dividend payouts: Apple's significant free cash flow allows for investments in research and development, acquisitions, and dividend payments to shareholders.

Risks and Considerations Before Investing in Apple Stock

Despite the positive outlook, it's crucial to acknowledge the potential risks associated with investing in Apple stock. Market conditions can shift rapidly, and even seemingly stable companies face unforeseen challenges.

- Competition from other tech companies: Intense competition from companies like Samsung, Google, and others constantly puts pressure on Apple's market share and profitability.

- Supply chain disruptions and their impact: Global supply chain issues can significantly affect Apple's production and delivery of products, impacting revenue and potentially stock price.

- Regulatory risks and potential legal challenges: Increased regulatory scrutiny and potential legal battles can create uncertainty and impact Apple's financial performance.

- Overall market volatility and economic downturns: Macroeconomic factors such as recessionary pressures and interest rate hikes can negatively impact even the most successful companies.

Conclusion

This article analyzed the factors contributing to the $254 Apple stock price prediction, including Apple's strong financial performance, anticipated product launches, and growth in key sectors. However, it's crucial to acknowledge potential risks before making any investment decisions. While the $254 target presents an attractive potential return, thorough research and careful consideration of your individual risk tolerance are essential before investing in Apple stock (AAPL). Conduct your own due diligence and consult with a financial advisor before making any investment decisions related to the Apple stock price prediction. Remember to diversify your portfolio and only invest what you can afford to lose.

Featured Posts

-

Analyzing Wedbushs Bullish Apple Prediction After Price Target Adjustment

May 25, 2025

Analyzing Wedbushs Bullish Apple Prediction After Price Target Adjustment

May 25, 2025 -

Apple Stock Performance Q2 Report And Market Outlook

May 25, 2025

Apple Stock Performance Q2 Report And Market Outlook

May 25, 2025 -

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Proshloe I Buduschee

May 25, 2025

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Proshloe I Buduschee

May 25, 2025 -

Escape To The Country Affordable Dream Homes Found Below 1m Budget

May 25, 2025

Escape To The Country Affordable Dream Homes Found Below 1m Budget

May 25, 2025 -

Analysis Brbs Banco Master Purchase And Its Implications For Brazilian Banking

May 25, 2025

Analysis Brbs Banco Master Purchase And Its Implications For Brazilian Banking

May 25, 2025